Weekly Recap | March - W3

U.S. Macro Overview, China Stimulus, Computing Power Demand, Gold ATH & Why, Buy & Hold Portfolio, Weekly Planning & Ulta Q4-24.

Macro.

And again, more of the same.

CPI & Core CPI.

Inflation continues to slowly decelerate although the detail is as usual, pretty bearish for households. The hurt is done.

Energy is again the source of deflation, only from a commodity point of view. Services are inflating both MoM & YoY. Bottom line: households will pay more for services & less for the commodities. So sure, it’s not fully inflating, but it still is rising while salaries aren’t. The result? Pressure.

Food continues to be more expensive, but we know other factors impact it, so let’s move on.

And the rest - excluding food & energy, continues to be more expensive. Core CPI is under expectations but still very high. Everything continues to inflate MoM except transportation, though it’s much higher YoY, so…

Households are getting crushed and I don’t see how we avoid that famous recession sooner than later. If not a recession in the real definition of the term, at least a real slowdown in U.S. consumption, hence why I do not want to be too exposed to stocks in that sector.

PPI.

PPI came with really positive numbers, although with constant higher lows & not a real downtrend. But it gives some positivity for the next months.

Not much more.

Michigan Expectations.

Yet, inflation expectations aren’t slowing down, on the contrary.

Not sure this is really valuable as those are only expectations. But it matters to the market as most investors look at it, and this explains why Gold is doing well lately.

I personally am still not sure if we will have inflation but as I shared on my FY25 expectations, I believe it will be either it or recession. Will be hard to avoid both.

Jobless Claims.

Labour market continues to be resilient, which is kinda normal as the US Initial Jobless Claims doesn’t include federal employees which have different systems. It shows that the private labour market is still healthy.

But it doesn’t paint the entire picture.

China.

If you follow me since some time, you know that my assumptions with China were that the government would boost local consumption through small, regular & targeted stimulus. I detailed my view on my Investment Case.

It has started some months ago, and the government announced more of those measures this weekend.

“To vigorously boost consumption, comprehensively expand domestic demand, enhance consumption capacity through income growth and burden reduction, create effective demand with high-quality supply, and strengthen consumption willingness by optimizing the consumption environment while addressing prominent contradictions restricting consumption in a targeted manner, this plan is formulated to implement special actions to boost consumption.”

This is the introduction of their announcement & is exactly what I expected to happen a year ago. It’s great to see confirmations. We’re not out of the woods yet but the bull case continues to perfectly move forward.

The communique doesn’t give specifics but they are making plans to grow incomes for everyone while pushing even further for key sectors & raising the minimum wage. They also intend to help families with subsidies, insurances, help for schools, pensions but also improve medical help & their unemployment system.

There are many more keypoints I won’t go over as we don’t have specifics, the bottom line is that lots is going to change if they apply those measures, which will be pro innovation, inflationary & meant to boost consumption & investments, from locals & internationals.

The bull case is more & more alive.

Watched Stocks & Portfolio.

TSMC & Computing Power.

I continue to repeat the same thing but it is because every week, we have more & more confirmation that my assumptions are true: demand & need for computing power is far from over.

Firstly, we had TSMC monthly reports & the data is bullish as we are talking about a 43.1% increase for the month & 39.2% for the two first months YoY, which is really huge as the numbers were pretty big in FY24 already.

There is a need for more semiconductors which means there is a need for hardware, as data last quarters pointed that most of those semis were used for HPC hardware.

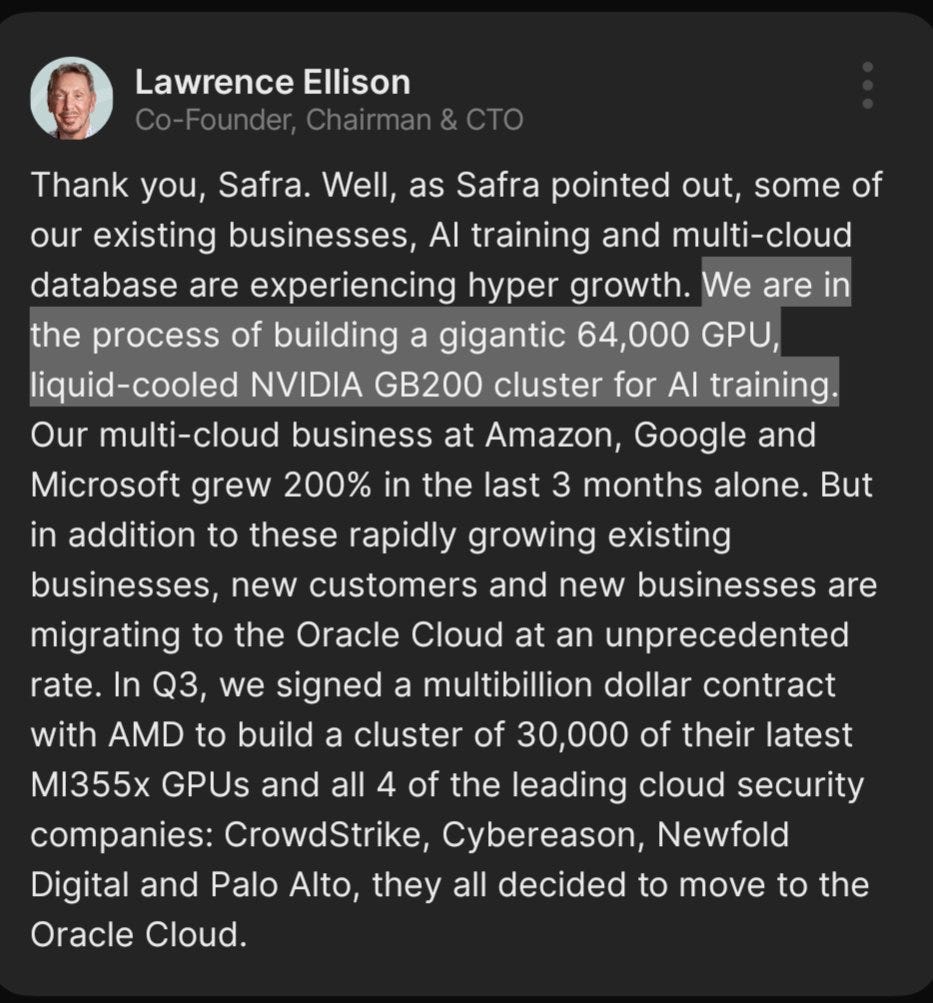

Second, I will repeat that most companies are announcing the growth of their data centers with always more GPUs while publicly stating that their actual infras aren’t enough to answer the demand. It keeps going.

We’re talking about both Nvidia & AMD, and I start to believe that the latter might do something in the future so I’ll keep an eye on it. But we’re not there yet.

Third, it isn’t only true with U.S. companies, it also is true with other countries with Chinese companies talking about growing their investment in datacenters, Europe with the same trajectory or the UAE with comparable plans.

Demand isn’t slowing.

Gold All Time Highs.

I’ve been really bullish Gold & shared it often here, although in all transparency I failed to rotate enough capital to it last month, I should have taken more profits & bought more gold considering my convictions but that’s how it is. Being right isn’t enough in investing…

Nevertheless, the asset is where liquidity is going in time of uncertainty & it shows. I believe Bitcoin will behave the same in time but the world still sees the asset as a speculative & risky one.

Structurally bullish on both, but short medium term will be about Gold.

Buy & Hold Portfolio.

I took some time before doing it as I really wanted to only have one public portfolio, but I ended up opening another one, much less aggressive where the goal will be to buy great companies at fair price & hold. Nothing more.

The goal is easy: A $4,000 DCA at the beginning of each month to buy the best assets at the moment. Rinse & repeat every month, and we’ll talk about it again in a few years. Here’s the first monthly liquidity attribution.

I will do a detailed post the coming week or the one after to detail the portfolio, how I’ll deal with it & the narrative/assets I am looking at for the long term. This portfolio will be about fundamentals only, so we have to think about the future.

Weekly Planning.

Besides this write up, I will look at PDD & Nike this week, the first one being an important earning to me as it’ll confirm Chinese consumption.

I will probably only do a Sunday review for both of them, bit more complete than usual but they are not interesting enough for specific write ups.

Other.

Ulta Beauty FY24.

A lot of enthusiasm went into Ulta Beauty in 2024 as an obvious play, we had tons of noise on the name when Buffet bought in while I confirmed my take that it was a value trap, at least short term.

So far, the data proves me right - short term. I have no idea how things will be in five years so if you buy for the long term, sure. But I continue to think this stock isn’t worth liquidity medium term as I am really not confident on U.S. consumption.

The year closes with huge $1B of buybacks which is a good capital allocation at actual valuation, but we’re also talking about 0.7% growth of comparable sales - which is not even inflation, hence a real decrease of frequentation, and FY25 guidance isn’t better.

I’ll continue to monitor the stock but won’t attribute any penny to it.