Weekly Recap | July - W4

ETH ETFs, Saylor & the crypto market, Crowdstrike & Wiz, SearchGPT against Google, The running shoe war, LVMH & weekly earnings

Ethereum ETFs & Bitcoin Talks

First week with the ETH ETFs live, going as planned with Grayscale clients emptying their bags and the asset losing -11% under the selling pressure - while the rest of the market held pretty strongly, especially Solana.

Around 15% of the Grayscale trust has been sold in a few days, resulting in a negative net inflow of -$177.6M. This is certainly not a bad thing; those ETFs had actually much more attraction than I would have expected as we still have a net inflow of almost $1B without Grayscale impacts, for $1.66B of volume.

Very impressive numbers, comparable to Bitcoin’s first days. Much, much better than I expected, and this is a very good sign long term; there is institutional demand for Ethereum.

Bitcoin 2024. The international conference was held this week in Nashville with some key speakers such as our famous Michael Saylor, other well-known names in the industry but also some newcomers from politics, trying to rally some votes, Robert F. Kennedy Jr. & Donald Trump.

While the first one made his predictions for the future of Bitcoin, the other two promised to fire Gary Gensler from the SEC or to start a national strategic reserve of Bitcoin if elected - beautiful promises but well…

One thing for sure, the narrative around Bitcoin & cryptos completely pivoted in a year's timeframe and there is no more doubt that the asset became important for politics, institutions & companies.

As for those predictions, many consider them ridiculous - me included. But things are always crazy with Saylor and I learned to at least respect the man if not to believe him, because he used to look crazy giving this kind of speech a decade ago.

Look how things turned out.

The market. Hard to know where we go now. I’m still bullish for the rest of the year, especially with rates potentially getting lowered in the next weeks or months now - Powell will decide next wednesday.

Sitting on my hands for my spot holdings, slowly trading some coins when the market gets depressed - things are going well as the trading account is up +50% YTD.

Crowdstrike v2 & Wiz’s Iron Balls.

Not many companies have the balls to say no to Google, especially when they propose to buy you for $23B… Yet, Wiz did say no as they certainly believe they can do better with their own IPO… Hard to believe a company can do better than they’d do being integrated into Google but who knows? They’ll try their luck.

Wiz is offering comparable services to Crowdstrike, public cloud security and we can assume they plan to tons of business after the “Crowdstrike mess”, which is maybe one of the reasons not to accept Google’s offer - maybe.

Competition is fierce in the cyber sector.

Search GPT Will Kill Google.

Nahhh. But there’s some news at Microsoft offices as OpenAI is releasing a new feature for its ChatGPT, which surely is aimed to beat Google Search.

The tool is on a waitlist to be tried, but as of now, it’s hard to imagine anything hurting Google especially while you can have this kind of AI research done directly in the browser. As for the quality of the answers… After trying GPT-4 for a few months, I’ve not found it particularly good, at least not better than Google.

Will need to test this when it comes out, but after seeing Google’s quarter, I’m not sure anything is capable to hurt their business & monopoly short term.

But competition never hurts.

The Shoe War.

We had Deckers results this week, owners of the Hoka brand, which is doing very, very well as sales grew +29.7% YoY. This is good for On Running and confirms my earlier take on Nike’s poor results.

There is no issue with demand; people actually want to buy running shoes lately, even though we start to see a slowdown in consumer buying power - runners are addicts, they won’t ever stop running, Phil knew that.

When Nike’s footwear revenues are in decline YoY while Hoka & On Running grow more than 25%, it’s nothing to blame on the demand or on the macro economy, it’s to blame on the management, the product, or the brand.

Besides Nike, those results are a good omen for On Running results coming in two weeks; there’s enough space for two in this industry and enough market shares to eat from Nike & Adidas for both Hoka & On.

The French Touch

LVMH reported earnings this week, and it’s a very interesting name to watch as the stock has been punished lately because of the uncertain political atmosphere in France more than because of its business.

But this quarter wasn’t the best for the company as organic & global growth is slowing or even declining now.

Coco Chanel said “Luxury is a necessity that begins where necessity ends.”, Seems like not many have this necessity lately, except when it comes to the Chinese, who seem to be the only ones spending in the world right now when it comes to apparel.

Will have to wait before buying in, in my opinion, except if the timeframe is for the next decade in a daddy portfolio, then I believe LVMH is a great catch at these prices.

Earnings

We had great earnings this week, but the potential biggest winner, in my opinion, was Nvidia, who everyone talked about to say that they were craving their products and still in their waiting list…

But besides them, Spotify did great, defying any logic.

Google did wonderful and was as usual punished by the market.

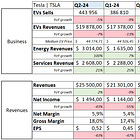

Tesla did great on some specific but far from good globally.

And Enphase starts to see the end of the tunnel.