Various Q3-24 Earnings

Nvidia, Palo Alto, PDD & TJX.

Some quarters from companies I follow out of interest or for their potential but won't really dive into - for now. I know these can interest many here, so I still give my opinion on their earnings.

Nvidia.

The beast continues as demand for HPC doesn’t slow - yet.

EPS. $0.75 | $0.81 | +8.00% beat

Revenue. $33.13B | $35.08B | +5.89% beat

$11B of buyback.

Market didn’t react too well although the stock stayed mostly flat after earnings, but the quarter remains very, very strong with HPC still growing triple digit YoY & 30% QoQ, while “Demand for Hopper and anticipation for Blackwell - in full production - are incredible as foundation model makers scale pretraining, post-training and inference.”

It's worth noting that the automotive & robotics branch is also growing 30% QoQ & 76% YoY as those sectors gain traction. More daily products will require computing power, this tendency should continue in parallel with HPC.

The first signs point to continuous demand which might slow down in intensity and show lower growth as comps get harder, but continuous demand nevertheless. That's what came out from most mega-cap earning calls as Tesla continues to spend, Meta intends to spend at least as much in FY-25 etc, only Google intends to either flatten its costs or reduce them, slightly.

Guidance points to this with $37.5B of revenues expected in Q4-24 which investors seem to find weak, even talking about a 22% QoQ revenue growth… This is the problem with such exponential growth, it makes great numbers seem small… Truth is, the guidance is strong.

There's honestly nothing to comment on the finances, Nvidia owns a monopoly for the most demanded pirces of hardware at the moment. They grow rapidly, they have insane margins & generate so much cash, they don't know how to spend it, so they buy back their shares.

This isn't a bubble, this is a strong demand for a technical revolution. Stocks are expensive, yes, but they're not bubbly, they reflect a real hardware & software demand which they are the only ones to provide in some cases.

Excellent quarter, as usual, which shows that the AI trend continues.

Palo Alto.

Will you platformize or won’t you platformize.

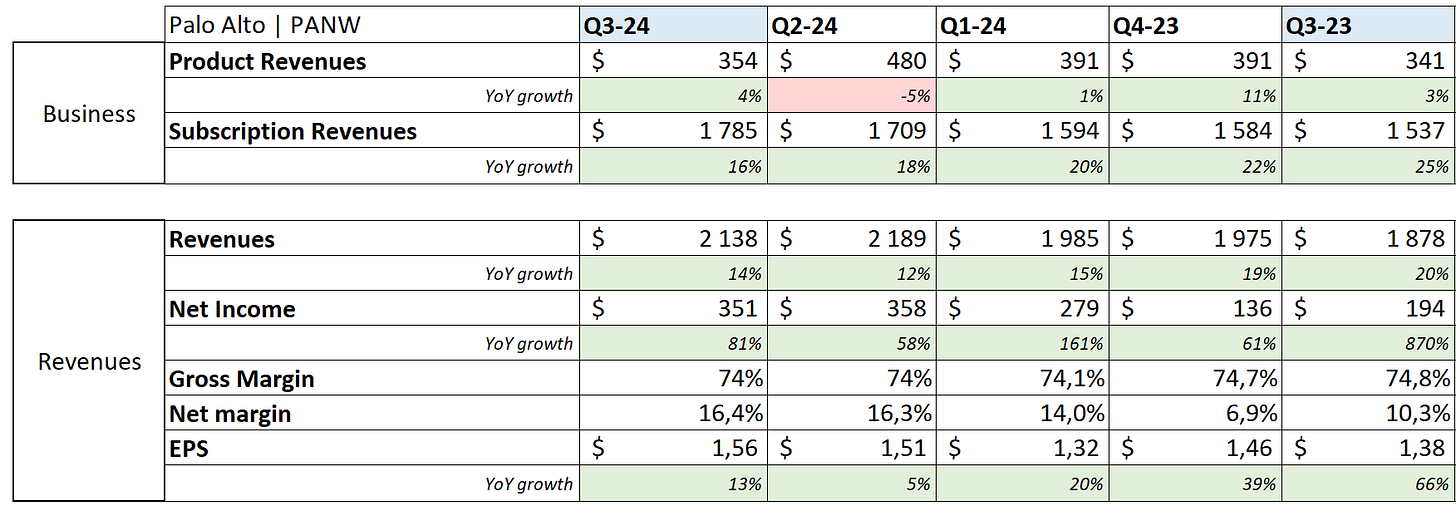

EPS. $1.48 | $1.56 | +5.41% beat

Revenue. $2.12B | $2.14B | +0.90% beat

“We see a growing market realization that platformization is the game changer that will solve security and enable better AI outcomes. I expect this will be a multiyear trend for which we are best positioned to deliver to our customers.”

The debate is still the same but I personally believe that Palo Alto is right to change its model from a classic security hardware interconnection to what they call "platformization".

And clients seem to agree as it translates to a $12.6B RPO up 20% YoY, a double-digit growth on the use of those services and a 40% growth YoY on their next-generation security ARR which keeps them on track for their $15B NGS ARR by 2030 - which would mean doubling their revenues by then. Things are a bit slower than many would like but it's a steady process and as I said many times, changing security infrastructures in big companies takes years, not weeks.

Finances are very promising with the first tick of growth reacceleration combined with growing margins, thanks to their new platformization which also comes with better execution & margins.

Guidance remains strong & was actually raised, with a 20% growth expectation on their RPO, and above 30% growth on their NGS ARR & revenues between $2.22B & $2.25B, up +12% YoY.

Pretty strong & stable quarter in my opinion, worth holding on to those shares. The company also announced a 2-to-1 stock split effective mid-December.

PDD Holdings.

No fireworks.

Revenue. $14.47B | $14.16B | -2.16% miss

EPS. $2.82 | $2.65 | -6.03% miss

I don't see anything wrong in this quarter, business is growing healthily due to growing consumption & usage of their services. Some could point out the slower growth which is true but it's still more than reasonable. Others (or the same) will point out growing expenses which are mostly spent on marketing & deals with partners to… Accelerate growth.

Pick your camp, but it isn’t very logical to be on both.

I also need to point out that this is a Chinese company operating in other markets, on other currencies, and the Renminbi is weak at the moment which hurts expectations, but also the business. This will fluctuate but cannot be blamed on the company.

The Chinese trade is still controversial at the moment despite valuation. I'm still bullish on Alibaba but PDD would be my second pick. More on this next week.

TJX Company.

I won't lie, I am not interested in TJX, it only is a good proxy for consumers' health.

EPS. $1.10 | $1.14 | +3.64% beat

Revenue. $13.95B | $14.06B | +0.81% beat

And things are pretty stable with continuous growth although truth is, the U.S. growth was only around 3% which is basically no growth, inflation adjusted. The rest of it came from Canada & the company's international portion and was actually inflated due to currency conversion.

It's not a big deal but it's worth noting. There's no consumption growth YoY inflation adjusted - like for PDD, we'll talk more about that next week.