Weekly Recap | August - W1

The famous Black Monday, W. Buffets is selling, Palantir's taking Olo's business, TSM's July results, Tesla deliveries, Earning & Price targets.

Black Monday.

I saw this trending earlier this week as many overreacted to the market correction. I’ve already discussed what happened, the probable reasons, and my stock watchlist and buying prices on Monday - it's all here if you’re interested.

There isn’t much more to say, except that most stocks recovered their losses within a few days. I’ll focus here on the crypto market which followed the SPY, dropped like a stone and then rebounded just as quickly.

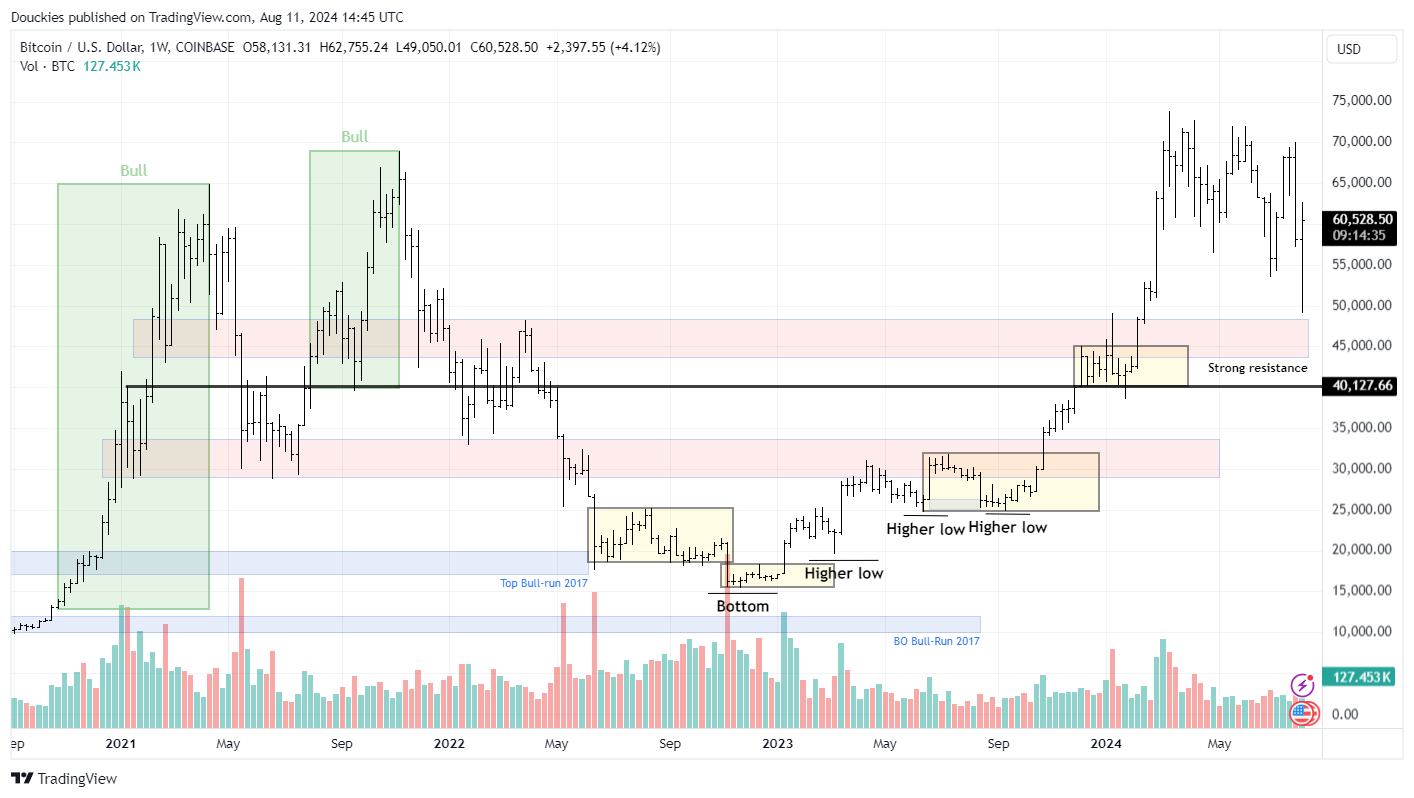

In term of price action first, Bitcoin, Ethereum, and Solana all found strong support levels to bounce from - key prices that many long-term investors were watching. For example, Bitcoin dropped perfectly to $50,000, a strong support level and psychological price point.

I personally bought the wick on the three assets but crypto has the bad habits of always retesting them… Which doesn’t mean we will without any doubts go back to $50,000 in the next days, weeks, but I personally think we will - and I will buy again if it happens.

Not much has changed for Bitcoin in terms of ETF inflows, which means buyers are holding the asset, or at least not selling at $60,000 - it’s worth noting that the ETFs opened at $45,000. If investors are comfortable bringing in $17B of net inflows between $45,000 and $65,000, this large range could very well become the bottom for the next few years and I’ve decided to restart my long term DCA, based on those data I consider pretty bullish very long term - decade or so.

About Ethereum, things are better than I expected.

We closed the first weeks at -$405M of net inflows with Grayscale selling -$2.3B - which means lots of inflows from others and indirectly, institutional demand for the asset. Grayscale's sales are slowing rapidly although they still hold around 60% of their reserves pre-ETF.

I am still holding it all and planning to buy blood. I still believe there is an upside in the crypto market for the next months, but that’s only my view of things and my plan - I could be wrong!

Buffet Gold Mine.

Back to the stock market, or more precisely to Mr. Buffett, whom everyone is looking at, as usual. He decided to sell a massive portion of his positions over the last weeks, notably in Apple (from $135.4B to $84.2B) and Bank of America (for roughly $4B).

There isn’t anything unusual about them selling stocks and I don’t think any of us should even try to understand why they are selling - we do not play the same game and do not have the same rules. What is unusual and raises so many questions (which will stay unanswered) is the amount of selling.

Berkshire now sits on a bit more than $275B of cash - more than most Western countries’ sovereign funds, just to put things in perspective.

Are they raising cash for an acquisition, for internal business expenses, or expecting a recession? I cannot answer, but I personally won’t stay invested at 100% anymore and will keep and grow my cash pocket. We’re not in a stable situation.

Palantir - Wendy & 52 Weeks High.

Two subjects today for Palantir, with the first one being a new partnership the company signed with the food chain Wendy’s. I don’t usually comment on every new partnership, but this one is a bit different because it concerns a restaurant franchise, Olo’s territory - more or less.

Wendy’s is planning to use Palantir’s AIP principally to optimize its supply chain.

“This partnership will bring QSCC towards a fully integrated Supply Chain Network with opportunities for AI-driven, automated workflows as well as a future Wendy’s connected ecosystem of suppliers, distributors and restaurants.”

This isn’t exactly Olo’s core business, but it is part of it. I called it the “Palantir of restaurants” some time ago, as I didn’t expect restaurant franchises to turn to such a complex product to manage their supply chain, but… it isn’t that complex with bootcamps and frameworks.

This is another proof that Palantir’s software can be used in absolutely every industry and one of the reasons why the stock is reaching a new 52-week high this week.

It is mainly due to its excellent quarter, but it all goes together. Pretty glad the market gave me the opportunity to grow the position at $22 this week before such a quarter.

I wouldn’t call this bearish for Olo, as again, this still isn’t their core business, but it is impressive for Palantir to expand into so many industries that fast.

Taiwan Semi Condutors.

The data speaks for itself as, once more, TSM is reporting an excellent month with strong revenue growth QoQ and YoY - and will certainly finish the year with excellent results.

It’s always good to see demand for their products as it indirectly means that there is still growth to be expected from the computing power hardware sector.

Tesla Deliveries.

This isn’t much true for Tesla, whose deliveries are still expected to be lower & lower. No official data here, but Troy is regularly accurate with his expectations and even a small margin of error won’t turn the last months from where they are to strong growth.

A big difference in the company’s biggest markets, which can be attributed to the macro environment in the U.S. and Europe, but not really in China… A decline probably due to strong local competition with brands like BYD, Li Auto & other smaller ones who are focusing on selling cheaper cars.

Tesla has long been the EV brand, the only one selling a real product, but it isn’t the case anymore - although they’re surely still the best ones. But once again, this isn’t the investment case for Tesla; it is important but not the entire thesis.

Earnings Reviews & Price Target Update.

We closed a packed week with a lot of holdings reporting, and two new positions. Here’s the update for the four companies I closely followed, which reported this week.

I reviewed Palantir’s price upward and HIMs’ potential impact from a recession as I think management raised good arguments about their consumers’ need for their products.

Here are the reports.