Various Q4-24 Earnings

Okta, CrowdStrike, Victoria's Secret & JD.com.

Some quarters from companies I follow out of interest or for their potential but won't really dive into - for now.

Okta.

I still follow the company but need to dig deeper into the fundamentals. Nevertheless, they really are doing great.

Continuous & stable growth in both RPO & cRPO, meaning a sustained demand for their products and services. There’s no slowdown, and guidance aligns with this as management expects a 16% YoY cRPO growth for FY25.

Revenues reflect this as well and the company anticipates a 25% YoY growth for FY25, which also signals growing demand from new clients. The last three quarters were profitable & FY25 should be too.

As I said, I need to do more work to really analyze the fundamentals, but there’s clear evidence of growing demand for their services, and it seems worth a deeper look. Besides that, shareholders must be pretty satisfied with this quarter.

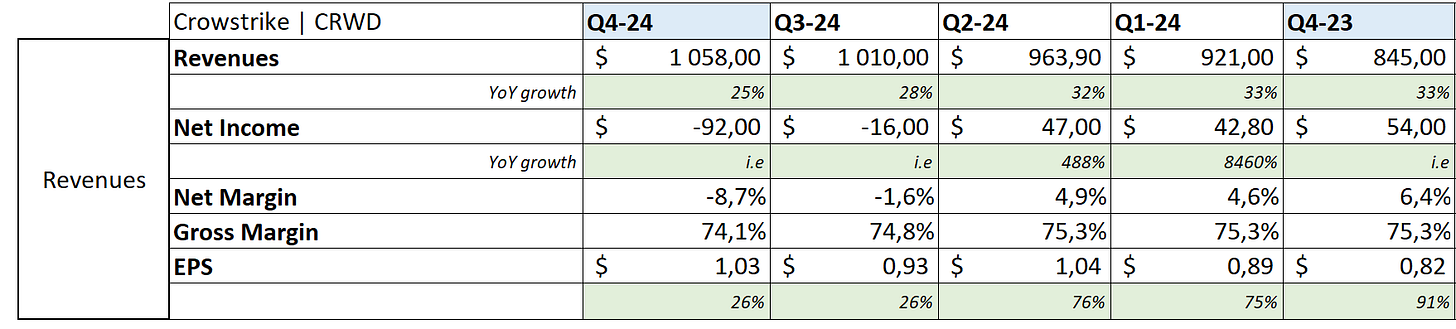

CrowdStrike.

Comparable conclusions for the company responsible for the Microsoft outage a few months ago.

ARR continue to grow above 20% YoY, with 5% of that being net new, showing strong retention & either deeper relationships with existing clients or the acquisition of new ones. I said after the outage that it would take more than a human mistake to push companies away from CrowdStrike, and that seems to be exactly what’s happening. Clients didn’t leave and are continuing to increase their partnerships, with growing adoption of multi-module solutions.

Revenues also reflect this. Growth is slowly decelerating but there’s nothing to be concerned about, even though the outage still impacts some of their expenses, hence another unprofitable quarters. Guidance points to 20% growth for FY26.

I wouldn’t be a buyer at this valuation, but holders should be satisfied & those who took advantage of the outage dip had great returns.

Victoria’s Secret.

Closing a complex year for the women’s brand.

The company ends the year with a 1% increase in revenues and a 2% decrease in comparable sales, meaning most of their growth comes from increased prices - not something you really want to see in any brand. And the guidance isn’t better, projecting another flat year with no expected growth.

I’m still following it because the brand is iconic and doesn’t take much time to track, while ir might become an opportunity if the spark returns. We’re not there yet, and I see no reason to touch this name for now.

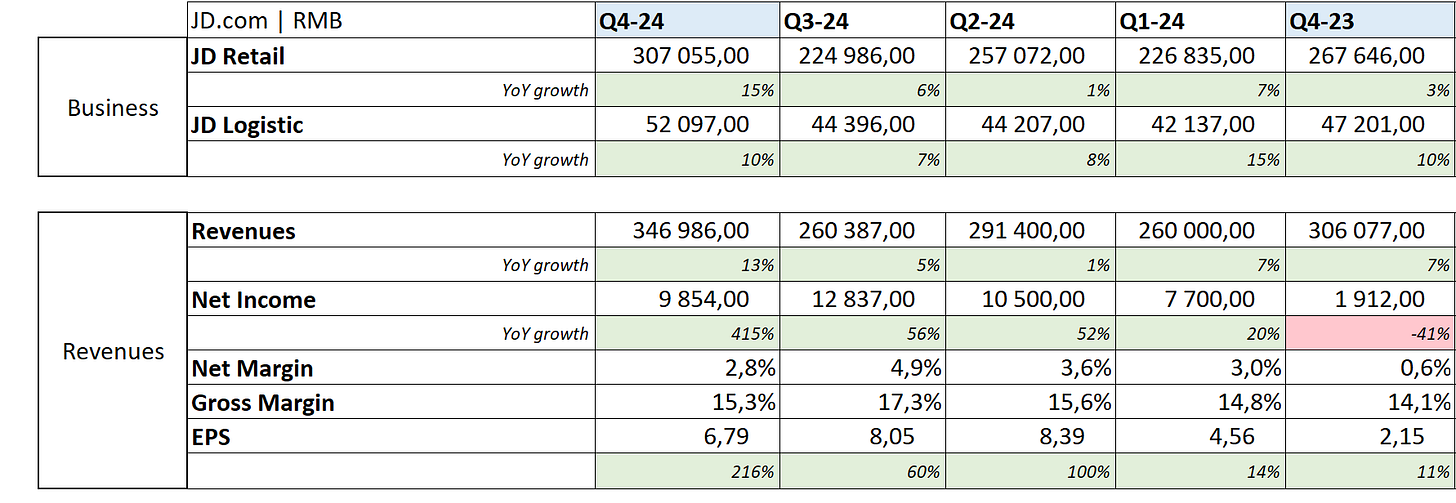

JD.com.

I’ve talked about China this week already, so you know my opinion on this name. But this quarter confirmed it.

We’re seeing growth acceleration in terms of retail sales, which is everything we want to confirm the bull case for JD.com - and for China at large. E-com companies have been investing in themselves for years, patiently waiting for consumers to bounce back, and the data suggests that’s happening right now.

"We head into 2025 with more optimism, as consumption sentiment steadily picks up."

Even better, growth came from both sales and advertising, showing demand from consumers as well as companies trying to reach them - usually a good indicator.

Beyond that, revenue growth is accelerating, margins are stable & expanding YoY, free cash flow reached 23.47M RMB, with $3.6B in buybacks and the announcement of a $0.5 dividend per share.

There’s everything to like while the stock remains pretty cheap. As I shared in my China investment case, I now have exposure to it through the KWEB ETF. And as I mentioned, I intend to continue buying.