Weekly Recap | May - W4

Treasuries Situation, Google I/O, GLP-1 News, Tokenisation, Elon & xAI, Palo Alto & Decker Q1-25 & Weekly Planning.

Macro.

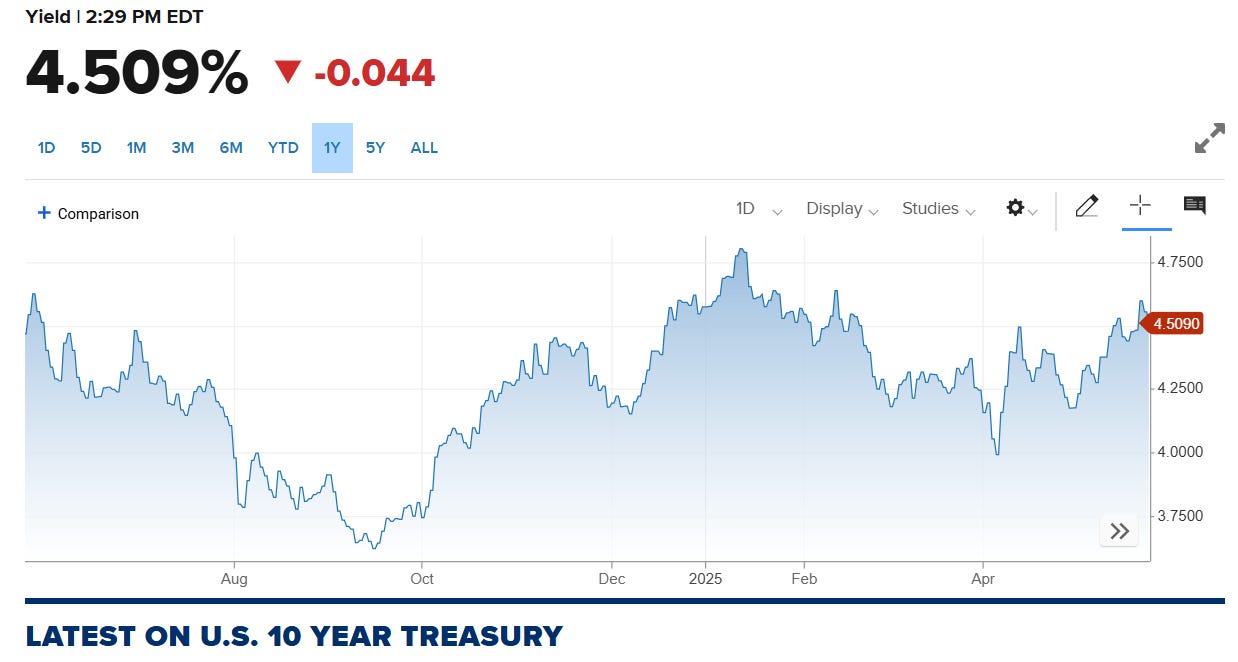

A quiet week macro-wise as the situation did not change. The narrative remains the same & the only asset which matters is the 10Y treasuries, which isn’t healthy, at all.

We had an auction for the 20Y treasuries on the 21st which disappointed the market as demand was not there, highlighting the lack of interest for U.S. debt. I will continue to be bearish medium-term as long as this yield is not back under control & as I said many times, I don’t see how this can be done but with a recession.

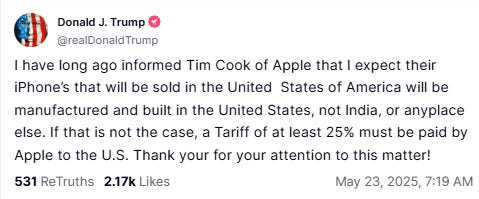

And like clockwork, Trump came back with his tariffs narrative, scaring the market with Europe & Apple as his targets. On the first, his narrative remains that Europe was built to hurt the U.S. and that a 50% tariff seemed appropriate & would be applied from the 1st of June. The problem is that we’ve seen this play out many times now and the market “knows” or expects deals to be made before or rapidly after this date and is not scared much anymore.

The second against Apple makes even less sense to me as Trump is now directly targeting an American company, asking them to hurt themselves & their U.S. consumers knowingly, or to face tariffs.

Estimations for iPhones made in America are around $3,000, a price which would destroy demand from American consumers. It would be cheaper for them to fly to Europe & buy an iPhone there as those tariffs would only target U.S. consumers… Seems like a good way to help my countries’ economy though.

More of the same… I continue to hold lots of cash - around 40% of the portfolio, and will gladly sell a bit more if we continue to go higher as I continue to expect lots of trouble before the end of 2026. More about this soon.

Watched Stocks and Portfolio.

Google I/O.

The company presented tons of very interesting innovations at its yearly keynote this week, proving that they were not late at all in AI & services for their users, although the market still doubts it.

On the most interesting features presented, we can highlight the live translation for Google Meet, already available & soon to be deployed in many more languages.

The Gemini live camera, an AI application which allows your phone’s camera to see & hear what is around you and communicate with it. Google will integrate it in glasses to compete with Meta’s smart glasses, a product I personally am very bullish on.

I shared last week that I wasn’t worried about the slowdown in Search - if it exists, as it is a normal shift from old to new methods, what matters is how Google adapts to LLM usage and they do it very well in my opinion, with their AI Mode, an integrated LLM in your Google browser. No second app, any research will give you an AI preview & allow you to challenge it through LLM conversation with AI Mode.

More interesting, Gemini Personal Context will allow their AI to access your Google data - we’re talking Gmail, Maps, Photos, Android, YouTube & everything offered by Google, in order to help you do anything you need. It is meant to be your personal agent with complete knowledge of your life. We can discuss privacy here but I will let each of you have your own opinion and will focus on how transformative this could be.

Lastly, the try-on feature which will allow shoppers to try clothes on their avatar online to see how it can fit at least in terms of style.

Those are the highlights of the presentation in my opinion but they also presented new Gemini versions, agentic capacities, more advanced image, video & sound generation & more…

Bottom line, Google is not behind. They are in a different situation and can propose different services than just another LLM because they already have the user base, so they work on leveraging it. And in my opinion, this is the right strategy & they are executing perfectly.

Hims & GLP-1.

The market fell back on its bad habits & sold the stock on the news that Cigna - a healthcare insurance company, will work on capping patients’ expenses to $200 per month for branded GLP-1 drugs like Wegovy & Zepbound. We already talked about insurances some weeks ago; today, GLP-1 drugs are not reimbursed by most private healthcare insurance for weight loss purposes, only reimbursed for their original purpose - diabetes. Cigma is trying to change this.

I assume the market interprets this as less demand on Hims or maybe less demand globally for their weight loss category as more will have access to GLP-1 drugs, but it completely ignores what we already know.

First, Hims is growing very well without its GLP-1 & weight loss branch. It is not a weight loss or GLP-1 company, it is a personalized wellness marketplace.

Second, Hims will continue to compound semaglutide for personalized clients, those won’t go to generic doses.

Third, those drugs do not have a lot of retention, more than half of their users stop them after 3 months due to extreme side effects. Making the drugs cheaper won’t change this.

Fourth, not everyone wants those drugs, they are not magical. They work wonders on some patients but not the majority while many simply don’t want such aggressive alternatives. We still need classic methods to lose weight and that is what Hims offers on its platform.

The market continues to react as if GLP-1 was a miracle drug everyone wants & as if Hims wasn’t selling anything else.

Elon, Tesla, xAI & Compute.

Tesla’s CEO is apparently back on the production line as he confirmed on X a few days ago that he would be back full-time to his companies - leaving Doge aside. xAI, Tesla & SpaceX can run without Musk but the market likes it better when he is focused on them while it will also take some pressure off his image as many around the world blamed him for his work at Doge, hurting his brand.

On xAI, Elon also confirmed that they intend to buy 1M Blackwell chips, confirming that demand for computing power is far from done & that the infrastructure we do have is simply not enough. We have confirmation of it every week.

Palo Alto Q1-25.

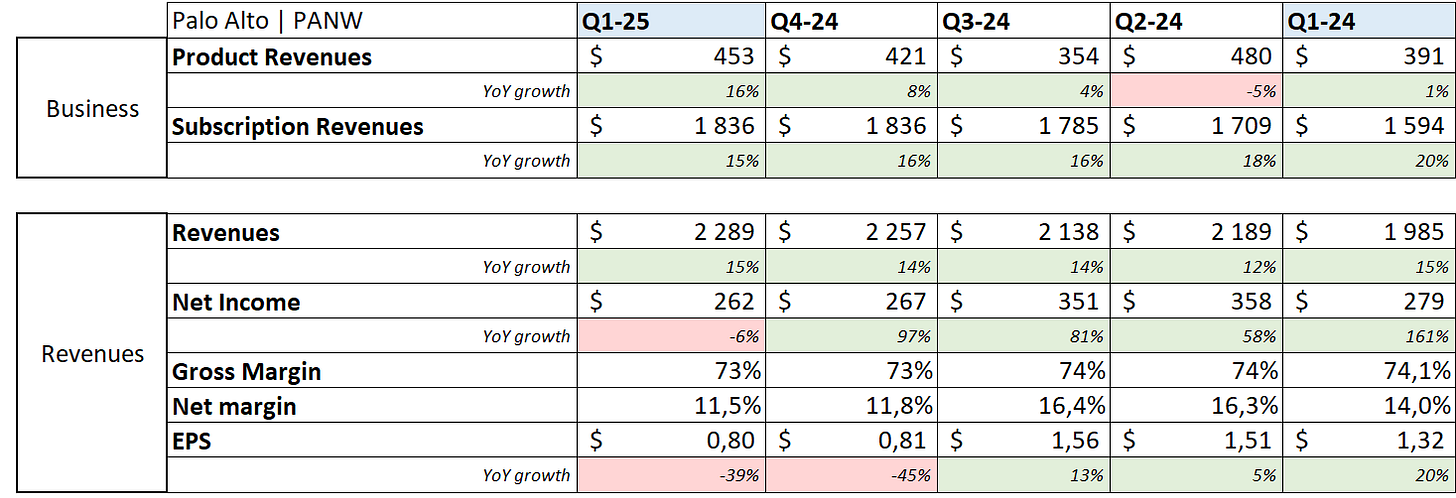

A correct quarter for the cybersecurity provider.

Demand for their products continues to grow as platformization starts to roll in with a 34% YoY NextGen ARR growth & a 19% YoY RPO growth. There isn’t much more to comment on as this is the bread & butter of the company and what made the market doubt for long. But results start to speak now. The company even ended up raising slightly its FY25 guidance.

The company is excellent, its product also is, and the switching costs for this kind of business are massive. There are no doubts that Palo Alto will do great, the important thing now from an investor point of view is valuation - which is pretty rich. My personal target to accumulate would be around $110 or around 40% lower than today’s price…

Will continue to monitor.

Decker Q1-25.

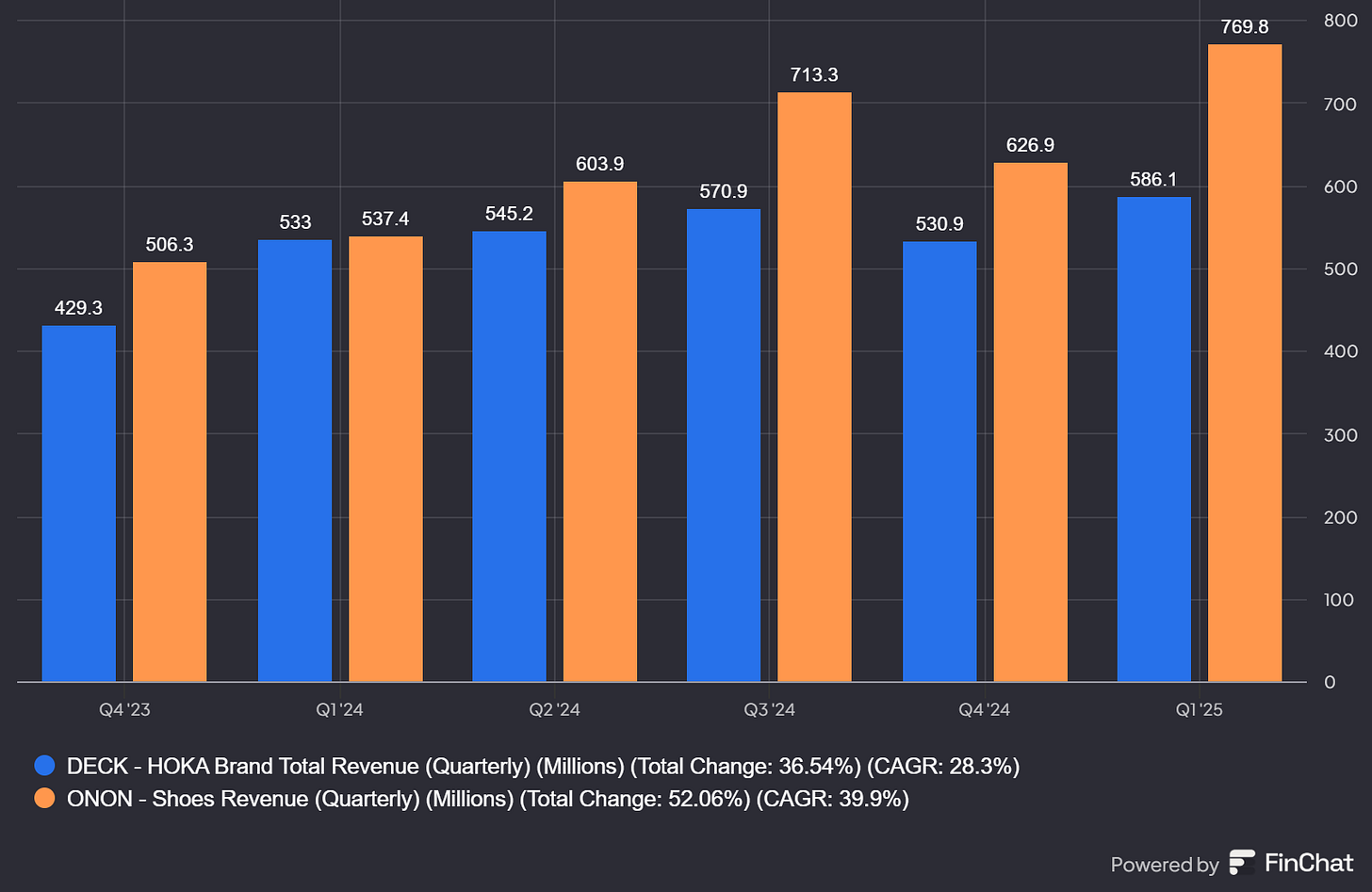

I am not a shareholder nor intend to be, I follow Decker as the main competitor for On Running with its Hoka brand, which is growing really well with a 23.6% YoY growth led by DTC & comparable net sales up 13.4%, which highlights a strong demand for the brand itself.

These two brands could become the two new giants of sportswear in the next years & as you know, my money is on On. But it’s important to keep an eye on competition. So far, both of them are very healthy and growing very well.

Weekly Planning.

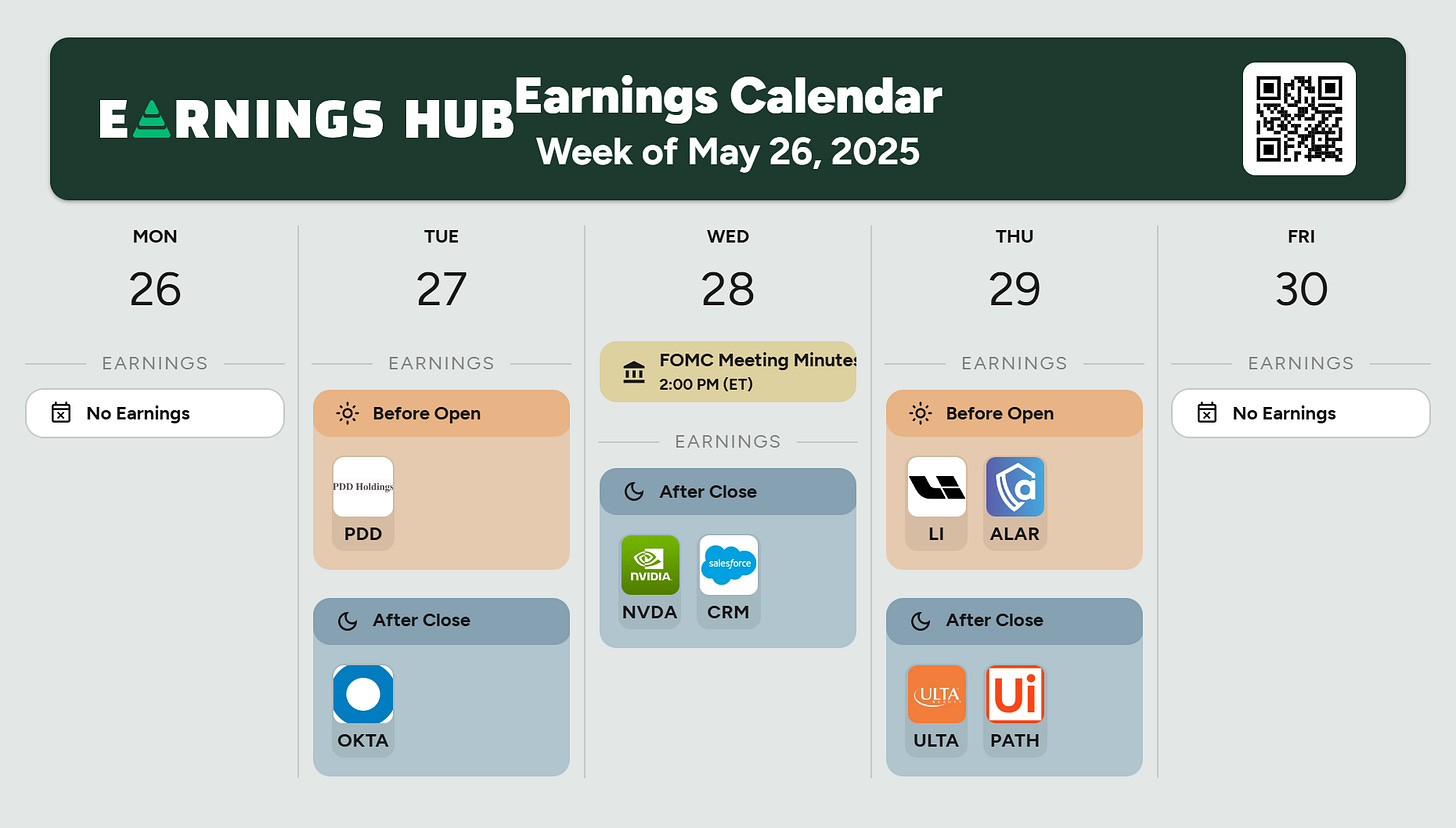

Some well-deserved rest now but still some companies to keep an eye on. PDD to start with on Tuesday as a good indicator on China’s health and of course Nvidia on Wednesday with a full report Thursday. The rest is out of curiosity with companies like Ulta which should give us an idea of consumers’ strength.

And as I said, still lots of writings ready to be sent, including a review of all the stocks I follow, their accumulation targets & my view of the market at the moment, Duolingo’s & AST Mobile Investment Case, and the Japanese bonds situation.

Lots of things to do even without earnings!

Thanks for the recap..!