Various Q1-25 Earnings

Celsius, AMD, Arista Network, Uber, Novo Nordisk & Shopify.

Accumulation targets & my opinion will be shared tomorrow in the weekly for the company I personally consider worth buying.

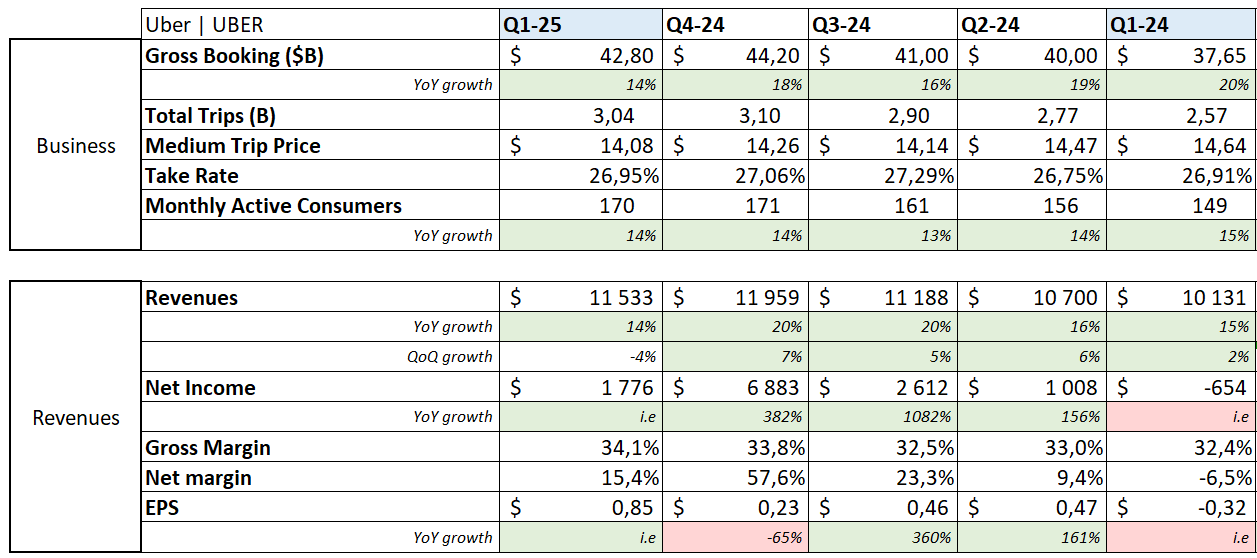

Uber.

A good quarter.

Fundamentals continue to improve with constant user acquisition & spending while the company’s network effect is growing stronger than ever with a record +20% YoY active drivers & couriers and a 17% YoY increase in merchants. Everyone wants to be part of Uber because this is where most of the traffic is. And this is also true for new sectors, with 18 new partnerships with autonomous vehicles companies like Waymo, Volkswagen, PonyAI & many other - only Tesla is missing.

In terms of financials, we can note a small decrease in growth rate & a decline QoQ, but this should be temporary as guidance is about a 20% gross booking growth next quarter - at the upper range & in constant currency. Margins remain very stable as management is executing perfectly, hence growing cash generation.

I am a big fan of Uber & you guys know it by now. I missed the perfect entry sub $70, but I am sure we will have opportunities in the next year as Uber remains a customer-facing app, and you guys know my bias on consumption.

No reason to rush; performance comes with execution.

Arista Network.

Continuous perfect execution & fundamentals.

Revenues continue to accelerate, margins are perfectly stable, and we have constant confirmations that datacenter spending is not slowing. Nothing else to say.

Shopify.

The platform continues to globally dominate.

Growth is stable in both spending & subscription without any sign of weakness, which attests to the global growing usage of their services. Financials are also stable with constant revenue growth but declining margins, probably due to the growing proportion of Shop Pay.

Nothing special to comment on!

AMD.

Still interested in the (so-called) Nvidia killer. Not happening yet but it’s important to follow in case the narrative finally happens as it could become a massive opportunity.

The data center branch is growing, but not as fast as it should if AMD were to really be the key player for AI infras. Here is what growth looks like on a trend leader.

Growth remains strong though & total revenues are accelerating. I read a lot about AMD & how their hardware & optimization is supposed to be on par with Nvidia’s GPU + CUDA when it comes to inference. If you read my Nvidia bull case, you know that inference should be much bigger than training. If so, AMD will have this kind of growth curve. If. Not when.

The rest is very healthy with stable margins & cash generation.

Keeping an eye on the name. For now, fundamentals are good but not good enough & price action is terrible. Wouldn’t touch it personally.

Novo Nordisk.

I will start to follow Novo & some other names in healthcare as valuations are getting interesting & stocks continue to fall to lower lows. I do not have my template for the company.

Hard to call this a dying company, but a simple comment decided the stock’s fate.

“The updated sales outlook reflects lower-than-planned penetration of branded GLP-1 treatments in the US, impacted by compounded GLP-1s […] However, we have reduced our full-year outlook due to lower-than-planned branded GLP-1 penetration.”

Compounded GLP-1 is over, which means revenues will entirely go towards branded products now, but for sure penetration isn’t that good as we’ve seen in Hims reports; most patients drop before finishing the first trimester due to side effects.

The guidance was reduced, but they are still guiding to between 13% & 21% growth, which is far from nothing really, after growing at a 27% CAGR over the last two years. Novo isn’t the kind of stock I look at for my long-term portfolio, but if opportunities present themselves, I won’t miss them.

For now, fundamentals are strong, valuation is good, but price action remains terrible. More patience. But you will hear about the company a bit more.

Celsius.

You guys know I am not excited for Celsius since some time now, especially with my personal bias on consumption & a potential recession.

And this quarter is not really giving satisfaction with a continuous decline in America’s revenues - its biggest market. International growth is healthy but is insignificant. The acquisition of Alani is helping as most growth is coming from their products, but it’s clearly not enough.

On the positive side, I always said the most important metric on Celsius’ deck is the monthly retail sales, and data is pretty positive with three months of sequential growth for both Alani & Celsius products.

This could signal a bounce in consumption with summer coming & with the inventory channels now clean, growing sales would be transformed into growing inventories, hence revenues for the company. This is for the positive.

I do not intend to touch the stock as I do not want retail-focused stocks in the actual conditions. But I will continue to keep an eye on it as I am sure a time will come when it will give us great opportunities.

Quick and sweet - thanks!