Various Q4-24 Earnings

Spotify, Google, Enphase, Match Gr., Uber, Disney, Novo & Lyly as a proxy for GLP-1, Amazon

Some quarters from companies I follow out of interest or for their potential but won't really dive into - for now.

Spotify.

I still personally don’t understand the attraction to Spotify & continue to believe Google’s YouTube is a much better solution but well… When it comes to the stock market, Spotify is just doing really, really well.

Revenue. $4.15B | $4.53B | +9.08% beat

EPS. $2.06 | $1.88 | -8.74% miss

The quarter is excellent, once more. We could be annoyed by a slowing growth but comps get harder every quarter, in percentage that is but the volume of users added is constant, with a record acquisition this quarter. MAUs & Ad-plan acquisition follow the same pattern. All in all, a very healthy & growing demand for their product.

Revenues are of course very good with double-digit growth & the year closing up 18%. Growth came from both the growing user base but also an uptick in pricing for premium subscribers. Keeping in mind that Spotify is a European company, hence affected negatively by a very strong dollar.

Not much more to comment as the rest is great. Margins are growing as the company optimizes its profitability driving record income & cash flow with $2.28B of FCF FY24 - with $267M of SBCs, for $5.6B of net debt. Very comfortable.

It’s hard not to like this quarter if you’re a shareholder, although valuation is crazily stretched by now but that’s what great companies deserve.

Google.

The market keeps being ridiculous on Google & Meta’s CapEx but we’ll see why there are no reasons to panic.

Revenue. $96.67B | $96.47B | -0.21% miss

EPS. $2.13 | $2.15 | +0.94% beat

Everything is going well for the company which closes its year up 14% YoY, growing healthily. The tough cookie comes with analysts, as at the end of the day companies are compared to expectations, not fundamentals. Google lightly missed clouds revenues by 2% & global revenues by 0.21% which is honestly negligible.

The company closed the year with growing margins, $75B of net debt with $72B of FCF & returned $69.5B to shareholders with dividends & buybacks, while guidance was good - about double-digit growth.

The issue came with the CapEx guidance, as Google changed its narrative from “we will have flat CapEx FY25” to “we will spend $75B”, a 50% growth... And for a reason I still do not understand, the market doesn’t like CapEx, while Google clearly proved they knew how to spend their money wisely to generate more revenues later. This is shown here, with the company’s ROIC since they started investing in AI.

Return on Invested Capital computes the added growth from previous expenses. If past investments create value, the ROIC grows. This means that the company was efficient in its spending, and Google clearly is.

Some companies aren’t, shareholders should punish those. But punishing Google for being excellent at driving future returns makes no sense to me - by the way, Meta is in the same boat.

Going back to CapEx, this spending will obviously go towards high-profile engineers & hardware and I think this comment from the call says it all.

“We do see and have been seeing very strong demand for AI products in the fourth quarter in 2024. We exited the year with more demand than we had available capacity. So we are in a tight supply demand situation, working very hard to bring more capacity online. As I mentioned, we've increased investment in CapEx in 2024, continue to increase in 2025, and will bring more capacity throughout the year.”

It also, once more, highlights why I am a buyer in both Nvidia & Nebius, as my bull case remains that hardware demand will grow for some more time but that afterwards, computing demand will continue to grow much longer as when infrastructures are built, they’re meant to be used.

Bottom line? Excellent quarter, confirmation of Nebius & Nvidia bull case, great pullback for those who want to accumulate.

Enphase

Management dealt perfectly with the storm & it might be time for the company to shine again, depending on future demand.

Revenue. $377.51M | $382.71M | +1.38% beat

EPS. $0.75 | $0.94 | +25.33% beat

The year was hard but the company is showing its third consecutive quarter of growth in terms of microinverters shipped which clearly shows that the inventory has been cleared by now from installers. Batteries shipping continue to be irregular but this is normal behavior & the global trend remains positive.

Revenues reflect this fundamental change with growing profits & margins as the company restarts its business healthily. The YoY comparisons aren’t worth using as FY23 was the best year of the company & struggles started in 2024.

The takeaway here is that management is really competent & drove perfectly through the storm. Now, guidance remains weak which I wouldn’t blame on the company but on the demand & the market itself. Solar panels remain expensive, rates are high & politics aren’t very favorable to the business anymore.

Things are getting better but it could take quarters or years for the market to boom again like it did in FY23 & I do not want to tie liquidity to this name waiting & hoping for it to happen.

There are reasons to be optimistic. None to buy. My take.

Match Gr.

I continue to report because I thought the Tinder brand was strong, but I might stop following this company soon.

Revenue. $857.75M | $860.18M | +0.28% beat

EPS. $0.83 | $0.59 | -28.92% miss

Business isn’t going well with the global tendency being more expensive subscriptions & declining user base. As to the reason for it, is it because they find it too expensive or don’t like the apps anymore… Hard to say but the trend is bad either way. The only app thriving is Hinge, growing in spending & users, but it isn’t enough to hold the company as Tinder remains the main brand - a declining one.

Revenues reflect this obviously, and worse, the company continues to pay itself with SBCs through the roof while brands are declining… Really not a positive indication on management’s objectives & competence…

So yeah. Might be the last time I talk about this company.

Uber.

On the contrary, this is a company I might talk about more & more as I am honestly considering tying liquidity to it.

Revenue. $11.77B | $11.96B | +1.61% beat

EPS. $0.48 | $0.23 | -52.08% miss

The businesses are really healthy & growing very well. Gross bookings continue to show that usage of their services is growing rapidly, take rate is flatish, slightly up which is positive although the business is meant to scale on volume & not take rate, but slightly higher take rate is always good.

The rest follows, more users, more trips… More cash.

I sent the investment case on the name yesterday with the investment plan, so you’ll have all the informations you need there.

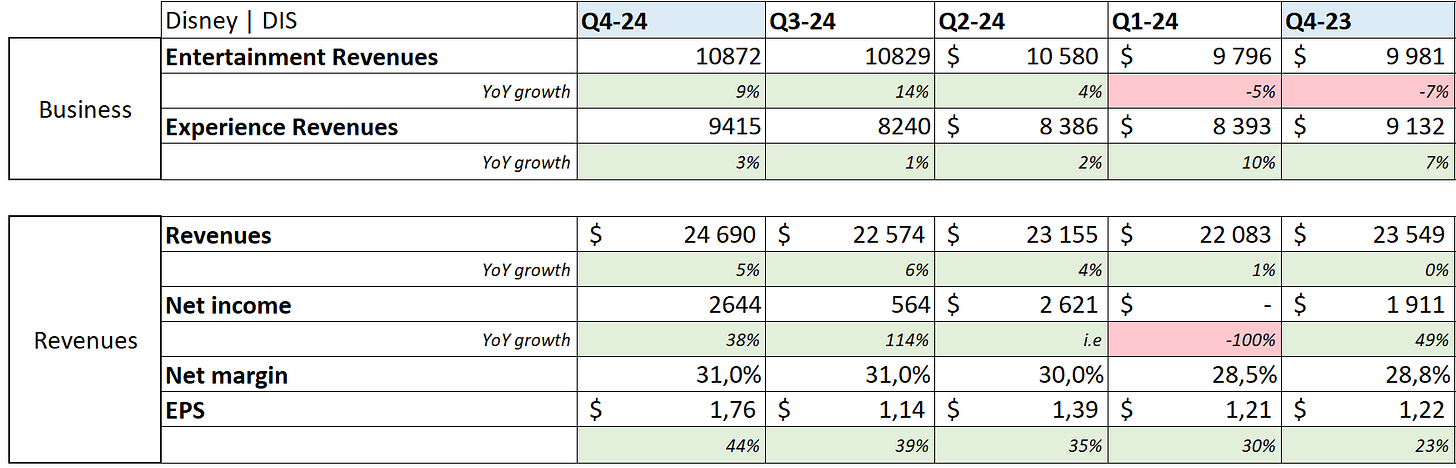

Disney.

I follow Disney by love more than by interest & it’s nice to see that things are shaping better for the company.

Revenue. $24.55B | $24.69B | +0.57% beat

EPS. $1.43 | $1.76 | +23.08% beat

Entertainment revenues are back to healthy numbers with a great pipeline, while the parks continue to drive engagement.

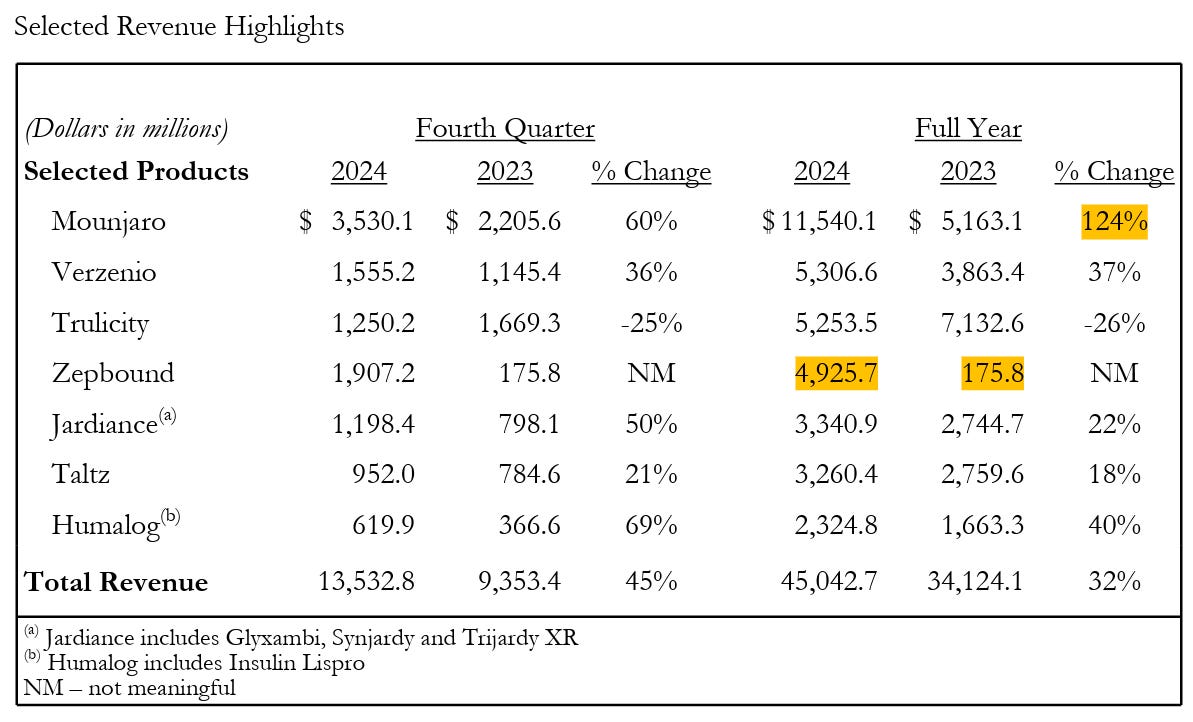

Novo & Lyly as a proxy for GLP-1.

Both companies are the original sources of GLP-1 drugs which makes it interesting to look at to have an idea of the demand for those products.

The answer is found rapidly to be honest… In Novo’s case, we are talking about rapidly growing demand for their products for weight loss. Sales are still climbing double digits and those drugs are responsible for most of the company’s growth.

For Eli Lilly, things are even more impressive with triple digit growth for both GLP-1 drugs. It doesn’t separate the demand for weight loss & for diabetic needs but with the latest tendencies, we can easily imagine where the strongest demand is.

The bottom line is that demand for those products from a weight loss perspective is skyrocketing. And those two companies are still struggling to answer the growing demand.

Between the shortage & the fight from the new U.S. administration with the FDA & other health institutions, I believe Hims will be quietly selling its product for some more time.

Amazon.

Not much changed for Amazon, which remains a growing giant.

Revenue. $187.23B | $187.79B | +0.30% beat

EPS. $1.48 | $1.86 | +25.68% beat

Business remains excellent with double-digit & stable growth in the important sectors - mainly AWS & e-com. Even more impressive, margins in each continue to grow & all of them are now profitable - which was hard to reach for the international e-com.

The bottom line is a growing demand for their products, growing revenues & growing margins hence more cash flowing inside the company’s balance sheet…

Amazon continues its transformation from a growing beast to a growing & profitable beast. And it plans to continue to do so as the guidance talks about more spending, more investment into their datacenter as, like Google, they struggle to answer the demand.

Great quarter although, of course, the market isn’t happy about continuous spending. But it’s Amazon, what did they expect?

Following Disney by love :p Glad that they’ve captured hearts. Yes hope they do well so that we can keep going to their parks!