Weekly Recap | August - W4

Hims & GLP-1 drugs, Crowdstrike's drama continues, Ulta's disapointing results, PayPal's new partnership, Apple & OpenAI.

We are closing on a pretty packed week with lots of volatility in the markets, both ways. Lots of things to talk about today.

Hims, Lilly & GLP-1 drugs.

I’ve finally released my investment case on Hims which is available here if you didn’t read it yet.

Besides providing a digitalized, customizable & efficient service, one of Hims’ main advantages over the competition is the attractiveness of its products, cheaper than almost every competition.

That’s why the market got excited when they said they’d add the expensive GLP-1 drugs to their products even though it didn’t bring any revenues yet, we talked about it during the last quarter review last week.

The market is a machine to anticipate good news, but also bad news, and that’s what it did when Lilly announced a new branded GLP-1 product for half the price of its original drug - the new product’s price ranging from $399 to $549 per month, which the market saw as competition to Hims.

https://investor.lilly.com/news-releases/news-release-details/lilly-releases-zepboundr-tirzepatide-single-dose-vials-expanding

I disagree with this take as it for sure is competition but should not hurt Hims in the long term, far from it, for different reasons.

1. Hims’ actual growth & business is rocketing and not impacted by GLP-1 drugs at all. Lots of projections can be done without them and are very bullish, with the stock very attractive at today’s multiples.

2. Hims proposes lots of different forms of weight-loss drugs besides GLP-1 and many customers will still use those, growing revenues for this category. Besides this, nothing prevents Hims to propose those new drugs from Lilly in the long term.

3. Most of the value added from Hims comes with the digital service they provide and were they to propose this product, I believe lots of users will buy it through Hims & not through Lilly or other providers.

I believe the market is giving us a very good long-term opportunity at this price and I’m still accumulating, not too aggressively but not slowly neither.

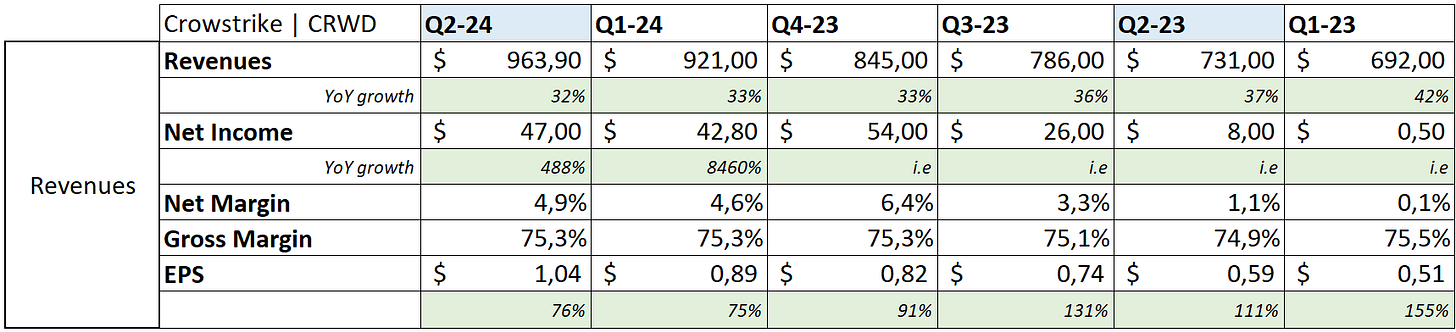

CrowStrike Under Water.

We have to come back a month earlier for this subject, when CrowdStrike provoked an international IT crash which affected the all world.

The cybersecurity company released its quarter this week and although the numbers were good & the market reacted properly… Things aren’t as good as they look to my opinion or it sure is too early to tell.

The stock is up 40% since its bottom around $200 based on optimism only, and short-term data coming from a very correct Q2-24.

But the truth is that problems start only now as the July crash didn’t impact the second quarter and consequences will come only in a few months - potential clients leaving, legal battles, fees…

It started to show in the guidance which came weaker than expected and competition is already rubbing its hands, especially Sentinel One which didn’t hide its intentions at all.

"Our outlook is that there may be benefits that come from CrowdStrike customers ... but our guidance isn't dependent on it."

I am the first one saying that the switching costs of those products are strong and probably unnecessary to go through in CrowdStrike’s case as the issue was a human error, but only time will confirm this and I still wouldn’t buy in now, even after this strong quarter.

It’s too early.

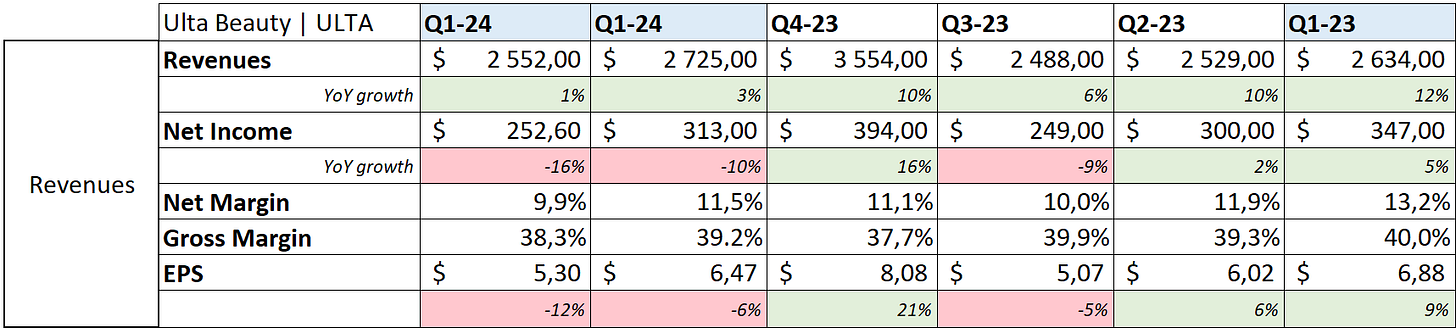

Ulta’s Disapointing.

There was a big difference between Lululemon’s results & Ulta’s results this week which is, to my opinion, resumed in one word: management, although it isn’t the only problem at the moment as the business is also a bit shaky.

But a slower consumption wouldn’t be a problem without shrinking margins & declining EPS even with strong buybacks. I’m personally adding Ulta to my “good but weaker brand, struggling business” list along with Nike & Starbucks, stocks which could become opportunities when/if demand for their brands returns & if management does what it takes.

As for now, my conclusion is the same for the three of them: No stocks are undervalued just because multiples are low, especially not in a very competitive sector, with a lack of demand for your brand’s products & without revenue growth.

A company can be called undervalued only with a healthy business. Buying today is buying hope. Not fundamentals.

PayPal New Partnership.

I’ll send you back to last week where I talked about the partnership between PayPal & Adyen to provide Fastlane to the latter’s customers.

PayPal continues to add new partners to provide its new checkout method with Fiserv this week, another payment aggregator, and this continues to be very positive & bullish for the company’s future.

https://x.com/acce/status/1829113299905991077

Apple & OpenAI.

Apple is in talks to invest in OpenAI - founders of ChatGPT. Lots of speculation around this new.

No idea about the amount, but the noises are about how late Apple is when it comes to… tech in general, but in AI most importantly, with Apple Intelligence not being quite comparable to what other companies are providing.

Rumors go as far as a potential acquisition, without any signs pointing to it but they’ll surely deepen their relationship and integrate more & more techs from OpenAI into their hardware.

Very interested to see how things will go with Microsoft being a major actor & investor in OpenAI. Small war between the two giants? A remake of Jobs vs Gates?