Weekly Recap | July - W1

Not much happened this week as it includes the 4th of July, which means lots of companies and institutions are kinda off. We still had a few pretty interesting news, starting with a more global reflexion.

Market Rotation

The market has been breaking ATH over ETH since 2024, with the SPY up around +17%. It might be time to think about where the money has flowed during this time and where it will flow in the next few months.

IT hardware. It’s no surprise that tons of liquidity have flowed to the AI hardware companies, starting with ASML 0.00%↑ , TSM 0.00%↑ & SMCI 0.00%↑ and ending with NVDA 0.00%↑.

Each & every computing power hardware seller has been doing wonders over the last year, selling their products to every tech company that wants to build a new and more powerful infrastructure for its data and AI services.

Advertising & AI companies. We started to see strong results from the first ones buying, which are of course the biggest ones, namely GOOG 0.00%↑ , META 0.00%↑ & AMZN 0.00%↑ . I assume their new infrastructures have already started showing results as they were able to create new services or upgrade those that already existed and sell them to advertisers with higher margins – this is what we see from Meta’s last quarters.

Meta, Google and Amazon all printed a new ATH this week while two of them were declared dead for different reasons when I bought in a few weeks ago.

But it hasn’t been the case for all of them as hardware was rare over the last quarter and went to those who had the biggest resources. I wouldn’t be surprised if the next quarters were to show the same growth & business improvement for smaller companies that leverage AI for useful services – there are not many, but one of them could be PLTR 0.00%↑.

But there is more to the market than AI and computing power.

Cybersecurity. Everything needs to be secured as these infrastructures are no different from older and more conservative IT networks. This will surely be done by the best technologies available on the market at the moment – talking about PANW 0.00%↑ , CRWD 0.00%↑ & ANET 0.00%↑ for example.

All those companies’ products (and others) will surely be in high demand over the next quarters to ensure that the new services are safe and optimized. This might be the next very interesting leg of growth, and I think many stocks in this sector are still trading at fair multiples - although being close to ATH.

I will watch them closely over the next quarters. Once all of those infrastructures are done we might start to see retailers improving their own revenues as their marketing will convert more thanks to better tools and leveraging AI & other techs to optimize their business will allow margins & penetration to grow.

We’re not there yet but it is already interesting to look at some of those companies as most are actually tradding at pretty low multiples - accumulation starts months or years in advance.

Tesla Deliveries.

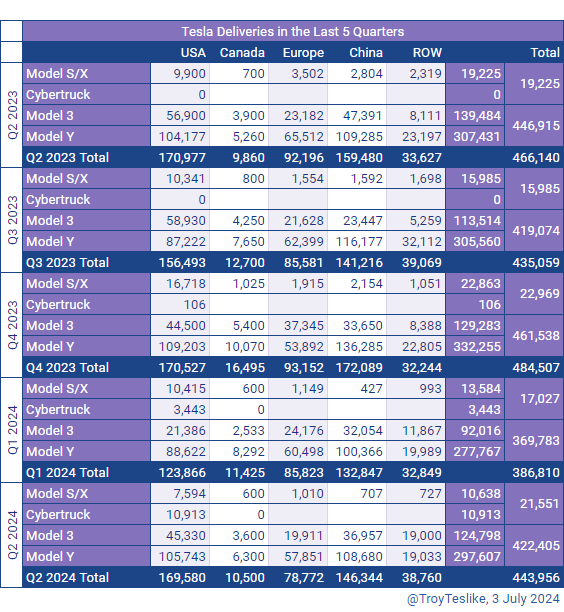

Tuesday was a big day for Tesla and shareholders. The company delivered 443,956, much above the market’s consensus of 425,000. Many are still saying these are weak numbers as we are still in a -4.8% decline YoY which is true but Tesla is still the biggest EV seller and we’re back on growth QoQ.

But things are a bit more complicated than this.

The macro is still a bit complicated in the West as interest rates are still pretty high - meaning more expensive cars. Tesla did have lots of sales over the past months and that might be one reason for higher deliveries, which do not necessarily mean revenue growth, but we will see during the earning end of month.

Demand. I read a lot the argument "deliveries grew because of sales," which might be true, but it would then mean that demand for Tesla’s products is pretty strong and that clients aren’t buying simply because the car’s price is actually too high – in big part because of the current interest rates.

It seems even more true looking at the deliveries per region as the biggest decline is in Europe, where Tesla didn’t do any sales and interest rates are still pretty high – with a global economy in a really tough/bad spot.

China is also down 13,000 deliveries probably for different reasons - namely a fierce competition. We’ll come back to them later.

Inventories have been reduced significantly, which goes against what many said last quarter, claiming that Tesla was producing much more than the actual demand. Elon said during the call that inventories raised last quarter because of difficulties delivering on time due to external factors.

I guess those numbers proved him right as they took more than 33,000 cars out of their inventories this quarter.

Global demand for EVs isn’t slowing and this is shown not only by Tesla's numbers but more globally with Chinese brands like BYD, Li Auto, and Nio, which are all growing above 20% year over year. The first on has delivered 426,000 EVs during its Q2.

The difference in products with Tesla & China is probably a big part of why growth is slowing there as Chinese companies focus on cheap cars – some can sell for less than $10,000. They do not target the same clientele and the market is much bigger for cheap cars.

Globally, these numbers aren’t bad for Tesla but once again, their EV branch isn’t the investment thesis at current valuation. It is still important to see them grow, or at least stay healthy – which they are at the moment, in my opinion.

Energy. More importantly, Tesla deployed more than 9.4 GWh of energy product storage during this quarter – I could give historics but the picture will do a better work.

This is the real deal of this report as Powerwalls, Megapacks, and superchargers are meant to be a rapidly growing part of Tesla’s revenues while many didn’t believe they could scale these products.

I think this number shows that they can and that there is strong demand for them – waiting time for new orders is now pushed to Q1-25. I hope the trend can continue, and we will have much more answers during the last month, but this is significant as this part of Tesla has much higher margins which could help raise incomes after the recent margin decline of their EV branch.

The stock reacted very (too) well to those news which are pretty good news.

That bounce at $140 proved to be a good buying point, up 75% since then, but the market is now pricing lots of hope for what’s to come with the 8/8 event where many expect the company to finally reveal its robotaxi.

My take is that optimism should grow until early August as this presentation is probably much more important than their actual earnings. Any concrete news on the robotaxi could trigger wide reactions, but any disappointment will certainly tank the stock as the market now needs Tesla to bring its solutions to the world and not only talk about them.

Things take time, but they need to move forward.

Crypto Market - Bitcoin, Ethereum & Solana.

We’re off to a bad start for the summer in the crypto market as Bitcoin is getting dumped violently lately, and this trend shouldn’t change short term but it will give us lots of very interesting answers on Bitcoin’s place in the world as an asset.

Most of the selling pressure comes from Mt Gox. To summarize quickly, Mt Gox was an early crypto exchange that went bankrupt in 2014 after being hacked and losing most of the cryptos it held for its clients. The remaining Bitcoin the company still owned were frozen during the bankruptcy process, which has just finished. They now started to redistribute roughly 140,000 Bitcoin to those who were impacted by the hack. For some perspective, Bitcoin closed 2014 at $311 and is up 17,000% since. Needless to say, this distribution will make lots of holders happy to cash in their gains – hence the selling pressure.

To be exhaustive, there is also selling pressure coming from the German government, which chose to sell some Bitcoin it confiscated over the years. I won’t discuss much about how stupid I think it is to sell a few thousand Bitcoin while many states now see it as valuable & slowly buy in, but well… Europe. I also need to point out that they chose to start selling precisely on the 4th of July, a day when the U.S. market is closed and ETFs cannot absorb the selling pressure – interpret as you wish.

It will take a lot to absorb 140,000 BTC, and this is where things get interesting as institutions are now part of the game as the ETFs registered $14.6B of net inflows since January 2024 when they opened with Bitcoin trading around $47,000.

Inflows continued until early March, which is roughly when Bitcoin reached its new all-time high at $73,800 but they kind of slowed down rapidly after that. Bitcoin is now breaking its support and falling pretty violently, as only it knows how to do – trading at $55,000 as I write this.

My take here is that we will have lots of answers over the next weeks on how Bitcoin is viewed by institutions. Is it an asset they want to accumulate? Is it an asset they only speculate with? Do they believe in its scarcity and intend to hold very long term, or will they get out, worried about so much volatility?

And more importantly: What prices will they judge a good price to act on?

We should have answers to all those questions in the next months as we will certainly see a fierce liquidity battle between the Mt Gox sellers and the global markets. My eyes will be focused on those ETFs net inflows for the next weeks.

Ethereum & Solana. Things are a bit different for these two even though when the king falls, everyone follows, but not necessarily as violently, and these two have held some key zones pretty admirably – respectively above $2,800 and $120.

None of them is impacted by spot selling as much as Bitcoin and both of them are following the ETF narrative as these will open for Ethereum in the next days or weeks, while Solana should be the next in line and demands are already being sent to the SEC. Both present some pretty good R:R at current prices in my opinion and are the only cryptos I hold at the moment.

Lots of uncertainty in this market lately but I do believe we’re in the most interesting time where institutions will publicly need to decide how they want to expose themselves and treat these assets.

Alibaba Buybacks.

Back in the East, where EVs are sold like small breads, Alibaba announced that it used $5.8B to buy back 77M of their own stock – a $77.3 median price. They bought back 3.4% of their entire company in just one quarter. The company is accelerating its buybacks as their stock is very cheap and they surely want to optimize their cash.

It’s a nice thing to hear but the truth is that the company still needs external investments for its stock to rally and that this won’t happen until trust is back between our countries & institutions.

Nevertheless, those are good steps in term of fundamentals.

Thank you for reading it all! If you like it, please consider subscribing to receive it all directly in your inbox and not miss a thing!

Everything I share here is free but if you found the content valuable enough, you can always leave a tip!