Weekly Recap | January - W4

Jobless claim, liquidity & Debt ceilling, Bitcoin & Crypto market, Trump's Executive Order, Celsius analysts rating, Earnings,Nebius, Stargate project & AI Infrastructures, DeepSeek.

This is going to be the first lengthy report of the earnings season and a good one as both the S&P 500 and Bitcoin printed new ATH this week, while Trump had a very, very busy week for his first days in office.

Macro.

Not many developments in the U.S. macro. The only new was the jobless claim which came hot, pointing to rising unemployment. The market can interpret this two ways: the economy is struggling more & more or the FED will have to cut rates faster than expected - which was the bearish narrative some days ago. But the macro perception changes every two days, so... No point in focusing too much on it.

What matters more is the liquidity which is good for now, and this should continue as the debt ceiling hasn't been resolved before Trump’s inauguration and is forcing the Treasury to push into the economy cash which was saved during Covid.

The TGA was drained of $200B in December & the taxes won't be enough to fulfill it. As long as the debt ceiling remains, liquidity will be drawn back from it into the system, and that is good for risk assets.

Lastly, Trump is starting to use his leverage with tariffs, talking about 10% for Chinese imports at lunch, to finally talk about 20% at dinner & open the next morning saying that they could envisage not putting any tariffs under certain circumstances... Politics at its finest.

The market doesn't seem to care much about this game for now as it is just talk but again, strong tariffs would be highly inflationary. It's important to keep an eye on what will be done, not just what is said.

Watched Stocks & Portfolio.

Bitcoin & Crypto.

Lots happened in just a few days for the crypto market, mostly good news with the biggest one being the Executive Order signed on Thursday with a few keypoints.

First, the creationg of a workgroup composed of both crypto aficionados & high government officials, with the objective of sharing knowledge and establishing a final & pro-innovation regulation, answering the demand from the ecosystem actors to know by what rules they have to play.

Second, discussing the potential “digital asset stockpile”. Nothing was discussed or settled yet & this is far from the Bitcoin Strategic Reserve that many were expecting. The group has 180 days to come back with a proposition.

My opinion on this is that the government will hold what has been confiscated through the years but won’t buy more. I personally do not believe in a SBR, but I would love to be surprised.

Third, the most important point on this order, the revocation of the SEC SAB 122, a regulation which forced banks & financial institutions to list crypto assets held as liabilities.

Banks loans capacities are dictated by the strength of their balance sheet, holding crypto assets as liabilities impacted directly their capacity to do business & was not worth it. It wasn’t forbidden but it was made impossible.

This won’t be the case anymore, and with the strong demand for crypto assets, I wouldn’t be surprised to see financial institutions bring back their crypto services, with SoFi in mind. This is bullish for everyone.

I remain bullish for the next months for the crypto market, between good regulatory news, the actual narrative & the first spikes of retail interest, I see no reasons to be bearish for the next months and still hold my positions, with some more speculative bets now on memecoins & tokenization.

Celsius Rating.

A new downgrade for Celsius, hitting harder and already beaten stock & plunging it to a new lower low on Thursday.

I would have been concerned if this price action happened for fundamental reasons, but we are talking about an analyst rating here and those guys are always late & biased by prices.

Buyers woke up on Friday & pushed the stock above its older low. Deviations happen, lines aren’t meant to be perfectly respected, so there are no concerns for me here.

The bull case remains & I continue to hold the position.

Earnings.

The only earning I followed this week was Netflix & I shared a specific write-up for it, to highlight how great their quarter was. Here’s a recap of the updated fair value of the companies I covered & follow this quarter.

Other Subjects.

Interest in Nebius.

I had heard about Nebius some weeks ago but moved on without digging the subject. Shame on me for not doing the work as it turns out that Nebius is a computing power farm, a subject I talked about months ago in my energy investment case.

I talked about them from the energy consumption point of view while Nebius is more focused on the B2B service PoV, but it also provides great services because of its energy consumption optimization, exactly as described in the IC.

I am finishing the write up about the company & its bull case & will send it Monday or Tuesday pre-market. I am not yet 100% sure to buy but big chances I do, especially in the actual markets with the AI narrative continuously getting stronger & stronger.

Project Stargate & AI Infrastructure.

This project was announced by D. Trump Thursday, a coalition between some giants - SoftBank, OpenAI, Oracle & MGX, with the objective to invest around $500B for AI capacities in the U.S. during the next 5 years.

That is a lot of money & the initiative is backed by companies like Nvidia, Microsoft & others with really large pockets, with Satya casually saying “I’m good for my $80B” on CNBC like if he was going to buy some bread.

Mark Zuckerberg also said on an unrelated interview that Meta was planning to raise its CAPEX to between $60B & $65B for the same purposes: AI infrastructure.

The AI boom is far from finished, and the biggest winners from it are companies like TSM, ASML & Nvidia without any doubts, them and energy providers as all those datacenters will need electricity once set up - we’re not there yet but the market always anticipates.

DeepSeek.

Staying with AI, a Chinese company released some days ago a LLM comparable to OpenAI in terms of benchmark performances. Something which shouldn’t be possible if only for the restriction to sell computing power to China, but also for the technical knowledge advantage that the U.S. supposedly has.

The bigger problem comes with the costs. The fund manager behind DeepSeek is said to have spent less than $150M to build it and estimates its training costs around $5M. To compare, OpenAI estimates its ChatGPT 4 training costs to be above $100M.

The numbers have to be taken with caution as reality is certainly more complex. It still raises the question around the narrative “more equals better” as, whatever the real numbers are, DeepSeek still does as well with less. There might be more work to be done with optimization of the computing power usage than with more datacenter investments at the moment.

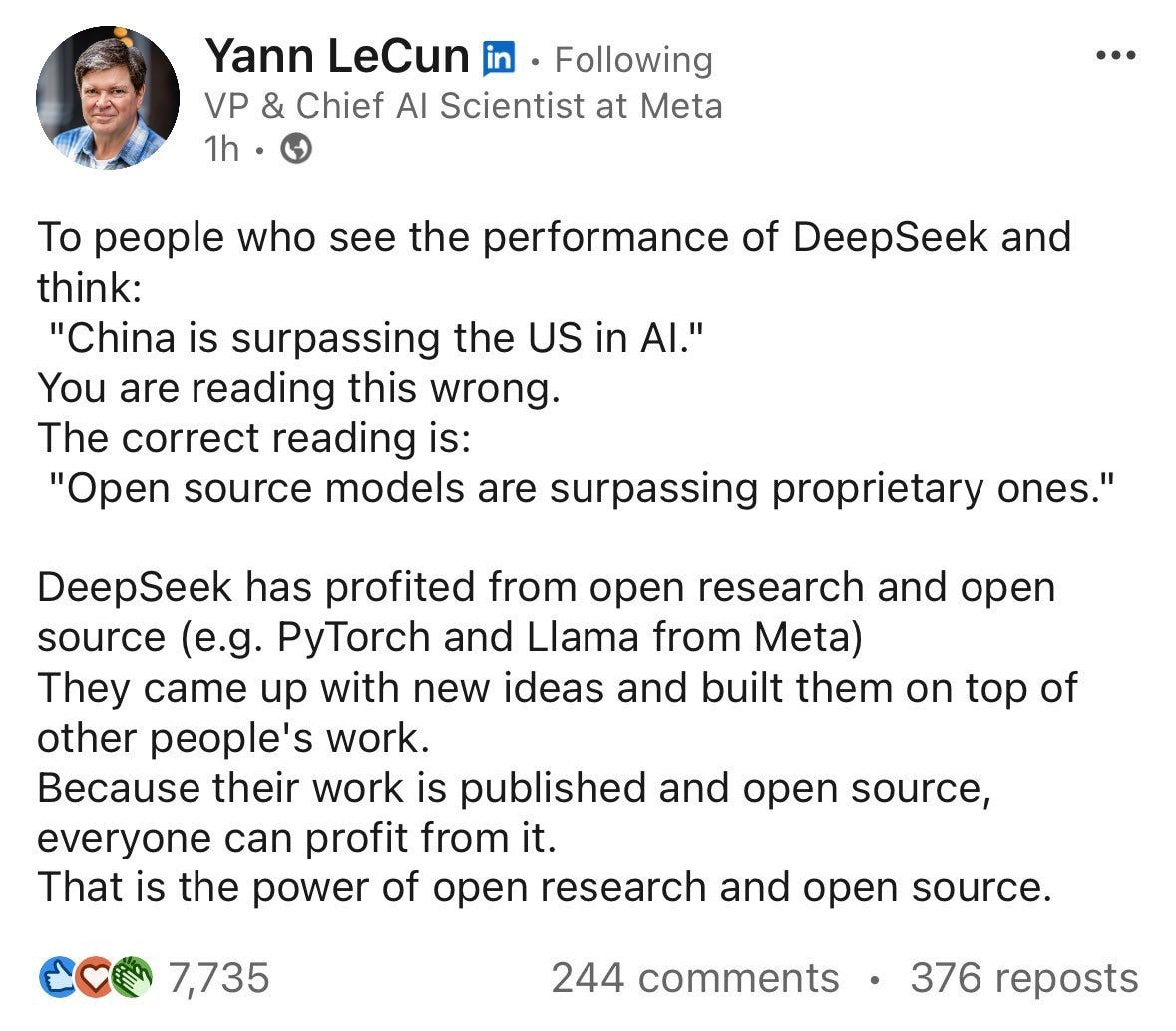

Meta's AI chief has another view on the subject which also makes sense.

Bottom line is that without their insane spending on hardware & public release of their data, no one could have optimized their software to do better with less.

I am just sharing this because I believe it is interesting; it doesn’t change much in terms of investment as the money is still spent on hardware, be it useful or not.

Next Week Earnings.

We’re entering spam season with lots of companies reporting earnings. I will cover Tesla & Meta with a specific write-up next week and limit myself to commentaries for SoFi, Starbucks, ASML, Microsoft & Apple, very probably with a specific write-up on Saturday.

And to that I’ll add the Nebius IC Monday or Tuesday.

I’ll look at both Visa & Mastercard for consumer health & at Decker as an indicator for On Running which will report later. We also have some oil companies on Firday, I will comment on those if there is anything worth saying.