Various Q4-24 Earnings

SoFi, Starbucks, ASML, Microsoft, Apple, Decker as a proxy for On Running & Visa/Mastercard as a proxy for consomation.

Some quarters from companies I follow out of interest or for their potential but won't really dive into - for now.

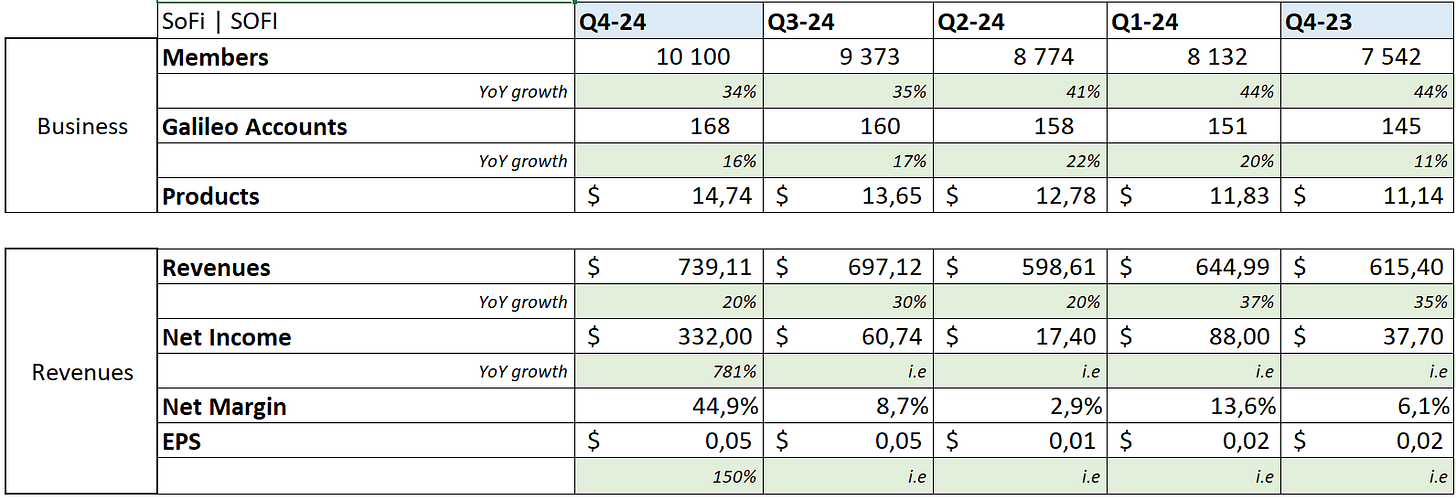

SoFi Technology.

I own the stock but don't dig much into as my bull case was based on valuation & its tech branch. Traditional banks often lag behind and end up with terrible user experiences. Better tools attract more users.

EPS. $0.04 | $0.05 | +25.00% beat

Revenue. $682.2M | $739.11M | +8.34% beat

The bottom line of this quarter is that the company continues to grow healthily, both as a bank & as a tech provider with a FY24 establishing new records like revenues, profitability or book value, with a growth in acceleration for many key metrics - notably new users.

The market was unimpressed at first not because of the quarter itself, but because the EPS guidance was weaker than consensus. Things got better during the call in which Noto confirmed that they’ll focus on growth next year, before profitability, hence lower EPS FY25 but a confirmed guidance on track for their long term goals on profitability. In other words, a step back in order to leap forward.

Still excited for this company & holding both long term calls & shares. If anything, this quarter confirmed that management is really great & that they continue to prioritize long term healthy growth over short term stock pumps - which could be frustrating but is ultimately what you want as a shareholder.

Stabucks.

No surprises here as the coffee brand delivered bad results, once more.

EPS. $0.67 | $0.69 | +2.99% beat

Revenue. $9.31B | $9.4B | +0.95% beat

The problem remains the same: less & less frequentation in their coffees around the globe. If it were local, it could be explained, but the trend happens everywhere & that indicates a fundamental issue with the brand.

The problem is even worse when we see that average ticket is constantly higher - which could probably be one of the reasons for the lower frequentation. Less frequentation & higher prices…

“Global comparable store sales declined 4%, driven by a 6% decline in comparable transactions, partially offset by a 3% increase in average ticket.”

The stock actually reacted positively to this earning because of the potential & very, very low expectations. Everything looks great when you don’t expect anything. But that doesn’t make Starbucks a great buy.

The company has structural & fundamental issues, this is clearly not the kind of stock I want to put liquidity on, I’d rather focus & concentrate on others. It’s worth keeping an eye on it as the brand remains strong & a reversal is possible with the new management but it’s way to early to consider it.

ASML.

Great results for thelithography monopole which honestly comes at a crucial moment for the stock market.

EPS. $6.71 | $7.31 | +8.94% beat

Revenue. $9.02B | $9.89B | +9.60% beat

The quarter & the year ends with great data, a double digit YoY growth in revenues & growing margins, especially net margins which indicates optimization in the company itself - always great to see.

Most importantly, net bookings are back to growth with €7.1B for the quarter, after two quarters of sluggish & surprisingly low value which worried investors. Guidance came as expected between €30B & €35B which again, reassured investors & the market globally that the bull trend for computing power hardware might not be finished. ASML is the first player in the chain, so showing strength is important.

They also confirmed the global take that cheaper AI computing power meant growing demand which was actually a net positive for the entire ecosystem. Not very surprising but probably helping after the DeepSeek frenzy.

"Any technology that will contribute to a cost reduction overall in AI will increase the opportunity. This has been true in this industry for the last 40 to 60 years. I think it's still true moving forward."

"If you make AI cheaper, more accessible, and more energy-efficient, it can lead to a democratization of AI in a way that is necessary for it to become prevalent."

China still represents 40% of the company’s net bookings starting 2025 which isn’t an issue per se, but could become one depending on how the west intends to regulate their export of high-end tech.

Lastly, the company grew its dividend but did not buy back any shares this quarter which is surprising considering the valuation. I shared my view about it and the opportunity ASML could represent with this note before earnings.

I intend to do this more this year, sharing when the stocks I follow reach fair prices to my opinion. I believe it is valuable even if I do not personally buy them, feel free to tell me what you think about this.

Bottom line. ASML did great, guidance is great, this is a great sign for the computing power market & the actual bullish narrative around it.

Microsoft.

This one will be fast.

Revenue. $68.81B | $69.63B | +1.19% beat

EPS. $3.10 | $3.23 | +4.19% beat

The market disliked the earnings which seems a bit weird to me as they look excellent, although at the end of the day stocks trade on expectations & they were short on cloud revenues & FCF.

Stock is pretty expensive as well hence the reaction. You cannot miss on expectations when you’re priced for perfection. But the quarter showed strength in the key domain while management continues to invest in itself.

Boring & strong.

Apple.

Another rapid report.

Typical Apple. Slow growth entirely held by services revenues as the company has now established a huge device base around the world & capitalizes on it - although they will struggle to grow it now as shown by the flat YoY iPhone sales.

Massive revenues, stable margins, crazy cash generation & return to shareholders with $23.6B of buybacks & $3.8B of dividends.

To me, Apple is a wonderful stock to hold & a terrible one to buy.

Decker.

I won’t go over the entire company as I am not particularly interested in it, I only look at the Hoka brand to have an idea of the demand for running shoes around the world as a proxy for On Running.

Results are good with a 23.7% revenue growth YoY. Strong brand, strong DTC demand which illustrates a demand for the product itself, not an impulsive buy on the store. Guidance was raised & justified by a stronger demand than anticipated.

Good. Although somehow the market punished both On & Decker for the results. Hard to follow as everything points to a growing demand for their products.

Visa & Mastercard.

Those two are a proxy to consumption although they do not make any distinctions between households' incomes or products bought. It just gives a good idea of the amount of money which goes out of the population's wallets.

And the data is good with the key takeaway that consumption is still stronger than inflation rates, which means consumption is still growing.

From Mastercard, GDV grew 8.9% YoY with a bigger growth worldwide than in the U.S. - which still has a strong 9%. Volume growth is really strong in all regions.

From Visa, High single-digit volume growth, boosted by international volume - up 7.5% in the U.S. Cross-border volume shows double-digit growth.

I don't look more into the business; both are excellent & should be part of any long-term/stable portfolios.