Various Q3-24 Earning

SoFi, Starbucks, Robinhood, Uber, Apple & Amazon.

There are companies I follow out of interest or for their potential but won’t really dive into - for now. I know these can interest many here, so I’ll still give my opinion on their earnings.

SoFi.

I do follow and own the stock (even some calls), but never shared detailed reports as it is pretty complicated to go into a bank’s statement and my investment thesis is based on its external banking product & tech platform. I could talk more about it if you’re interested, but I don’t intend to for now - more interesting subjects elsewhere.

Either way, the company gave another great quarter.

EPS. $0.04 | $0.05 | +25.00% beat

Revenue. $632.33M | $689.45M | +9.03% beat

SoFi continues to attract more and more clients and these use more & more products, bringing in more cash while other banks and institutions continue to use and need Galileo after a small slowdown a year ago.

Execution is still perfect with revenues back to growth, a fourth profitable quarter in a row and very good margins while holding healthy lending levels and growing their revenues from tech platforms and other services. Very, very healthy.

I did buy a bigger chunk under $9 as the price action was finally waking up - I shared this in the buying plan. We’re up more than 30% since but we could have a nice retest around $9, which I would buy again. Otherwise, I intend to sit on my hands.

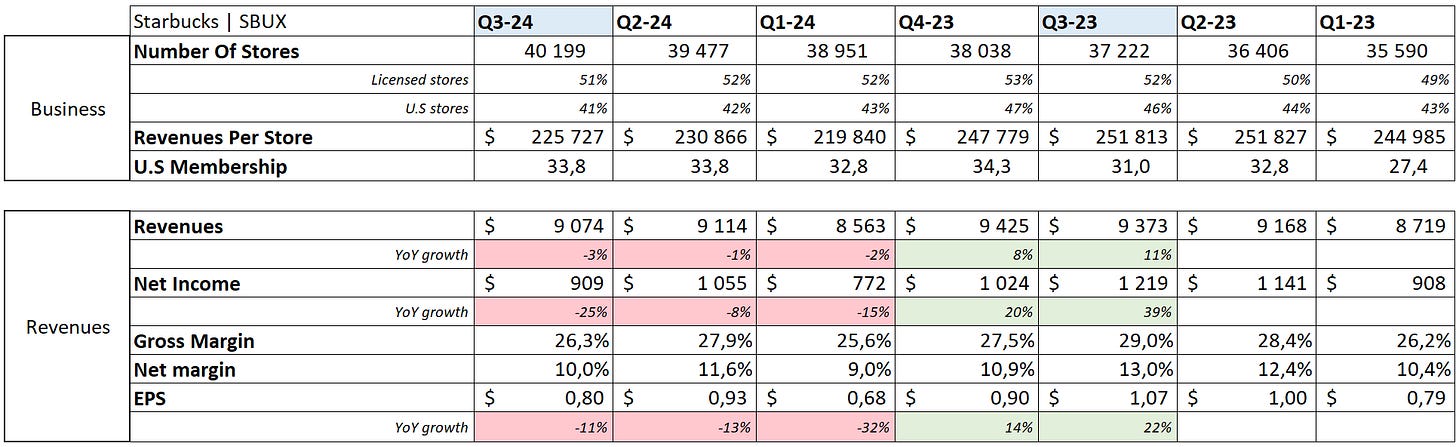

Starbucks.

The worst quarter on the list; although there’s nothing new, the company already released a “pre-earnings” update last week to prepare shareholders and make this quarter the "trash quarter," with all the bad news to start fresh.

EPS. $1.03 | $0.80 | -22.33% miss

Revenues. $9.37B | $9.07B | -3.16% miss

So here we go, with a pretty bad quarter and no more guidance for at least a year, not a very positive indicator.

Business-wise, things are bad as worldwide foot traffic is declining while average ticket prices are slowly growing - fewer clients for more expensive products. Except in China where things are worse as prices & foot traffic are both declining.

This shows a clear disinterest in the brand and I wouldn’t blame it on the consumer or the industry as many competitors are doing wonderfully, and every data point indicates strong consumer demand.

In terms of financials, revenues are declining, margins are shrinking, logically resulting in declining EPS. The balance sheet doesn’t please me at all with net debt of -$19.5B, which isn’t surprising as they need to operate real estate. But there are reasons to worry about the current state of business.

Starbucks is a great & iconic brand but I wouldn’t put my money on it. They are undergoing lots of management and fundamental changes and they could turn things around, but I won’t pile in until I have proof of that. It’s worth following it - not more.

Robinhood.

We talked about their event some days ago and the company keeps transforming its platform into the biggest casino possible as it added betting options - on the next U.S. president only for now.

The strategy is working and tons of capital are flowing to the platform, attracting lots of new users with strong cash incentives.

EPS. $0.18 | $0.17 | -5.56% miss

Revenue. $650.67M | $637M | -2.10% miss

"I'm really proud of our Q3 results and how smoothly our product engine is humming. We have a ton of momentum, and we’re just getting started."

Spoken like a true trader.

We have a double miss and a harsh market reaction because expectations were very high but everything seems good business-wise. Every metric is pointing to more clients, more assets & more activity which is what every broker wants. This mostly comes from incentives to transfer from other brokers but it’s hard to know when - and even if, this will continue & for how long - or if users will stay afterward.

There isn’t much to comment on financially; business is good and growing properly; healthily is another question… Margins are in good shape although fluctuating but this shouldn’t be an issue.

As for the stock: Robinhood is still a cyclical business boosted by market volatility & excitement. Bitcoin is at its ATH & SPY has been very volatile lately - both upward & downward, and incentives to transfer accounts to their broker are still being offered.

I don’t see any reason for short-term issues with the business so I would hold onto my shares if I had any (I don’t), but I wouldn’t love them too much either; those boys will need to be sold soon enough. I would not buy any though - even after this post-earnings drop.

With the market & economy as they are, I’d rather focus on owning quality assets and I do not believe Robinhood is one.

Uber.

Another pretty strong quarter.

EPS. $0.41 | $0.46 | +12.20% beat

Revenue. $10.98B | $11.19B | +1.89% beat

$375M of buybacks.

Business is going well with a 20% increase in growth bookings on constant currency with both mobility & delivery growing double digits, a global number of trips constantly growing while average prices are decreasing. Volume is key for Uber.

The future also seems very nice as Uber is partnering with Waymo for autonomous rides and with many other companies providing similar services. I’d love to hear about the price per trip with those but I guess I’ll have to wait for data.

In the meantime, as Uber does wel, its drivers also do well as their pay grows following Uber’s growth - which is good from a social point of view but not so good from an investor's point of view as it acts as a glass ceiling.

In terms of financials, I’m still not a big fan of Uber; data is great, growth is strong and the company delivered record net income but most of it comes from revenues external to the main business - “only” $1B comes from that business; still strong though. The same goes for FCF, with $2.1B for the quarter - 65% of it coming from stock-based compensation; hence strong dilution even with buybacks. Balance sheet is even - slightly negative, but Uber intends to pay off more than $2B of debt next quarter so there are no worries here.

A very good quarter in my opinion. I am not invested and do not want to be, but I would hold my shares if I were, and understand completely why one would buy in.

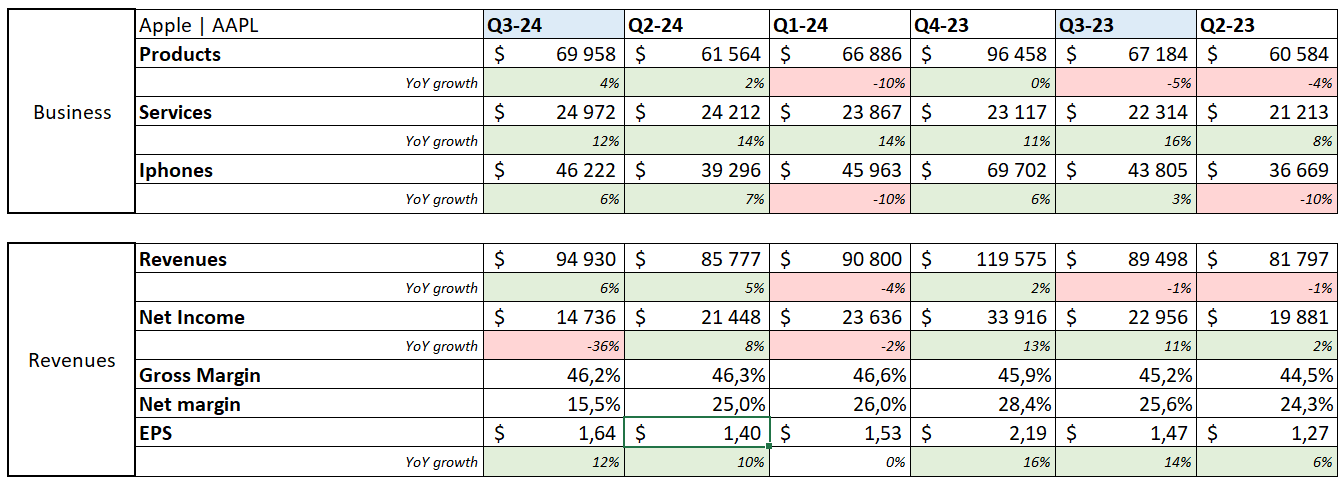

Apple.

I honestly don’t know what to call this quarter; my personal opinion is: tasteless - but that often is the case with Apple for me.

EPS. $1.60 | $1.64 | +2.50% beat

Revenue. $94.56B | $94.93B | +0.39% beat

$110B of return to shareholder for the last twelve months.

More of the same: another strong quarter for iPhone with new record sales and new record highs in terms of connected devices & therefore services revenues. The rest of the products show either slow growth or flat performance - hence my "tasteless" comment… Interesting to note that growth came entirely from Western countries;

Financials are very strong as usual with correct YoY revenue growth and net income impacted by a much higher tax rate at 50%. No troubles at all in terms of margins which would have remained stable without this increase.

So yeah: more of the same! I understand why many like the brand, company, stock, and its stability - but it just isn’t for me!

Amazon.

The retailer gave satisfaction, once more.

EPS. $1.14 | $1.43 | +25.44% beat

Revenue. $157.2B | $158.88B | +1.07% beat

There are many satisfying points during this quarter, but as usual lately, the most important data come from its business optimization.

Business-wise cloud continues to accelerate its growth while margins follow the same tendency; advertising almost reaches last year’s Christmas quarter in terms of revenues and subscriptions constantly grow as more & more users are attracted by Prime. The online store - heart of the business, is also growing healthily; everything looks great in terms of numbers & fundamental updates.

But the biggest positive comes from business optimization. Not only are they growing in terms of revenues, but all businesses reached their highest operating margin this quarter with their international segment being profitable for two quarters in a row!

As the company optimizes its operations, margins expand, profitabilty grows Amazon generates always more free cash flow - up 123% YoY.

It’s very hard - if not impossible, not to be very bullish on Amazon for the next few years, especially with Christmas season coming next quarter and I can see no reasons not to buy or hold this stock.