Weekly Recap | April - W1

Some words on phychology, the Master Plan Behind tariffs & Why I Am Not Rushing to Buy, China, GLP-1 News, Tesla's Deliveries, Nwoclouds are Winning & Circle IPO.

Might be worth starting this weekly with some words as this week was in the top five of the biggest weekly drawdowns for the S&P 500, comparable to drawdowns in the 2000 dot-com bubble, 2008 financial crisis or 2020 COVID pandemic. Not nothing.

Portfolios are hurting, but truth is the S&P is only back to where it was less than a year ago and there is room for much more downside. It’s impossible to anticipate what will happen as we are entering the realm of liquidity & emotions and fundamentals & valuations don’t matter anymore. It’s all about, “Should I withdraw my money? It keeps going down. I am selling everything. I can’t take it anymore”

Panic.

Everything is out of our control either way. The only thing we can control is how we react. The rest doesn’t matter much and shouldn’t be a concern. I can’t change the tariffs, I can’t change the market’s psychology, I can’t change geopolitics - nothing. What I can control is what I do with my money & how.

I’ve been saying a recession would come, with or without tariffs. I’ve also said many times it was necessary to purge inflation. Trump’s announcement & reactions made it clear they want it to happen - or to make the market believe it will happen.

My take from here is that we will enter a correction, a bear market, or whatever you want to call it. In those situations, nothing matters but liquidity and stocks can go very, very low. We should be prepared for this eventuality & have a plan.

Mine? Continue to put cash aside from income streams. Slowly deploy part of it into blue-chips monthly. And wait for the market to show signs of a bottom, keeping in mind that this will happen before the economy itself gets better. Markets always anticipate. Until then, there’s absolutely no point rushing to buy falling knifes or obsessing over things I can’t control.

The next few months are going to give real opportunities to build wealth. Bull markets are cool and all, but the truth is that money - real money, is made when buying right. So let’s focus on buying right, controlling our emotions & being patient.

Let’s keep grinding.

Macro.

Most of this report will once again be about macro & tariffs, as it’s what really matters right now; to understand where we are, where we’re going, and what we should do.

I will start with the conclusion; you guys can go through the argumentation if interested.

In Brief.

Trump’s tariffs aren’t about tariffs; they are about reducing the U.S. interest on debt by lowering treasury yields. The FED couldn’t do it with its tools, so the government took matters into its own hands & took actions to crush consumption in order to reduce inflation, hence yields. And I don’t think they’ll stop until this is done.

Their work to rebuild the U.S. economy will start afterward, even if this means going through a recession, as they will then have tons of financing power to invest, help families, stimulate the economy & create programs.

It’s about burning the rotten foundations to build a stronger house.

Doing so will create pain - on the economy & the market, which means stocks won’t bottom tomorrow. This will give us opportunities to accumulate the best companies at really good prices before new bull runs start. There’s no point being aggressive until the market settles, and this can take months, even years.

Slow and steady is the motto for U.S. equities right now.

This trade war will create lots of pain around the world as well as China is now part of it, in a very strong position. They are growing their stimulus, boosting consumption, focusing on increasing population’s buying power, investment capacities, will to innovate and take part in the stock market.

They could be able to take the lion’s share during this tough period in the West, and we shouldn’t sleep on Chinese innovation, products & stock market.

For investing.

Short term - few months, bearish U.S. & neutral China.

Medium term - up tot wo years, bearish U.S. & bullish China.

Long term - two years & more, bullish U.S.

I’ll share my detail plan with assets, buying plan & cash management this week.

The Tariffs Plan.

I’ve shared before that Trump’s electoral campaign was clear about their goal: to push the U.S. into a recession & then rebuild strong fundations. I also said that I didn’t believe them capable of going through with it as it would be a gamble, with the stakes being political credibility.

“Starting with strong cuts in expenses with the DOGE and tariffs on the entire world would increase unemployment & inflation in the U.S. and accelerate its path to an unavoidable recession.

Once again, Trump’s first measures will be the most important thing to watch when he takes office in January. My base case is that it’s all teeth and no bite, things will continue as they are as no president voluntarily plunge their country into recession, especially when the long-term consequences are impossible to forecast in the actual geopolitical state of the world.”

Well, I’ve been right on the forecast but wrong to underestimate their balls. They had a plan, they shared it & they’re indeed going through with it.

Here’s a recap of what is happening and why they are doing this, with the conclusion being pretty straightforward: Reduce interest on debt payments, which are around 13% of U.S. expenses today.

Let’s review the logic.

The U.S. pays interest on its debt based on treasury yields of different timframes which are determined by the market, based on inflation. Investors lend only if they are paid a yield above inflation expectations.

Inflation remains high & cannot be fixed because of fiscal dominance. The debt paid to bondholders gives them liquidity to spend on anything - for individuals, or to hire with high salaries - for companies. If the biggest spenders can grow their consumption & compensate for the rest’s decline, inflation won’t slow.

The FED’s quantitative tightening was clearly not enough to bring inflation down and has reached its limit, as I’ve shared many times. Crushing liquidity further will create more issues than it could resolve.

There are no tools left to lower inflation but one: crush the biggest consumers & their buying power. In other words: crash the market by forcing a slowdown in consumption & wealth cushion.

How to? Ridiculously aggressive tariffs are perfect for this. They’ll rapidly increase prices of everything, everywhere, since the U.S. still relies on imports for most consumption. This will lower consumption with price hikes, reduce companies’ growth & earnings, assets prices & therefore, in time, inflation.

This is the playbook.

It seems taken from a sci-fi novel as it literally says that the government is voluntarily scaring the market & potentially triggering a recession to reduce consumption and inflation. This is my interpretation - one I shared months but couldn’t believe would become true as again, it’d be a political suicide.

But Trump is now in his last term. He can’t be re-elected & has nothing to lose, his only objective is his legacy. He has a huge ego, and when you reach his position, what’s left to conquer? Being the president who put the U.S. back on track while having the balls to do what needed to be done… That’s a legacy.

Here we are. Markets are scared, the S&P’s declined trillions in a few weeks, everyone calls for a recession and magically, the bond yield of every treasury duration rapidly decreased, passing from 4.24% to 4% this week, and from 4.67% to 4% since Trump took office.

And just like that, the U.S. interest on debt passed from $128B per month in January to $110B today - a $216B yearly reduction. Keep in mind the math is rough here, as I assume all debt is held in 10Y yields, which isn’t the case, but it gives an idea of the amounts we’re dealing with.

This is why I do not believe we’re done; this is why I believe markets are going lower. Because it has nothing to do with tariffs, blaming other nations, or anything else & has everything to do with bringing this yield & inflation back to 2%. Negotiations will happen, and the market will have bounces. But until the U.S. interest on debt is back on track, Trump’s mission isn’t done.

The FED couldn’t do the job with their tools due to the fiscal dominance, so the government did what had to be done. It creates, and will create pain, but from an economic point of view, it’s the only way out of their actual hole.

The Consequences.

As to what will happen? There’s no way to be sure of anything. The world has changed those last years and this gamble could cost a lot to America. It will be interesting to watch & try to forecast but for now, I only have two convictions I will play by.

First, if I am right , this is just the beginning of pain for U.S. equities but it is worth buying them, as we are talking about some of the most important companies in the world which won’t disappear because of a recession. When/if Trump’s plan succeed, it also means the rebirth of a very, very strong America, back to stimulus & focus on asset prices, which remains the foundations of the country.

A plan I’ll gladly be on board with.

This is why I remain calm, I start to slowly deploy cash & wait for the market to settle before being more aggressive. “Don’t bet against the U.S.” said Buffett, and he’s right. That doesn’t mean we should always be all in on them though. We have time. Let’s take it, and the next decade should be incredible.

For context, if Trump is indeed going all-in to crush inflation & treasury yields, and we do enter a long bear market - months to years, here’s the SPY’s average P/E ratio at the bottom - we’re at 24 today. This should give us an idea of when we can start to buy more aggressively.

In brief. Slow accumulation of the best U.S. assets while growing the cash pockets from income streams & being patient.

Secondly, I’ve talked so much about China already that you must be tired of it, but I need to continue because I believe the country will be a big winner at the end of this mess. I’ve said my piece here already.

They did retaliat already with their own measures: a 34% tariff on all imports from the U.S. plus an export control on rare earths - critical commodities for the U.S. They are going personal, hitting where it hurts.

Here are a few key points on why I believe China will emerge stronger:

E-commerce like Alibaba, PDD, and JD’s will remain cheaper than equivalents in the U.S. even after tariffs. The same is true for BYD’s cars & more.

Westerners will have to look for cheaper alternatives as everything increases in price from one day to the next. Chinese apps and products are well-integrated into Westerners’ lives nowadays & will offer the cheaper options. This is where spending will be going.

China is pushing stimulus to boost consumption, innovation, investments, and its stock market in general. Local consumption is - and should continue, to rise. This coupled with a not so slowing consumption from the west is pretty bullish.

Neighbors are losing partnerships with the world’s top consumer; they will look for new, more understanding partners with the capacity to absorb their products or help for investments. This is a pickle for the U.S. as their weakness & aggresivity could push allies in Chinese arms.

They have leverage to negotiate against the U.S., probably the only conutry to do so. With their size in the world economy, their holdings of treasuries & gold and the soft power they have been growing lately… They won’t cave.

The world isn’t about the U.S. only anymore and we shouldn’t sleep on China. The “why” explained in the article below is even truer now.

In brief. I was bullish on China bu am even more now as they simply are in a better position than the U.S. And if they continue to stimulate their economy & grow local consumption, investors will somehow go where performance can be found. Short term, it could very well be China. Long term? Also.

Lots of things happened those last few days & will continue to happen the next ones. This trade war has only begun & I think those who believe a rapid resolution are dead wrong & will be punished for being to aggressive, too early.

As usual, this is my opinion today & I’ll happily change it if data & conditions change. But for now, this is how I intend to manage my money: aggressive on China, slow accumulation of blue chips in the U.S. and patiently waiting for the dust to settle.

I’ll share my detail plan with assets, buying plan & cash management this week.

Watched Stocks & Portfolio.

Medicare, GLP-1 & Hims.

Trump’s administration rejected Biden’s proposal to include GLP-1 drugs in Medicare refund policies for obesity purposes.

Today, those drugs are reimbursed for their original functions - cardiovascular risks & diabetes, but not for obesity. Only some private insurances accept this. In brief, no patient will be refunded for using GLP-1 drugs to lose weight only.

Dropping this proposal and refusing global coverage means most patients will have to go either through their private insurance - if covered, or pay from their pockets. With the prices of those drugs, cheaper is of course better and Hims has the cheapest solutions with its $299/month liraglutide pens.

This might not be great news for healthcare at large, but it means the market remains - and will remain, very large for Hims’ weight loss products as the company doesn’t work with any insurance.

Tesla Deliveries.

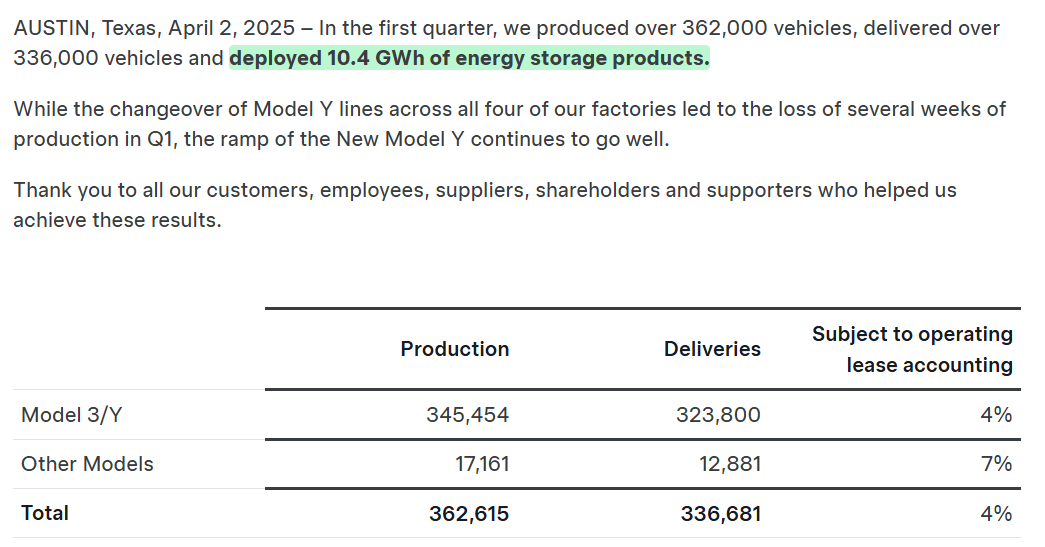

Another tough quarter for Tesla. I’ve commented a lot on the decline of sales over the last few months, so it isn’t a surprise to see a 13% decline YoY.

I’ll continue to say the same things: First, we are waiting for the Model Y refresh and for sure some clients are holding off before buying. Second, macro is still tough and consumers don’t have money & can’t access cheap debt, not helping consumption. Fourth, there is a degradation in image for Tesla since Musk is at Doge, this cannot be ignored. Lastly, the Tesla bull case isn’t about EVs but about FSD & Optimus.

The silver lining remains the GWh installed, which, while flat QoQ continue to prove that the energy part of the company is going to grow & become significant soon enough.

Circle IPO.

My favorite piece of news this week. Circle is the company issuing USDC the second-most-used stablecoin in the crypto ecosystem. I’ve said many times that these two companies - Circle & Tether, have one of the best businesses in the world, easily comparable Visa & Mastercard.

I have a write-up ready since months to explain this, as I thought it was an interesting subject, but I will transform this into an investment case as I will for sure look at the IPO to be a shareholder - at fair value, of course.

Very, very exciting. That’s all the color we have, so let’s remain patient. But again, very exciting.

Google to Rent Compute.

We talked about Nebius & CoreWeave last week, I detailed why I believed neoclouds weren’t the best stocks to hold long-term, while being great & useful businesses.

We had proof of how good their business is, as Google - an hyperscaler with huge datacenters filled of GPUs, is looking to rent some compute from CoreWeave.

This is a big deal for many reasons. It confirms that neoclouds either have some usage of GPUs that hyperscalers do not have - which would be bullish for neoclouds, but we knew this, or that these hyperscalers just don’t have enough compute for basic tasks, hence very bullish for Nvidia.

Either way… bullish Nvidia & compute in general. Probably bullish neoclouds, but I will repeat that even if I believe the businesses are great, the timing isn’t the best in terms of investing. I’ll gladly buy in once the storm quiets down.

Great recap, thank you!

Hard to keep a clear head during emotional times like this. Thank you for sharing!