Weekly Recap | January - W1

Happy New Year, Portfolio review, What I expect during 2025, China's 10Y yield, U.S. unemployment & Tesla deliveries.

Happy New Year.

There's no other way to start this report than by wishing you all a Happy New Year; may 2025 bring you health, joy & everything you're looking for!

I am not part of the "new year new me" trend, but I've found that setting objectives helps. So here are a few things I will be focused on during this next year & what you guys can expect from me with this Substack.

Beat the market. Nothing changes here; that remains my goal number one & I've done it already, so there's no reason not to do it again with consistency, focus & work. We'll have to see how things go, but it will remain my priority number one.

Share great work. I am not about volume but about quality. I will do volume on X, so if you're welcome to follow me there if interested but this Substack is meant for quality, great write-ups sharing investing ideas & executions.

So I’ll keep the same rythme.

Weekly recap each sundays, as long as there is material, divided in three part - Macro, Followed companies & Other subjects, more if necessary.

Detailed earning & call review of the companies I have convictions on or follow closely - worth following.

Investment thesis for new positions, argumenting the fundamentals & execution.

Other write-ups if I feel like it, focused on investing principles, economy or whatever I find interesting writting about.

Focus on execution. This will be my most important word going into 2025. I feel like too many focus too much on fundamentals, ideas & convictions. Those are important & are the base of investing, but those alone won't be enough to beat the market.

Execution beats the market. Nothing else.

Read. Read. Read. Reading is underrated nowadays while it honestly is one of the best activities, professionally or personally, for global knowledge or simply to relax... I closed 2024 with more than 25 books & the objective for 2025 remains to read at least one book per month.

Quality over quantity, again. But the more, the better.

Remain consistent, humble & focused. It's not always easy, especially as I & some here close the year with triple-digit returns, I get tempted to call myself the best investor in the world & get sloppy or cocky.

The thing is, if I end up taking this road, the market will be more than happy to bring me back to reality, and it usually isn't pleasant.

I'm starting 2025 up 0%. The game resets. Let's start playing.

Portfolio Review.

The year closed with Bitcoin up 121%, the S&P 500 up 24.1% & gold up 27.6%.

My personal portfolio is up triple digits, but I have no proof of it, so I'll move past it & share the public portfolio I started in September, enough to outperform both the S&P and Gold for the entire year.

Its composition didn't change since I shared it before the holidays, but proportions did as I used most of the cash I got from de-risking the portfolio during the red Santa rally - closing both Bitcoin miners & my Solana position.

This cash went mostly back into Bitcoin & Ethereum - as we retested the wicks I talked about pretty often, but also Hims & Celsius - as price action continues to be pretty interesting & give good entry points, and lastly, Gold - as I slowly DCA out of my risky assets.

Everything was shared in both those write-ups before the holidays.

The portfolio is still accessible here if you want to have a live view on it.

https://savvytrader.com/wealthyreadingspro/long-term

My View for 2025.

Nothing changed in my view of the economy, market & politics during the holidays and I couldn't find any data or interesting read that changed my mind. So I remain very bullish short-term with the conviction that things will turn ugly at one point, probably sooner than later.

Everything is argued here, probably the most important read of this Substack if you're interested in my opinion.

So this year will be about controlling & checking how markets react to macro data. In terms of investing, it'll be about risk short-term before deleveraging towards value & diversification - mostly gold, potentially China & energy.

Might not be the most interesting year. But investing isn't about constantly being thrilled; it's about making & preserving money.

Maccro.

Now to the market part of this report.

China’s 10Y.

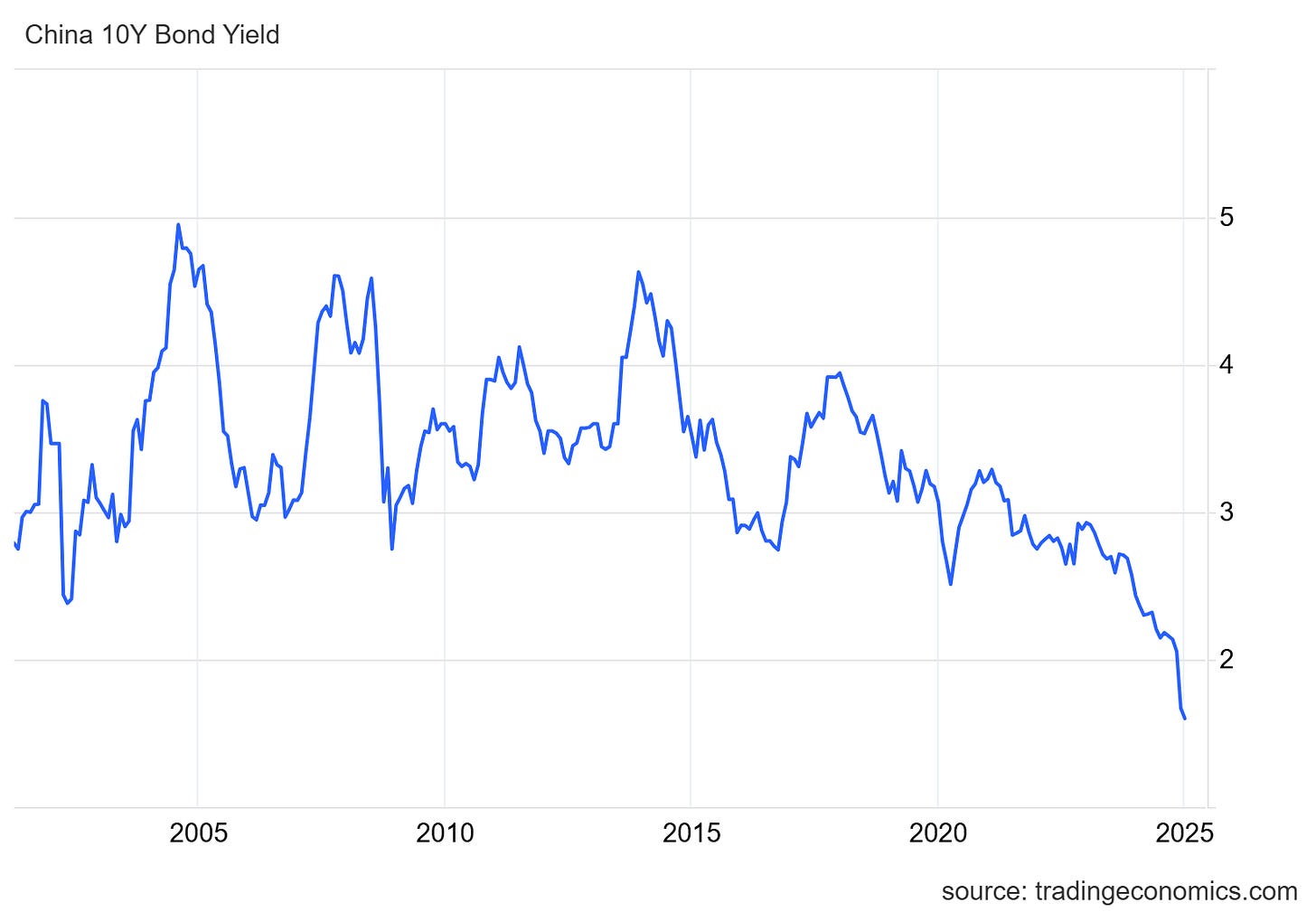

I've seen lots of really bad & not factual takes around the free fall of the Chinese 10Y yield, some calling it evil, others calling it a premise of the biggest crash ever or the sign the country will collapse… So much bias.

Facts are much simpler. Yield falls because of strong buying pressure, and when yield falls that much & that fast, it usually comes from money printing - i.e., the government prints money to buy its own debt, creating inflation.

Now, we should talk about this from two PoVs:

Market wise, this is a good thing. We said many times that China's actual problem was a lack of spending & deflation, and this can only be fought by incentives to spend and monetary inflation - which usually go together. So this is nothing but what most investors have been waiting for, Chinese stimulus.

Socially wise, this isn't necessarily a good thing… Chinese are savers; they keep cash in bank & usually buy bonds. Why wouldn't they when their currency is deflating & bonds are growing in value? Any Chinese holding bonds these last 5 years has seen its buying power grow.

Which low-income household westerner would say no to such a situation? To see your salary stagnate but grow in buying power over the years?

China is at a crossroads. Money printing, inflation, innovation & spending, or stable prices, growing buying power & financial social order? Will the rich get richer through debt & investments, or will the low incomes continue to grow their buying power through hard work?

The west chose its path. China will very probably choose the same for the simple reason that it is convenient for the rulers. Although the biggest difference is that Chinese rulers do not fight for re-election very often…

China is still the most interesting region to watch economically, and this apparently won't change this year.

U.S. Unemployement.

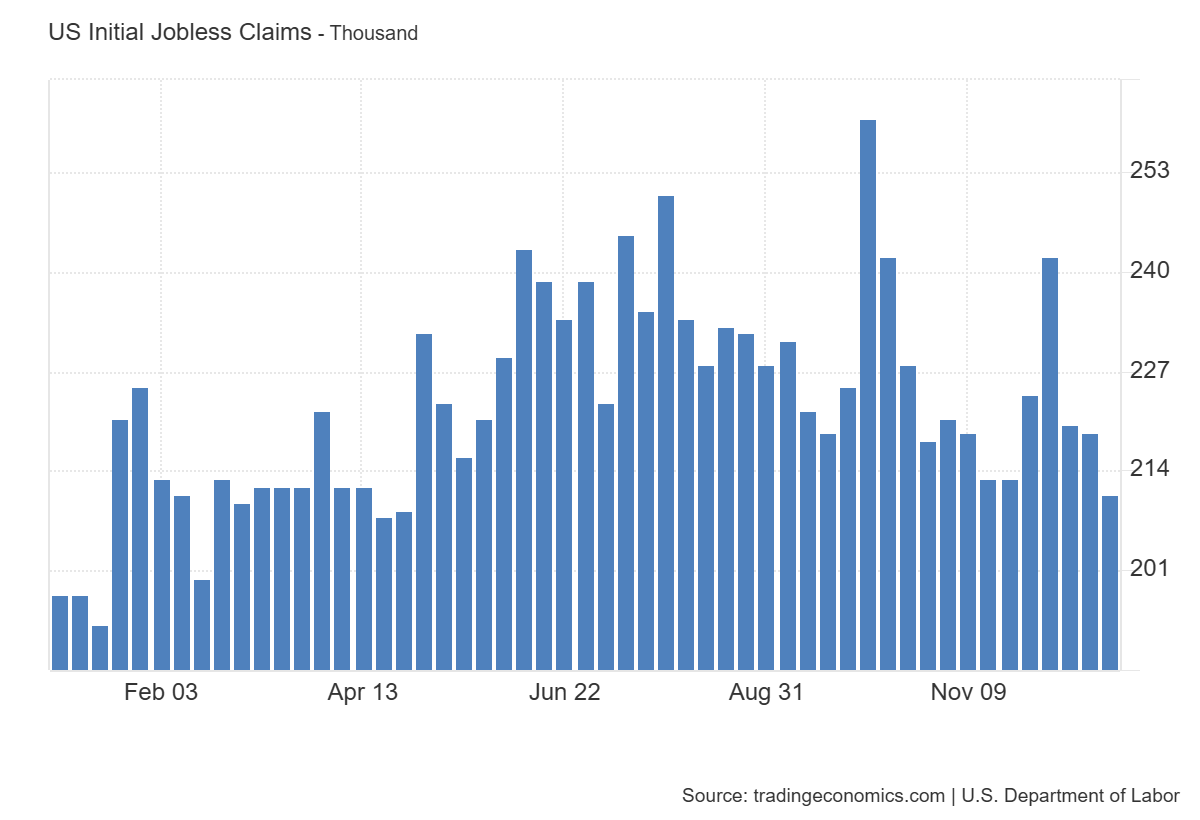

We continue to bounce between bad news & good news depending on the months in the U.S. as jobless claims came 11k below consensus & continue to print lower lows.

This is obviously a good thing & a great tendency, but these data remain highly volatile & dependent on seasonality. It remains good news for the markets & the economy.

Watched Stocks & Portfolio.

Tesla Q4-24 Deliveries.

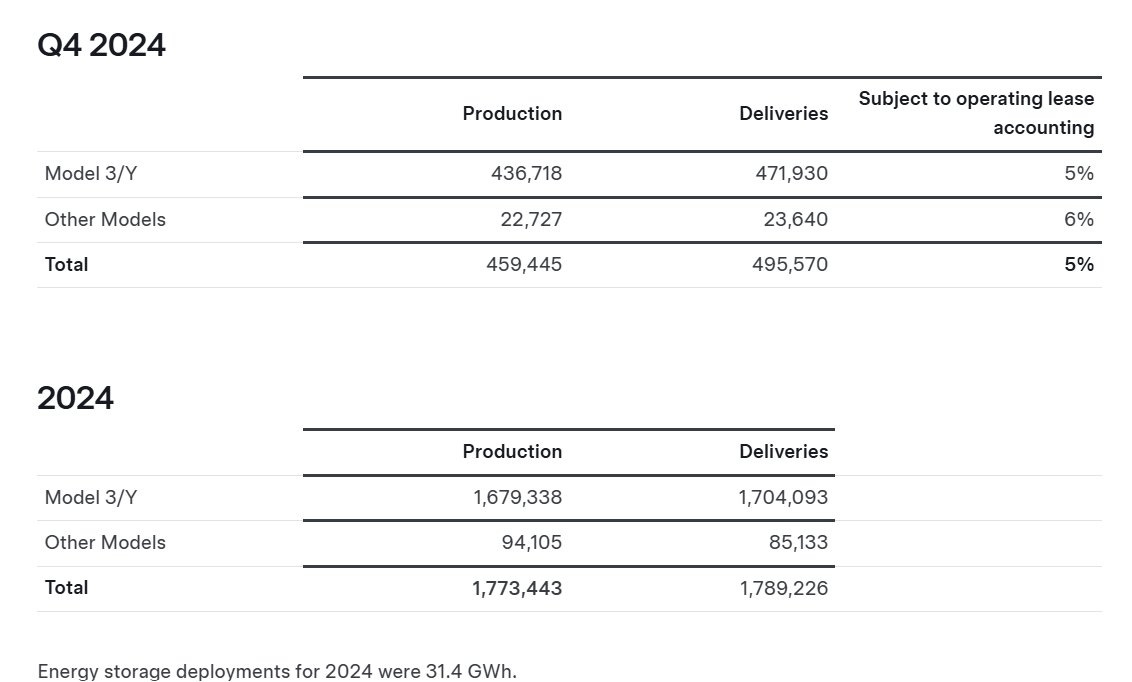

We got the final delivery numbers for Tesla and they're honestly… not that good.

We're talking about a 2% growth YoY for the quarter but a -4% decline for FY-24 in terms of deliveries. To my opinion, this number doesn't matter much & you can be bullish or bearish biased.

For the first, high interest rates this year clearly hurt demand, adding to that a strong inflation which left many households with less money, incapable to afford debt. On the bear side, Tesla ran plenty of favorable lease programs & price cuts during the year, which should have boosted demand.

Pick your side. Mine's that Tesla is trading at x112 earnings & x13.5 sales, so the market clearly doesn't value it based on its EV business - and I don't either.

If you're disappointed by those numbers & holding shares at this price, I'd suggest re evaluating your bull case because you honestly shouldn't be holding Tesla for its EV business anymore at this price.

As long as the numbers do not indicate a big drop in demand, I'm personally okay.

On the good part of this report, there is a clear surge in demand for energy storage as the company installed 31 GWh in FY-24, up triple digits compared to last year. Great news considering that this is a much bigger margin business than the EV one, while we also saw great news around FSD.

Tesla isn't an EV play anymore, since long, and the market reacted to this news with this in mind.

Largest percentage gainer is olo, but no new commentary on that?