Weekly Recap | Market's Crashing.

The breath of recession on our neck.

The market gave us a good idea of how scared it is about a possible recession and how it would react if it were to happen: violently. That’s what we’ll talk about today as we didn’t have much news this week. What happened, why, and how can we prepare for those situations - and what could be coming.

Here’s the summary, feel free to jump to the end if you're not interested in the broader context.

1. Peter Lynch’s stomach.

2. Liquidity cycles.

3. Interest rates & recession.

4. My stocks list, buying prices & priority.

I’ll start by reminding you that I do not give any advice; this is only my opinion and my way of doing. I’m only sharing it. Nothing is to be followed or taken for granted.

Peter Lynch.

For those who do not know him, he is one of the best investors out there with returns around 29% per year for more than 20 years - transforming $10,000 into $1.6M in two decades, not bad eh?

He has a very famous quote, which I’ll share just here because it clearly fits today’s mood.

This is a proper introduction to this write-up.

Now let’s get a bit more technical and review what is happening and what to do about it - or at least what I will do about it.

Liquidity & Cycles.

Politics & governments gave us the most intelligent people over the past decades with the best institutions ever created, namely the FED & the IMF, between others - feel the sarcasm.

Those people believe they can control money and have been trying to do so for years, failing miserably each time, and today is another one of those times - not too long after the Covid failure.

Let’s talk about liquidity & cycles - and try to keep it light.

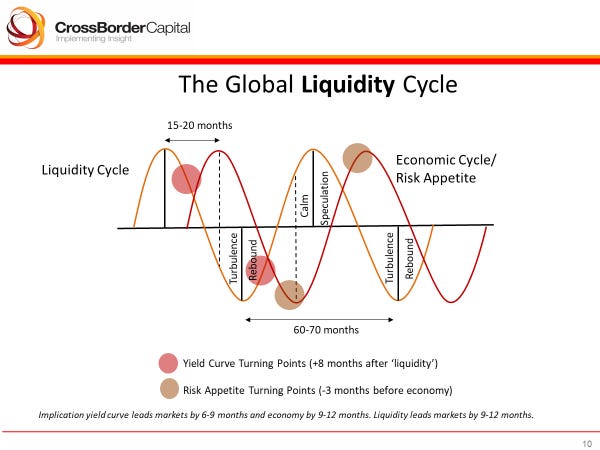

The concept is pretty easy to understand but impossible to control. Our economy is nothing but a constant repetition of growing & tightening liquidity. This is what the FED is doing all day long thanks to interest rates which they raise or lower according to what believe is the best to do.

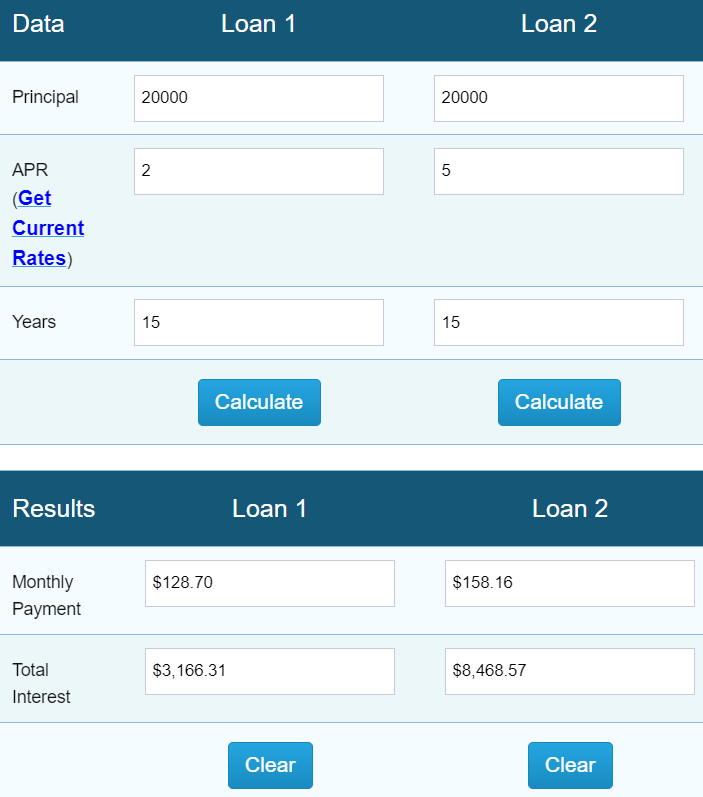

That’s where the concept is simple: Low interest rates mean an easy access to loans and a stronger consumption as people have more money and can borrow easily to consume. High interest rates means higher fees to pay to the bank on their loans and therefore a harder access to credit & less money available to consume.

You can see the difference.

Higher interest rates mean less consumption. Anything besides basic needs is made harder as households keep less money for themselves, which leads to less revenues for companies and the start of a nefast cycle.

Interest Rates & Recession.

Interest Rates.

When Covid struck and our government shut down our countries & economies, they had to compensate for us to continue living. When people don’t work, they aren’t being paid so the state took it on its back to help each and every one of us by raising liquidity - lowering interest rates and throwing money into people’s bank accounts.

A picture is worth a thousand words, so this is the dollar money supply - literally the amount of dollars in circulation around the world.

After creating so much money and distributing it to everyone without any restrictions, consumption didn’t stop - not even slowed down. People were not at work and had tons of money sent to them reguularly so they did the only thing they could do when you have time & money: They consumed, more than ever, and inflation came.

The only way to fight inflation is to lower liquidity, and that is done by stopping consumption - in other words, by hurting households’ buying power through higher interest rates. That is what the FED did two years ago. Less consumption means less revenue for companies, less revenues mean layoffs, feeding the chain of lack of consumption and bringing more layoffs - as the fired employees won’t have money to spend.

Slowing down consumption with higher interest rates will reduce liquidity with time, that is what you can see happening early 2022 on the screenshot above - although you can easily notice that the liquidity taken out of the economy is a very small portion of what has been poured in.

Recession.

This is a good summary of where we are today in terms of macroeconomics, but I want to say two things before going further.

First, the conclusion is easy to be drawn after the events. It’s easy to say “this happened,” but it’s hard (impossible really) to know how things will happen in the future. Money, liquidity & the economy at large aren’t controllable and only politicians think they can do it efficiently. The last decades clearly showed they can’t, but they’ll keep trying because they don’t have a choice anymore.

Second, I have no idea how things will turn out in the next months. The actual panic on the market might be just that: a panic as the market anticipates a recession which might or might not happen. The only thing I know is that in the markets, it’s better to be prepared than not, and that’s what the rest of this write-up is about.

The narrative lately has been that the interest rates will be lowered and that this will bring liquidity back to the economy, but reality is a bit different. The last months under high-interest rates have done their job, the labor market is hurt, unemployment is rising, consumers consume less, which means companies also start to hurt. The economy is now struggling.

Reaching this situation is exactly what the FED wanted but we’re now potentially too deep, and the question is: Can we bounce back to a healthy economy without passing through a tough recession? To do so, the economy has to be hurt just enough so that there is a possible come back.

Not too much; otherwise, it will take years to bring back enough liquidity to consumers. But not too little neither, otherwise bringing back liquidity will start another cycle of strong consumption and rising inflation.

The perfect middle ground is very thin and almost impossible to reach. That is exactly why the markets usually crash just before interest rates are lowered: because investors want cash before the recession hits and destroys companies revenues - and the sign of lowering rates is usually the start of the recession as the FED is always too late.

Liquidity is king.

This is where we are and what happened today as many are withdrawing their money from the market, expecting a recession, expecting that the FED will fail to reach this perfect spot and will push the economy too far, to a point where it will break and need to be fixed and not just restarted.

So we’re back to the only thing we can do in the face of a greater force: be ready for everything. Not anticipate - we can’t anticipate what will happen. But we can be ready for whatever happens.

Companies, Buying Prices & Priorities.

You will find below a list of the companies I do want to buy & hold over the long term with what I consider being their fair price, based on today information - those assumptions will change as new information come.

Bold are my must-buys & bigger positions.

Green are focus buys, companies I believe are strong enough to go through a recession without any issues and whose stock will bounce back rapidly.

Orange are wonderful and healthy business but they will likely be impacted, maybe struggle a bit, and take longer to catch up.

Red companies are great companies which should be heavily impacted by recession, mainly because their business rely on consumers or because they are still small and might struggle financially during a recession. I personally will buy them, but in last priority.

Advertising. Meta & Google are two of the best businesses in the world at the moment, especially as digitalization continues to ramp up and online advertising is one of the most critical expenses for any business.

AI is currently optimizing their tools and creating better products for their clients, a trend that will continue in the coming years while both are also expanding into other areas.

I will take any opportunity I have to grow my position in these two beasts.

China. Alibaba is alone in this category but is also in a very specific situation. It needs international liquidity to pump but no one wants to put their liquidities in China lately, yet the business is simply wonderful & growing.

It’s a bastard situation where if the U.S enters in recession, investors won’t pour liquidity in the U.S market so it might capture it. Or not… Hard to know but I certainly will buy more.

IT Hardware. This is the narrative I push since long and probably one of the only sectors where business shouldn’t decline much. Companies like Meta, Google, Amazon, and others sit on more cash than countries and will certainly continue to deploy it, recession or not - probably at a slower rate but still. Building infrastructures take time and they won’t stop entirely.

Even if I were wrong in terms of timing, those companies are still strong and their products will be very demanded later on, I have no problem buying at the right price and holding through tough times.

Software. Those will still be used by many companies because they rely on them to function while many others will build new relashionships even under tough macro conditions.

We might have a slower growth but nothing to worry about over the long term as demand will come back, at least for the best of them - namely Palantir which I will buy heavily at the right price.

Payment & Banks. Even if the West pays & consumes less, banks & payment systems will still be used. It won’t be my focus because it isn’t my favorite sector but PayPal is still undervalued and SoFi is still the bank of the future.

Healthcare. There is a big difference here between Hims & Transmedics.

Hims will be hurt in a recession as most of its products aren’t really medical - or at least not critical. Consumers could choose to prioritize other leasures or have different priorities and stop buying their Hims treatment. But it still is a wonderful comapny with a strong balance sheet, strong enough to survive a recession and probably thrive afterwards - but this will need to be controlled.

While Transmedics’ business relies on critical and not postponable healthcare - organ transplants, it should continue to thrive even under recession. Yet, the market will certainly punish it harshly as there is a big difference between the stock and the underlying business - investors want liquidity.

Energy. Both Tesla & Enphase have been very hurt by high interest rates, but the truth is a recession will certainly hit them even harder as the problem is the same: consumers don’t have money to buy their products.

Important to keep an eye on them and buy in if we enter a depression as I believe in their long-term prospects, but they have to be bought more carefully than others on this list.

Apparel & Consumables. This category is the tough one as all of those companies will be hurt by a lack of consumers - which will happen in a recession. Those will be closely followed and bought only if the company is still behaving well, not in terms of growth but in terms of finances, through the period.

I personally believe that those will take long to come back in case of a recession, and there’s no rush buying in as the other categories will catch up earlier.

My Take.

As to what I think about the macro and the stock market itself, we sure had a good example of what would happen if we were to really enter a recession. The market simply overreacted today and caught up as we still have more buyers than sellers. Hard to know how the FED & other institutions will react to this, but I certainly don’t think we’ve seen the end of it, I do believe the next months might be a bit tough and don’t trust our institutions to work wonders.

But the truth is no one knows and it doesn’t really matter. What matters is to be ready in every possible situation, and for me, it sums up to two things:

1. Know your companies & where you want to buy their stock.

2. Keep liquidity as long as you have doubts about the macro: stocks can fall very deep.

And always, always follow your plan & your research, not your head. It’s always hard to buy on a sea of blood. Trust them and execute when the time comes.