Weekly Recap | June - W3

FED Stays Still, China Consumption, Transmedics Competition, Hims Branding, Meta News, PayPal Agentic AI, Tesla Energy & AST new contracts.

No change on buying targets on plans, although the tech giants continue to feel topy short term and seem to confirm a double top - TSM, META, PANW, ASML & NVDA to name a few, while small caps continue to go wild.

I also want to highlight the Transmedics plan as I did on the last portfolio modification write up. Plan’s here, keeping in mind my average still remains below $80 so I can average up as my optimized average cost is around $110.

Price < $130 - Slow shares accumulation.

Price < $115 - First long-term option call position (1 year further minimum).

Price < $100 - Aggressive buying of both shares & option calls.

Macro.

Iran.

The United States did enter the war in Iran & bombed nuclear sites. Once again, I am not here to comment on politics, no one cares about my personal opinion.

This strike was done after market closed entirely which confirmed that Trump wants minimum impacts on them, hence has a clear plan to have the situation resolved by Monday morning. My take is the same than last week.

“My personal portfolio sits on almost 30% of cash and I will be patient to reallocate it, tons of stocks’ are waiting for a beautiful pullback. The S&P has been rallying big time since April & the tariff fears, and we probably need a breather, with or without an Israel/Iran war.

I am in no rush to buy and will patiently wait to see how the situation evolves. Tech & growth might take a hit, and I’ll keep an eye on my buying prices.”

As I above, most of the big tech is close to confirm a double top & this could be the last push needed to make it happen, while many growth stock are waiting for a pullback. The option account might hurt but I intend to hold my positions.

This situation is also why I bought oil companies & shared a plan for both OXY & DVN as anything happening in the Middle-East will trigger an oil spike. Those position will act as some hedge.

In term of planning - because that’s what matters. I see three situations.

Cease fire & talks happen or are announced before market opens - probably what the U.S. administration is hoping for, and the market might not react or give some obvious pullbacks to buy.

Nothing changes - war continues but no escallation, and the market reacts with pullbacks on growth stocks which I would start buying but very slowly, as I personally am not in the narrative of the WW3.

The most unlikely to my opinion but what do I know? Iran retaliates on U.S. bases or any kind of reachable assets and this conflict is escalating. I do not believe in the WW3 scenario as anything like it would require an approval & backing from China which seems far fetched - why would they accept to back up a war with the U.S. to protect Iran’s nuclear program? Either way, I would sit & wait if anything were to fall on U.S. bases.

As for everyone talking about Iran potentially blocking the Strait of Hormuz, most of the oil passing through there is going to Asia, so blocking it would not really hurt the west but would hurt China - not what Iran wants really.

In brief, I will be a buyer on any large cap dip & growth cap support retests as long as Iran doesn’t retaliate on U.S. assets - including both shares & options. If this happens, I probably will sit & wait, with a very slow accumulation of my favorite assets if we reach very interesting prices like in April.

All my buying targets are detailed on the Welcome write up shared above.

Interest Rates.

The FED left interest rates unchanged once again, without any surprise but one comment from J. Powell.

“With uncertainty as high as it is, no one holds these rate paths with much conviction.”

Even the FED doesn’t know what to do anymore and the market, X & Trump are losing their minds over the institution’s stubbornness to keep rates stable while having clear data showing that inflation is under control & the labor market is weakening, two conditions which should be enough to cut rates.

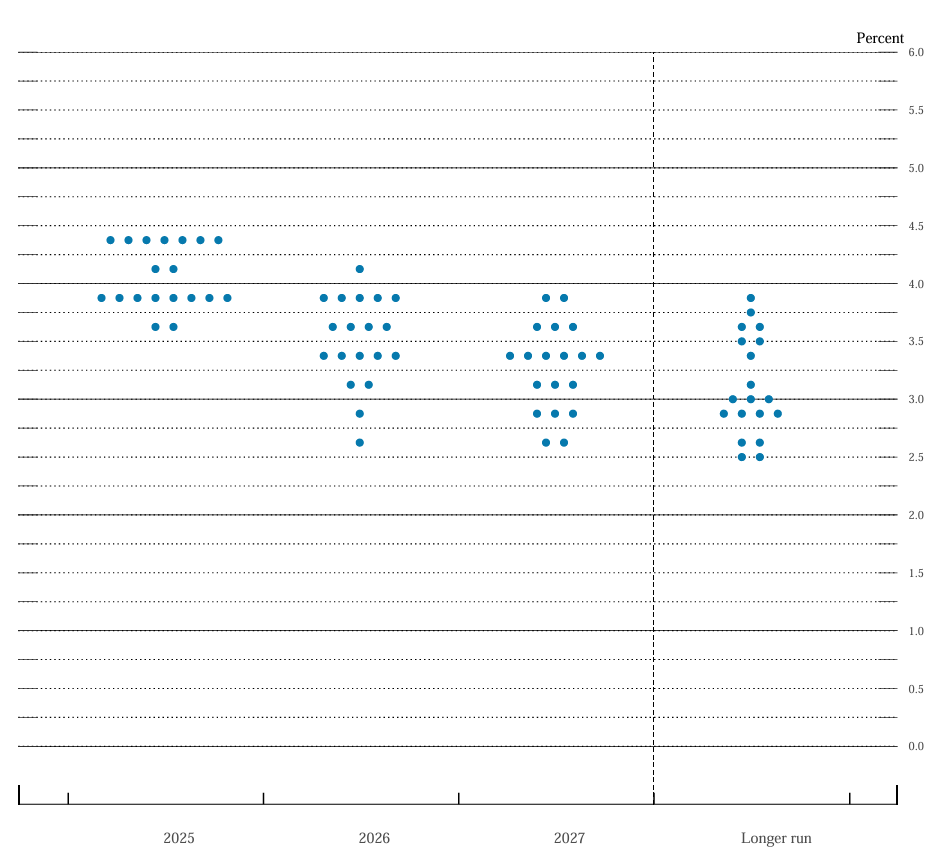

And yet, the FED is clear that it won’t happen any time soon with a dot plot assuming rates above 3% by 2027...

My opinion remains the same since months: rates don’t matter in a fiscal dominant environment & a 50bps cut won’t change anything. If some believe that lower rates would mean less deficit… They’ll be surprised when rates are finally cut because deficits won’t slow down.

At this point, to be honest, this starts to feel like a good reason to sell the news when the FED finally cuts those rates by choice or after something breaks in the system and the FED has to do emergency cuts.

Bottom line, it doesn’t matter in the actual economy.

China Retail Sales.

You guys know how bullish I am on China & Asia - through their population’s buying power increase, and the data continues to prove my thesis right with a 6.4% YoY growth in consumption - 7% excluding automobiles, 4.9% above consensus.

The more time passes, the more bullish I get on the region.

Watched Stocks and Portfolio.

Transmedics & OrganOx.

The FDA approved OrganOx’s hardware to be used in flight transportation this week, which triggered a selling on Transmedics’ stock - which was necessary after such a run-up those last weeks.

OrganOx proposes comparable hardware to the OCS, using normothermic perfusion to keep organs at body temperature up to 24h. They performed 6,000+ transplants since inception & are exclusively focused on livers - compared to 7,000+ OCS usage for Transmedics EOY24 & theit multi-organs hardware. Both companies are working to integrate kidneys without any set dates yet.

This company will be a clear competition to Transmedics for the liver market, but I personally am not really worried.

First, Transmedics is known & widely used now, serves not only liver but also lungs & heart with an upgrades starting trials this year. Its multi-organ hardware compatibility makes it a better option as the same hardware can be used multiple times, with the same staff’s training. Hospitals using different hardware for lungs & others could end up having some formation issues or over costs, compared to a unified one.

Second, the market underestimates the lack of dynamism in the medical sector and that trust matters. Practitioners will not migrate to a comparable product if they built trust, habits & competences using one without a drastic upgrade - like the OCS compared to actual ice buckets.

Third, Transmedics is more than OCS; it is an end-to-end transplant service which brings value in terms of rapidity, costs, quality & organization. OrganOx only sells hardware & needs external organization to complete the transplant.

In brief, competition was to be expected but Transmedics’ multi-organ hardware & ability to create value through the entire transplant chain, not only through hardware & organ conservation makes it the best option in my opinion.

I continue to accumulate.

Hims New Product.

When the healthcare industry meets branding.

The company introduced a new drug: Biotin + Minoxidil Gummy for hair regrowth. It is interesting as hair loss is a huge concern for men & women, but the product is not what I will focus on today; it simply is another product, nothing crazy.

The branding though is something else. Itdoesn't look like medicine but like a candy and not only does it look like it, but it also has the taste & the texture of one. And if you think it doesn’t matter, you’d be wrong.

"Because the truth is, it doesn’t matter how well a medication works if it's not taken consistently. Our mission was to give providers another option to address the unique needs of their patients in making available a treatment designed to foster habit through genuine desire, not forced routine."

Today, 50% of medications for chronic diseases are not taken as prescribed. Because they are not appealing & often not good or enjoyable to take - understandably, or because of side effects.

Transforming a drug into a beautiful & apple-tasty gummy with a beautiful packaging will change a lot in how the drug is perceived & therefore, consumed. You are not sick or under treatment anymore; you are just eating your candy.

Many won't believe this will work. But your brain, habits & unconscious perception are more powerful than your will. Even the advertising changes; the gummies are not shared in a medical setting anymore but on a desk next to beauty products.

"The first-ever prescription hair regrowth gummy [...] From its core ingredients, to its delicious green apple flavor, to its sleek, elegant packaging, every detail was considered to create a convenient, modern, and delightful solution built with women’s unique preferences in mind."

Hims doesn't sell drugs. It sells candies which make you feel better, and this will make the entire difference in terms of the patients' relation with their treatment.

I will share more pictures at the end.

Meta News.

Tons of news this week, all of them making me more bullish.

WhatsApp Monetization.

The messaging platform is finally being seriously monetized through three methods: promoted channels (channel users will pay for it), subscriptions (to those channels on which Meta will take a fee), and ads in status - the Instagram story equivalent. The platform also already has its paid business plans.

Meta continues with its usual methods: Create a platform, build a user base, and only then monetize it. A new source of revenue.

Meta’s Ecosystem.

I might need to review my Meta investment thesis to add this: Meta is clearly trying to build a self-sufficient ecosystem.

It owns its own AI model: Llama, which is leveraged through all its apps and we know that really soon, we will be able to purchase through LLMs. They own the apps & their billions of users & millions of businesses/advertisers.

Soon, final users will scroll Instagram, find an ad they are interested in, click on it and buy directly from Instagram in a few clicks before going back to scrolling. One of the company’s biggest challenges is to grow time spent on their apps, and if those do not need to exit the application to buy anymore… Why would they leave?

WhatsApp’s monetization goes in that direction as users can start conversations with businesses directly through the app. No need to pass through any browser anymore; WhatsApp does everything.

Oakley Smart Glasses.

The company announced its new smart glasses in partnership with Oakley. Hardware focused for sports with equivalent functionalities to the Ray-Ban - access to audio & video directly & Llama to communicate, but with a longer battery life & better video quality - Ultra HD. Starting at $399.

Can't wait to see what Red Bull's athletes will do with those.

PayPal & Agentic AI.

This simple screenshot made me buy back into PayPal as the company is working on transforming ads into carts, meaning you would be able to buy directly in-app with Fastlane for example. Without leaving it or using any browsers - exactly as discussed above with Meta who will be able to build the ads but will need a checkout partner to process the payment, that is what PayPal is working on.

This is the future of advertising & the future of e-comerce, and PayPal is also working to integrate those technologies directly in LLMs.

The future of the internet will be you opening your LLM and asking it to create a cart of the brown pants from a specific brand in your size. A few seconds after, you will have this kind of ad and click “Buy with PayPal” connect Fastlane, use the code you received on your phone, and… And nothing, because PayPal knows your credit card and where to ship your package.

Tesla & China.

The company is building its first grid-scale battery power plant - and the largest, in China with a $557M contract. China is the biggest solar market in the world.

Such infrastructures will become the new normal all around the world very fast as the future will be a mix of energy generation & storage, to help regulate & optimize the grids.

AST Mobile With Airbus & in India.

My investment thesis on AST will be shared during the next weeks but I already share the news around the company, which is now planned to expand in India through its partner Vodafone & its antenna in the region - Vodafone Idea. We are talking about 1.1B users for the satellite service without any acquisition costs as they will all be leveraged by the already established infras of Vodafone Idea…

Second news of the week, Vodafone - again, intends to leverage AST’s infrastructures to serve Airbus & its governmental clients in hard to reach areas.

"Additionally, mobile broadband coverage can be extended to hard-to-reach rural areas and out at sea using new low-earth orbit direct-to-mobile satellites being pioneered by Vodafone."

We still do not know if there is retail demand for the product, but there sure is one from businesse & governments, and we know it will reach billions of reatils rapidly once deployed & online. If demand is there, cash will also be.