Weekly Recap | March - W5

Mistakes, Market's Reaction (or Lack Thereof), Tariffs on Cars & Healthcare, Focus on GPUs, Inference, Nvidia in China, CoreWeave IPO, Impacts on Nebius & Robinhood Event.

Big week.

I’d like to start with a rapid word on the market itself - what I got right and what I got wrong so far. The last 6 months can be summarized in only one mistake, which was enough to crush performance: not following my own advice.

I shared in November that I wasn’t confident about FY25, because of consumption & potentially tariffs & DOGE, depending on how they’d apply their policies. They went all in, and instead of accepting that I was a bit early in my rotation and pushing liquidity to gold and China - as I said I should, I stayed greedy on risk.

And this is how things went; a 20%+ delta between those assets.

Performance went from 42% alpha to on par with the S&P 500 for the last 6 months. In other words, one hell of a mistake for someone who knew - and shared many times, that this was coming.

Another proof that execution is superior to ideas.

That being said, things are how they are and the only thing that can be done now is to continue grinding, find alpha in the months to come. No overreaction, no overtrading - just focusing on what’s coming & finding narratives that can outperform - only for the active portfolio.

It’s just the start.

I will write another Investment Thesis in the next weeks to clarify my actual position: where we are, where I believe we’re going in the next months & years, and what I intend to do. And I’ll listen to my own advice.

The bottom line is that we are entering a very turbulent period, and we’ll need to focus on long-term fundamental in my opinion. The market will give opportunities, so we should plan for the next 5 years & beyond.

Macro.

I wouldn’t call this a mistake because, as an investor, we have to build convictions and play them. But I have to say I was dead wrong in terms of timing when it came to the expected bounce. I shared last week that the FOMC meeting gave the market everything it wanted, but it apparently wasn’t enough.

We didn’t have much news this week - at least nothing really interesting, but here’s a rapid recap & some comments.

Core PCE & PCE came in slightly hot, which means inflation continues to fluctuate. We already knew this, but the market seems to constantly be scared.

GDP came in 10 basis points higher than expected - nothing interesting as the market is focused on the decline coming from the trade deficit due to tariff frontrunning.

Jobless claims came in lower than expectations - good for the economy but bad for the market’s perception.

More tariffs will be announced Tuesday. No idea what’s coming to be honest, and it’s hard to believe Trump on anything either way.

Bottom line, This continues to show the Fed was right to wait on cutting rates, which doesn’t please the market which is now scared & selling in anticipation of Tuesday’s tariff announcements. Big week coming.

Tariffs On Cars.

I’ll talk about these because they’re live, although Trump said - as usual, that he’d be open to negociation. So who knows? Maybe they’ll be canceled by the time I share this weekly update.

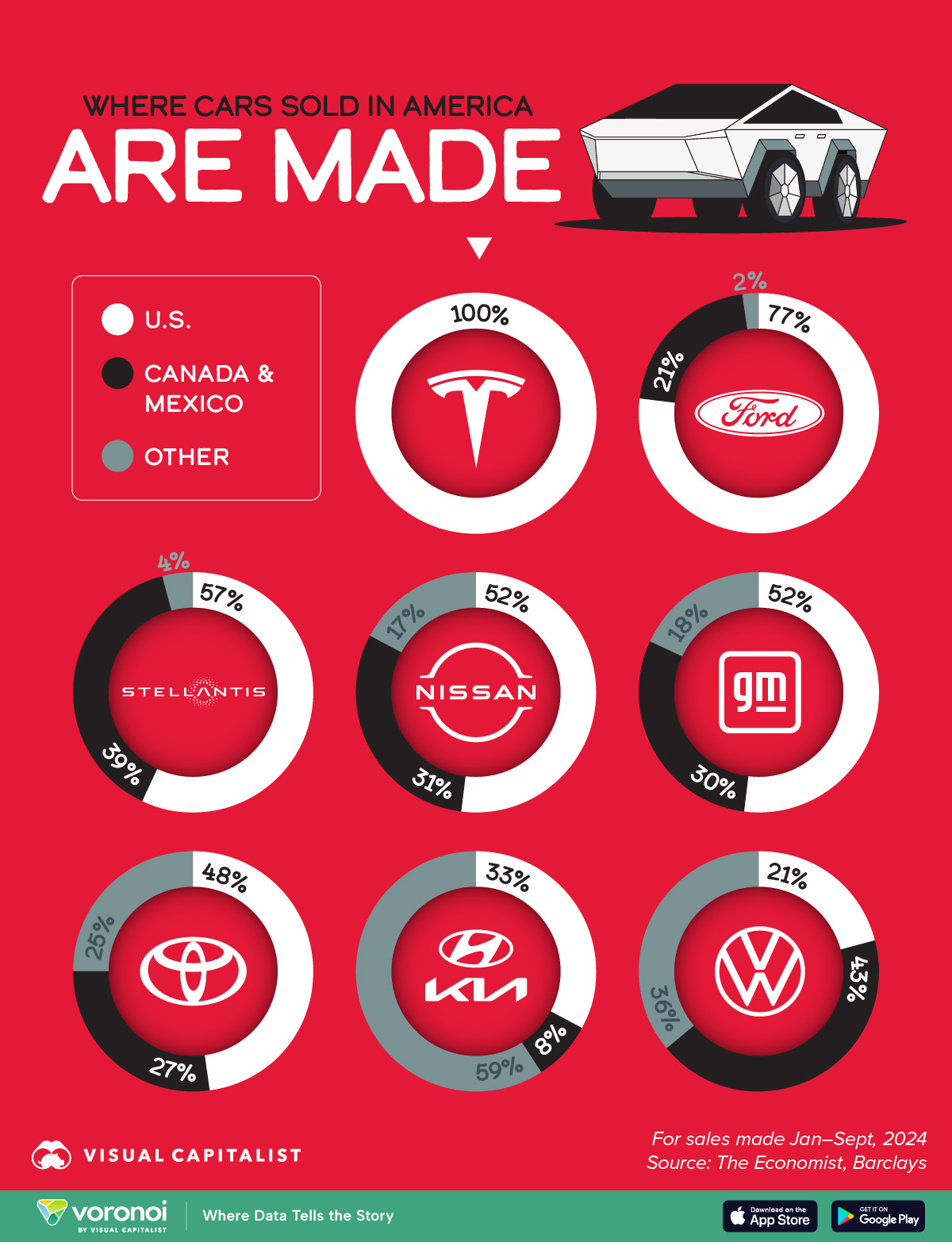

The U.S. will now have a 25% tariff on imported cars - impacting most manufacturers while making the product more expensive. Silver lining as a Tesla shareholder: Tesla is the only brand manufacturing 100% of its cars sold in the U.S. within the U.S.

We’ve seen the brand struggling big time lately, and I’m not sure this will help sales. But the bottom line remains that Tesla became less expensive relative to competition overnight.

As for the narrative “It’s again a rule in favor of Elon” or things like that, not being a fanboy, but let’s move on. These tariffs were planned long ago, and Tesla didn’t know they’d come when they chose to manufacture 100% of their cars in the U.S. a decade or more ago. Plus, it doesn’t really matter.

I still believe this is a terrible idea from an economic point of view, but it seems like Trump is ready to put terrible ideas into practice. So, here we go.

Tariffs on Healthcare.

We’ve talked about Hims a lot lately and I released a commentary of Andrew’s really interesting interview with Himshouse yesterday - worth a read.

The industry is also targeted from tariffs as Trump announced his intention to impose some on the healthcare industry. This seems even more ridiculous than the rest, as it means drugs will get more expensive, healthcare will too & directly, some parts of the government expenses as some drugs are covered by social security. Seems smart for someone who wants to reduce deficit.

For Hims or Transmedics - companies I own, it’s hard to know if they’ll be impacted. Both produce their hardware or drugs in the U.S., so they shouldn’t be affected for their final products. But it’s hard to know where components come from. If those are impacted by tariffs, it will affect their final pricing.

Hard to understand this move, but it’s hard to understand a lot of things lately. I’m not sure we should think rationally about most information.

Watched Stocks & Portfolio.

Lots of talk about GPUs this week because it’s an important topic for long-term positions, even if the market sells this sector in the short term.

The Need for GPUs.

The biggest question lies around the need for GPUs - or computing power more broadly. How much do we need now & how much will we need in the future? Here’s what I wrote about the potential need for inference in my Nvidia Investment Case:

“There is a global consensus saying that inference requires less compute than training, but I - and many others, tend to disagree with this. Most, I believe, forget to factor the massive usage of AI tools in the future & its different applications - we’ll talk about those just after. One person using an LLM isn’t compute intensive, but hundreds of millions of users will need thousands of GPUs to manage inference, and this need will grow depending on how complexe the model is.”

And we had one of the first displays of this this week, as ChatGPT released its new 4o version and the internet decided to use it for the best purpose there is: redoing every piece of content we have in Ghibli style - for my greatest pleasure. This led to the case described above: a much better AI model being used in huge volumes - not a few thousand but probably millions, for a pretty intense usage: image generation.

If you’re interested in some of the best results - to my judgment, it’s here:

https://x.com/WealthyReadings/status/1904989348497440908

And after tons of crashes & refusals to generate images, we had this.

As I said in Nvidia’s write-up, inference is no joke.

“What we know is that today’s installed compute isn’t enough, and this is confirmed by providers like Google, Amazon, or OpenAI, which cannot satisfy the actual demand for both training & inference while the number of models deployed & real-world use cases widely available are few. What happens when we have thousands, millions of apps & billions of users on the most advanced models?”

I am really, really long Nvidia.

China, Nvidia & The H20.

yet, the GPU company & the entire sector, didn’t do well this week. As is fhte actual sell-off in the market, China said they’d change some of their environmental curbs, and respecting them would mean Chinese tech companies could not buy or use Nvidia’s H20 chip anymore.

Some context first, as we’re talking about regulation. The U.S. has export regulations fortech hardware to China based on computing power, licensing, geography, etc. The H20 was designed for the Chinese market, to provide them with the best possible chip under those regulations - and to access the eastern market.

Now, we learn that China is changing its regulations to forbid their companies from buying them, which is weird, as most of those companies try very hard to access the best hardware possible. Mix signals here.

This is the new & the stock didn’t like it, as we’re talking about a $17B yearly market for Nvidia. But here are my two cents:

First, China, like the U.S., knows how important AI - computing power in general, will be for the future of innovation. As the country is trying to turn toward it, they’ll need the best hardware. Second, Nvidia is the best, and the H20 delivers better results than their local alternatives - thanks to CUDA. Third, this is proven by what companies do. They continue to massively buy the H20. Alibaba, Baidu, Tencent, and the like still buy Nvidia. There’s a reason.

And this was confirmed by H3C, an assembly firm responsible for selling H20 locally in China, which confirmed they didn’t have enough chips anymore to meet demand and that they’ll start selling to the highest bidder:

"In the notice, H3C said it would distribute incoming H20 chips on the basis of a profit-first principle, prioritising stable, long-term customers with higher profit margins on their orders."

These three points highlight how important it is for any company that wants to be relevant worldwide in AI to rely on Nvidia. And it’s hard to believe that China would deliberately shoot itself in the foot and accept falling behind. I believe there are two possible solutions from here.

First, Nvidia did tailor chips to avoid export controls from the U.S. The H20 is meant to be sold to China, so I don’t see why they wouldn’t tweak it again to address these new regulations.

Second, China knows how important it is for its companies to get a hold of Nvidia’s chips if they want to remain competitive - and they do. I’d assume they’d rather have their own chips, but they’re not there yet. They can choose to go down this rabbit hole & fall behind. Or to have a deal, allowing the H20 to be bought.

Truth is, we are entering a period where countries bluff & accept the consequences of those bluff, which can end up with markets turmoil. I said it here already, I’m not sure we should think rationally anymore.

Nebius, Underperformance & CoreWeave IPO.

I’ll start with the stock’s underperformance and my commitment to it - without results so far. There’s a fine line between being ridiculously stubborn and patient enough to be rewarded, and I’m really starting to question where I stand.

I’ll explain why.

Nebius Isn’t A Good Long Term Position.

This is what I believe. I shared it as a narrative trade to ride the AI & computing power demand wave - which, as we’ve seen, isn’t slowing. But I never thought it would be a great very long-term hold - 5 years & more.

For a simple reason: Nebius sells a commodity, which is usually not a good business.

When many companies provide equivalent services, the winner is the cheapest. We can argue there’s more to it, especially for Nebius, which is known to be one of the best not only in terms of pricing but also in terms of services at large - which is true, Some of it is due to its internal expertise, while the rest is due to its partnerships.

Notably, the one they have with Nvidia, which allows them privileged access to their hardware - something others don’t have. They’ll get Blackwell chips with priority while competition won’t access them for months. There’s a window during which Nebius will be a better provider, not only in terms of pricing but also in terms of service,.

This is what I intended to play: the growth stage where demand is huge & we don’t have many providers yet, so most of it doesn’t go to the cheapest but to the best - that’s Nebius.

But this could, or should, fade.

In time, companies will have this hardware & upgrade their products, services, etc, to be comparable to Nebius. This is where the war on pricing starts, as most will offer comparable services, at least comparable enough so pricing is the deciding metric, and when that happens, demand should pass to the cheapest.

Does that mean Nebius won’t be part of it? No, they could be one of the top provider by then. But as of today, it’s really hard - impossible really, to know or anticipate. Or, to be more precise, I’d rather not try to as the unknowns are many and I cannot make a case on why Nebius would remain the best in 5 years.

If we were to take a comparison, we could talk about the cloud services market which was born years ago now. The boom was comparable with many companies proposing those services, but as they became uniform, only the best remained. Today? Market is controlled by a few key actors, whereas it was hundreds of them a decade ago.

I won’t deny that having a 2% market share of a multi-billion-dollar industry is a bad thing. I’m just trying to highlight why I believe we’ll see the same dynamic and why I chose to only play the early stage.

What isn’t a commodity, though, is the hardware - hence why I’m so bullish on Nvidia. Because even if renting GPUs becomes normal, all those farms will still need to buy them. And that means they’ll continuously need to go to Nvidia - and indirectly TSMC. That’s where the value is, in my opinion. The safe bet.

In brief, I’m still holding because I still believe my thesis is right & the market is mostly selling off the current political environment. I still believe a bounce is coming sooner rather than later.

CoreWeave IPO.

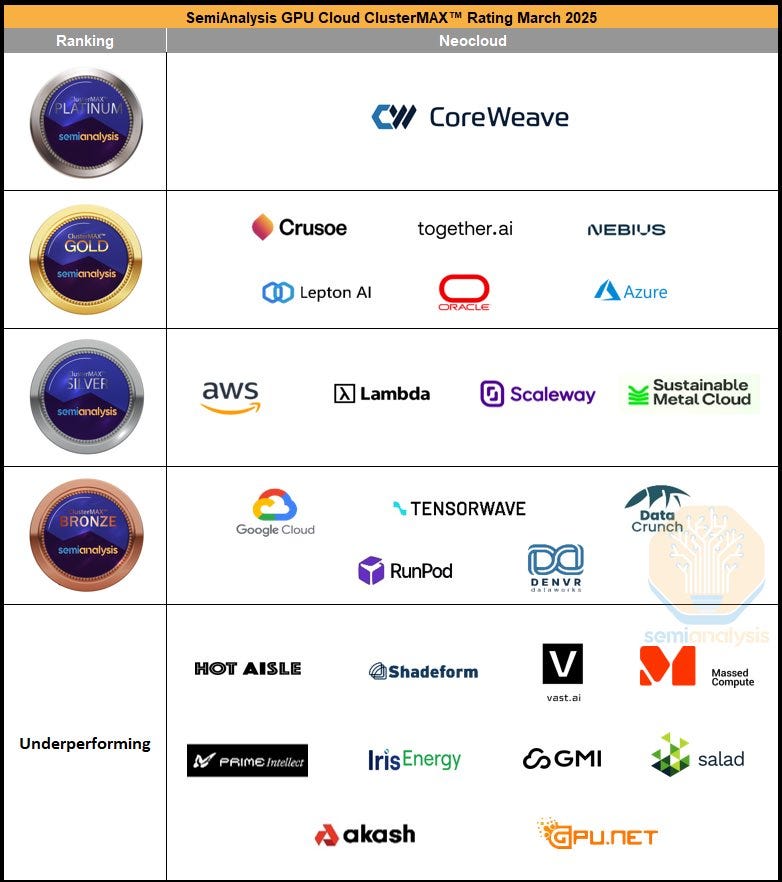

You saw this name in the screenshots above. CoreWeave is supposed to be the best AI cloud provider service in the market at the moment, just above Nebius in terms of quality of service.

The company went public on Friday - terrible timing…

Yet the stock held up better than expected & it now gives us a great comparison point for Nebius, closing its first day at a valuation of $18.52B compared to Nebius’ $5.3B. Here’s some data.

Lots of assumptions here, let me go over them.

The most important one comes with CoreWeave’s ARR as they didn’t disclose it but disclosed RPOs, which are multi-years contract - with an average of 4 years, and we know they have a contract of $12B with OpenAI over the next five years. That means 80% of their forward revenues come from one client - not the best.

My assumptions are that $12B over 5 years equals $2.4B per year, and that $3B - the rest of RPOs, with an average contract length of 4 years (disclosed in their S-1 file), means roughly $750M per year. Hence, FY25 revenues around $3.15B and ARR above $3B. I believe it could be slightly less as we know Microsoft already paid part of the contract this year, but as nothing is precisely disclosed I’ll keep the higher end for my assumptions. I also assume that Nebius will reach its $1B of ARR by the end of this year and its high-end guidance of $700M in revenues for FY24.

Excluding other concerns like actual growth - which is similar, although Nebius is still young, and profitability - on which Nebius is much better as they project to reach it this year while CoreWeave is bleeding money and heavily indebted, we could say that both stocks are actually trading at comparable forward value.

I believe Nebius is a much better company, but the market isn’t giving any asymmetry here. It offers comparable value for both of them - give or take, which isn’t the most bullish, to be honest, as it means the market doesn’t believe Nebius is worth much more than $30 (in the best case where the stock catches up on CoreWeave’s forward ARR).

My personal average being at $32, I still believe a bounce and a bit of optimism back in the market will give me a good enough exit - hence me still holding the position. We’re reaching peak pessimism, and although I’ve been saying this for weeks, I continue to have the same take and my money on it.

Other Subjects.

Robinhood Event.

I’ve said many times that I followed Robinhood by curiosity more than interest, but I have to admit I really want to use their platform now - and sadly can’t as I’m European. They really are good at everything they do.

Their last event focused on the announcement of their banking service - and some other services like a better UI & AI functions for options trading, UI improvements, and some advising tools with competitive fees.

But as I said, the most important is the announcement of Robinhood Banking.

What sets the company above competition is its design and ergonomics. The team did live demonstrations and everything is easier than ever with instant transfers between Robinhood accounts - savings, checking, or investment & more, while Gold cards have already been live for months.

I’ve got to admit that Robinhood is turning out to be everything SoFi investors wanted to see. It doesn’t mean the latter will die, but my personal investment thesis on SoFi is exactly what Robinhood is delivering today: a perfect financial app offering almost every service it needs to with the best ergonomics possible.

There isn’t any lending yet, to my understanding, but if Robinhood were to bring it to their platform… it wouldn’t be a gambling or investing app anymore - it’d be the best 2.0 bank. They’re just great, so I’ll add it to my watchlist.

Thanks for the commentary..!