Weekly Recap | January - W3

U.S. & China macro, Lululemon & Abercrombie guidance upgrade, Meta & TikTok, Bitcoin loans, Hims volatility, TSM earnings, Trump memecoin & Starship 7.

Macro.

U.S. Data.

I am rapidly going to comment on the macro data although to be entirely honest… It doesn’t matter much. There’s no need to check the data every day, what matters are the trends and those aren’t changing since months ago.

PPI & CPI.

Both came “cool” this week, although not much below expectations.

Inflation remains strong in the sectors which hurt while energy continues to drive the overall numbers down. Nothing changed, lower-income households keep hurting. & more medium income households start to struggle. The rest live well with their assets growing in value while their salaries are enough to consume.

As for the trends, well… Prices keep rising as shown here with the PPI.

As usual, the markets & the economy are two very different thing & even if the second impacts the first, things can remain uncorrelated for long.

Labour Market.

The second mandate of the FED… a huge mess. We regularly have contradictory data which make no sense & make it very hard to understand what is happening. Data will show a strong labour market with strong demand while unemployment continues to rise & institutions will correct the data two months later talking about an issue with their calculation method etc…

Hard to comment, really.

China Data.

On the other side of the world, the middle kingdom’s collapse is apparently going pretty well - this is irony, just to be sure.

Q4-24 GDP rose to 5.4%, retail sales to 3.7%, industrial output to 6.2%… I won’t go over it all, the take away from this data is that things are going pretty well for the country, with a positive continuation for the good things while the bad things stagnate without getting really worse.

I remain optimistic for China, long term.

Watched Stocks & Portfolio.

Lululemon & Abercrombie Guidance.

Both raised their Q4-24 guidance after a strong holiday performance, which indicates a pretty healthy consumption in America during the period & most importantly, that Lululemon potentially fixed its “newness” issue sooner than expected.

Lululemon now expects revenues between $3.56B & $3.58B & EPS between $5.81 & $5.85, respectively up 2.3% & 4.1% since their Q3-24 guidance, a pretty strong raise. The market reacted badly as it seemed like nothing is enough for it lately, but this is great new.

Abercrombie followed, raising its Q4-24 revenues expectation from between 5% & 7% to between 7% to 8%. As a reminder, the market destroyed the stock with a -20% after this announcement. Hence ANF being the new position in the portfolio.

Bottom line, this is great news & highlights a strong U.S. consumer, at least for premium brands.

Meta layoffs & TikTok.

It’s spring cleaning time already at Meta as after announcing the end of their DEI & fact checking program, they’re now announcing a 5% reduction of their “lower performers”. My nose tells me those were in Meta thanks to the DEI program.

On another subject, there are lots of talks about a potential ban of TikTok in the U.S. to protect their interest & the attention of their population. The government refuses to leave the algorythm & data collection of Americans to a Chinese company.

I am not sure having an opinion really matters on this question. Lots of heated debate around it but it seems reasonable that the U.S. government refuses to have a Chinese entity controlling an app used by half of the U.S. population. Kinda understandable, while China also refused this by a ban on Google’s apps, Meta’s apps etc…

It’s all about who owns the algorithm.

As to how things will turn out, it’s hard to say as Trump released a post today saying that they’ll try hard to find a solution to keep TikTok open. Not sure how closing the app would impact Meta & Google but it surely would bring back more users to American products, although not all of them.

Bitcoin Loans.

If you read my Ethereum investment case, you know there is nothing new here as it is possible since long on the DeFi to borrow stablecoins against Bitcoin. What’s new is that Coinbase, a legal & U.S. approved institution, will also propose the service.

No crazy innovation, but an important move forward in terms of acceptance.

Hims Volatility.

Volatility has been crazy on Hims lately due to many different news. Some about the GLP-1 as a big portion of investors believe it is the biggest narrative for the company. others because of the recent news around Novo & Lilly, be it lower revenues than expected, news around their GLP-1 drugs or the fact that they’re working on less expensive solutions… Everything is seen as bad for Hims.

On another end, we had an article from BofA talking about weaker than expected card sales during the holidays. The stock lost 7% after the publication of this article, which said that the holidays week saw lower usage of credit card than expected…

Not really relevant…

Still is interesting to note the strength of the stock which, twice this week, open largely red before closing flat.

Charts can only give you so much, but this shows a strong demand for Hims in the actual price range, and this is a really positive sign.

As to how this credit card data could impact the quarter? I have no clue, but honestly, neither does BofA… Fundamentals & financials remain great & valuation more than correct. Can’t control more than that.

Other Subjects.

Taiwan Semiconductors Earning.

TSM gave great earnings this week & proved once more how excellent & important to the world economy the company is.

Revenues keep growing & margins keep expanding. It’s hard to say until when this will continue but for now, their new 3nm are driving those results and it should continue as long as the HPC industry continues to upgrade its hardware for AI.

This also means there is a continuously strong demand for those HPC hardware which is a pretty good new for the market & those companies.

Trump New Memecoin.

Rapid word about this, I won't comment on how ridiculous & shameful it is because that's my personal opinion.

Just gonna say that this is the guy many around here expect to create "the U.S. Bitcoin reserve fund". This is how he sees this industry. As a meme industry.

This highlights that we won’t have any super cycle - those don’t exist. Nor a Bitcoin fund. Not now, it's way too soon. The industry is viewed as ridiculous, not serious, a joke, nothing else. Things will pump, but that doesn't make it legit.

It’s just sad.

On another hand, as this memecoin is set up on the Solana chain, the token has also surged, following the memecoin itself & my Solana position, bought the 8th of January is already up more than 40%.

Hope some of you guys bought the holidays dip. My take remains the same for the crypto market, we’re now entering the stupid portion of the cycle, approved by the new U.S. president himself.

Few more months & I’ll be entirely out but there’s some riding to do before that.

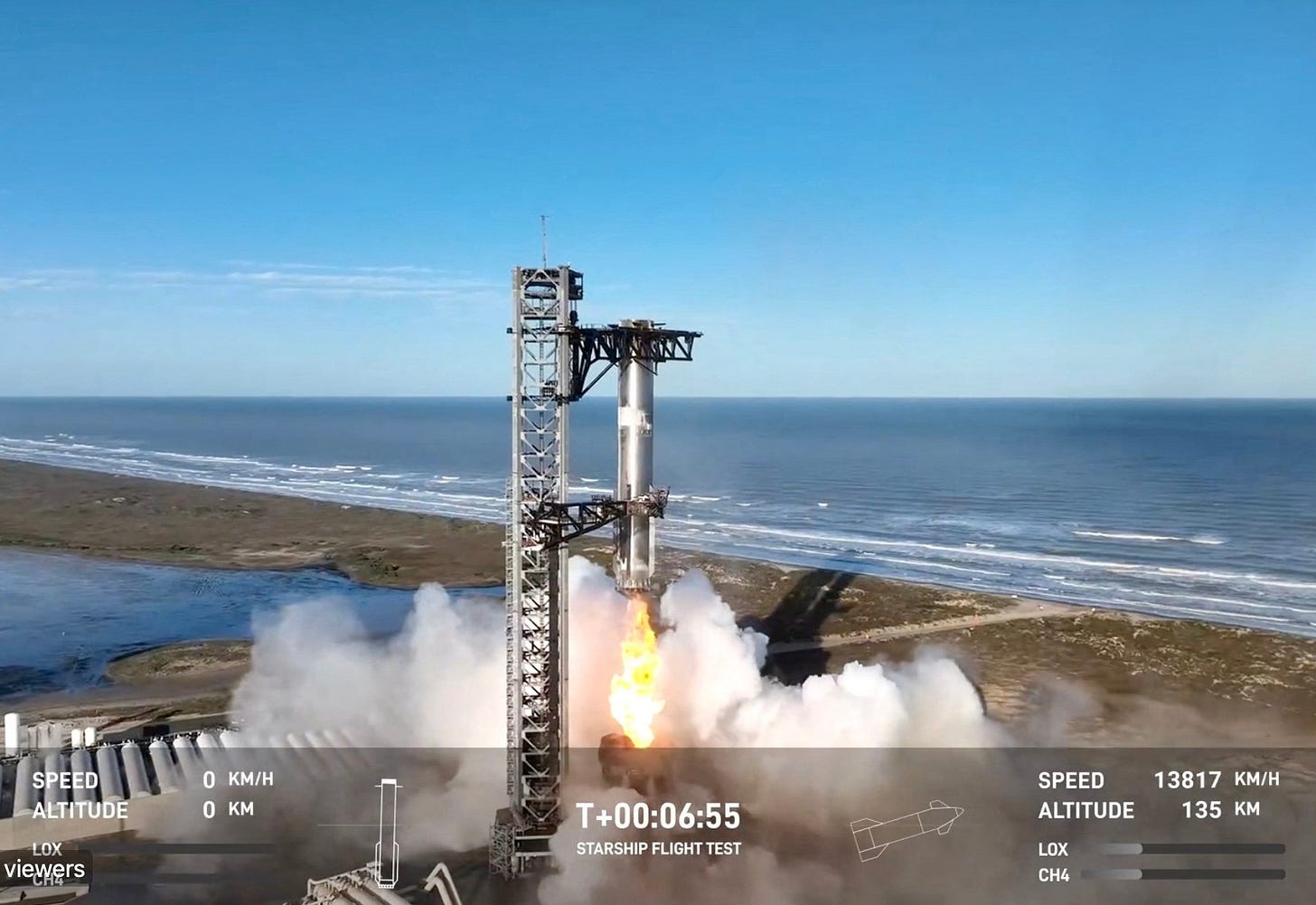

Starship Flight 7.

Two out of two for the mechazilla’s chopstick, which once more was able to catch a falling building on fire.

The other part of the ship transformed itself into a beautiful shooting star which spooked lots of people who were unaware of the tests - understandably.

As Elon said, entertainment is guaranteed.

https://x.com/elonmusk/status/1880040599761596689