Weekly Recap | August - W3

Earnings season recap, PayPal & Adyen, Alibaba in China, BTC & ETH ETFs update

PayPal & Adyen.

The big news this week comes PayPal who’s partnering with Adyen to provide Fastlane through their infrastructure. Few words on Adyen first, for those who don’t know them: they are a payment system aggregator company, proposing merchants different technologies for their checkouts - including PayPal, and taking a fixed fee on every transaction passing through their infrastructure.

Since the company already works with PayPal, it seemed logical for them to also implement Fastlane in their offerings.

A rapid reminder of Fastlane as well, the new checkout technology developed by PayPal, allowing their users to be automatically recognized on any online store and to complete their purchase in only a few seconds as everything will be fulfilled automatically once the user is verified - we’re talking about a 70%+ conversion rate, far better than the competition and a 30%+ checout rapidity.

Pretty good news for PayPal for different reasons.

First, it will very probably drive more volume to them as consumers always go for the simplest option. If they want to buy anything on a merchant's store and have different methods to do so, they’ll very probably use Fastlane now because it is easier & faster than using their credit card, for example. And Adyen provides payment solutions for lots of merchants, so this is a big market which is now opened to Fastlane.

Second, if Fastlane is indeed as good as advertised, it will certainly force many merchants to propose PayPal as a payment solution on their stores. You always want the best conversion system to do more sales.

This partnership basically opens Adyen’s maket to PayPal Fastlane, and if it is as good as promised, we should see a rise in its usage from Adyen’s merchants. I would love to have statistics on this in a year or so.

Either way, it’s a win for PayPal - and for Adyen, which gets more for doing nothing.

Earning Season Recap.

We are mostly done with the earnings season, at least with the peak. We still have more companies to report their second-quarter results but things will be calmer for the next month now. Maybe it’s time for a small recap.

Consumer Strength. I will start by talking about the consumer because it is probably the most important subject lately, and there's a lot of things to say. Consumers should be divided into two groups: low-income households & others.

I think we are starting to see a prioritization of expenses for those lower-income households, and it is beginning to show for some companies selling retails at all prices like Starbucks, McDonald's, or Nike.

We don't have a weak consumer, though - simply some prioritization in expenses. Services like Hims & Hers, Netflix or Spotify did not slow down at all, indicating that households certainly judge those subscriptions to be worth it.

On the other hand, premium brands like On Running or Cava are still thriving & growing. And I expect Lululemon next week to print a correct report after proof that the U.S. consumer is still strong, with TJX Companies' great quarter this week.

Besides households, talking in geographies, the expected trend is drawing itself. A constant American spending. A slowing Europe, as usual, behind in everything and still shooting its own foot with more regulation & price controls. And a thriving Asia, which is home to lots of companies' growth, especially when it comes to retail & brands - hence hope for Lululemon’s quarter next week.

This is an overly simplified take on the consumer; it simply shows the global trend I noticed during the last quarter & from the outlooks of different companies. Focusing on premium brands, prioritized subscription service companies & companies selling internationally seems to be a winning combo for consumer-related stocks.

Tech. Nothing special to talk about here, as tech & semis are still thriving, growing strongly & investing more & more in their own infrastructures. Not much has changed since the last quarter in this area, and continuing to buy these great companies at good prices also seems to be a winning combo.

Some specific stocks. This week showed some very positive price action with Palantir & On Running both printing 52-week highs, along with PayPal, finally, which is now trying to break out of its one-year resistance and stabilize above $70.

I’d gladly buy the retest under $70 if the market gives it.

Alibaba is following the same pattern, trying for the second time to break its $80 resistance on some very positive new we’ll talk about just after. I do not plan to buy any more as I'm already properly exposed to China and this stock.

But I certainly hope this breakout works this time.

For the falling stocks, namely Lululemon, Celsius, Hims & Airbnb, I also really like the strength they’ve shown over the last few days, with a potential bottom printed for Lululemon around $230, although the earnings next week will set the direction of the stock.

The three others have already reported their earnings and are behaving pretty well since, but it is still too soon to be optimistic about a reversal - although not too soon to DCA.

Recession. I'll still talk about the potential recession many were scared about no longer than two weeks ago. Those fears have been lifted with the last macro data and better-than-expected earnings and many now expect the first rate cut next month - and this should finally happen if we read properly between the lines of J. Powell’s last speech.

But we're not out of the woods yet, and I will consider a recession possible as long as we are not back to normal interest rates without violent consequences on the economy. Lots of things still can happen between now and then, and I'll keep cash aside in case it happens; there’s a much better opportunity cost to have 10-20% of cash aside than to be fully invested at the moment, in my opinion.

The market is very intense to watch, but there’s not much to do in reality. It's all about occasional buying & lots of waiting.

Alibaba to open trading in China.

The Chinese e-commerce giant will soon be trading in China, and this is pretty good news as it means an opened door to potential billions of inflows. The giant was only quoted on the New York Stock Exchange and in Hong Kong until today, but the latter is converting the stock to its cross-border listings.

It’s hard to know how this will unfold & affect price action, but there surely will be some buying as Alibaba can easily be compared to our Amazon in the West - and god knows westerners love to buy Amazon, so why would it be different for the Chinese to buy Alibaba?

Trading should start on September 9th.

Bitcoin & Ethereum Update.

Nothing new in the far west - Bitcoin & Ethereum are pretty flat although the week end seems to start strong. The ETFs are also pretty flat, with a constant $17B of net inflow on BTC & still a $450M outflow on ETH, with not much demand for it as we could have expected, but still better results than I thought.

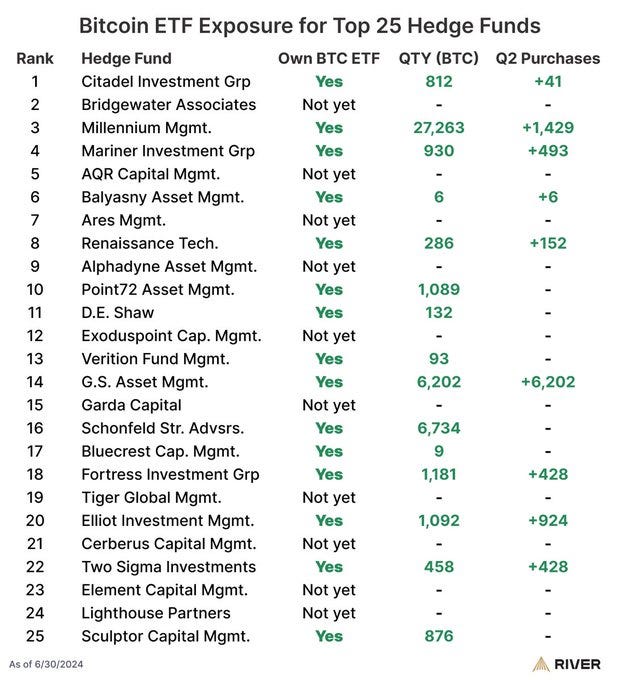

We still have some interesting stats with 60% of the largest hedge funds now having exposure to those Bitcoin ETFs.

Things changed rapidely.

I’m still with the same playbook, waiting for a potential wick retest like I shared last week, but I am still very optimistic for the rest of the year, especially with rate cuts coming and if the Fed really manages to do this soft landing miracle.

Still holding strong and buying when occasion arises.