Weekly Recap | July - W2

Lululemon vs Nike, Amazon is cheap at ATH, new position in Alarum, the world needs more semis, Tesla reports (again) an event & rapid review of Bitcoin.

Lululemon & Nike - The Free Falling Duo.

The entire “retail” sector is in trouble lately and most companies relying on consumer spending power have seen their stocks go down and reach new 52 weeks low over the past weeks.

LULU 0.00%↑ & NKE 0.00%↑ are two good examples but I’ll talk a bit about why a falling stock isn’t necessary a good opportunity - everything depends on why the stock is falling. It’s not a surprise that I am still bullish on LULU 0.00%↑ despite the recent price drop, NKE 0.00%↑… Is another story.

Starting with LULU 0.00%↑ who’s business is going pretty well.

Revenues are growing, income is growing, EPS and revenues per share as well. Nothing here shows a struggling company. Although growth has slowed, the stock being back to early 2023 valuation makes up for this while the company is still looking for single-digit growth this year - even more growth in income & EPS.

A stock falls for two reasons: fundamentals and financial issues or due to ratios contraction. The difference is easy to see in graphs.

In Lululemon's case, both forward P/E and P/S are lower than the actual ones, and we can clearly see a drop in both P/E and P/S over the last few months. This indicates that multiples have been contracting and that both revenues and earnings should continue to grow over the next year - resulting in lower multiples.

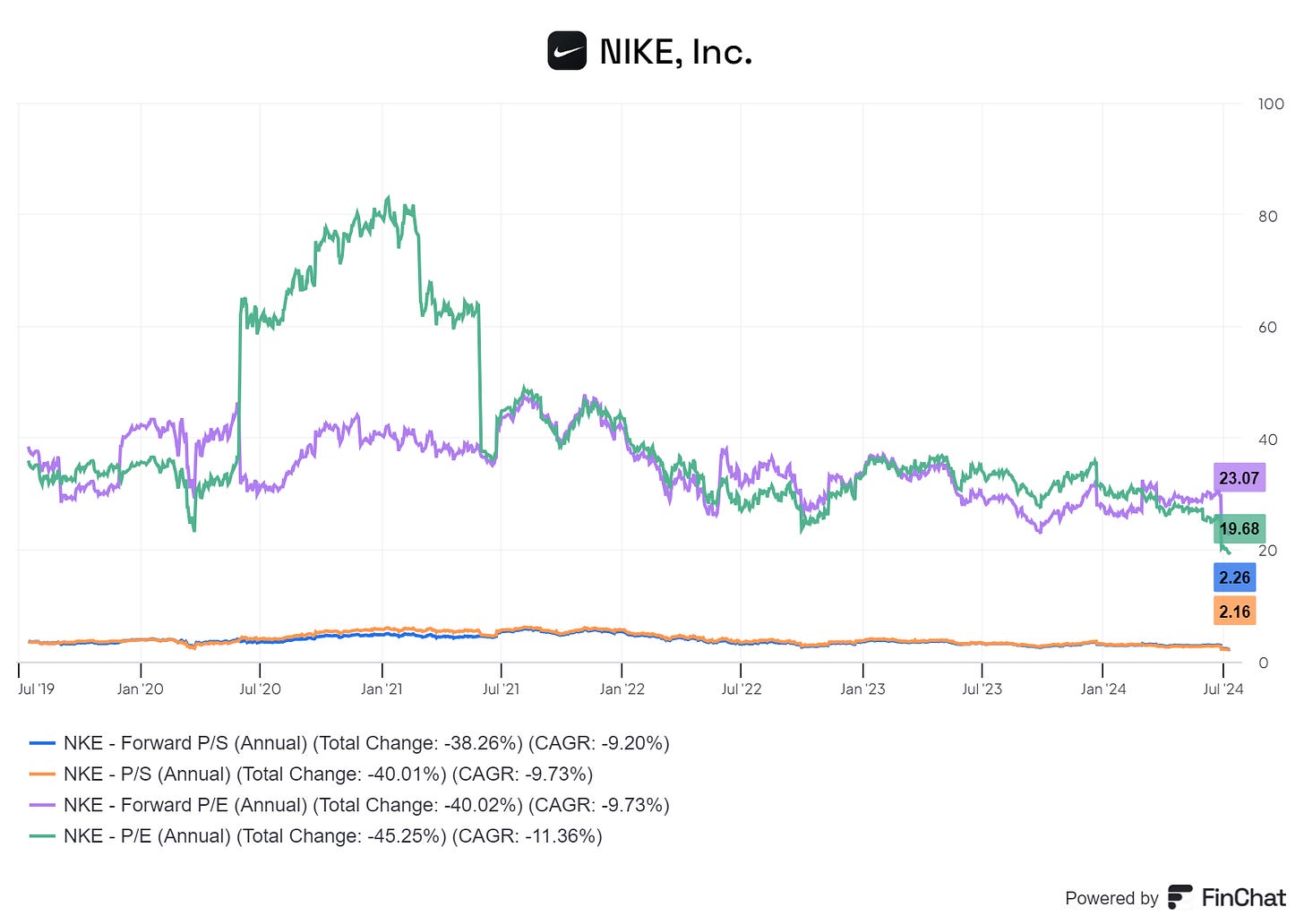

While in NKE 0.00%↑ case… Let’s say that the picture is really different.

Both forward and actual ratios have been flat last months while the stock has been falling like a rock - down 60% since early 2023. If a stock falls while multiples stay flat, it means that revenues and earnings are also falling. And having a F.P/E above its actual P/E means that Nike will need higher multiples to compensate for lower earnings.

My take from all this is that some stocks fall because of multiple contractions which happen as investors do not want to tight their liquidity to those names, often because the sector isn’t very shinny lately. But rotations will happen and those names will trade at higher multiples later on, creating good opportunities. While others fall for other reasons and should only be watched or ignored.

Amazon, the cheap king.

As long as we are talking about valuation, we should talk about Amazon, which is trading near its all-time high lately but has arguably never been cheaper.

Jeffy's selling. Starting with Jeff the seller who plans to sell roughly $5 billion worth of his stocks and doesn’t intend to sell any under $200 - he already sold more than $1 billion this week. We should see an interesting battle between the demand and Jeff over the next few days to see if there is enough liquidity for Amazon at $200.

My bet is that there is and if I’m right, what comes next will be violent...

The Cheap. There are many positive catalysts lately around Amazon, it’s valuation being one of them.

I wouldn’t call it cheap but a P/S ratio of 3.5 is the stock's median ratio over the last 25 years, so fair value seems right.

But many things have changed for the company over the last few years. It isn’t the cash-burning startup it once was; it is now a profitable behemoth with a strong balance sheet and he market will start talking about buybacks, dividends, or any other way to return value to shareholders.

Doing so, or simply not increasing its share count anymore while keeping its current growth would rapidly grow its EPS and other ratios while decreasing the stock’s multiple and attracting tons of liquidity in the process.

All of this with a booming business, strong advantages over competition, presence in very different markets while their products are all highly demanded.

I started a position around $195 and would love to grow it around $190. It will take some time for Jeff to sell what he wants but I am really bullish on this stock for the next quarters/years and wouldn’t be surprised if the $200 mark is demolished before Q3.

Alarum pre-earnings & position.

I also took a medium-term position on ALAR 0.00%↑ this week as the stock was oversold after releasing its pre-earnings results this Wednesday.

Alarum is the company that owns NetNut, an online scraper whose job is to collect data online for different companies to analyze and compare. This is the final service NetNut provides but there are tons of parameters and automation to configure to get the results they are looking for. What’s interesting is that NetNut seems to have found what customers want as their late growth is due to their actual clients drastically increasing their use of the software - which is what we want to see as it means they sell what clients want and attracting new clients is easier with leverage.

We’re with a very small capitalization of $250M which involves lots of risks and volatility, but the business has grown at 80% CAGR over the last three years while being profitable and having a very strong balance sheet.

It’s hard not to like what we see, especially in the data business and with a very correct valuation after this 30% drop in two days. The company now trades at 21x F.P/E and 6x EV/Sales which are very, very reasonable ratios for any company with modest growth in the software/AI/tech industry - so kind of undervalued with a 80% + growth...

This position isn’t a given though, as there are lots of risks in investing with such small capitalization. Their stock is linked to their growth and any misstep triggers very strong volatility, which is what happened this week - although the misstep was for NetNut's revenues “only” growing 95% YoY…

A sell-off which happens while the stock is up more than 600% since January 2024 and could be seen more as investors cashing their gains on a very small capitalization than an issue with the business.

Time will tell, but there is a pretty strong case to make for this small cap.

Taiwan semiconductors in June.

No surprises here; growth is definitely back for Taiwan Semiconductors and stays strong as the company revealed its June revenues, up +28% YoY for the first semester.

This confirms the demand for semiconductors, which indirectly confirms that the demand is still strong for any computing power hardware - hence bullish for Nvidia, ASML, and Micron Technology.

https://x.com/WealthyReadings/status/1806344992685724083

Tesla delays its August presentation.

As usual, Tesla will not deliver on time and the presentation that the market was excited about apparently won’t happen on August 8 as planned - although nothing has been confirmed nor denied by the company, the information comes from Bloomberg.

This is classic Tesla. The presentation clearly appealed to the market as the stock is up around +60% since it was announced, and it is now being pushed away as engineers were surely not ready to show anything anyway. It saved the stock.

This presentation won’t change much except fuel more hopes, as FSD isn’t ready yet to be fully rolled out in the form of a robotaxi. The next earnings are much more interesting in my opinion as we will see how strongly the energy segment can impact the company’s revenues and have more answers on their EVs medium selling prices and more.

As usual with Tesla, lots of noise for not much.

Bitcoin & Germany.

The German government is finally done selling its 50,000 Bitcoins and has completed liquidating its holdings in a week. The selling pressure brought Bitcoin to $53,500, but the asset quickly recovered to trade around $58,500 this weekend. What is interesting to see is that half of the selling was bought by the U.S ETFs - Europe sells while the U.S buys.

The downward pressure will continue as Mt. Gox clients haven’t gotten their assets yet, but this first test was already pretty positive and there’s no doubt that the old broker will do things more smoothly than the German government to get the most out of its sales.

Thank you for reading it all! If you like it, please consider subscribing to receive it all directly in your inbox and not miss a thing!

Everything I share here is free but if you found the content valuable enough, you can always leave a tip!