Weekly Recap | April - W4

Important long term investing plan, Airbnb & the FTC, Autonomous vehicles (Uber, Tesla Waymo & Volkswagen), Palantir partnership, Nvidia vs Huawei, Avride, Earnings, Valuations & Weekly planning.

Macro.

I won’t go over macro today & will focus on what happened over the last few weeks, which haven’t been usual. It’s important to understand the market mechanisms & why almost every U.S. asset went down during this period as it will help us make a plan & hold on to that plan without worrying too much macro at large. As Peter Lynch says.

“In the stock market, the most important organ is the stomach. It’s not the brain.”

Can’t say he’s wrong. But knowing what’s going on keeps our stomach from hurting in tough times and stops us from panicking & dumping our assets for no reason. You don’t stress about what you understand.

Actual Conditions.

First, we talked about the different types of assets & why each of them are important depending on the economic conditions.

You will find the details & argumentation in the write up but here’s the conclusion.

Growth + Inflation = Stocks.

Growth + Hyperinflation = Stocks & Gold.

Growth + Deflation = Cash & Bonds.

Decline + Inflation = Gold.

Decline + Deflation = Bonds.

What made those last weeks different is that assets did not behave as they should. We are in very uncertain times, still have inflation, interest rates remain high, U.S. debt is out of control, lots of geopolitical tensions & more… The playbook says we should see gold, the dollar & U.S. treasuries go up as most liquidity goes to defensive assets to shelter from a potential storm, while stocks go down due to profit taking & growing uncertainty. We should see.

Stocks down.

Gold, dollar & treasuries up.

And yet, here’s what we saw.

Stocks, treasuries, dollar down.

Gold up.

Only gold behaves normally and the world is selling dollar & treasuries while entering uncertain economic times. Something rarely seen before and many conclude that this indicates the end of the dollar’s supremacy & of the world’s trust in U.S. assets.

I disagree. Everything can be explained.

Here’s What Happened.

Since Trump announced the tariffs, the world somehow changed & most importantly, institutions, countries, international funds, companies & other investors - the bulk I call “liquidity”, understood it & took precautions.

Why? Because we aren’t in an uncertain market or U.S. economy, we are in a trade war affecting the entire world. There is a possibility for the world economy to be reshaped in the next months without the U.S. at the heart of the financial world anymore. It is very different to what happened the last decades with classic recessions, markets or currency crises. It is a structural risk affecting the entire world and everyone wants to be prepared, just in case.

How? By withdrawing money. I explained not long ago that the U.S. were the financial center of the world with the strongest & most stable assets, and liquidity was flowing into them as wealth is always stored in the best possible alternative.

Today, the world is cautious & anticipates the worst.

What would you do if you had money invested but were now in complete uncertainty. You might lose your job or earn less from one day to the other, have no idea what the future holds but you still need to sustain your family, pay your mortgage, bills… You’d certainly sell some of your assets right? Get some cash. You might not need it, maybe everything will end up well, but just in case.

This is what the world did those last months.

When crises happen, liquidity usually flees to the best assets: Dollar, gold & treasuries. When Trump declared that the world order had to change, that the U.S. would set up tariffs & try to refund its deficit, the rules changed. The U.S. became the source of the uncertainty & the best defensive assets weren’t U.S. assets anymore. The world sold those and put their liquidity into assets they own - local currencies or gold, because they do not know what Trump wants, how far he would go & what he’d be ready to do. So they took precaution & put part of their wealth into assets they have a certain degree of control on. Not the best assets but the best alternative right now. This, plus the fact that they also needed liquidities to pay for their expenses, debt or else as economies around the world are contracting. When economies struggle, liquidity is king.

That’s all it is. There are no plans to hurt the U.S or to turn away from the actual order. It is all a matter of fear, uncertainty, needs & anticipation. Something any reasonable manager would do in such uncertain times.

To go further, confirm this take & point fingers, the biggest U.S. assets sellers are the countries whose currency has been up the most against the dollar. And those are the two closest allies to the U.S.: Japan & Europe. I thought China was part of it when it started. Turned out they’re not - not massively at least.

What Now?

We have many scenarios of what could happen, but keep in mind that up to now, the world - allies & foes, is getting rid of U.S. assets not because it doesn’t trust them at all anymore, but because they need liquidities, first, and there is a very small chance that things change drastically, second. Will they? I don’t think so.

First, it is possible that the world does not trust the United States anymore if nothing changes. If so, liquidity will not find its way back home. Yet, No one wants to store its wealth in something which won’t keep its value, it’s ok to do so for a short period of time to shelter a storm but not for years. It always goes to the most efficient place & that isn’t local currencies. The best alternative would be a new financial place around the world… But nothing exists today, and financial places aren’t built overnight, they are built through decades. As of today, none can hold the world’s liquidity like the dollar or U.S. treasuries can. None are valid alternatives.

Second, liquidity could go to hard assets - gold. The only asset which could shelter so much liquidity & somehow, it is what is happening right now. Capital flew out of the U.S. and went directly into local currencies & gold, hence the massive pump those last weeks. But gold, perfect to preserve value, won’t be enough in modern economies as it doesn’t allow money creation, debt, leverage nor yield returns. Good during storms but not good enough for the long term with modern economies. Bitcoin would have the same problems.

Third? We could go back to what was. And I believe that will happen. Again, the flow from capital out of the U.S. is a matter of temporary uncertainty & need. Not distrust or wish to end the actual world order - the biggest sellers are actually the closest allies of the U.S. I personally don’t see why it would be any different in the medium term & I believe liquidity will find its way back home to the U.S. once Trump slows down on the uncertainty & reaffirms that the dollar will remain the global reserve currency. Trust isn’t lost, it is doubted.

The Plan.

If we understand this, we understand what could & certainly will happen, and it allows us to make our plan & stomach it. My bias is that the uncertainty will come to an end & liquidity will go back to U.S. assets because the contrary would create situations no one wants - complete trade wars, currency wars, maybe even real wars. It also is the most likely outcome because even if countries & institutions sold some assets, most of their wealth remains stored in the U.S. Everyone has an immense interest to see uncertainties end & U.S. assets stable again. Hopefully, leaders around the world know this and do not wish anything else.

In brief.

Do not ignore gold & Bitcoin - which I accumulate weekly. Even if not ready to blow up yet, the world issues exist & one day will. When that day comes, you’ll want to preserve some wealth & those are the only two assets capable of doing it.

Do not ignore the dollar & believe it is dying - nor U.S. assets at large. Liquidity will go back to those when uncertainty is settled & trust is reinforced. The U.S. will remain the financial center of the world & liquidity will go back to them because there are not valid alternatives to this. Focus on the best assets.

Do not ignore the rest of the world, especially China. Even if this uncertainty should be - hopefully, temporary, it still sends a very clear message to the world: countries have to be more independent & the U.S. won’t be here for everyone anymore. This might change when Trump leaves office but until proven otherwise, I would rather have some exposure to the second most important economy of the world.

Liquidity will come back but exactly like liquidity is doing right now, it will not hurt you to take precautions for your own future. The U.S. will remain the heart of the financial world during the next years because it is what the world needs, so I continue to buy dollar - as a European, and U.S. stocks.

But taking precautions won’t hurt.

Watched Stocks and Portfolio.

Airbnb & The FTC.

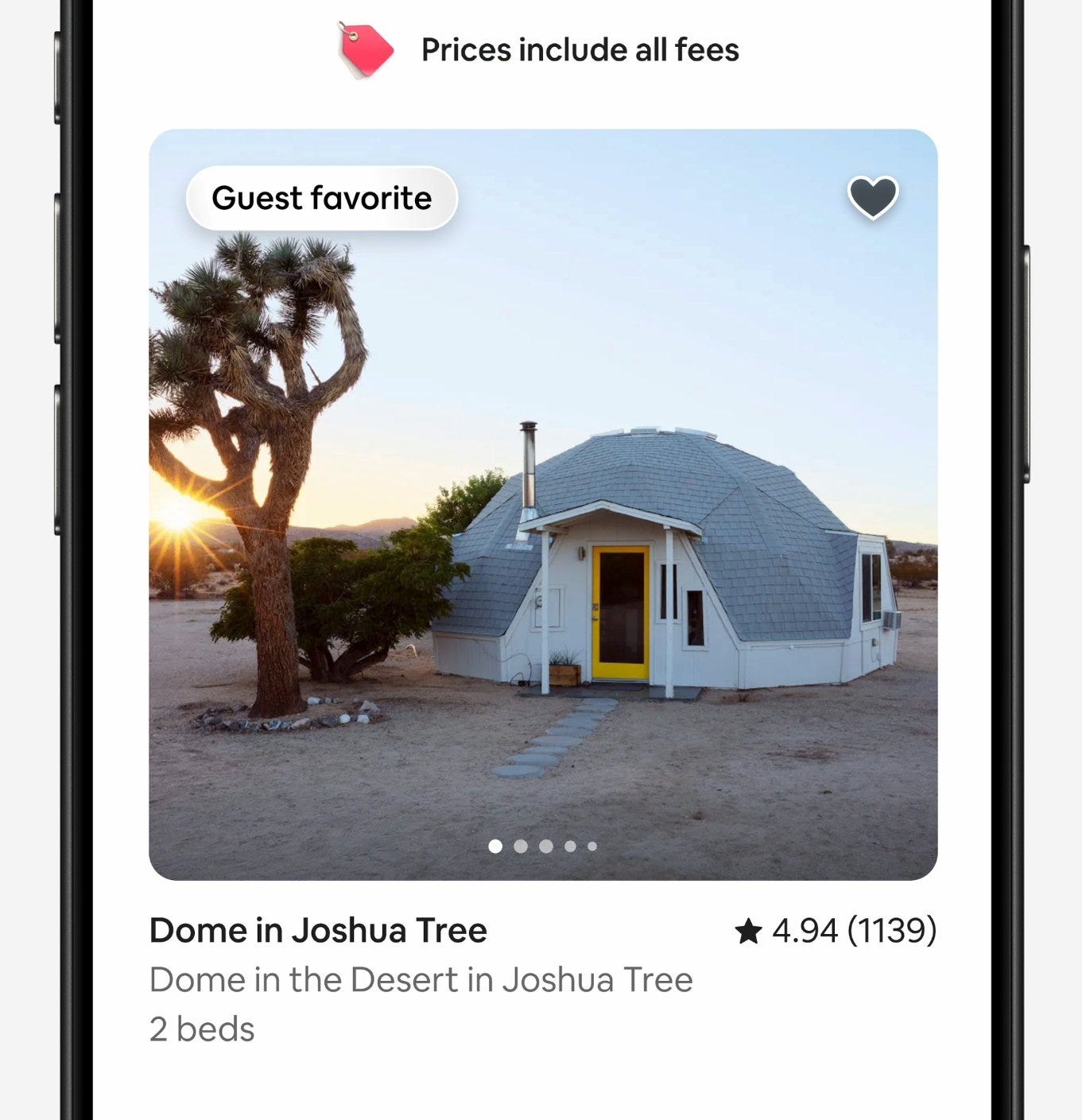

New regulations in the U.S. for Airbnb which will now have to display the final price of any booking directly on the homescreen.

"Starting today, guests around the world will see the total price of their stay - including all fees before taxes - right from the start."

We already have comparable regulations in Europe and I do not understand why this wasn't done earlier in the U.S. This will also force owners to reduce their outrageous pricing as competition will be increased from upfront transparency, and low prices are a net benefit for the company - as explained in the investment case.

They end up being forced to do so but it should still be a net positive for most users of the platform, only hosts will feel a bit cheated - those who abused on fees at least.

Autonomous Vehicles.

Lots happened this week.

Uber & Volkswagen.

Uber & Volkswagen’s partnered to deploy thousands all-electric autonomous bus & vans, expected to be tested in Los Angeles this year for commercialisation in 2026.

More vehicles going to Uber, confirming the idea that the platform’s network effect is stronger than ever which confirms the investment case - you know where to find it.

Waymos.

Second, Waymo did lots of noise as Google shared that they were now doing 250,000 paid trips per week with the objective to deploy their cars to four more cities during the next two years. But they went even further than this as Waymo’s officials said that they thought possible to sell the cars to households.

My opinion is that this is lots of noise for nothing. Waymo are very useful and will be for inter-city mobility. But the complete autonomy will be sold by Tesla and Tesla only - at least there is no competition today.

Two reasons: Price & Technology.

First, a Waymo costs north of $100,000. Maybe more, depending on the data you take, but $100k at least for production & equipment only. If Google were to sell their cars, they'd need to add margins.

Useless to say, it won't be accessible to many households. Maybe companies, but then what is the point when they can operate them themselves? Besides pricing, we can also talk about design, comfort, safety etc... Waymos are just not meant for households & individuals.

Which car would you buy?…

Second, a small reminder that Waymo works on mapped roads only. Meaning users won't be able to use them autonomously unless Google maps... The entire world. This is unrealistic, really.

Let's keep our feet on the ground. Waymo is a wonderful product for city mobility, not for household autonomy. And Tesla FSD is perfect for households and will probably be great for mobility as well - if they finally deploy a product and if they find users, hopefully through Uber.

Palantir & Google Partnership.

Once again, I do not intend to comment each partnership. But things became bigger since NATOfor Palantir. Now, Google is going to share FedStart in its cloud, allowing all of their customers to use it in order to deploy their software to governmental agencies. Google’s user base is not small and FedStart is priced on usage…

A multiple win. Companies will be able to deploy & receive accreditation much faster, Palantir will be the bridge with accredited tools for them & Google connects its huge user base to the best software deployment tool... Impressive.

Nvidia, China & GPUs.

We did not have much more news since the U.S. reinforced their export control on Nvidia’s H20 but Chinese local companies are already planning to fill the gap. It’s Huawei who’s already working hard on it with manufacturing plans for its 910C GPUs.

Many others will try to fill the massive & growing demand from China but as I said last time, nothing can replace CUDA. And as long as this remains true, Chinese companies will continue to work with Nvidia to manufacture chips tailored to controls.

Compute Spending Reduction.

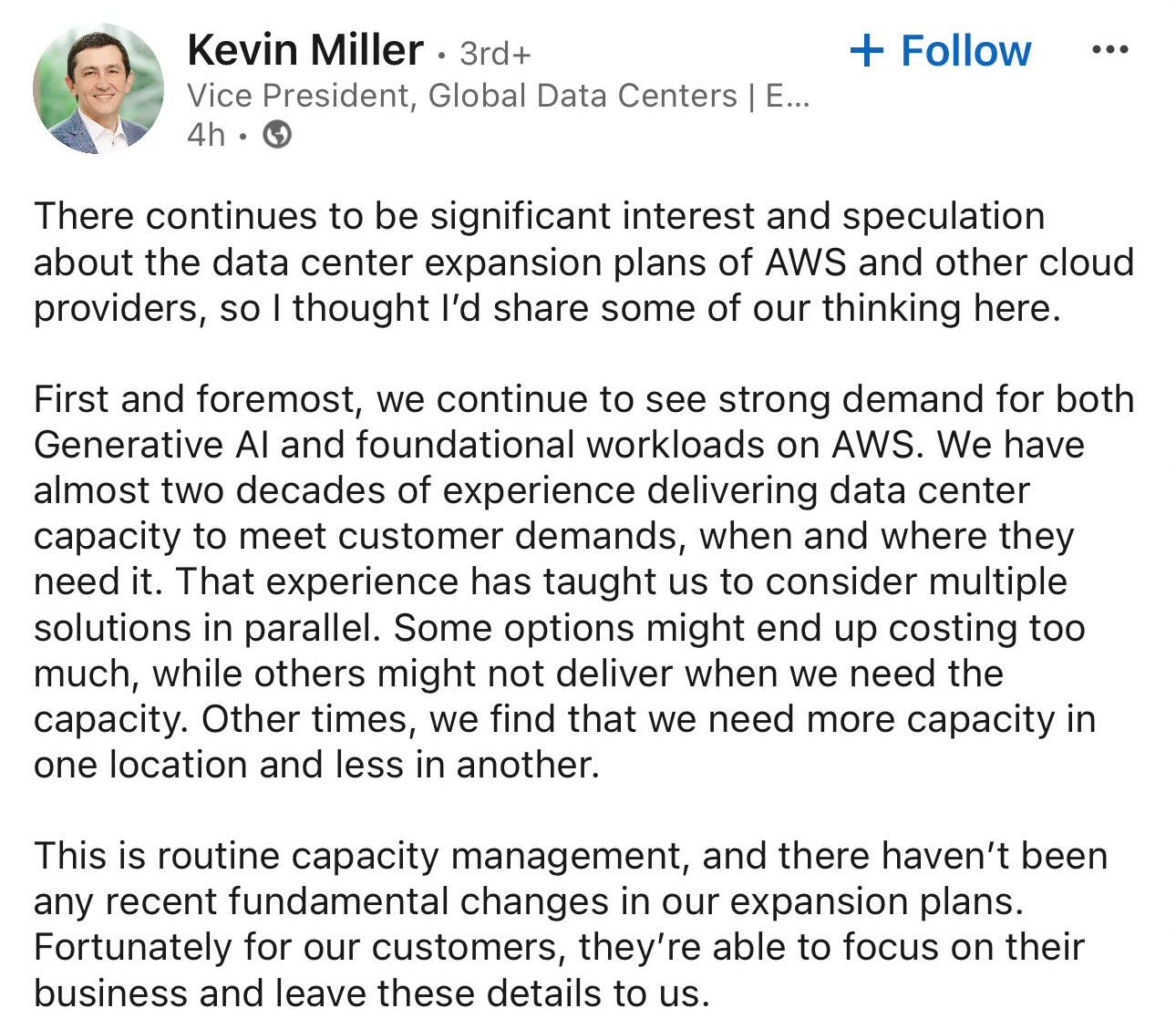

We had rumors a few months ago of Microsoft slowing its spending for datacenters & AI related expenses, reducing or pausing its loans for buildings or space etc… This was due to their retraction from OpenAI operations, meaning the latter would migrate its compute usage from Microsoft to third parties.

This week was Amazon’s turn, with comparable rumors. The only difference is that those rumors aren’t due to partnerships, and if they end up being true, it means a global reduction for compute demand & not a migration from one provider to another.

Those are the rumors, but they’ve been clarified rapidly by management.

We had more.

“We continue to see very strong demand, and we’re looking both in the next couple years as well as long term and seeing the numbers only going up.”

On another hand, Google’s quarter this week confirmed that demand was as strong as usual & that they still didn’t have enough infrastructure.

Noise until proven otherwise.

Nebius Avride Data.

Some numbers for Nebius’ autonomous delivery system which was deployed a few months ago on the Ohio State University. The company deployed 112 robots & partnered with 18 restaurants on the campus.

Since January, we are talking about more than 80,000 deliveries - more than 1,300 per day, robots working 14h per day to feed hungry students.

I focus my Nebius bull case on its computing power brach but this one could become something as we are talking about an easy business to maintain - only the hardware, very interesting for consumers as it makes it cheaper - no humans to pay, with pretty interesting margins & capacities to expand.

Lots of potential.

Earnings.

Enphase.

There isn't much to say on this quarter.

Demand is declining in the U.S. & stable but not really gorwing in Europe. Interest rates & declining buying power in the west makes the business complicated as the products are pretty expensive. This results in flatish deliveries YoY & another decline QoQ, with revenues behaving exactly the same. Numbers seem better but they are compared to the worst quarter ever for the company.

I will continue to monitor the company because household autonomy is important & will be a subject in the next years - I believe, but the situation is really complicated for now, due to external factors mostly. There is nothing to do with this stock, but I want to be there for when things start to change. Until then, I do not see any valid reason to hold or buy it.

Chipotle Earnings.

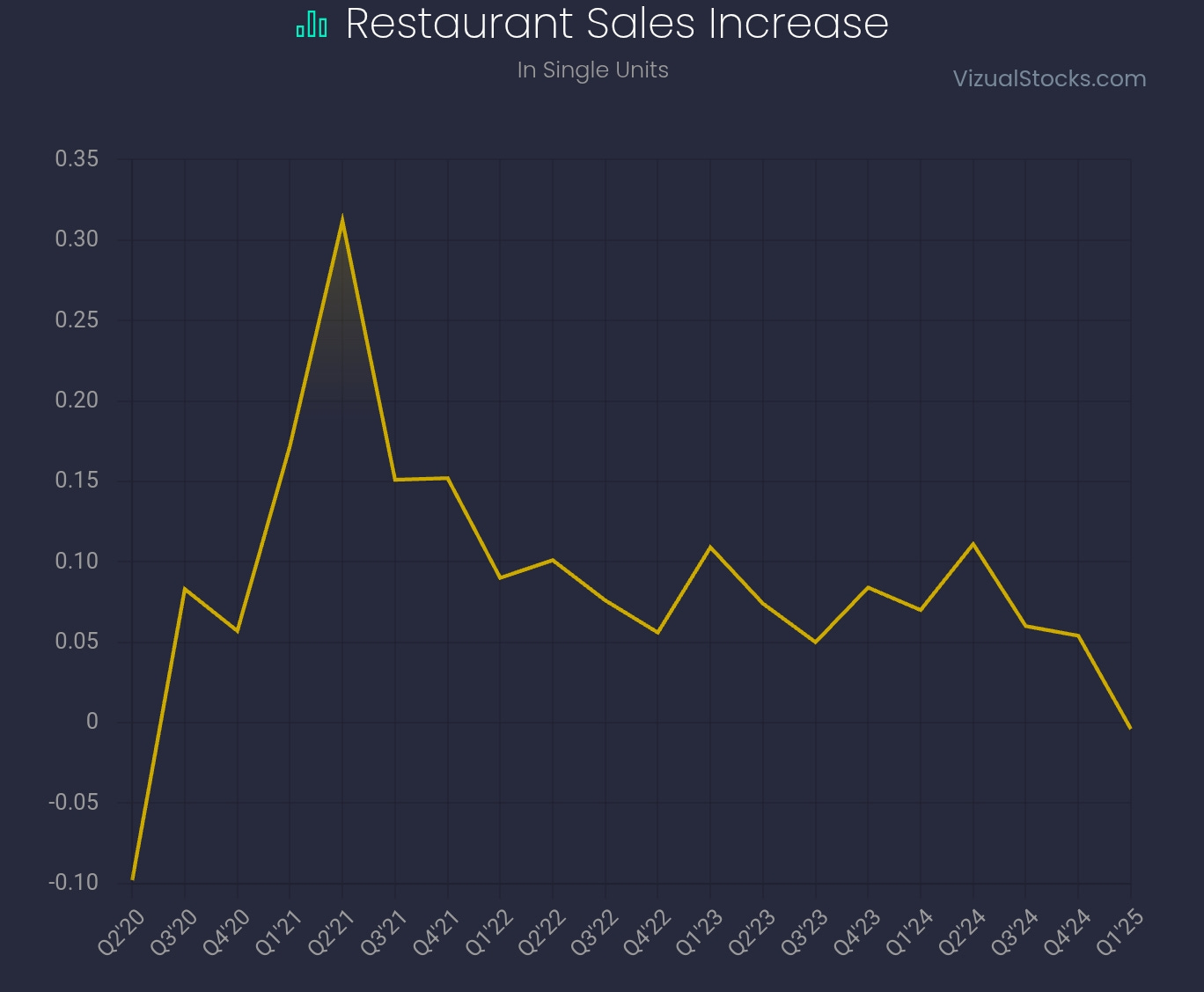

I do not follow the company but I thought it could be interesting to use it as macro confirmation. The Mexican franchise turned out to be one of the favorite dine out places over the last years which meant really great results & growth, but even the favorite ones start to show weakness with a clear decline in comparable sales.

Comparable sales are the YoY comparison of the existing restaurants’ sales growth - hence excluding restaurants opened less than a year ago. What was usually stable between 5% & 10% is now a 0.4% decrease. There are two ways for restaurants to increase revenues: attract more clients or increase prices/consumption. The most important remains to have a strong frequentation.

“Comparable restaurant sales decreased 0.4% due to lower transactions of 2.3%, partially offset by a 1.9% increase in average check.”

Which wasn't the case this quarter. Management says it is partly due to a change in consumer spending, but also bad weather - as in traffic reduced because of it in some regions. They remain confident that growth will come back in the second part of the year, so we're left to see if this is a temporary setback or not.

You know how I feel about macro & consumer in the U.S. medium term, so I am not really bullish on this sector. I will continue to monitor, restoration is great to control consumer spending.

Valuation & Accumulation.

As usual, here’s my valuation of the stocks I follow & my take on each, updated with the latest data.

Weekly Planning.

We enter the heart of the earning season so I will start to spam you & maybe even bring back the Saturday write up for the companies I look at but do not follow closely. Here's what you can expect this week.

Wednesday: Detailed Review on PayPal

Thursday: Detailed Review on Meta

Friday: Detailed review on Airbnb.

Saturday: Comments on other earnings.

Sunday: Weekly.

I finished writing my Duolingo investment case but will send it after earning season - too much content otherwise. But I will do a detailed review of their quarter, either on Friday after Airbnb or Saturday. Not sure on the timing yet.

Agree..! We are seeing a lot of fear and speculation, a lot of scared money, but I do not see valid vehicle/s where that money will feel as safe and as liquid, as is in the $. Some day that will change, absolutely, but I do not think that day has come. People forget just how big of an economy and consumer the US is, how much trade is conducted in $, and how much is dictated by the $. Buying the dip..!