Weekly Recap | February - W4

Liquidity update, DOGE is violent, Fort Knox audit, Lots of Hims news, Palantir fell, Tesla expansion & Uber, Crypto hack, AST SpaceMobile interest, Earnings & Price targets, weekly planning & Arista.

Macro.

We’ll start by coming back to last week & talk about liquidity. Here’s what I wrote then.

“The situation remains the same in the United States & the data continues to point to a potential end of QT soon. In brief and without going much over the charts, the labor market continues to slowly weaken, inflation remains stable although we’ll talk about it a bit more, the debt ceiling isn’t resolved yet & the reverse repo and TGA continue to be drained of their liquidity.

Powell said that cuts would come only with a weaker labor market and stable inflation. That’s where we are. And QT will eventually need to end to push liquidity back into the government accounts… So we’re still good, short term.”

The FED released its FED minute of the last meeting this week & confirmed the view that something will need to be done until the debt ceiling matter is resolved as otherwise, the government will have some issues financing itself.

“Regarding the potential for significant swings in reserves over coming months related to debt ceiling dynamics, various participants noted that it may be appropriate to consider pausing or slowing balance sheet runoff until the resolution of this event.”

This is bullish liquidity either way. On one hand, the government ends up draining the TGA in the system, on the other, they end up slowing QT & they probably won’t go back to rapid decrease of the balance sheet. Or both.

Pro liquidity either way.

DOGE.

Too much to say here… I shared on my FY25 review that DOGE would be all words no bite. Couldn’t have been more wrong.

I’ve also said that going too hard & letting Elon loose would be bad for the economy. Seems like Trump made its call. A story in two pictures.

And then, Elon went full Elon & is apparently going to treat the U.S. government like he treated Twitter.

My opinion remains that being too aggressive with this kind of measures isn’t going to help the economy. Less employment leads to less consumption, hence a potential recession. Let’s see how things unfold, but this comes after the new of thousands of IRS employees fired, lots of budgets cut, lots of financing cut etc…

They’re going strong. And it doesn’t make me very confident for the medium term although the good thing is, we won’t have to worry about inflation as spending will decrease with such measures…

Bottom line. Not confident medium term - six monthsish, as things kinda of things take time to spread in the economy.

To comment from an economic point of view, this is a necessary step if we want our government to come back to reason. Pain can always be postponed but they’ve been too far to come back without pain by now. The faster the better & Trump apparently decided to be that guy.

Fort Knox.

On equivalent news, Trump gave green light for the DOGE to audit the gold reserves at Fort Knox, reserves which haven’t been audited for decades…

Not sure what they will find - or not. But it sure will be stressful as if the U.S. do not own the amount of gold they said they did…

Hard to imagine the reactions.

DOGE Propostion.

On an opposite theme, Musk proposed to distribute part of the DOGE savings to the Americans in the form of checks. He first talked about $5,000 each and then Trump talked about 20% of the total savings divided by head. A mess.

This is obviously a terrible idea. You don’t fire people, cut budgets, cut expenses & save money to then waste it in unnecessary & inflationary stimulus… It doesn’t make sense, none.

This is only noise from now.

In Brief.

We knew that a Trump mandate would be a volatile mandate & it is impossible to have any idea of what’s coming…

Some talks lead to no actions while some actions come without any talks… We’ll need to adapt as information comes but this means the market will be wild as any machine made to anticipate won’t react well in an environment where anticipation is impossible…

Tons of divertissement. But we need to buckle up our stomachs.

Watched Stocks & Portfolio.

Hims & Hers - Again.

I obviously talk a lot about it as it is my biggest position, but so much always happen around this name that we need to continue.

At-Home Lab Aquisition.

This is the bullish new, really bullish actually. I keep repeating myself: Hims bull case is about personalisation, offering their patient the best possible service, tailored to their needs. And they keep going that way.

They acquired an "at-home lab testing facility, Sigmund NJ LLC, marketed as Trybe Labs" and paid for it in cash - no information on the amount yet. This will allow them to propose a new service.

Clients can order testing kit for different tests targeting vital organs, potential disease, simple check-ups of specific health details. They receive the test kit at home, perform the test - everything is simplified so anyone can do it, send the samples back & wait for the results.

The list goes further but I didn’t want to overdo it, this already gives an idea of what they’ll propose and show that they also propose tests they do not have drugs for in their platform. This means they’ll either grow their offering focusing on those or will just deliver the service for their patients to have a centralised & easily accessible data for themselves - kinda cool.

A service accessible & interesting for all their patients, those with serious conditions, those with simple curiosity, those who need personalised drugs etc…

Those results are then sent directly through the app and Hims will be able to propose personalized treatments for everything tested, if needed & accepted by the patient. With their ergonomy, we can assume that a simple process will be automatically started in a few clicks to then receive their package home a few days later.

It’ll also help Hims grow their database & leverage their AI services, as this will bring tons of data to their servers. Data they’ll then process to find connections between conditions & either automatically propose drugs to their clients but also anticipate potential conditions for others & much more.

Pretty impressive to me. Management always said priority for their cash was to grow the business. It's exactly what they're doing.

“Unlocking the next level of personalized healthcare.”

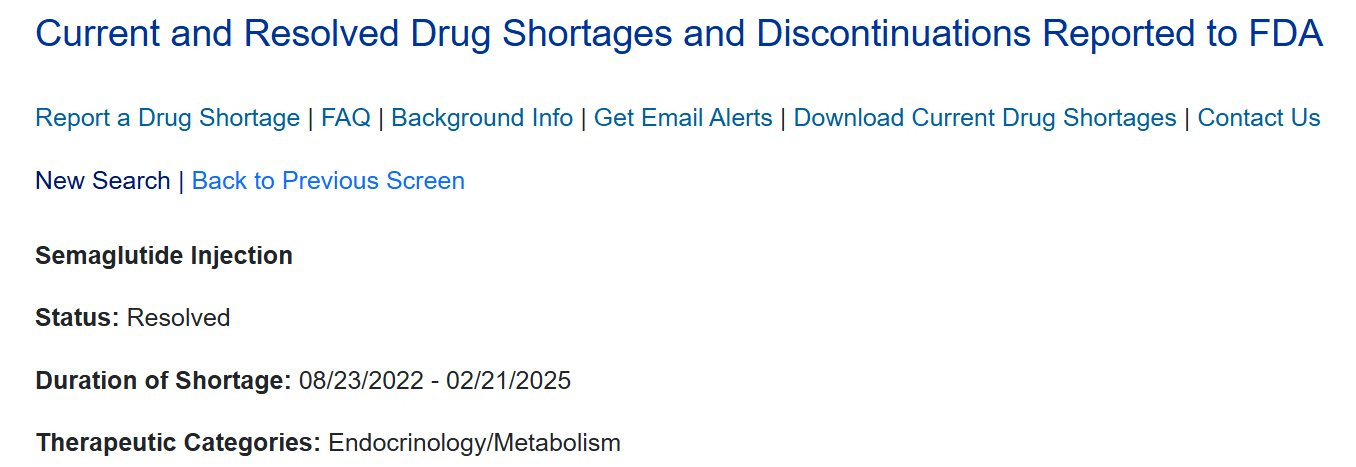

FDA & Semaglutide Shortage End.

The day had to come when the semaglutide shortage would end & Hims would need to stop compounding its drugs based on that molecule. This has of course been a shock for the market as the new came out of nowhere.

The bottom line is simple, starting Friday, Hims has 90 days to stop its operation & forward its clients towards regulated drugs - hence Novo Nordisk’s.

This is of course a blow for the company’s future potential growth as demand for those drugs is through the roof, question is how will they soften the blow & adapt themselves, as weight loss solutions aren’t only semaglutide.

Lots of speculations around on how this will work & Andrew Dudum also released a statement kinda weirdish after the new was published.

Many, I included, understand this statement as Hims will continue to deliver their semaglutide compounded products because they’re not simply drugs sold due to shortages, they’re personalised drugs which do not enter into the FDA shortage regulation as they’re tailored for their patients.

This is speculation & we’ll have the earnings tomorrow, so more news then. But it seems like Hims & its semaglutide compounded product isn’t going without a fight. More news tomorrow.

Pentagon Budget Restriction & Impacts on Palantir.

This was the funniest market reaction of the week - although it hurt the portfolio. Palantir fell 16% and although valuation & profit taking was certainly the biggest factor, this new triggered some selling.

If you read my investment case on Palantir, you know that AIP is meant to optimize companies for anything they wish, resulting in better operations & cost reductions.

Musk & Trump, through the DOGE initiative, want exactly that. Leaner & cheaper operations while cutting corruption & wastes. The narrative that cutting budget for the Pentagon will hurt the budget attributed to Palantir, a tool meant to do exactly what they want to do, is kinda ironic.

Nothing to see here to me, especially while my personal bull case is on the commercial part of the business.

Nevertheless, Palantir was so expensive for so long, it needed a breather. Now will the stock continue to fall or not, I have no idea, but I did the trimming I wanted to do so I am fine with anything.

Tesla in India but not in Uber.

The first new is quite straightforward, Tesla will start selling its EVs in the Indian market, which can become a big deal as we are talking about a 1.4B population.

Now, to be honest, we also need to factor in the poverty in India as we are not talking about a 1.4B potential buyers, and it is pretty hard to know what percentage of the population can, first, afford a Tesla & second use it. I have no idea of a number but fact remains that any new market is a net positive for the company. Will it revive growth? I am not sure.

The second new comes from Uber’s CEO, Dara Khosrowshahi, who said during an interview that Tesla refused to integrate their robotaxi on Uber. We talker about this possibility in my Uber Investment Case.

I remain with the same conclusion: it isn’t the right choice. I see no reason to fight for users when you can join forces & share a much bigger cake. But again, Tesla likes to control everything and have done so well because of this.

My problem here is that we have a lot of questions unanswered - and I say this as a Tesla bull. When will robotaxi be available? How much will they cost? How fast can they be produced & commercialised? Will they be cost competitive with other AVs? What about the cost per mile? How fast before the app is live? How will Tesla attract users without advertising? Will users go to Tesla instead of Uber? & many more…

I believe Tesla has the best product with its FSD for personal use, I am not sure anyone needs such a perfect FSD for short city trips, which are most of what Uber proposes. Any autonomous vehicle will do the trick, the difference will come with pricing & we have no idea of the robotaxi price per mile.

We also need to factor the preference of users. I am sure some will refuse to enter a Tesla for the brand, others will refuse to enter a car without a steering wheel while others will simply continue to use Uber because it’s their go-to app.

And for the very long term, in a decade or so? I have no idea and it is impossible to foresee to be honest. So let’s just see how things go but not having Teslas on their app won’t kill Uber like many say it will, not until all the questions mentioned above are answered with the most bullish answer possible made true.

Crypto Hack.

We lived through the biggest hack on cryptocurrencies, ever. The North Korean hacker group Lazarus - if we trust the on-chain guys who identified them & I do, drained the exchange ByBit of $1.8B in Ethereum.

Lots of reaction since & this raised lots of question but let’s first give a big congrats to the team which reacted like any company should react: with the CEO livestreaming & answering honestly the questions. He said the funds were lost, he said users couldn’t withdraw money, he said it would be tough but he also said they had back-up funds, they had measures taken, etc… They were dead honest & admitting the bad helps anyone believe the good.

As for the funds, it’s hard to know what will happen. Cryptocurrencies aren’t banks, once the money is lost, it’s lost, but Ethereum isn’t Bitcoin, it isn’t as decentralised. And most importantly: cryptos aren’t the good place for crime.

The hackers have been rapidly identified - few hours, the funds have been tracked down to the last Ethereum afterwards & the community has been able to see everything that was done through in-chain data. Their address ended up being blocked from most of liquid exchanges. Bottom line, funds were blocked.

Lots of questions were then raised on what should be done. Should their funds be burned, their address blocked, the blockchain forked so the tokens could be sent back to ByBit? Lots of debates.

As of now, everything isn’t resolved but the market didn’t react to the new at all. No volatility, no sell-off, no nothing… As I shared earlier, I sold a bit of my tokens in case a FTX fear would take the market, but it behave like nothing happened & nothing will happen.

ByBit seems to be an honest actor & clients portfolio remain funded. If anything, the fact that the market didn’t react kinda shows that there are no more sellers and that even such an event won’t make the last holders sell.

I’ve said this a few times already and haven’t been right yet. But I believe we’re going higher.

AST SpaceMobile.

For those interested, I have started my research of AST SpaceMobile & really got interested. It will take me time to get to the bottom of it but the narrative is damn interesting, and an investment case will very certainly be shared before the next earnings season.

I am not rushing this because I do not think it is worth liquidity right now. But it certainly is worth knowing the company well enough to be able to pull the trigger when the time comes.

So, stay tuned.

Earnings.

We are closing another week of earnings, I commented on the ones I was interested in and here’s the list of the stocks and their fair value to me - as in the price at which I would consider buying them.

Weekly Planning.

We are starting what is probably the busiest week of this earning season for me. Four days, four holdings & many other interesting companies. Here’s the plans for the detailed review, in your inbox pre-market.

Tuesday: Hims

Wednesday: Olo

Thursday: Nvidia

Friday: Transmedics

Some of those might also reach your inbox on Saturday with a rapid review, but I assume one write-up per day is already a lot. It is going to be a big week people.

Other Subjects.

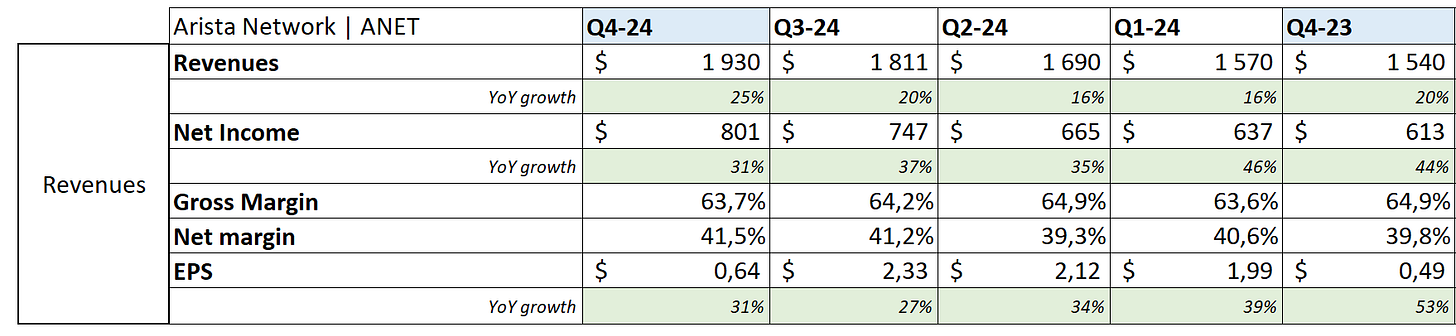

Arista Network Q4-24.

Lastly, a rapid overview on another excellent quarter for Arista Network.

There isn’t much to comment, the company continues to excel, demand for their product is constant & this translates in a rapid & constant growth with growing margins. This company is the definition of excellence.

But its valuation also is, and the market wasn’t happy while they delivered everything they could. Doing better would have required a fundamental acceleration which wasn’t realistic.

Shareholders should be happy with such quarters either way.