Weekly Recap | December - W3

Market's in turmoil, Government shutdown, Crypto market review, My portfolio, Hims GLP-1, IMF fights against Bitcoin, Nike's quarter.

Global Market Review.

We’re closing a complicated week, a red one for most of us, but I'll detail today why it is, in my opinion, nothing but a complete overreaction from the market to an insignificant problem.

This kind of week is why we need convictions, as it would be very hard psychologically to hold some positions otherwise. Although, to be real... The S&P is only down 5% & Bitcoin around 15%... The portfolio is down around 7% in the week while still up more than 20% for the last three months... Everything is relative.

Inflation.

I am repeating myself since some weeks now, but I continue to expect inflation to be the biggest problem going into 2025, and the market started to react negatively since the PPI & CPI data release earlier this week, rightfully, while those numbers started to confirm my thesis for 2025.

And I thought at first that this was the principal reason for this correction, the only one that really makes sense and seemed confirmed with the spike in the US10Y.

But after taking some time & watching the market’s reactions, I changed my opinion. If most were scared about inflation, Gold would also spike up as liquidity flows to a safe haven to shelter a tougher period. But this never happened. Everything turned red fast & strong, which isn’t the sign of a fundamental correction.

This is the sign of complete overreaction, profit-taking without plans, panic & very probably some leverage flush. The reason was probably because the market believes we will have less liquidity than expected going forward... Which isn’t true.

FED Cuts Rates.

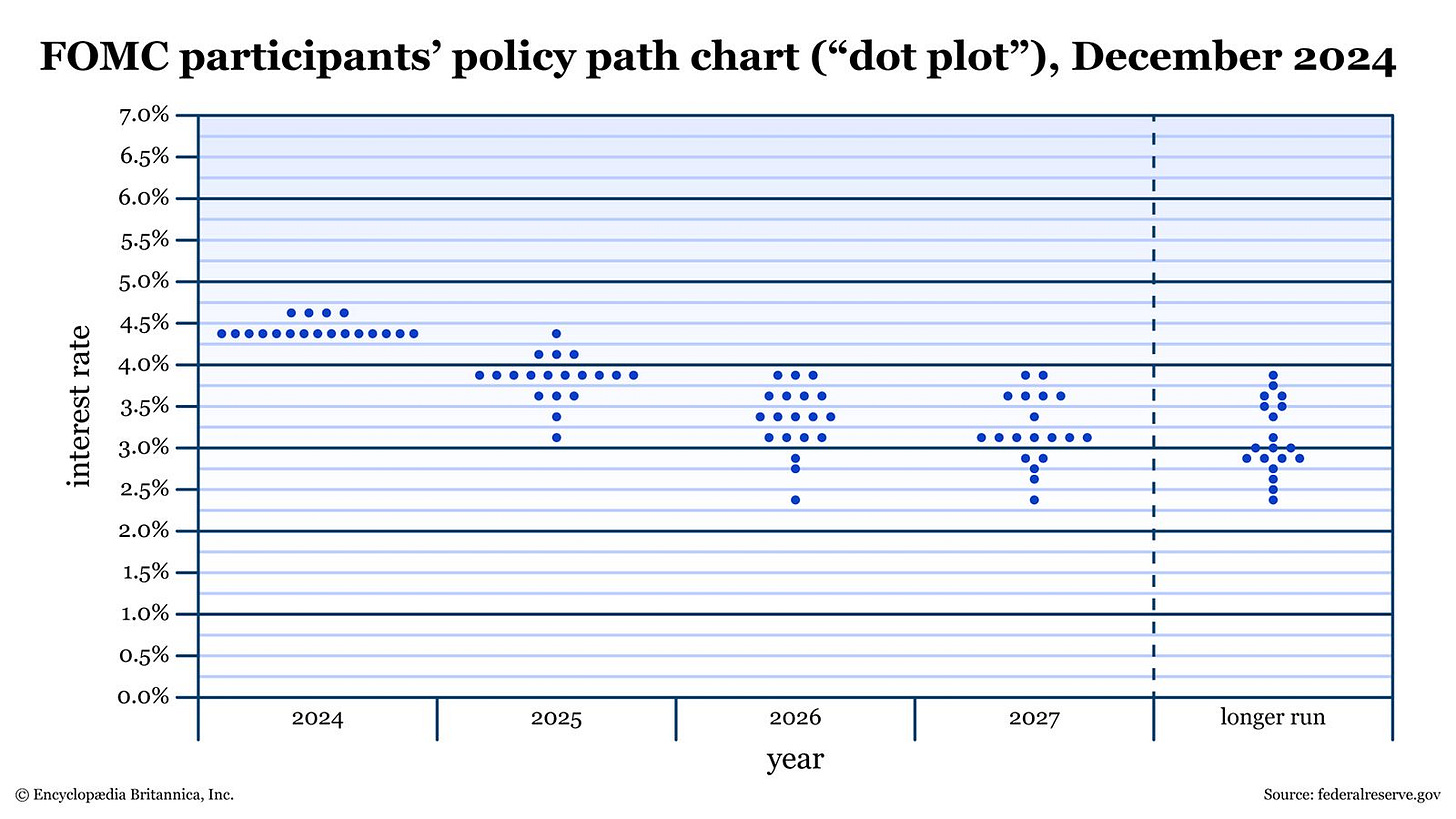

The FED decided to cut interest rates by 25bps & real problems started when they shared their projections for 2025.

The issue is that, with stickier inflation - shockingly, the FED doesn’t intend to cut rates too rapidly, projecting only two during 2025. Less cuts equals less liquidity - from the market perspective. This isn’t true anymore since Covid. In a fiscal dominant economy, liquidity is created by debt monetization, not household or corporate debt.

Most households already own debt & won’t renegotiate as long as interest rates are above their actual rate - most probably under 3%. While 4.5% or 3.75% makes a difference, it isn’t major enough to change the face of global liquidity. So, again... Interest rates do not matter, at all. Hence, two, three, or four rate cuts in 2025 won’t change much.

In other words, the market is ridiculous.

Government Shutdown.

Some positive news. The different parties in the U.S. government continue to pull their strings to get what they want in exchange for passing the required bills for the government to "agree" & "work" properly. Every time you hear "government shutdown," you should hear "bullshit."

The only interesting part from a market perspective is that when it happens, some governmental payments are frozen and the FED needs to step in & use its account - the TGA, to fund what needs to be funded... Which is generally pro liquidity, and very good for the markets.

What is good isn’t that the FED spends money. It is that after they spent that money, they have to replenish their account... By injecting liquidity directly into the markets.

Crypto Market Review.

As usual, cryptos are hurt much more than other risky assets during downtrends, and it’s actually been a long time we didn’t see a real correction there, which are very different from liquidity flushes. If we look at the on-chain data, nothing suggests we’ve seen a top, and I don’t believe we have. But this correction isn’t only due to leverage.

I look at a few on-chain data but all of them are related to what long-term holders do, because those are the guys who create the top when they sell and speculators aren’t enough or don’t have enough liquidity to swallow the selling pressure.

This indicator calculates a ratio from the profits made per Bitcoin sold. The bigger the ratio, the bigger the profits made by sellers hence longer they held the coin. We saw some selling when we broke 2021’s ATH, exactly like during the previous cycles, and we’ve had some selling since we passed $100,000. But it hasn’t been significant enough to be compared to the previous cycles’ top.

On another hand, we’ve seen outflows from the U.S. ETFs for the first time in weeks, which confirms the structural difference of this dip.

I still am not concerned at all. I will start to be more prudent from now, but my base case remains that we’ve not seen the top. I intend to buy the wicks again but slower as this could take longer to come back, maybe some weeks.

I still decided to cut my positions on the miners with a nice profit. I don’t think we’re done with those assets but I would rather not own them if we enter some weeks of undecision on the king, and would rather redeploy this liquidity to other stocks or, better, Bitcoin & Ethereum when they give clear signs of bottom. It's hard to know where that will be, but I would advise looking at ETFs net inflows during the next week; they'll probably turn green at one point.

Patience will be needed here, and as usual, wicks are meant to be retested. You can expect me to buy when it happens.

Portfolio.

I have not touched anything else on the portfolio. This price action has been hurtful & I personally regret not having taken a bit more profits or hedged my positions considering my bearish bias the last weeks.

What’s done is done. I am holding qualitative companies, bought at a reasonable price. There’s no reason to be concerned for those. Nothing changed.

Again, I do believe this is a ridiculous overreaction but it also serves as a warning, and no one knows if we will see another leg up or only a dead cat bounce. The next weeks will require more caution as my thesis remains the same. I'll try to read more & remain open to other opinions in the next days, as I will have a bit more time. It's important not to be blinded by our own in moments like this.

Other Subjects.

FDA & Trizepatide Shortage Resolution.

The FDA ruled for the shortage of Trizepatide to be resolved on Thursday, forcing 503B compounders to stop their production in the next three months & plunging Hims into a tougher situation during an already tough day.

Now, I believe we've covered this many times already, but I'll do it once more. Hims doesn’t sell Trizepatide compounded solution but semaglutide, and those remain in shortage. The market sees this as a prediction of what will come for semaglutide & is certainly right, but overreacting. Hims remains a wonderful company with a strong weight loss branch.

FMI vs Bitcoin.

I'll share my opinion but before, I am biased toward Bitcoin & financial freedom on this subject, so keep this in mind reading further. I don’t & never considered the FMI to be the international bank they claim to be, trying to help the world. I see them as an institution using its control over the global currency & the payment system to put under a leash those who it judges usable. As advertised: biased.

This new has been overlooked while being one of the most important one for... Maybe the world & certainly Bitcoin’s future. El Salvador has been very clear on its Bitcoin policy for years, betting the future of the country on the asset, using it like many countries used gold centuries ago.

After threatening, ignoring & publicly bashing the country for its stance on Bitcoin, the FMI seems to have changed its position and passed from threat to... Corruption. The official article talks about conditions which were finally met by the country to receive their loans, like if it were always an option.

You’ll need to scroll to the end of the document to find this.

What is asked from the country is to not recognize Bitcoin as a legal currency and to ban its usage for tax purposes. It still can be used by private companies & households if they decide to, but not for federal purposes, and all relation to the assets will be controlled by the State.

As long as I'm biased, I'll share my conclusion. This is a statement of weakness by the IMF, which had no choice but to pay to get the country out of this Bitcoin standard.

A small loan of $1.4B, extendable to $3B, while the total amount lent by the IMF to El Salvador during the last 50 years cumulates at $1.44B. A pretty big loan for such a small country & the need to meet such weak conditions. A huge win for the country who got a huge loan at small cost - although we miss lots of details, of course.

The country accepted to put its leash again, but pragmatism won, and it now is a golden leash. Bitcoin became a target, but the example the IMF wanted to make of the country backfired...

There is now a price not to adopt Bitcoin.

Nike Q3-24.

I won't spend too long on this subject...

The bottom line is that there is a decline in every product and every geography, with a continuous struggle in China & Asia at large... The story remains the same in my opinion; there is a problem with the brand and the demand for it...

It remains a wonderful and strong one, but the fundamentals aren't bouncing back yet.