Weekly Recap | May - W5

Uncertainty, Liquidity, Inflation, Investing Framework, Hims Dominance, Transmedics Bull Case, Google News, Bitcoin, Cosmetic Sector, ASTM in Asia, PDD Earnings & Weekly Planning.

Macro.

I wish we could have a quiet macro part of the report, but I do not believe it will happen during the time Trump is in office.

First of all, we had the news at the start of the week that judges ruled Trump's tariffs to be illegal, which should have ended up with their entire cancellation. To learn two days later that nothing of the sort would happen & that other institutions ruled that Trump could change those tariffs whenever, however…

Just after this, Trump decided it was time to be aggressive & throw numbers again, said they would now apply a 50% tariff on Europe from June 1st. A few days later, those were finally pushed to early July. Then, Trump raised the actual 25% tariffs on steel to 50%. And just before the market closed on Friday, we learned that the deal supposed to close fast with China, stalled. That the U.S. was planning to add export controls on their high end tech hardware and that China was playing hardball on a deal for rare earths… And sadly, this was a quiet week.

I do not talk about the potential implications of each because as usual I, & the market, do not believe anything anymore. We had comparable news & noise for months for at the end most of them to be cancelled or modified so it is useless to listen to them all by now… And the market doesn’t react much to anything anymore, which isn’t a good thing to my opinion.

In terms of data, the core PCE - the preffered inflation indicator of the FED, is getting closer the the FED’s 2% target with a reading at 2.5% this month, which will restart the discussions about rate cuts.

Hard to know what the FED will do, the data looks good enough to be more agressive on those cuts but the uncertainty around tariffs makes it all very complicated… No good solution.

Some more data as X often talks about the cash stored in money market funds - the aggregate of low-risk debt, treasuries, cash, etc… with the conclusion that this is the amount of cash ready to come back to stocks.

And it does represent a huge amount of capital but I see things differently as this cash pile kept growing, despites what X considered to be some “generational opportunity” on the market in April. But those kind of prices were not enough for liquidity to leave the MMF & come back to risk assets. That gives you a pretty good insight on what those managers need to go back to risk assets.

As I said for months now, the most important chart to look at is the 10Y. Until this boy melts, this cash won't come back to risk assets as treasuries provide a risk free return while uncertainty isn’t bullish for stocks.

I continue to believe that pain will take time to materialize in the data. But it is here already, and it won’t get better with these kinds of policies and back & forth negociations which hurt small & big business.

Watched Stocks and Portfolio.

Before starting the news, I did a small diagram of my investing process, which can be interesting to understand how I buy stocks. I will try to gather all important investing information in one write-up soon enough which I’ll update every week or so, so you guys can have access to all my stocks’ buying targets & strategies in one place, instead of have it all spread through different write-ups.

In the mean time, here is my investing process.

Hims Business Model.

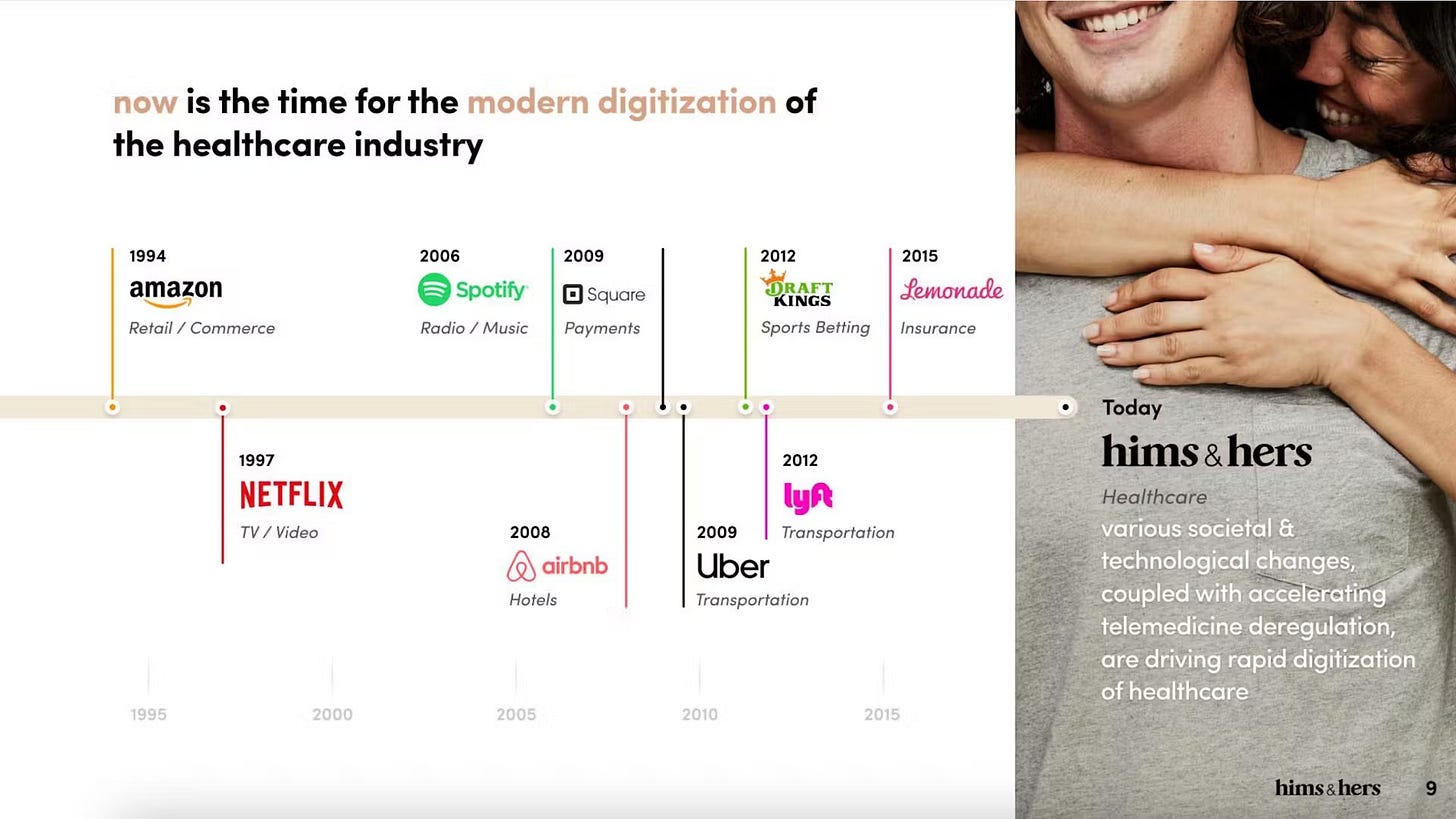

This is more a CVS news than a Hims news as the first company is closing 270 of its locations. For those who do not know CVS, they own multiple pharmacies in the States. This is, to me, the confirmation that Hims' business model will thrive while older ones will slowly fall, that the healthcare industry is slowly being disrupted.

We live in a world where clients or patients want rapid, efficient, personalized services & products at their fingertips. The time when you had to drive your car to buy your products is over.

Netflix killed the classical TV industry where you had to wait out advertisements. Uber killed the drive-in as you now can have the same result without even driving. Amazon killed the shopping industry where you had to move & wait in line in different shops to purchase your goods. And yes, Hims will kill the classic pharmacies where patients have to go & wait in line to get their wellness cream or pill.

CVS closing its locations is proof that business models have to evolve & that we now are used to higher quality of service & won't settle for anything else.

Google News.

The company is already planning its next Waymo expansions in Houston, Orlando & San Antonio, with some drone footage showing thousands of Waymo cars parked, waiting to be deployed. Everything is going well for the autonomous vehicle branch.

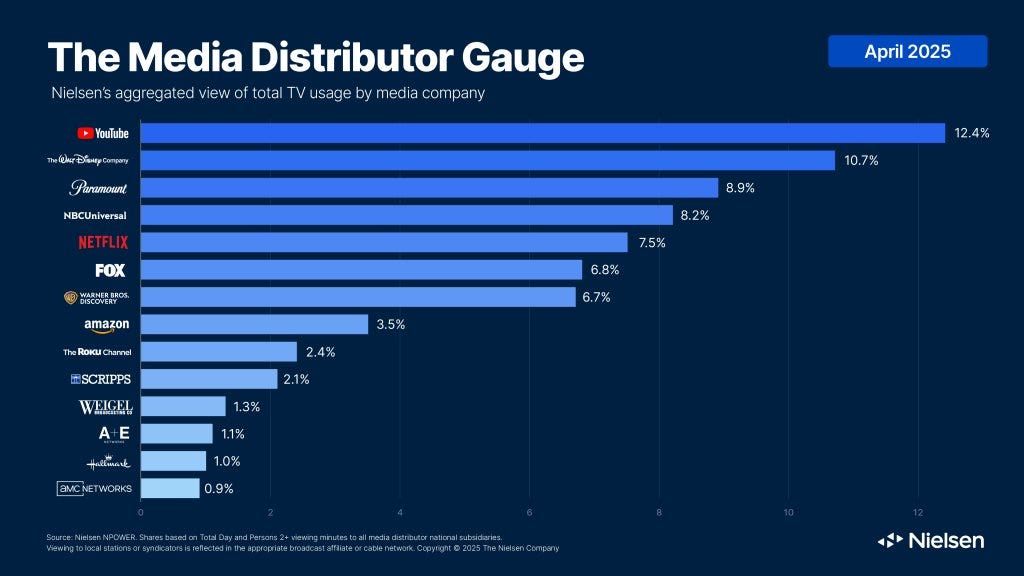

Second, YouTube continues to dominate & grow that dominance. Number 1 in TV shares & now responsible for 12.4% of total TV usage, up from 11.6% in March.

Another branch of the company which is really, really healthy.

Transmedics Bull Case.

We had a pretty interesting post on X from a transplant surgeon who was sharing how transformative transmedic’s OCS was for his industry, allowing him to plan & perform three liver transplants in the same day.

This is why I personally own & am very bullish on Transmedics.

Truth Social & Gamestop Buy Bitcoin.

We start to see a real tendency with more companies adding Bitcoin to their balance sheets, although for now no “serious” or external-to-crypto companies have done so. GameStop remains a meme & Truth Social… Well.

The only issue with this last one is that, being Trump's company, having Bitcoin on its balance sheet could raise some conflict of interest if the U.S. were to really create a Bitcoin Strategy, as it would certainly enrich the president by doing so. It’s not like comparable things have never been done but it wouldn’t look great.

Although you guys know my opinion on this: Governments aren't ready to buy Bitcoin, and the real bull case lies in private companies doing so.

Ulta & Elf Come Back.

Both cosmetics companies are showing encouraging trends, with better numbers than usual for the first one, delivering a prett correct quarter with positive trends.

We are finally seeing some ticks up in terms of spending, also helped by easier comps as 2024 was pretty tough. You guys know I am not bullish on the U.S. consumer & this kind of sector, but the data is for now proving me wrong, so congrats to bulls!

Elf also acquired Rhode, Hailey Bieber's cosmetic brand, for $1B and was rewarded by the market for doing so, expanding its portfolio & user base.

AST Mobile Deal in Asia.

I will talk more & more about AST as I will soon share the investment case and really like the company, especially its fundamentals.

The company contracted aa new partnership with Singapore’s Defence Science & Technology Agency, to leverage their technology during crises or to offer specific connectivity for some remote areas. Another proof of the importance & potential of their technology.

PDD Q1-25.

Numbers show some troubles for PDD.

My personal diagnostic is pretty rapid: being a global e-comerce platform focused on external markets during such uncertain times is not the best position, even if tariffs happened late in Q1, supply chains & uncertainty were already settled then. And it shouldn’t get better as Q2 will be fully impacted by tariffs & we now that commerce between China & the U.S. almost entirely stopped for weeks.

Management doesn’t give a breakdown of geography revenues so it is hard to say if this is the only issue but we saw no problems in local consumption wiwth Alibaba so my assumption is that the struggles come from western demand.

On the bullish side, we also know that PDD is working on modifying its business model & take rate which could also be the source of lower revenues - because of a temporary lower take rate, but once again, as management doesn’t share GBV, we cannot draw a precise conclusion.

One thing for sure is that consumption on PDD’s platform isn’t growing as fast as the market expects, and I personally believe it will take time for growth to come back as, once again, having a business model focused on external buying power & customer acquisition in the west won’t fade well during trade war times…

Weekly Planning.

We are finally in the quiet week although this one will have Crowdstrike & Lululemon report their Q1-25, two very interesting companies for me. I probably won’t do a detailed report for any but you will have my opinion on each on the weekly.

I have however worked on some investment cases that I will share now that we have time. Two are ready - Duolingo & AST Mobile, and one will be soon - Grab. Three great companies you’ll get to read about during the next month. I also am working on this master write up I talked a bit earlier in this report, where you will find all information needed, from how the substrack will evolve, to the important content passing by all the information on investing - buying prices, execution, portfolios etc…

Not a minute to be bored.