Weekly Recap | February - W1

Macro's a mess, Tariffs explained, Hims advertising & menopause products, Earnings & buying prices, Bitcoin & Central banks, Alibaba's LLM, Waymo expansion, Netflix trailer and Next week planning.

This boy will be long, brace yourself.

Macro.

The week was full of important & positive macro data but everything was rendered useless on Friday night as Trump announced harsh tariffs policies.

Here’s a rapid recap of the positive data & why I was very bullish until the announce… my timing was precious.

Two hours after this post, Trump imposed ridiculously strong tariffs.

Tariffs.

So we’ll only focus on the tariffs as this is the single most important subject. I’ll try to start & report the fact before giving my opinion. Here is what was announced.

25% tariffs on Canada.

25% tariffs on Mexico.

10% tariffs on China.

As of time of writing, the only exemption is for energy coming from Canada with “only” 10%. Here is the official reason for those.

“President Trump is taking bold action to hold Mexico, Canada, and China accountable to their promises of halting illegal immigration and stopping poisonous fentanyl and other drugs from flowing into our country.”

And here is what the U.S. president said about future plans.

“We're eventually going to put tariffs on chips, on oil and gas around the February18th and tariffs on steel, aluminum, and ultimately, copper, copper will take a little bit longer.”

There also are talks about “substantial” tariffs on Europe.

The original goal with tariffs was to make countries pay to access U.S. consumers & reduce the tax pressure on Americans while reindustrializing America & growing local production, hence their labor market.

Consumers would find a balance between rising buying power & rising prices while the government balances the lack of income from taxes with tariffs. It would give consumers the choice to buy locally & support their local industry or from importers at equivalent prices.

The plan was beautiful. But it was complicated to set up & more importantly, it wasn't supposed to start with high tariffs. It was supposed to start with reindustrialization & lower taxes…

If held as is, Americans will end up with higher prices, equivalent taxes & no alternatives for their products…

How tariffs work.

Starting yesterday, any importer buying product from those countries will have to pay to the government the equivalent tax when they import it onto U.S. soil. The importer pays the fee.

This doesn't change anything in the pricing of the products for the exporter; the only issue they’ll face is a lower demand as ultimately, the importer will charge more for the product when he resells it in the U.S., strangling demand.

A product exported $1,000 from Mexico will now cost $1,250 to import to the United States. Tariffs are usually redirected to the end consumer as no importer can pay 25% more without increasing final price, especially for lower margin products.

This is very simplistic but it is enough to illustrate.

The tariffs are applicable to ANY product coming from those countries, finished ones & raw materials - except energy from Canada as mentionned above. This will also impact the price of manufacturing as if tariffs on steel grow, the price of imported steel grows & the one of products manufactured with it will also grow.

Consequences.

To be fair, it is very hard to estimate the consequences of tariffs short & long term. The market could interpret this as a potential lower future consumption - rising prices aren't great, and lower margins for some business hence lower revenues, growth and a sicker economy.

All of it happening in what are already tough economic conditions with high interest rates and the FED fighting to balance inflation & the labor market. Those tariffs are a slap to the FED's face, whose already impossible job is now even harder.

We’ll have to see how things develop but this isn’t good for the market short/medium term. This is why I started to diversify outside of stock and bought gold and energy stocks not long ago.

My Opinion.

My opinion was that those tariffs won't happen. I first saw them as a power play from Trump to force those countries to answer his demand, with a potential magic solution found rapidely which would either cancel or reduce them.

Time passed & nothing changed. If the tariffs were to be applied, it could trigger the market as it'd mean.

Inflation would come back.

The FED wouldn't be able to cut rates.

Consumption would slow due to price increases.

Liquidity would certainly flow out of the market into cash for consumption.

This is the single most important subject at the moment. And if tariffs were applied as proposed on Friday… Hard to predict how that could end.

What is sure for now is that this will hurt Americans in the process.

Wait and see the next days. But this is concerning for both the economy and assets prices and would change things for me if the measures were to be held.

Bottom line, the actual tariffs on Canada, Mexico and China are a punishment for their lack of action, which makes me hope that they’re also temporary and could be canceled or reduced if those countries were to do the necessary.

The alternative is a trade war, where those countries would retaliate with their own tariffs and start a vicious circle of “who's the strongest” until one bows down, hurting everyone in the process.

A lose-lose situation based on ego.

Watched Stocks & Portfolio.

Hims Advertising & Menopause.

Big, big week for Hims & Hers as the stock reached a new all-time high following some really great news.

Starting with their Super Bowl advertising, which was internally made and hits the sweet spots when it comes to weight loss drugs to my opinion.

Perfect narrative.

“The system is broken and we, small Americans cannot do anything about it but remain victim of it. It isn’t our fault, it is them, you are victims, not responsible. But you now have a solution, a cure: our products.

Don’t be victims anymore. Take charge. Fight.”

I’ll refrain myself to share my personal opinion, fact is the ad is really great from a marketing point of view and that’s what matters here.

I ran some numbers for fun, which are of course way off, but it gives an idea of how great this ad could impact Hims.

Those are really rough math and are not perfectly representative as everything is more complex in real life. It is just to give an idea. The ad is great & the economics behind it are pretty favorable is what I am trying to share here.

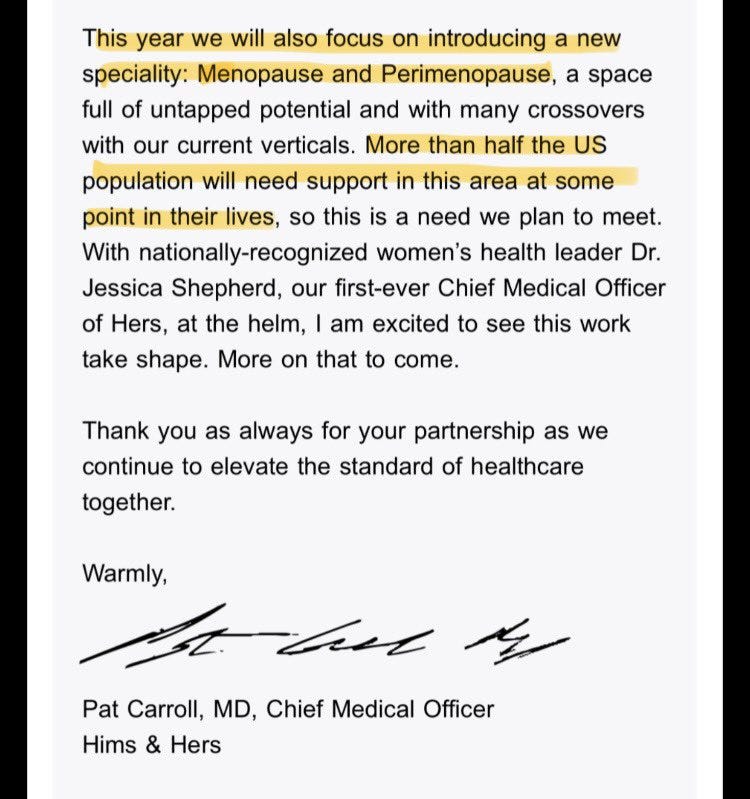

Second news, the company hinted to it many times this year already but it is now official, they will propose menopause and perimenopause products during FY25.

Great news all around and obviously, the stock reacts happily to them.

Bitcoin, El Salvadore & Adoption.

We talked about the FMI’s demands for El Salvador to let go of its Bitcoins regulations in exchange for funding some weeks ago.

The country followed through. My understanding from their communication is that by now, Bitcoin can be used if chosen by private entities but isn't a legal currency anymore and taxes cannot be paid with it.

This was to be expected but the most important part remains the country’s balance sheet which now holds more than 6,000 BTC & remains untouched, with no talks about selling.

In the meantime, we continue to see lots of discussions from central banks to add Bitcoin to their balance sheet. Senators in the U.S. are proposing bills in that sense. Switzerland is considering it, Czech Republic's boss said they were discussing it…

While as usual, our lovely Christine Lagarde, head of the European central bank, said that “reserves have to be liquid, reserves have to be secure, safe, they should not be plagued by the suspicion of money laundering or other criminal activities.”

So… No gold, no cash, no euros, no dollars… I guess she’s right, European reserves should be empty, that’s what they’ve been working at all this time.

The irony.

Sorry - too much personal opinion here. Moving on.

My base case remains that Bitcoin won’t be part of any big country’s central banks’ balance sheet this year, it is too early. It is already huge that those conversations are happening in the highest spheres of governments, but it will take time before they pull the trigger.

DeepSeek, Alibaba & OpenAI.

The story continues with DeepSeek although without much real news, lots of rumors, mainly on how they trained their LLM and if they did or not use OpenAI to do so. I still do not believe specificities matter.

DeepSeek shared new methods and this is a win for everyone. Models will get better although it has to be said once more that LLMs aren't a good product, what matters is what you do with it. A chatbot isn't a strong enough investment case.

Still, the competition was revived after DeepSeek's release & the next Chinese to release its AI was Alibaba, which is apparently… Even better.

The important take away here is that Chinese companies aren't that late in the AI and LLM race, and it is even better to see Alibaba is part of it as this was the bull case and the reason why I chose Alibaba over PDD for example: its tech branch.

Chinese e-commerce companies are undervalued but give a less interesting bull case than Alibaba exactly for this reason.

I also believe this forced OpenAI’s hand to release their new ChatGPT version which is apparently even better. Every company is now fighting & releases are frequent & improving fast. Competition is good for everyone.

It’s easy to lose track, bottom line is that it now is an all-in war with lots of different actors for a simple commodity. Winners will be those who can leverage it and my bet remains on Meta, for its user base & Palantir, for how its data analysis capabilities and adaptability to any industry.

Earnings.

We are closing a long week of earnings, I commented on the ones I was interested in and here’s the list of the stocks and their fair value to me, as in the price at which I would consider buying them.

New Week.

We’ll be starting a very, very interesting week on Monday with lots of great reports, but also lots of politics to follow to see how this tariff story unfolds and how the market reacts to it. Volatility to be expected…

You guys will receive a detailed review for Palantir, PayPal & Google. I will also pay close attention to Enphase, Spotify, Uber, Amazon & Disney and write about them with the Saturday write-up!

Other Subjects.

Waymo Expends with Uber.

We’ve seen in the Tesla reports that the company was going to run tests for its FSD fleet in Austin H1-25 but while they do tests, Google’s Waymo continues to expand commercialy to new cities.

Atlanta this time, with the rides exclusively available on Uber.

Netflix Trailer.

Gotta give it to Netflix, they’re amazing. They have been executing & proving the world wrong for years and are now an exceptional company.

And they know how to tease as they released their FY25 trailer and it’s pretty cool.