Weekly Recap | May - W1

Macro, Hims & Novo news, Tesla Semis, Nvidia & China demand, Earning recap & accumulation prices, Weekly planning.

Macro.

I spent a lot of time during the last week to share my views of the market, the macro & what could/will happen to my opinion so I will keep it light this week as nothing changed. We are still in a volatile market moving on headlines. I am still bearish medium term & believe recession is coming. And bullish long term on equities because liquidity has no other alternative for now.

This week's pump feels good after complicated months. It might continue. We might even see a new ATH on the S&P - or not. I, nor anyone, know. Things could go very fast with the FED cutting rates - decision next week, a deal being made with China or any bullish comment from Trump…

But those are just noise and won’t erase the pain inflicted to the economy these last weeks overnight. Let’s not get excited just because we had some green candles, let’s focus on the data. I’ll change my bias when data changes but until today…

To me, recession is coming and this is the relief pump I expected two months ago. Retail are buying the dip like never. And I believe they’ll be crushed soon enough. Hence my tendency to raise cash & not rush.

Watched Stocks and Portfolio.

Hims & Novo Nordisk.

Both companies officialized a partnership this week. The first step is to have Novo’s Wegovy - their branded GLP-1 drug, available on Hims.

"At a single, unified price starting at 599 USD per month, individuals may be prescribed Wegovy®, alongside Hims & Hers’ world-class, holistic approach to care, powered by today's technology. The offering is available this week on the Hims & Hers platform.“

This is the first news and it brings lots of implications.

First, Hims will sell branded solutions on its platform at competitive prices - compared to other resellers. It won’t be compounded semaglutide in terms of pricing, demand nor margins but it is much better than what was a few days ago already, and will remain on the platform for years.

Second, it diminishes the risks of Novo suing Hims for infringement - you usually do not partner with someone you’ll sue. This was the biggest short term bear case, hence the relief to see it lifted. I am also curious about what it implies for their compounded semaglutide - as Hims still proposes it for those who need personalized dosages. I assume it will be left aside, which again is very bullish.

Third, it is a validation of Hims’ platform. My entire Investment Case lies around it and how their focus on simplicity & personalization is their competitive advantage. Novo is selling its drugs through many other partners, but they chose to partner with Hims instead of cutting them off after the compounding dramas. Means something.

Fourth, this is only the beginning of their partnership which would place Hims not as a drug manufacturer, but as a global healthcare platform - which is the bull case. More confirmation.

“The companies are developing a roadmap that combines Novo Nordisk’s innovative treatments with Hims & Hers’ ability to scale access to quality care, aiming to "

I will let you interpret that last sentence how you want as it is pure speculation, but “improve long-term outcomes for more people, more affordably.” isn’t just about selling drugs through their platform to my opinion. Time will tell.

Later this week, the FDA aproved Novo Nordisk’s semaglutide oral solution filing, expecting a final decision Q4-25. This new would have dumped Hims’ stock without any doubts a few days earlier as the market would have seen it as competition, but the stock kept pumping after the release. I am not saying the market sees it as a bull case - although it certainly believes the drug will be available on Hims platform, but it sure doesn’t see it as a threat anymore.

There’s a clear shift in narrative.

Tesla Semi.

The electric truck will finally go to production. The factory is almost completed and the first units should come end of this year with production ramping through FY26, with the capacity to roll out 50,000 of them per year.

And the information doesn’t come from Elon so maybe we can believe it.

Nvidia & China.

Without any surprises, Nvidia confirmed this week that they were working on a new version of their H20, adapted to the new U.S. export controls. We knew this was coming, so it’s only a confirmation of how fast their teams can adapt.

Chinese companies will continue to priviledge Nvidia because of CUDA, as I talked so many times & detailed on the investment case. Once those GPUs available, volume will go back to Nvidia without much doubt.

Earnings.

As usual, here’s my views of the stocks I follow & the price at which I believe we should focus our cost average, updated with the latest data.

As shared above, to my opinion, cash is king. Most stocks on my watchlist are close to what I consider an optimum buying price but are also printing a lower high in term of price action - the start of a potential downtrend. We do not want to be caught in those but don’t want to miss great buying prices neither. The in-between is cash management. Deploying a bit to seize opportunities. But not everything as better prices might come sooner than later.

Patience is key. Opportunities always come. And they take time to form.

Weekly Planning.

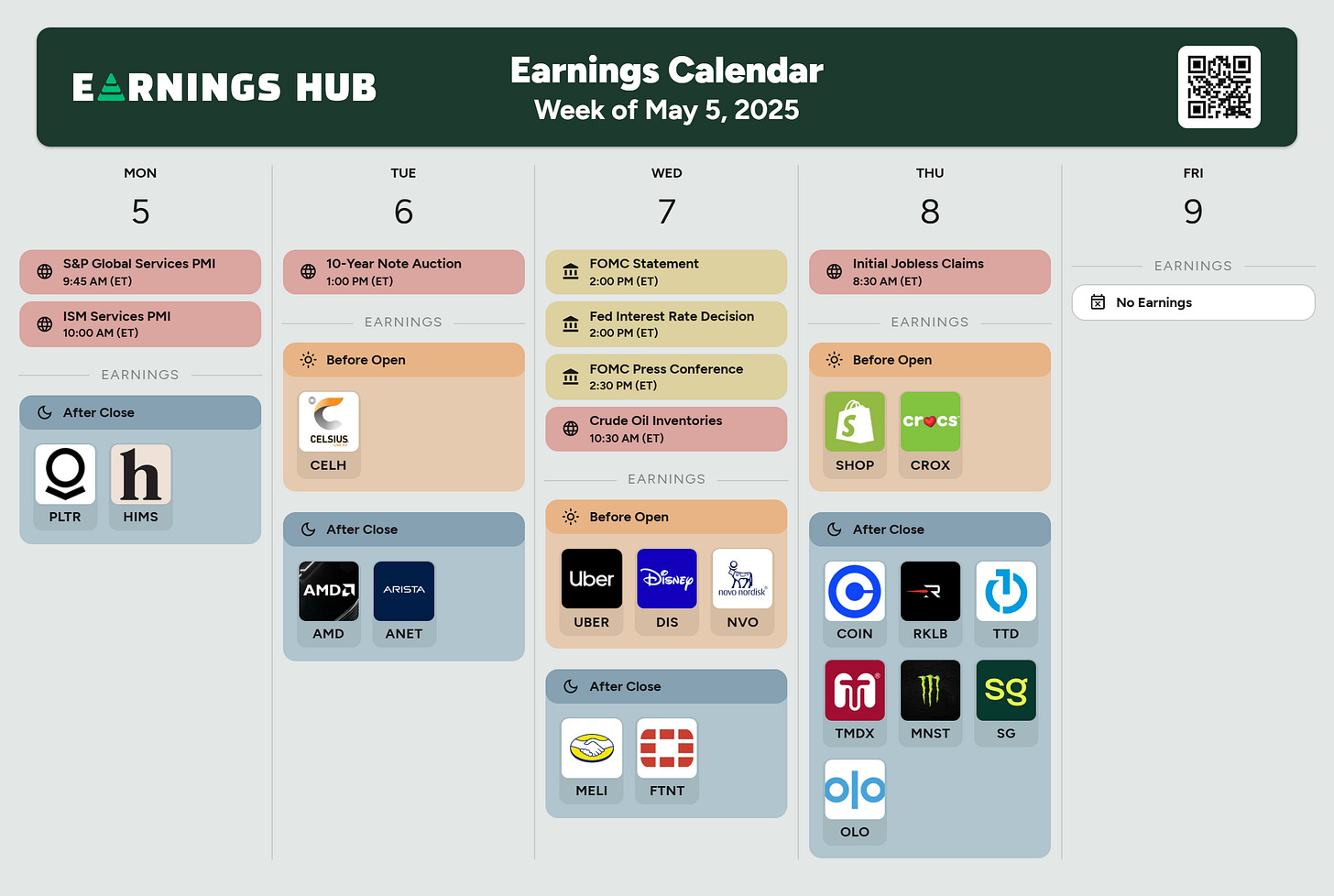

We are entering the busiest week of the season for me, not at the best moment. I will be very busy so I won’t give any dates for the write-ups - although I will try my best to do them less than 24h after release, as usual.

But you will for sure receive detailed reviews on Palantir, Hims, Uber, Transmedics & Olo this week. I will also keep a very close eye on Arista & AMD. And the rest will be shared on the Saturday’s write-up if interesting.

We also have the interest rates decision on Wednesday, which should not see any cut if the FED maintains its position but in the actual environment… Who knows? More volatility incoming for sure!