Weekly Recap | August - W2

Funds' & superinvestors portfolios, What is a CEO worth, Google The Broken & Accumulation.

It’s mid-August, and the market is pretty quiet - or companies are pretty quiet as the market ran pretty wild lately, not much news to put under our tooth.

The King’s Portfolios.

The latest 13Fs got out this week, releasing the portoflio content of all superinvestors & funds - with their holdings to date and last three months’ moves. If anyone is interested in going through those, everything is easily available here.

https://www.dataroma.com/m/home.php#google_vignette

China.

I think we could call Chinese stocks the winner once more this quarter, as I have seen lots of buying on PDD, Alibaba, and JD.com. It still isn’t the majority of investors, but it seems like their valuation is attracting more and more interest.

Michael Burry once more increased his stakes in some of those companies, but he wasn’t the only one.

Apple & Tech.

We’ve talked about Warren Buffet and his Apple selling but more followed his lead this quarter, although I believe tech was more bought than sold - especially Google.

Consumer Companies.

The big winners of this quarter, in my opinion. I have seen many super investors buying Starbucks, for example, while W. Buffet bought into Ulta, and Bill Ackman bought into Nike - while selling Chipotle almost at the top, not bad. I guess the very cheap valuation of this sector is starting to attract money, we talked about this possibility two weeks ago but I didn’t expect to see it start that soon.

They were not the only winners, though, as I’ve also seen lots of buys on Micron, Uber, and Adobe, which all saw their valuations dive during the last few months, giving pretty good entry prices.

Google to be broken?

There is nothing more dangerous to a capitalist economy than monopolies but our politicians forgot that long ago, and many of them formed, becoming more powerful than lots of countries by now. But politicians sometimes wake up to throw some threats and remember that they have a job...

That’s what happened this week as Google was found guilty in its antitrust case against the U.S. Department of Justice, where the judge ruled that the company “built an illegal monopoly over the online search and advertising industry” - shocking. As a reminder, Google is paying other browsers to use Google Search as their default search engine, so you might end up using Safari, Firefox or other, you’ll still browse the internet through Google Search - and that is true since years.

There are no solutions for now and I personally assume that nothing important will happen. Google could simply be forced into stronger regulation in its contracts with other browsers or face a small slap on the wrist, but the internet and the market got scared of this news as one of the strongest punition could be the breakup of the company into different ones.

I personally don’t believe in anything like this, and life will surely continue without anything significant happening - and Google keeping its monopoly. But it’s worth monitoring over the next few days, as any bad news could give some good buying opportunities.

Starbucks vs Chipotle.

The two franchises aren’t direct competitors but it seems that Starbucks didn’t care much as they literally poached Chipotle’s CEO, and gave the market an answer to the question, “How much is a good CEO worth?” Starbucks pumped 24% on that news, adding $20B to its capitalization in a single day - maybe this is the start of an answer.

We already talked about Starbucks and how different activists were getting into the name; we can assume this is the work of one of them, and that with a new & capable CEO now steering the ship, things will change.

I didn’t want to buy in at $75 and still do not want to, as a new CEO isn’t fixing the company’s actual problems in the short-term and I think this pump is just short-term optimism. But I’m glad for those who took the gamble in the lows as they’re now nicely green on their positions.

Weekly Buys.

As a new week start, new purchase will be made in the market.

Stocks.

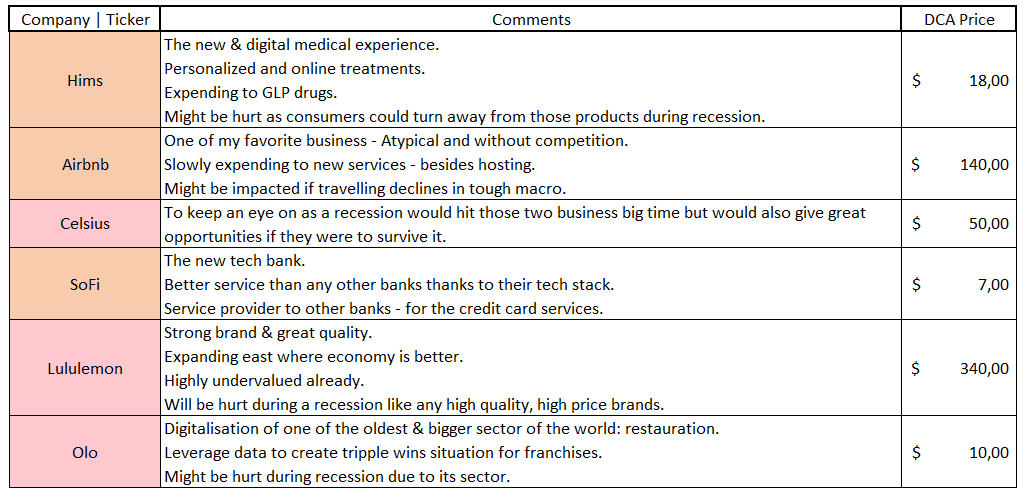

As usual, I will focus on buying companies I juge great & tradding at fair price. Here’s the updated table of those answering the requirement at the moment.

I will try & focus on Hims & Celsius as the position in both is still small and needs to grow, and will certainly add some Lululemon around $250 as earnings are in two weeks and the stock is giving some positive action.

Crypto.

I took profits on my Solana buys during the famous Black Monday two weeks ago as we were back to a strong trendline & up 30% since I bought. My take on the market is still the same: Wicks are always retested so I take things slow and keep some cash aside for that day - I will keep this view for easily one month.

The fact that it often happens doesn’t mean it will happen again, but I am playing probabilities here. I am ready to buy Bitcoin around $52,000, Ethereum around $2,200 & Solana around $120 - rough prices here, it will depend on if it happens, when it happens & more variables.

what is the significance of the different colors in your weekly buy list?