Weekly Recap | December - W2

PPI & CPI confirms my thesis, FOMC, Chinese Stimulus, Google ATH & Willow, Bitcoin vs Quantum & Microsoft, Crypto market review, Celsius new position & Adobe's quarter.

Macro.

U.S. CPI & PPI.

The monthly inflation data was released this week and it keeps saying the same story. Consumer Price Index is declining for non-retail services & products while necessary products for households continue to get more & more expensive.

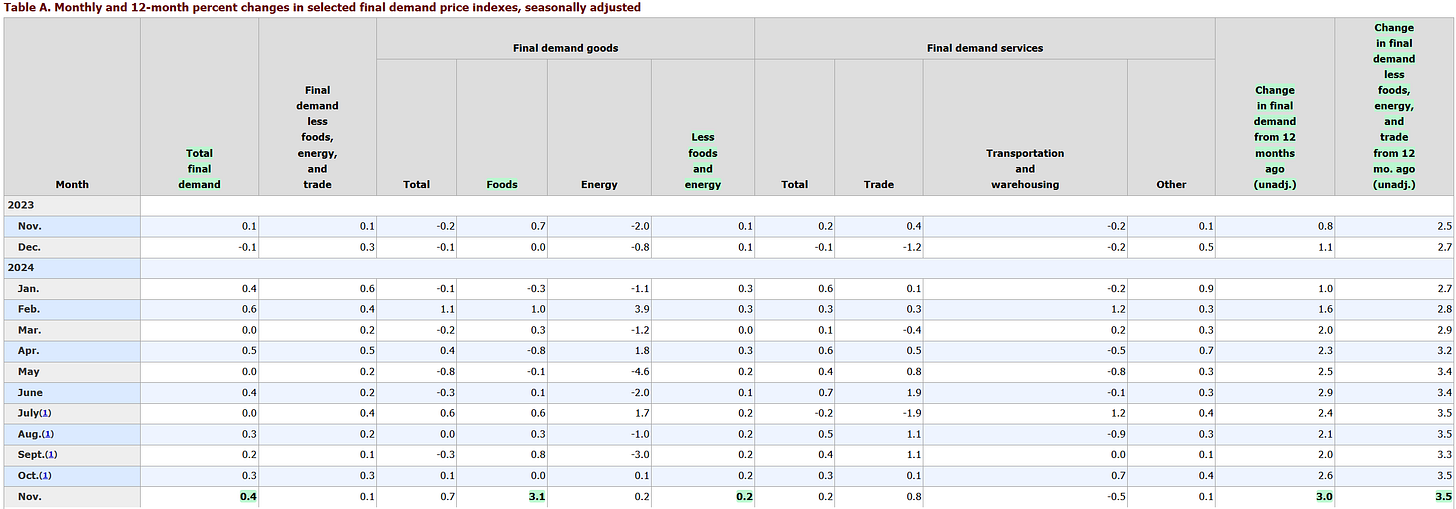

But the CPI is a laggy indicator, while the Producer Price Index shows the production prices, and it came hot this week at 3% compared to an expectation of 2.6%.

Logically inflation comes from necessary products, especially food as you can see. This shows that inflation isn’t beaten and mostly confirms my base case going into 2025 - that we are far from done with inflation.

The market reacted roughly to this data - which isn’t bullish, but ended up mostly green as - in my opinion, it is more focused on liquidity flowing in than on inflation. Nothing matters anymore for the market but liquidity.

As I said many times: perfect bubble conditions.

FOMC.

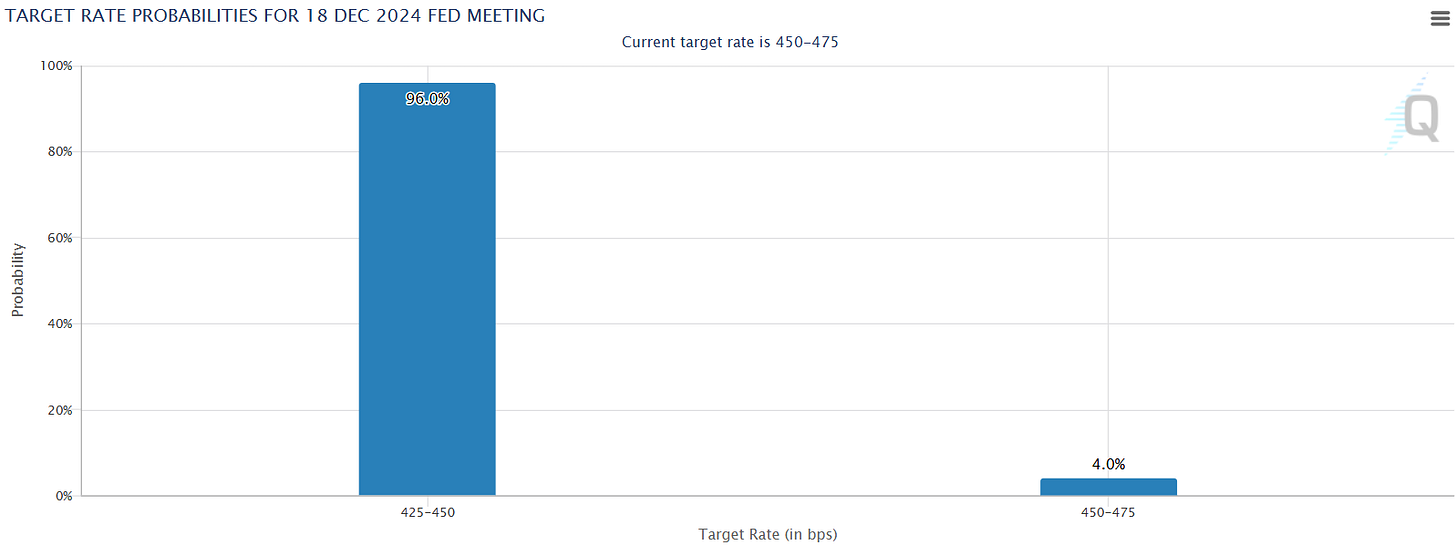

We will have this week the FED’s decision on interest rates. The street expects at least one cut and I kinda agree with it.

I also said many times that the FED position was intolerable lately as unemployment was rising while inflation wasn’t dealt with… Keeping rates high will hurt the labor market even harder while cutting them won’t help with inflation…

Once again, the market only cares about liquidity, so let’s hope it gets some good news this week, the contrary would be a tough pill to swallow…

Chinese Stimuli.

On the Chinese side, things continue as expected as the government announced its wish to have a "looser monetary policy" going forward, with specifics to be announced in March. Most would love for it to move faster but slow & steady is a better solution. I also assume that China waits to see how Trump manages tariffs & trade globally before taking actions.

My base case remains that China will have small, targeted & regular stimulus to boost consumption globally & efficiently fight deflation throughout 2025, favoring Chinese companies & any companies selling in China - including On Running, Tesla & Lululemon. We’ll have to wait a bit longer to have definite answers.

Watched Stocks & Portfolio.

Google, Willow & Bitcoin.

Two news in one here.

All-Time High.

The first one being a new ATH for Google, some months after the market called it late in AI, spending money uselessly, not innovative, that Chrome will be outpassed by LLMs & more… Lots of takes I’ve commented about both on X & here - here’s one example but I’ll let you search for more if you want.

I also wrote this on March as Google fell under $140 and this substack didn’t exist yet…

https://x.com/WealthyReadings/status/1766073152818368909

I didn’t have enough liquidity to fully take advantage of this situation but it is also nice to watch from the side.

Willow & Bitcoin.

The second news comes from Sundar himself who’s having some fun on X lately as he announced that Willow, their quantum computer, “solved a standard computation in <5 mins that would take a leading supercomputer over 10^25 years.”

The question was raised on social media: What about Bitcoin? With the underlying question: Can quantum kill Bitcoin? The rapid answer is no. But we can go further.

Quantum computers aren’t working yet. Sundar begins his sentence by "In benchmark tests" which is self-explanatory. I am not denying the advancements Google is doing in the field, I’m just saying that it is too early to assume those computers are up & running. They are being tested.

Assuming that Willow is in use already, it isn't powerful enough to crack Bitcoin’s encryption - yet. Some estimate that you’d need a few hundreds Willows functioning for a day to be able to crack Bitcoin’s easiest encryption.

Quantum computers need extreme conditions to work as the heat they generate is above what we know. Consensus talks about absolute zero which is - so far, not reproducible on Earth - at least for long periods. I'll let thermodynamics experts go further as it's not my domain but my understanding is that as of today, we couldn't use it for long periods of time. I'll let you dig on this subjects as again, I’m way out of my league.

Bitcoin uses different sets of encryption for different process, including ECDSA & SHA-256, which are the strongest encryption widely used at the moment. I'll let you take one second to imagine the disaster it would be if those two protocols were to be "hacked". Bitcoin would be the last of the world's problems. Banks would fall, national secrets would be stolen, passwords wouldn't be secure anymore... Chaos.

Bitcoin is resilient. Bitcoin is a software which can be updated. Its developers are aware of quantum and work on it since years. Quantum resistant encryption exists and is studied to be implemetned. The software will certainly be updated before quantum computers become a real risk.

In brief, quantum computers are a reality and could be a threat to Bitcoin & to every infrastructure encrypted with non-quantum proof systems. We could see the first applications of those computers soon enough and yes, it could be a problem for Bitcoin. But we are far from it and Bitcoin’s software will certainly be updated before the threat becomes real.

More Bitcoin, more Cryptos.

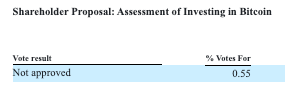

Without much surprise, Microsoft’s shareholders voted no to hold bitcoins on their balance sheet. Even more, almost no one voted yes.

We talked about it already and I didn’t expect this to happen. I believe mentalities are shifting about Bitcoin, for the better, but the world is not ready for it yet. Many are talking about national reserves or countries buying but I also don’t expect serious countries buying in. Not this cycle.

This cycle will remain a pump & dump and Bitcoin will crash in a few weeks/months exactly like it always did, only with less volatility than years ago. Don’t let anyone convince you otherwise.

I shared my buying plan a few days ago and I hope some of you had the time to read it before the market pumped back up, as the wicks were perfectly retested and the market bounced up to 20% for some coins since. Here is Solana for example, on which I didn’t catch the exact bottom but was close enough.

It isn’t the only coin I bought and I continue to be very bullish for the next weeks. I’ll continue to buy the liquidation flushes wick until we finally see some real on-chain data which indicates a potential cycle end. I see nothing of the sort yet so I remain long & since this flush, and finally leveraged again.

Celsius.

I shared a few days ago that I would start another position in Celsius when the stock would show some strength. That’s what happened this week with a potential weekly bottom finally in.

I pressed the button already with a position around $31 in the public portfolio, bought by selling some Lululemon & PayPal shares, not because I do not believe in those two stocks anymore but because I judge the potential of Celsius to be higher than the one of those two at current prices, as I judge that Celsius can easily reach $40 in the next three to six months.

SavvyTraders don’t allow options so I cannot share there, but I also bought Jul18'25 calls with a strike at $37.5 on my personal portfolio. As usual, when the convictions & the fundamentals are here & studied, and the market gives signs of strength, it’s go big or go home time.

If interested, the bull case is in the conclusion of this write up.

Other.

Adobe Q4-24.

the company shared a pretty good quarter but it wasn’t enough…

EPS. $4.66 | $4.81 | +3.22% beat

Revenue. $5.54B | $5.61B +1.19% beat

$2.5B of buybacks.

I honestly did not see anything wrong in the fundamentals. The company is growing, very consistently, and there is a strong retention/demand for their Creative Cloud products. The financial part is as good as the fundamental one with stable growth & expanding margins.

Yet, the stock fell more than 15% during the week, because of a weakish guidance & a strong valuation. Adobe guided for less than 9% of revenue growth FY-25 and the market didn’t like it as it assumed it comes from a lower demand or retention, probably due to those image generator tools or else.

The bottom line is that it sees this as a fundamental issue and Adobe’s actual rich valuation didn’t help.

The stock closed at $465 on Friday which still requires pretty high ratios to give proper return on investment by 2026… I’m personally not a buyer as those prices but I’ll keep an eye on the company.