Weekly Recap | March - W2

GDP projection, Market's emotional, Computing power, Nebius & Avride keep growing, Hims semaglutide, Retailers manufacturing, Bitcoin Strategic Reserve & Earnings.

Macro.

New week, more of the same… I’d just like to add below my pinned post, which is honestly the most important post to read in this substack, as we went over what is actually happening months ago.

It was easy to anticipate but it is very hard to play & my portfolio is down, like many this week. Anticipation isn’t enough when investing. I said it & I continue to believe that managing the next year well will impact our long-term performance immensely. Exciting times.

Let’s start with the usual.

Tariffs.

This week was the week where we thought we’ll finally live with tariffs: 20% on Mexico, Canada & China as Trump decided to upgrade the latter - why not?

But no… Another day, another miraculous solution found as some exceptions were set up for America’s neighbors. The bottom line being that from now on, there is a tariff on everything except everything… Not joking.

China is a different situation. It might hurt them slightly, but as I shared in my China Investment Case, a 20% tariff on those imports won’t change anything on how competitive their products are either way.

So more of nothing. And the market knew it as it didn’t move at all for days after the announcement. It expected the resolution we finally had; only problem is that this resolution came a bit too late, some real damages were done already.

GDP contraction.

Because of this:

The data was released on Monday & scared the market big time, passing from a 2% ish growth to a -2% decline in a few days. There is an explanation for this.

GDP takes into account trade balance. And when companies believe that from next week, their materials are going to cost 15% or 20% more, there is only one logical decision to take: to stock.

So that is what they did; they bought much, much more than usual to anticipate higher costs & ended up growing the trade balance deficit much more than usual, affecting negatively the GDP projections.

That’s all it is. Nothing more, nothing else. Uncertainty impacts companies.

Now don’t make me say what I didn’t say: the economy is still struggling & I’ve said it for months now - DOGE cutting expenses is making it worse, etc, etc… We’ve gone over it all for weeks now; things aren’t good & I am not bullish FY25 & FY26.

But in this specific case, there is a very logical explanation for the negative GDP. And even if Trump’s administration ended up finding exceptions, this episode feels like a wake-up call for the market, which now starts to understand what I shared months ago while is it shaken more & more by uncertainties.

My View.

It’s very hard to navigate in such markets & I continue to believe that the next months are going to shape the portfolio’s performance for the years to come.

My FY25 thesis remains & those last weeks just confirmed to me that this is where we are heading: toward a very probable recession. I believed we would have more time & potentially new ATH coming, but I will be a bit more cautious as, again, this week seems like a wake-up call to the market.

I remain positive for the next weeks. Liquidity is still great, and we have some positive news coming soon enough with the slowdown of QT or the draining of the TGA, which just started as the debt ceiling is still in place.

The market is in extreme fear & everyone is calling for the end of it at the moment, so I wouldn’t be surprised to see a bounce in March, maybe lasting April & somehow May. But I will be taking profit & starting the rotation I talked about months ago.

If you didn’t read my write-up on China, this is a good moment to do so as I’ll be growing my positions there.

I’ll adapt as best as I can, but I don’t feel confident in the market right now - too much uncertainty, emotions, high valuations for some names… A breather is needed & I don’t think the risk-reward is good enough at the moment, short/medium term.

I’ll update you either way, as usual!

Few More Words on China.

We had inflation data that came out this weekend & it isn’t good as the country continues on its deflationary path.

They don’t look good. This will give ammo to those who believe that China is entering a deflation cycle like Japan. As I said in my write-up, it’s possible; it is a risk. Nothing says that they will succeed in changing their population’s habits and bring consumption & inflation to the country.

But China doesn’t think about the next year or two. They think about the next decade. Their plan is set up & clear: small, regular & targeted stimulus packages - things won’t change overnight. Can’t judge them on this number only. Stimulus only began.

I’m not saying we should all be overly bullish on China, but we should all read about it & form our opinions. Mine’s that they’re in a pickle. But that they have a clear plan which will take time to give results. Not gonna judge after a few months only.

Watched Stocks & Portfolio.

Computing Power & Investments.

We have lots of news lately about Nebius & that is a really good thing; we’ll talk about it just after, but I’m reading some crazy things on X with lots of misunderstandings, so I will start by a small introduction on computing power as I want to make the subject really clear.

I’ll illustrate the issue with this post, for example - but many others have the same conclusions.

Comparing Mistral or DeepSeek to “tech giants” who “pour $100B+” is first ridiculous & second inaccurate. A good comparison to saying this is to say that every time you want to live in a house, you have to build it. Or that every time you need electricity, you need to generate it. It’s not true.

But if others do not spend billions on infrastructure, then they won’t be able to turn on the lights. Companies like Nvidia, ASML, TSM & co provide hardware. Companies like Meta, Google, Amazon, or Nebius then buy this hardware & build infrastructures. This is what costs money; this is where the massive CapEx goes: into infrastructure.

They then sell the usage of this infrastructure to companies like Mistral & DeepSeek, which obviously won’t need to invest as much to use computing power because they don’t need to own the hardware, just like you do not need to generate your own electricity. You rent it, just like they rent computing power.

If everyone had to manage their own electricity, everyone would pay billions. But we have companies doing it for us, so we only pay a few hundred dollars in bills. We’re still using their infrastructure & we couldn’t do anything without them. And as a reminder, Mistral was actually a client of Nebius to train its LLMs.

Mistral & DeepSeek are consumers & “tech giants” are providers. The first needs the second to build their apps; they couldn’t do sh*t otherwise. So, no, Mistral obviously doesn’t need to spend $100B to train models, but they couldn’t train models without other companies spending those billions in infrastructures. They’re all part of an ecosystem & dependent on each other.

Nebius & Avride Expansion.

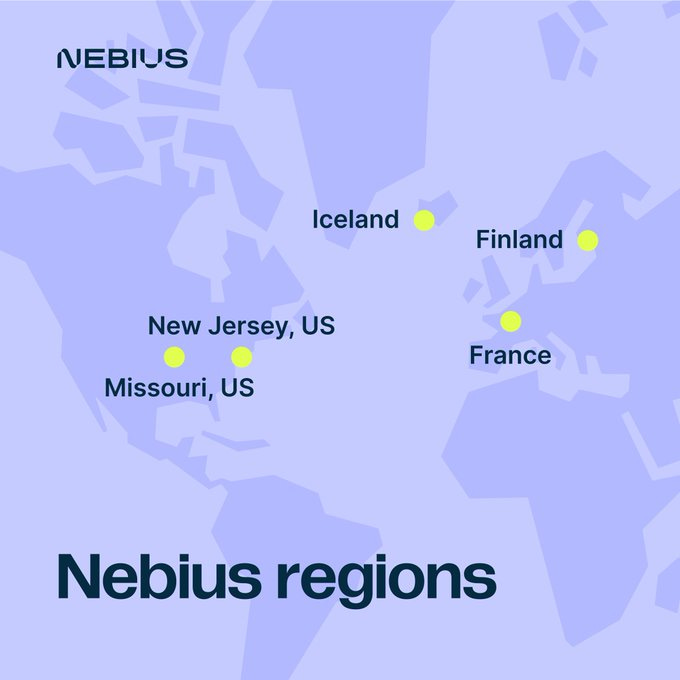

Back to Nebius, who announced that they were expanding their datacenters in Iceland & introducing 300MW more in New Jersey. They said they’d do it during their last earnings call, so it isn’t a surprise, but it shows that the company is moving fast.

As a reminder, expanding their capacity is a big part of the bull case; many computing power providers have been saying that they can’t answer the demand with their actual infrastructures. More MW means more potential clients.

And by diversifying in different geographies, they also broaden their potential clients as proximity means better service - in terms of latency but also of customer service.

Second, we have more news coming from Avride after the expansion of their delivery robot in Japan last week; the company announced a partnership with Hyundai with a commercialized product for this year.

You guys know I am on Tesla’s team when it comes to autonomous vehicles, but I also believe that Google’s Waymo & comparable have a place, if only to replace the actual Uber system with autonomous vehicles. Tesla’s FSD is meant for car owners to stop driving, but mobility services are another subject!

Good news.

Hims, Semaglutide & Novo Nordisk.

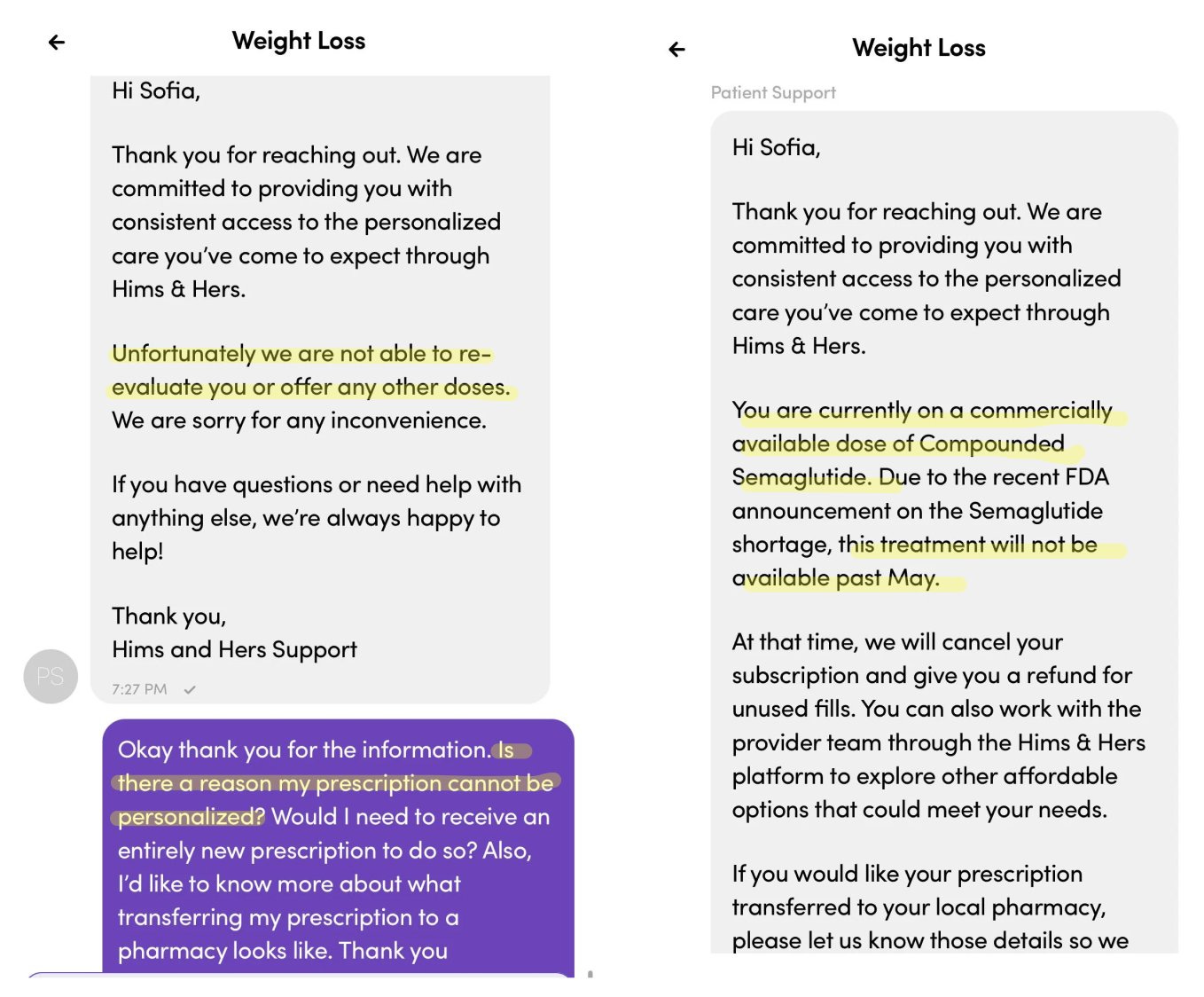

Hims has given back most of its yearly gains since the FDA announced the end of the semaglutide shortage, but the story has still some pages left apparently, as some conversations between patients & Hims’ team were shared publicly.

We’ve already had some screenshots of patients under a personalized solution where Hims’ team confirmed to them that nothing will change for them as the drugs they use aren’t commercialized, so they cannot find alternatives, which would apparently allow Hims to continue their business with them.

But we now had conversations with non-personalized solutions where the team explained that they couldn’t change & pass to a personalized one.

This is only my understanding & interpretation here, but I’d assume from there that Hims will continue to sell compounded semaglutide to any clients who need a personalization - something we already suspected.

They will continue their business with their actual patients and will certainly accept to provide to new clients if necessary - i.e., if they do not have commercialized solutions adapted to their needs.

My point sharing all that is that the market right now is pessimistic on Hims because it doesn’t trust the actual guidance & believes that all growth coming from semaglutide will end; hence guidance won’t be met. If those assumptions are confirmed, it means they will retain more of their semaglutide business than many expect.

The team is also trying to set up a petition & send it to the FDA to allow them to continue their business. I am not sure why they would spend time on this & it is a display of weakness to my opinion, a display that bears are right thinking that semaglutide is the heart of Hims’ growth. I still do not believe it, but future might prove them right.

On another end, Novo Nordisk announced a lower-price for their semaglutide drugs, starting at $499 per month, much lower than their initial cost but still much, much higher than Hims’ while not providing the same service at all. It probably won’t be a viable alternative to compete with Hims others’ products.

Lululemon & On Manufacturing.

I wanted to rapidly talk about Lululemon & On Running, using them as a proxy for most of the apparel retailers, as the market sold them off after the tariffs announcements while those companies won’t be impacted - not yet.

Both those brands & many others, stopped manufacturing in China years ago as cheaper competitors arose - Vietnam, Cambodia… Any products imported in America won’t be impacted by the new tariffs; hence their business remains the same without any impact on volumes nor margins.

Just wanted to make this clear.

Bitcoin Strategic Reserve & Crypto Submit.

More noise from the Trump administration, without anything concrete, but some positives. The president signed a decree to officially set up the Bitcoin Strategic Reserve, but I’ll detail why this doesn’t matter…

Here are the key takeaways:

All reserves will be managed by the Treasury.

The reserve will consist of what is already held by the U.S., hence confiscations. Those assets cannot be sold - on the open market. We’re talking about many different coins, including Bitcoin, Ethereum & other speculative assets.

No Bitcoin purchases planned for now & future decisions will be made by the Treasury.

No potential purchases of anything besides Bitcoin.

My overall reaction is positive. I have shared with you many times that I didn’t expect anything special & that the U.S. surely wouldn’t buy Bitcoin on the open market. So, that’s what it is. But this marks a clear shift of opinion & kinda officializes Bitcoin’s position in the world. It isn’t a geeky thingy anymore. They also made a clear difference between Bitcoin & the rest, which was really important.

As for the market, it sure was disappointing as many thought the U.S. would grow a Bitcoin position… While they’ll simply hold onto what they have, which is like doing nothing.

Second, they clearly state that those assets won’t be sold but could be restituted. As 100% of them come from seizures, 100% of them could be sent back to their original owners. Half of the Bitcoin holdings come from the Bitfinex hack, for example. So… they won’t sell, but that doesn’t mean they’ll keep them.

So yeah, besides the symbolism this act represents, it is a lot of nothing. I see it as a net positive, but many will be disappointed as their bags won’t be pumped by debt monetization - though expecting that was kind of delusional.

Concerning the Crypto Summit, nothing interesting was shared & the most important actions are the suppression of all the limitations set by the previous administration on financial service providers, which means those will be able once again to propose crypto services. We talked about this many times already; nothing new.

Crypto Taxes.

Just wanted to add a little bit on many tax revisions concerning cryptocurrencies by many countries, the latest being Japan this week.

It is just a proposition, but it is interesting & will allow me to go a bit further.

Taxes on gains are a government way of using its soft power to indirectly force people to save their liquidity somewhere specific. We all in our countries have fiscal advantages on some specific accounts.

This is because governments want our money to finance their debt or things like this. You’ll believe it is a good thing for you because you’ll pay less taxes, while the truth is they indirectly use your liquidity to fund their systems.

I am not saying it is right or wrong, I am just saying that lowering taxes on crypto assets is a mean for a conutry to attract users of those assets & indirectly, to legitimate it & grow adoption. Less taxes makes the asset more attractive.

Earnings & Weekly Program.

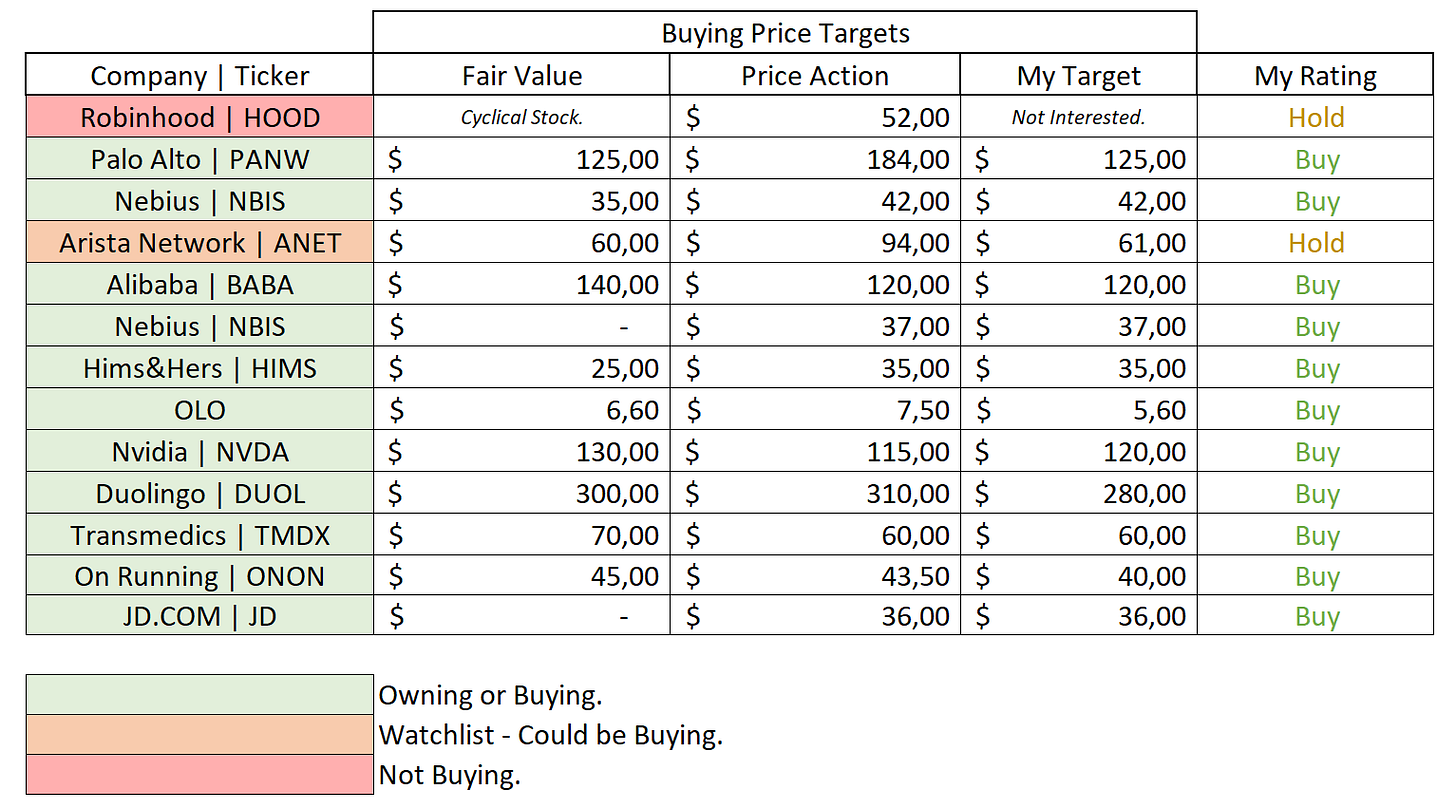

As usual, I commented on the companies I was interested in and here’s the list of the stocks and their fair value to me - as in the price at which I would consider buying them - you’ll find the others on the previous report.

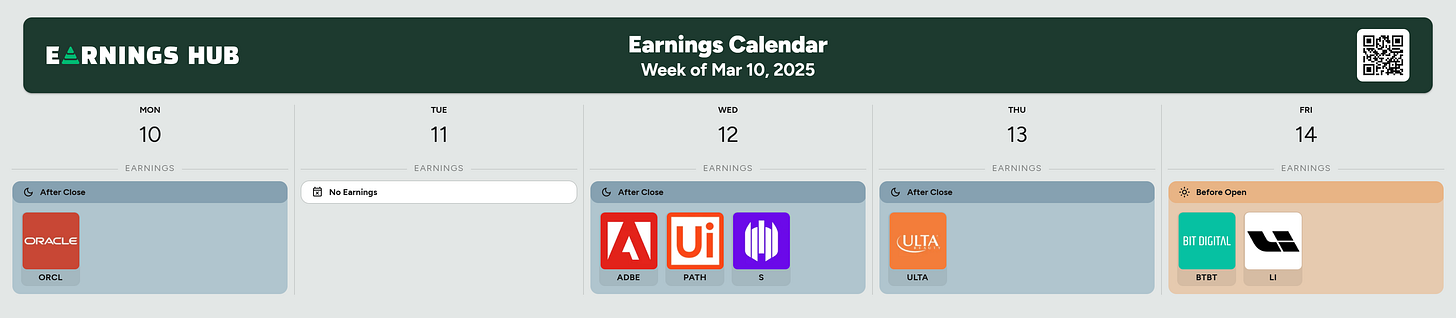

We’re not done yet with the earnings season, but the calendar is clearly slowing down now. I’m planning to do a deep review on Adobe as it clearly is one of my favorite companies to look at, but that’ll be all this week.

As I start to free up time, I’ll try to write again about other concepts. Feel free to tell me if there are anything you guys would like to talk about or any format to change, upgrade, or else!

This is a wrap for the week, but you can expect a portfolio modification at open as I’ve pushed some liquidity into the options account & intend to start buying long-term calls on Chinese companies - and one more.

Will see you then!