Weekly Recap | April - W3

World Order, China Macro Data, Nvidia H20 controls & U.S. Fabs, TSM Pricing Power, META's Monopoly, Palantir NATO partnership, Alibaba e-com, LVMH & Hermes Results, Weekly Planning & Price Targets.

For once, most of the value from this weekly will come from the fundamental part & not macro - finally!

Macro.

Nothing really new happened this week, we are still in the same situation - not a good one. The U.S. administration remains stubborn and no macro data point really matters in this environment, what matters will be their decisions.

And so far, nothing.

Worst to my opinion, we seem to go backward. The reciprocal tariffs were announced two weeks ago or so, mostly as leverage to negotiate deal and today… Nothing was announced. It is hard to know why exactly, either the U.S. demands are too high and cannot be met or other countries simply refuse to come to the table or try their best to get a better deal which ends up in disagreements…

Whatever the real reasons, this silence after two weeks seem to only point towards the facts that the U.S. aren’t getting what they want that easily, which means others, allies or not, are much tougher in negotiating and do not just comply. It shows that the U.S. leverage isn’t as strong as it used to be, or as strong as Trump thought.

And this is already a big shift. Even bigger, I personally would have expected countries like Japan or the European Union, historical allies & close partners, to comply rapidly. But the contrary is happening.

Delegations are moving, talks are engaged but nothing emerges. If the U.S. cannot make those comply, it will be much harder with others & almost impossible with China…

You can’t expect to tell someone’s kids how to behave if your own don’t listen to you.

Everything points to renegotiations of the actual world order. And it is fascinating. We are still early, things could change. This also is only about my interpretations of recent events, which might be wrong. I will continue to monitor, by pure interest, and hope it also interests you!

China Economic Data.

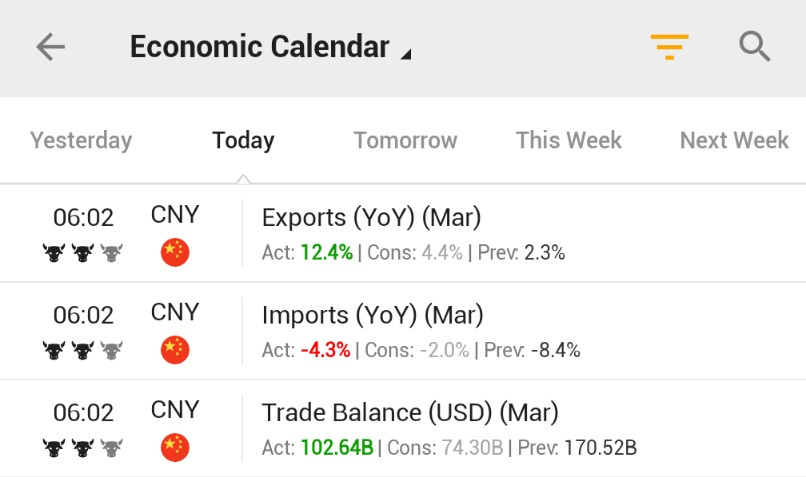

We had some macro data coming from China this week which showed a resilient economy, although I wanted to make the point that export & trade balance are boosted by the frontload of tariffs.

We’ve talked about it often. As many companies were expecting tariffs to hit, they did build inventories and this is reflected here with what seems to be major beats but is only a normal market mechanism. Next months will look very different.

The data which wasn’t impacted by tariffs though was the local consumption which rose 5.9% YoY & beat estimations by 1.7%. In brief, Chinese are growing their consumption, big time - as expected & shared here months ago.

Watched Stocks and Portfolio.

Nvidia H20 & Regulations.

I shared last week that the Nvidia H20 new regulatory framework wished by Biden’s government had been dropped - as this was shared by what seemed reliable sources, but it apparently wasn’t the case as the bomb dropped Tuesday that their H20 chip will be under export control restriction & require a new license to be sold to China, effective immediatly.

The Chinese market was worth $15B last year while demand was accelerating. This will hurt Nvidia on future sales but also on current ones as Nvidia has $5.5B worth of chips meant to be sent to China this quarter, which will end up on their inventory as their other clients have access to better hardware & won’t buy them.

A huge hit on the company. Jensen was in China two days after the new, meeting with AI focused companies there, probably trying to find ways to answer their needs with new tailored chips, respecting regulations.

This certainly comes as Trump’s administration continues to intensify its trade war with China & try to cut them from their most wished products. As everything lately, maybe this will stay. Maybe deals will be made… Who knows?

Nvidia Manufacturing Hubs.

While the administration hits on Nvidia, the company tries to answer their demands & announced that they were planning to build three factories in the U.S., in partnership with three different semi companies - TSM, Foxconn & Wistron.

This isn’t only due to the tariffs or the trade war, but also to the need to have supply chains locally instead of entirely relying on foreign factories. We saw how bad things can go during Covid. Those chips are critical to U.S. innovations & it is important to have some local production, even if it means higher prices for the end product - at least it will be available.

Tensions rise, and countries preserve their interests.

TSM Pricing Power.

As long as we talk about compute, we have to talk about Taiwan Semiconductor rising its prices to filter the massive demand to its U.S. based fabs.

Putting back context. Early April, Trump announces massive tariffs to the world with Taiwan facing 32% for all exports to the U.S., with a potential exclusion for high end tech. Nevertheless, most companies chose to change their strategy and to order their chips directly on TSM’s U.S. based fabs, which out of nowhere received an amount of demand they couldn’t satisfy. The only way to deal with extreme demand is to raise prices and only serve those who can pay.

This is what the company did. Which once more proves its dominance in the sector & how the entire high-end tech world rely on their product. Pretty good to confirm bulls bias & accumulation plans.

FTC vs META.

It seems to be tendance lately for American institutions to go against their companies for potential monopolies. We have a case against Google, another one in the U.K. and this case against Meta.

I do not think many market participants believe the FTC has a case as it seems like they are building it excluding Meta’s competition from the equation… Which is far from fair and could make 100% of American business look like monopolies. Everything is a monopoly is you remove their competition…

Here’s the actual social media landscape, which seems enough to conclude that Meta isn’t a monopoly to me but I am not part of the FTC.

Will keep an eye on it, but I personally do not worry about anything here.

Palantir & NATO.

I usually do not comment on Palantir’s partnerships. There are so many so often that I would need a Palantir special. But this one is worth commenting as it isn’t everyday that you can partner with the strongest military alliance in the world. The organisation did order an AIP system to help on important data-driven decision making, nothing out of the ordinary for Palantir - it is what they do.

Besides the partnership itself, what matters is the influence & publicity the system will get from it - and Palantir. AIP will be displayed at the highest level of western military & government decision making. It will be shown to every European country. Coupled with the success of the system in U.K.’s healthcare, it could trigger the interest from other European countries to maybe integrate AIP for… Anything where it could help - from IRS like in the U.S. to healthcare like in the U.K., passing by any other institution which needs optimization - there are many of them.

I’ve said many times that Palantir was meant to be the operating system of companies But it seems like it can also become the operating system of the West.

Alibaba TaoBao, 3rd Most Downloaded App in U.S.

We should note the irony on the situation as since the trade war with China started, social medias played their role & shared many Chinese stories around the world on how the supply chain really works - designs made in the west, fabrication in the east and then sent back to be sold at premium prices in the west.

It seems like this wasn’t known by most, and Chinese companies decided to bypass their western intermediaries & ask Westerners to come directly to them, that they would sell the same good without western margins. Any trend going viral on TikTok nowadays touches millions of users, and this happened.

"Globally, the Taobao app has been downloaded 2 million times in the last 30 days, according to Sensor Tower."

I am not sure we should read too much into it, even as a Alibaba shareholders, as buying directly from China won’t change the tariffs. Consumption won’t be moving from western entry points to Chinese entry points, not massively at least.

But once again, it shows that things are changing around the world.

Louis Vuiton & Hermes Results.

Those are companies I follow but do not regularly talk about. But it is worth it today as both released their Q1-25 and the difference is astonishing.

Both propose comparable products - leather goods, accessories, couture, perfumes, watches, etc… But Louis Vuitton struggles & shares flat sales YoY. And Hermes thrives with 7% YoY growth, pushed by almost all sectors - except watches which no one wants lately, in all geographies.

We can have our own conclusions, but it seems like a new giant is being born.

Weekly Planning & Price Targets.

Earnings season is back, which means you guys will receive every Sunday the updated valuation of the stocks I follow closely, based on the last data & my opinion on what to do with each.

Here are the ones of this week.

For full disclosure, I personally am not buying ASML because it isn’t in my Buy & Hold portfolio watchlist. But I could understand if you, or anyone, would be a buyer at today’s price & why. It simply isn’t a priority stock for me.

As for next week, be ready for some volume as I intend to cover Tesla & Google with a detailed review - on Wednesday & Friday respectively, with Enphase & Schlumberger on a Saturday write up & the weekly on Sunday. I will have a look on the rest & will comment if necessary!

We’re back!

Thanks for the write-up!