Weekly Recap | January - W2

Macro remains unstable, Transmedics short report, Nvidia's keynote, Crypto update & Mark Zuckeberg's positions.

Macro.

I'll start this second week of the year like I started the last ones... Repeating that the U.S. economy isn't very healthy. We've already seen some alerting data for the market, with the 10Y3M yield curve inverting, inflation ticking back up while sticking with high interest rates and the U.S. dollar at the same level than during the 2022 bear market... Things the stock market usually doesn't like.

Yet, stocks & crypto are holding strong, with high volatility but holding, as the market is now kind of schizophrenic & doesn't really know how to react to what. Some good macro news are seen as good news. Some bad macro news are seen as good news. Some good macro news are seen as bad news. Etc...

We've had strong data this week for the labor market with constant unemployment & more jobs added than expected, which one should interpret as good news but the market sees it as bad news because a strong labor market means no or fewer rate cuts going forward.

The market & the economy remain in an impossible position where rates cannot stay high as it hurts borrowing, the real estate market & many companies & individuals, hence consumption. But they cannot be lowered as it would result in a faster inflationary bounce.

All this to say that the market is nothing but the sum of the behaviors & opinions of millions, and when many have different opinions & behaviors, we get volatility & erratic moves. The entire narrative is around rate cuts at the moment & any data pointing out to delays will probably be sold.

This will only get worse as the intensity will grow over the next months, not diminish, and the market will change its opinion every week depending on this or that data even if the data itself is entirely irrelevant. And next week will give us lots of relevant data with retail sales & inflation...

Brace yourself. Volatility will certainly be strong in the months to come, both ways. But at the end of the day, I'm still bearish medium term.

To add oil to the fire, the commodity which remained pretty calm for 6 months starts to wake up & scare investors as if this could mean a more rapidly growing inflation. We're far from there yet as oil prices are still reasonable while production can be accelerated if necessary.

I still have no clue where the prices of oil will go but I sure want to be exposed to the sector at actual valuations. There are stocks which would certainly give good returns even if oil prices end up going down with Trump's "drill baby, drill" plan.

Watched Stocks & Portfolio.

Transmedics Short Report.

Transmedics took a beating this week on a short report document shared by Scorpion Capital, an activist investing company I've never heard of. I tried to remain neutral but I couldn't keep it any longer after reading their report...

We're talking about 300 pages of allegations & accusations, going as far as organ trafficking, without any real proof & based on this kind of argument:

“You should see Waleed arrive at conferences. They show up in these blackedout cars…and you think the president is showing up. It’s like three blacked-out SUVs. They all get out. They all look the same in their suits. Yeah, it’s like Waleed and his secret service, but it’s the TransMedics folks.”

“We believe TransMedics is operating an organ trafficking scheme, shopping and steering rejected organs to its top users as a quid pro quo for accepting them on its device and via its NOP service.“

This is before the tenth page of the report. It makes it hard to take the rest seriously...

Most of the negative points they talk about are known & part of the bear case. Their pricing strategy, competitive landscape, relation with Medicare, commercial tactics... Nothing really new.

Far from me to say that everything is perfect with Transmedics, and this kind of report can shake out some investors. Some things might even be right but so far, they're only speculations & far from unusual in the medical sector while if anything was true, this would mean that the FDA did a terrible, terrible job aproving their hardware…

Crypto Update.

Back at it after the kinda sad Christmas we had. Lots of volatility as the crypto market follows the stock market & its actual schizophrenia. It took only two days for the ETFs to buy back everything that has been sold during the Christmas holidays, although we've seen some selling since.

I personally remain bullish on the $90,000 support & will continue buying as long as we hold it. I went in more aggressively this week, and even bought some medium-term calls on CLSK, which really took a beating.

Nothing changes to my opinion, we're still missing one last leg, although once again, the market will decide what it wants to do based on the macro data, so next week will be a huge week with the CPI & PPI.

Other Subjects.

Nvidia’s Keynote.

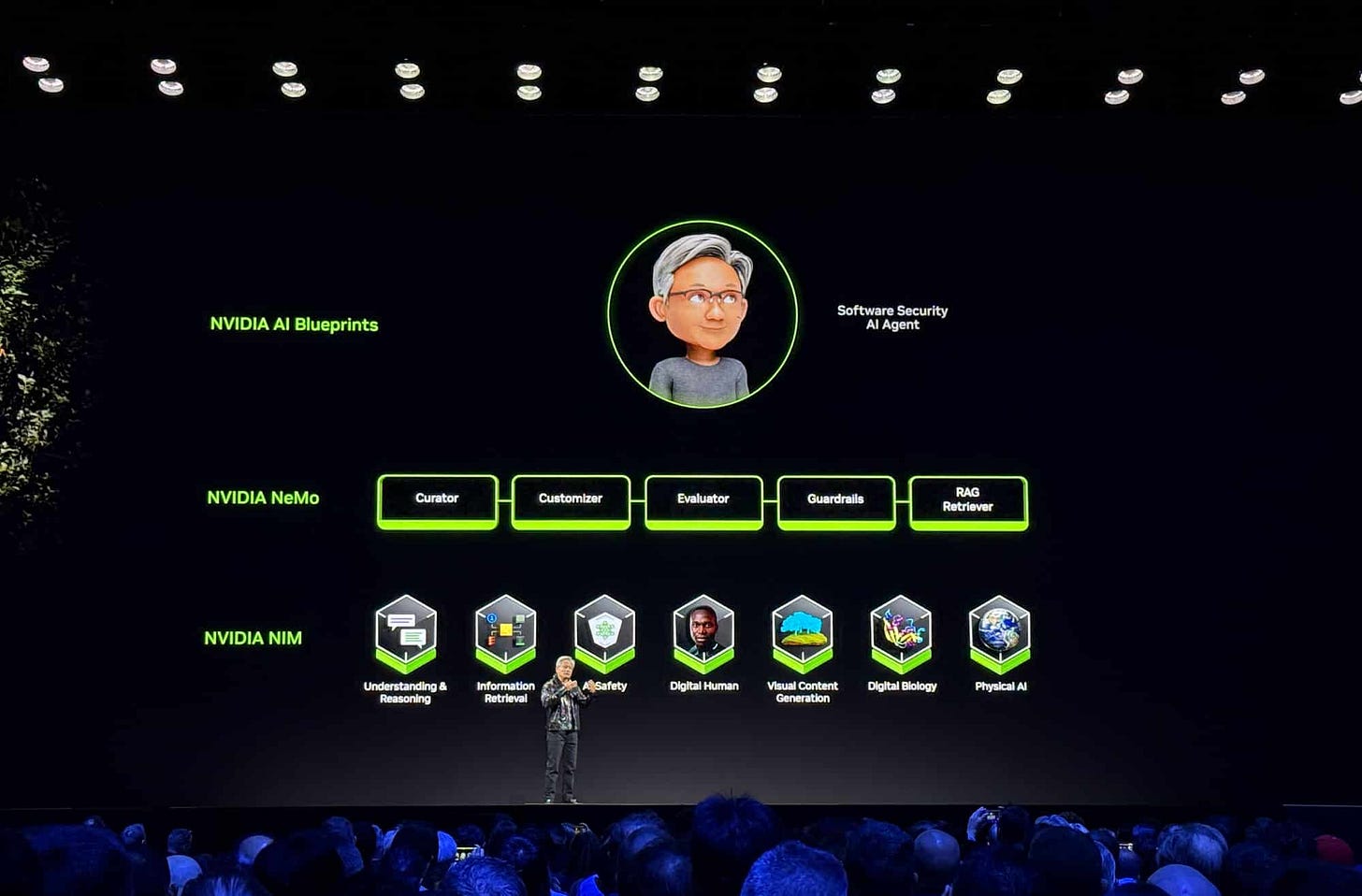

Rock star Jensen was back in a stadium for Nvidia’s event, with the leather jacket of course. And well... The future of computing power & AI is still pretty wonderful.

Starting with AI agents, which Jensen calls the future & it's pretty hard to say he's wrong.

The objective is already known, to train AI with specific data so it can perform tasks by itself. Nvidia also hinted that they'd like to train Agents with an entire company’s data… Sounds like what Palantir is already doing. Sure is a great confirmation for Palantir's business.

The keynote continues on many subjects we've already talked about, notably data capture & treatment, which remains the actual challenge to build real-world, physical world applications - Tesla knows this with its FSD & has around 10 years advance on anyone else...

But Nvidia goes further with a tool they call Cosmos which would be able to generate real-world situations & use those videos to train physical robots or any kind of tools. This honestly is next-level thinking... You don't need real videos if you can simulate & generate realistic & perfected ones... Smart asses.

Lastly, Nvidia continues to reduce the size of its computing power technologies & commercializes them to... Almost anyone - who can afford them. Hard to say how important this is as most companies turn themselves to clouds & virtualization, meaning everyone could & certainly will access computing power without the need to buy it physically. This is somehow what this conference was about & what companies turn themselves towards with computing power farms etc...

In brief? More computing power, cheaper & smaller, sold to data centers & others. While Nvidia leverages its own hardware to create any kind of AI software, be it to train them, to generate final services, or to deploy them in the real world.

The monopoly over computing power hardware is turning into a monopoly in both hardware & AI agents, hence software, including training or at least, rapid AI training which will certainly show an exponentially growing demand.

Zuckerberg’s Position & Fact Checking.

Lots of heat falling lately on Mark Zuckerberg as he changes his opinions & methods to follow Trump's. What is a pretty normal behavior in my opinion for the CEO of the most used social networks. He wouldn't have survived more than a few months without playing the political fields, and now that the tables have turned, he needs to adapt.

Anyone can have their own personal opinion about it but from a business & investing perspective, this is mandatory. He & his company need to be well seen by the current government & if it means bitching about the Biden administration on Joe Rogan's podcast, publicly stating that the Democratic party forced him to reduce free speech, coming back on the DEI programs & incentives on inclusivity, or stopping financing to fact-checkers... Then so be it.

It's fine to judge him for doing so, but I'm not here to talk about ideologies but about market & investment. And that's what a great CEO does, he plays politics. It might make him a "spineless & gutless snake", sure. But it returns value to shareholders.