Weekly Recap | March - W1

Market is emotional, Avride expands in Japan, Tesla sales & FSD, Computer power demand & Earnings review.

Macro.

A few topics today, starting with the usual ones: Jobless claims came in much above expectations this week, 242K vs. 221K expected, which continues to show weakness in the labor market while PCE came in line with expectations, a pretty good new for the market as this is what the FED is looking at for its interest rates decisions.

Business as usual.

Tariffs.

We also had the second wave of tariffs and the market didn’t react to it at all.

Trump announced a 25% tariff on Europe without exceptions - at least at the time of writing. This doesn’t matter much as Europe doesn’t export anything really interesting or vital either way, mostly leisure products.

So, no real biggie except for drugs and medicines, which are the number one import from the region, meaning GLP-1 drugs should be concerned by this if it were to be validated - at least Novo Nordisk’s ones. Not sure if this can play in favor of Hims, but it is an interesting development. It is a big deal for Europe though, negative one.

More importantly, Trump reiterated his wish to set up the tariffs he threatened a month ago on Canada & Mexico - much more impactful. Same story than last month, and we said back then that this would happen. He made clear demands and only gave a delay to both countries; he’s now unsatisfied with the measures those countries took, so he comes back with the same threat.

My conclusion is the same as when it was first announced: big talk that will certainly find a resolution at the buzzer.

If not, I keep the same view as I shared months ago: very inflationary in the short term, which aligns with my FY25 investment expectations but goes against a green market, obviously. Combined with the rest of the government measures, we have more and more pressure on the economy & consumption.

Market’s Emotional.

We’ve had a very volatile this week following many different events, mostly seen as a negative by the market but the PEC friday gave a nice pump to close the week. Bottom line is that the economy isn’t better & tariffs would make it worst.

Yet the market didn’t react to those news specificaly, I have two interpretations of this. First, it believes that they won’t go into effect and that another magic resolution will be found rapidly.

Second… the market doesn’t care much about anything anymore besides liquidity, and it isn’t really a good thing to me as it means investors - or most volume, disregard this data. We’ve had tons of volatility for sure; macro continues to be kinda unstable, and politics continue to be vocal.

I believe we are getting closer to a longer-term top, which means speculation is driving more volume than in usual market conditions.

And I tend to do what the market does: I bought this market dip for the same reason - liquidity remains positive and should continue to be for some months, due to fiscal dominance and the debt ceiling issue, which, as long as it stays, will force the government to drain its accounts. Plus, the potential slowdown of QT which won’t change much in liquidity but will certainly please the market if it happens.

Liquidity flowing = liquidity entering the markets.

We are certainly heated, and I have no idea how things will unfold, but if we were to see another leg up, I will take profits big time as I’d assume it will happen when the last drops of liquidity flows. Once/if QT slows and the TGA is drained, if the economy isn’t much better than today - and I don’t see how it can be, I really won’t feel good about risk assets.

I remain concerned and believe we’ll have some bad days during the next two years or so. And it is necessary for it to happen if Trump wants to build the golden age of America. You can’t build a house on rotten foundations.

Portfolio Modifications.

I kinda spammed you guys with portfolio modifications but will have to tweak the concept. I will only update for call option plays or major changes in the portfolio - new positions or selling/trimming. I won’t do anything for normal DCA buying as I usually share my targets, and you can get the information from the portfolio for those if interested.

Watched Stocks & Portfolio.

Nebius in Japan.

We’ve talked about Avride, the autonomous system branch of Nebius. They shared during the call that they received - or were about to receive, licensing for the product in Japan and confirmed this week that it was now a done deal.

The Japanese will see those cute delivery machines on their streets, only in Tokyo’s center for now, while the company continues to expand.

Avride is a bonus to the bull case, but I love to see bonuses do well.

Tesla Sales & FSD in China.

Two big subjects for Tesla. The first one is pretty bad news as January sales have plummeted in Europe.

This is one thing, but the real problem is that during the same period, EV sales in Europe grew 34%, which means demand is there but not for Tesla’s products.

As for the reason, it’s really hard to know. Some will speculate on Elon’s political opinions, macro conditions, lack of demand for Tesla, or the fact that people are waiting for the Model Y refresh before buying - which we’ll need to monitor.

I have no clue.

But my bull case for Tesla remains on FSD, Optimus & energy from this point forward, so… not very worried. And things are moving fast there as FSD was finally released in China with lots of surprises, as many were expecting delays compared to the original plan - as usual with Tesla. But no. We’ve seen lots of test drives already with very, very good results.

https://x.com/ray4tesla/status/1894550608017068376

Keeping in mind that Tesla trains its FSD on driving data from everywhere. Their cars are now able to drive in China after being trained with content from all around the world - mostly the U.S. obviously. This is the bull case and the proof of concept. FSD can be deployed everywhere without any changes to the software.

There are nothing comparable.

Computing Power Demand.

We’ve had Nvidia’s report this week, which reported what I think are great results, but the market was pretty angry and punished them for it. It seems like expectations cannot be met anymore for the company.

The bottom line, though, is that the demand for computing power is still growing, and all CEOs of involved companies are saying that they do not have enough to meet the demand.

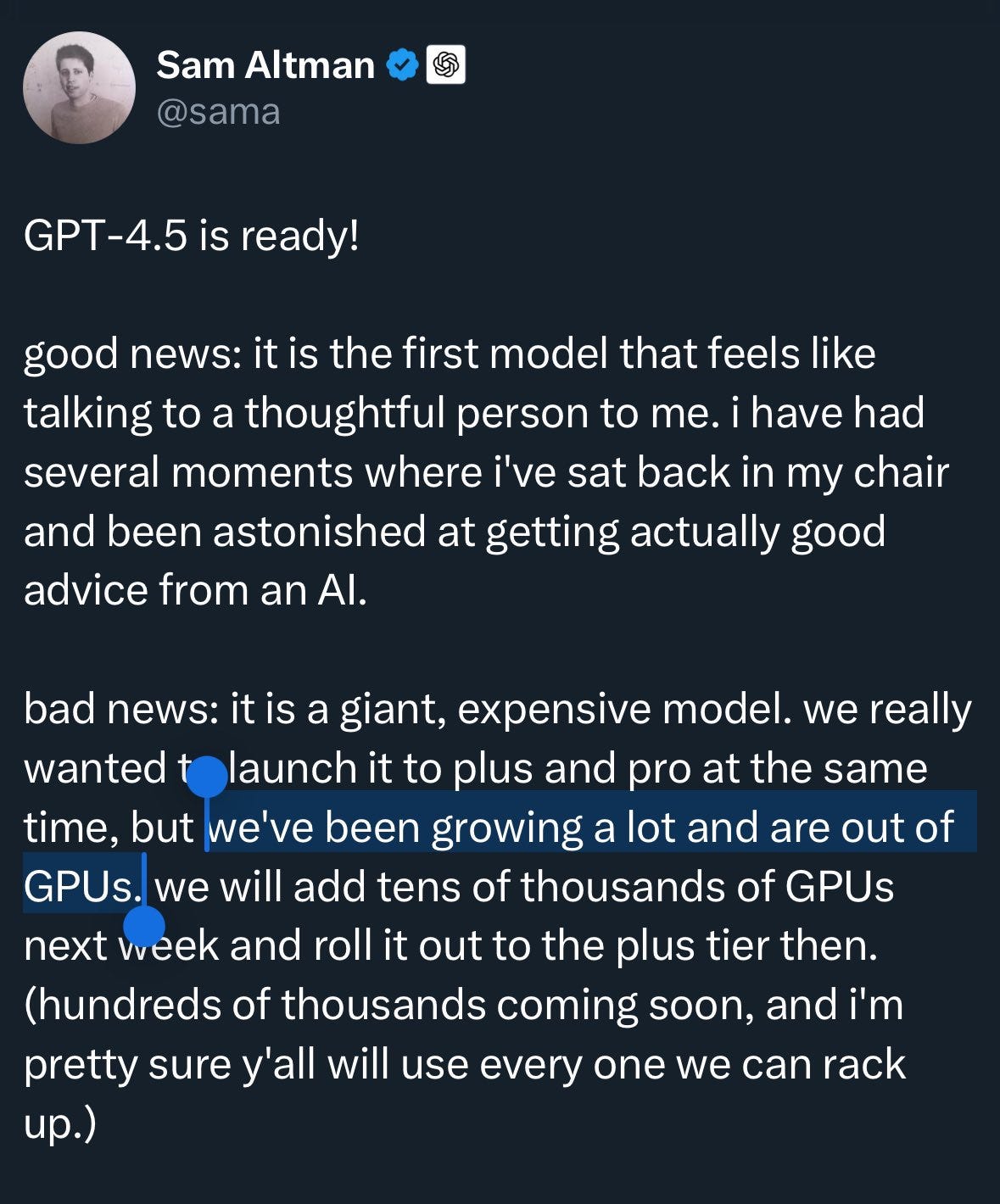

We heard it from Google in their quarter, we heard it from Amazon’s CEO this week, and in this post from Sam Altman of OpenAI again.

The market is globally unhappy and pessimistic at the moment, as shared earlier, but the fundamentals behind computing power are as strong as ever, with demand and need only growing.

Earnings & Weekly Program.

We are closing what was probably the busiest week of the season & we are closing it positively mostly - in term of fundamentals for the business I follow at least.

I commented on the ones I was interested in and here’s the list of the stocks and their fair value to me - as in the price at which I would consider buying them - you’ll find the others on the previous report.

About next week, some very interesting companies reporting, you guys can expect a detailed report on On Running on Tuesday. Nothing decided yet but I will keep a close eye on AST Space Mobile & JD.com, which might need a detailed report. The rest will be out of curiosity & probably shared on a saturday report.

Hope you guys had a great weekend!

What a week! Need to remember to rotate some liquidity into gold for the rainy days.

Yeah personally believe this will come handy at one point