Various Q1-25 Earnings

Spotify, Stabucks, Microsoft, Robinhood, Amazon & Apple.

Spotify.

Spotify confirms to be to music what Netflix is to TV shows & movies.

Users growth. Constant YoY double-digit growth & sequential growth - big or small doesn't matter much, for both MAUs & premium users through the years. Interesting to see that most growth isn't happening in the West anymore, which remains significant but a lower & lower part of total users.

Ad Business remains volatile. Both in terms of usage & revenues as we're talking about a 22% QoQ decrease & smallish 8% YoY increase. No reasons were given in the slides, but we start to see a decline in advertising everywhere while Spotify’s business remains pretty recent & not optimized yet. Not really worrying, in my opinion.

Revenues & Margins. Nothing to complain about as we're talking about constant double-digit growth again in terms of revenues while margins continue to expand as the company's expenses remain flat while revenues increase.

Cash generation remains strong. We're talking about $534M of FCF boosted by some financing & $42M of SBCs - reasonable. Balance sheet remains very strong.

Guidance points to continuation. Another double-digit growth in terms of revenue, sequential growth in terms of usage & constant gross margins above 31%. More of the same.

Nothing to complain about for shareholders; the stock continues to trade at a pretty huge premium, but fundamentals deliver, so...

Stabucks.

I won’t go over Starbucks because the only important data is that traffic is once more declining & average ticket once more growing.

International does look a bit better but compared to one of the company’s worst quarter, to put things in perspective. I’m just not interested.

Microsoft.

The beast.

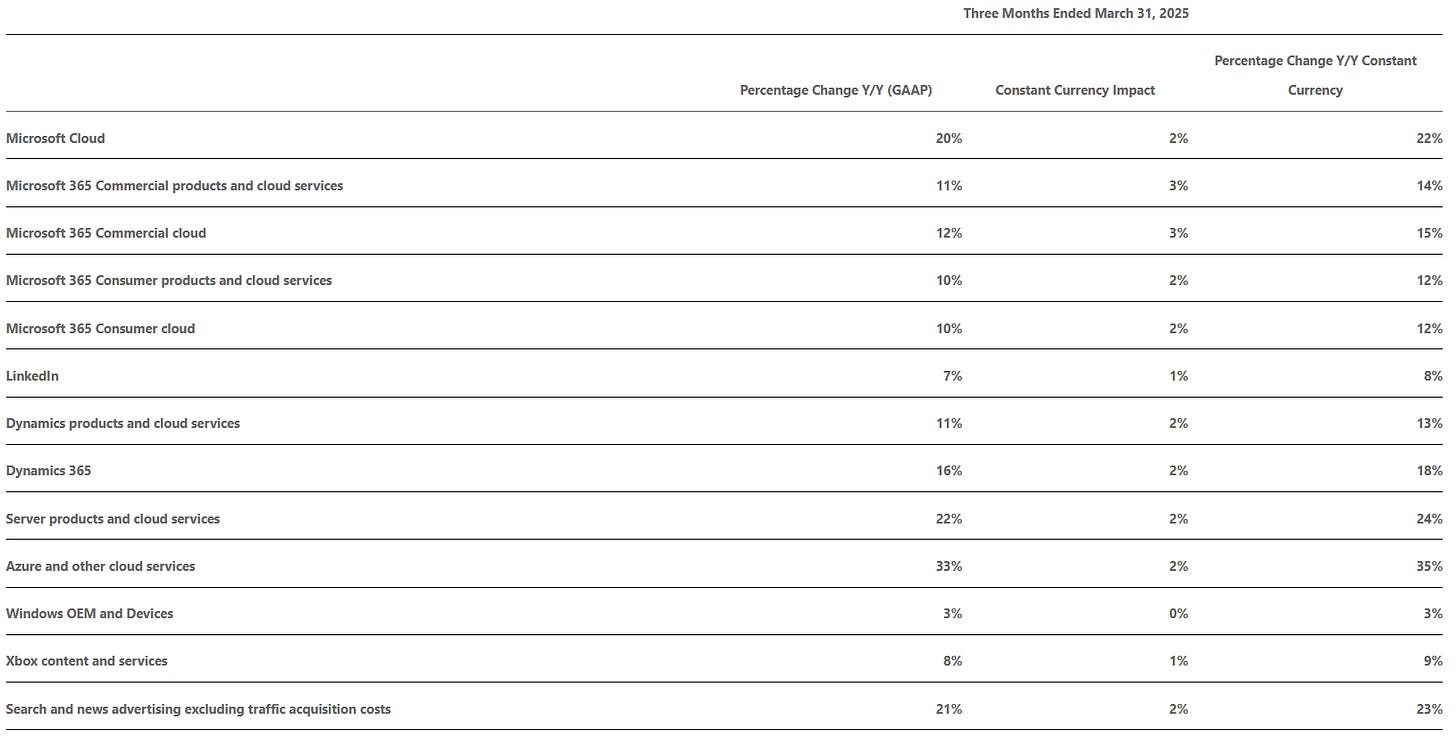

The quarter is pretty simple, everything is up big time, all of their branches, while Azure - professional cloud services, is up 33% YoY from alrerady very high values.

There’s nothing else to say…

Robinhood.

Gotta give it for another excellent quarter. I was there at $8 but I clearly didn't have the vision to see where they'd be, fundamentally, more than a year later.

Customers & Cash Tsunami. We know the company continues to attract more and more users, mostly thanks to its incentive programs. We see a clear acceleration in the Gold subscription, understandably with everything it offers, but also an acceleration in the funded customer accounts on the broker - up 27% YoY now, the highest growth of the past two years. This customer acquisition is directly correlated to the $18B of net deposits this quarter, which I find impressive considering the state of the market. Robinhood isn't the biggest platform, but people sure are buying - and continue to transfer their accounts.

Usage is rocketing. Most importantly, those users are not here to plant grass; they come with tons of cash and the will to use it and make the best out of the market conditions. Trends are clear that every asset's usage is growing, with options growing faster than the rest and becoming a big source of revenue as the market conditions are probably great for a bit more gambling - and Robinhood’s tools to do so are clearly the best. And people aren't here only to be active in the market, as the retirement accounts roughly doubled YoY - due to the incentives to migrate mostly, with their value tripling during the same period.

Business Model is Very Strong. As with every broker, most revenues come from transaction fees - roughly 63% this quarter, most of the rest coming from interest revenues. But the motor for brokers remains users and volume, which are both very, very positive, as we talked about above.

Financials Are Solid. Besides the classic growth in revenues and co - up 50% YoY, we have to note that expenses are flattish, growing way less fast than revenues. Operating a broker is roughly the same with 10 or 10M users, meaning scaling will be impressive. Solid enough for the company to stop its share dilution, great news for holders. In brief, the quarter is really great, although boosted by the current market conditions. But we cannot deny that Robinhood is attracting users like light attracts moths while improving its fundamentals at a pace rarely seen. It's hard not to be overly bullish on the platform, and what I thought would be a short-term fluke could turn out to become the best 2.0 broker, maybe in the world. Added to watchlist.

Amazon.

Another beast.

Although there are some worrying signs - besides the news between some fights with the tariffs policies & potential ties cut from Chinese products & resellers, which could affect the company. Growth is slowing in AWS & international e-com despites great & improving margins in both - highest ever for AWS & second highest for the e-com. It is hard to draw conclusions from this only but those are indicators. On the plus side, NA e-com remains really strong with a constant growth & improving margins - its highest ever.

What I see is a beast which continue being a beast, without much doubts but lots of uncertainty short term due to its business model for its e-com, and a strong competition from Google & Microsoft for AWS.

As for many comapnies lately, it’s hard to know what will happen short term. Long term? We’re talking about Amazon, I wouldn’t be worried.

Apple.

The fortress, as usual with $49.5B of buybacks & a new $100B plan & $7.6B dividends paid to shareholders. Not doing much but collecting.

Revenues up 5% YoY compared to a tough quarter a year ago with most coming from services as the device base is increasing & users continue to rely on their softwares. IPhone sales up 1.9% YoY with China flat in term of sales & most of the growth coming from America.