Transmedics | Q3-24 Earning & Call

Some concerns but the narrative is unchanged.

Violent reactions are normal when we talk about growth stocks. The market raised interesting questions about Transmedics’ growth & the demand for its product but my personal view didn't change at all.

Over the long term, years, I thought Transmedics was a good buy around $120 and is only a much better buy around $90. So I’ll be a buyer here, but again: the market is raising legit concerns.

Overview.

A growth stock cannot double miss, whatever the reasons are. Analysts are those who rule Wall Street, and the street cares more about their numbers than about the business itself.

EPS. $0.30 | $0.12 | -60.00% miss

Revenues. $115M | $108.76M | -5.42% miss

"We continued to make meaningful progress across each of our growth initiatives through the third quarter and maintain our conviction in our growth runway for 2025 and beyond."

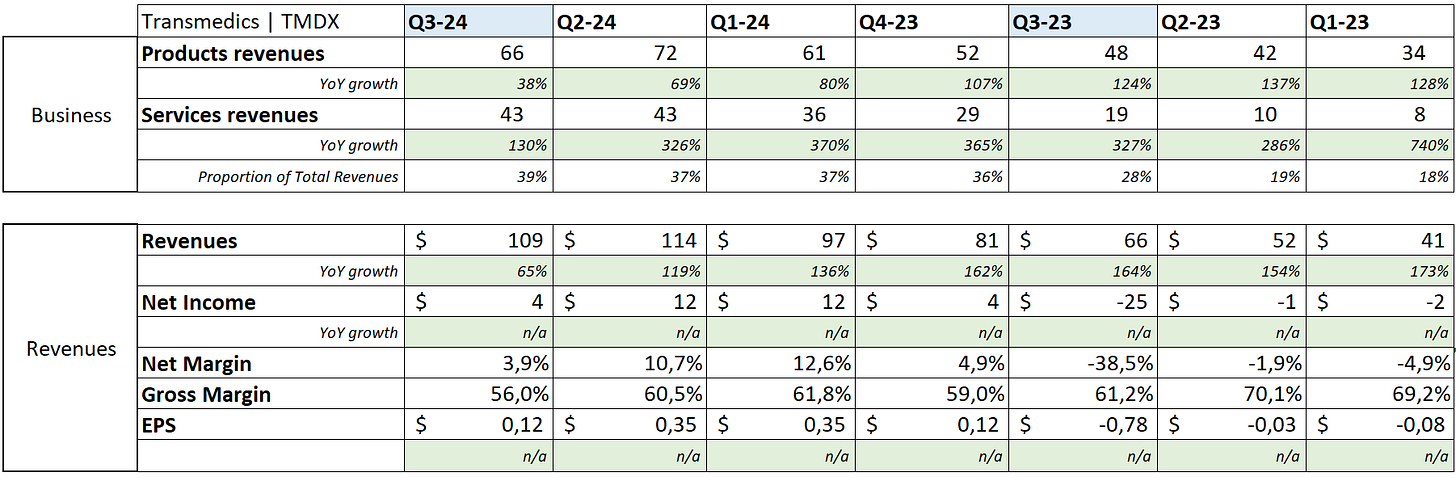

There’s a lot of green but the market focused on two things: A QoQ decline on revenues & gross margins shrinking.

Business.

Management spent the entire call repeating the same sentence, with different phrasing.

“We did not see any degradation of our market share.”

Many seemed to doubt it. Another important comment is that most of the headwinds were expected and talked about during the last earning call.

“We made our case. We thought we were clear, but maybe people didn't believe us. And if I want to provide any anecdote on it, I think maybe the headwinds in Q3 was slightly higher than what we anticipated, but we always expect that there may be slowdown during the summer months.”

So these numbers should really not have come as a surprise, but the market got too excited and believed analysts expectations more than management...

Globally, the business is pretty healthy and the company keeps improving its products.

“We are increasingly confident in the potential clinical impact of these new clinical programs as preclinical testing has consistently demonstrated superior outcomes for OCS heart and OCS lung up to 24 hours of OCS perfusion. These advancements stand to enable morning hours heart and lung transplants for the first time in history, which would represent a huge milestone that the cardiothoracic transplant field has long been aspiring to achieve.”

This is due to the OCS’s capacity to keep organs functioning healthily after extraction, another proof of how valuable their products are compared to competitors'. Besides improving them, they’ll also add addition organs soon. No date, no details.

The long-term goal remains to do 10,000 yearly transplants by 2028. The trend is pretty positive so far and should accelerate with the NOP, improved OCS and new organ systems which will probably be available by then.

Management also reiterated its long-term playbook for the company. Firstly, keep building their logistics networks. Secondly, continue to invest in their NOP clinical & technological infrastructures, and lastly, push R&D forward with the short-term objective to release their new generation of lung and heart OCS.

OCS. Let’s talk about the growth problem.

“In Q3, overall U. S. National liver and heart transplant volumes declined sequentially approximately 5%, while total lung volumes declined by approximately 3% in the U. S. There is no clear reason for these declines other than normal variability of donor availability and potential summer seasonality.”

This is the primary driver of the QoQ revenue decline and nothing the company can do about it. Their business relies not on demand for a product they can manage or advertise for but on a vital need, affected by seasonality. Once more with a new formulation.

“We have not seen any fundamental or competitive dynamics playing any role in the slight sequential decline in case volume for OCS in Q3.”

The decline is here. But if it is due to a lower demand, stronger potential growth in the next quarters will also be due to a stronger demand as market shares were not impacted. That’s what matters.

Logistics. The company is planning for its future and is training pilots & improving their NOP infrastructures. This incured one time expenses estimated around $2M by management, which will not repeat next quarter.

Secondly, running a fleet requires maintenance and as planned last quarter already, many planes went for it this quarter.

“As we stated in our Q2 earnings call, we also completed routine maintenance on several of our owned aircraft scheduled in Q3. This resulted in lower average daily planes available for missions compared to 2Q 2024.”

Out of the 18 planes now available to the company - 3 were bought this quarter, only 10 were available during the quarter, and TransMedics had to rely on third parties to meet their needs.

“Still, our owned aircraft covered 61% of our NOP flight missions in Q3, up from 59% in 2Q of 2024. We used 3rd party logistics partners to meet NOP missions while our planes were in maintenance.”

These two factors are what impacted margins. The company’s goals do not change; they target operating around 20 planes and intend to buy a few more during the next quarters. Maintenances will be normal behavior over the next years.

“We need to assume that on any given month, there is at least 1 or 2 aircraft that are in some form of maintenance. Some are scheduled and some are unexpected. That's going to be that's the life of operating a logistics network.”

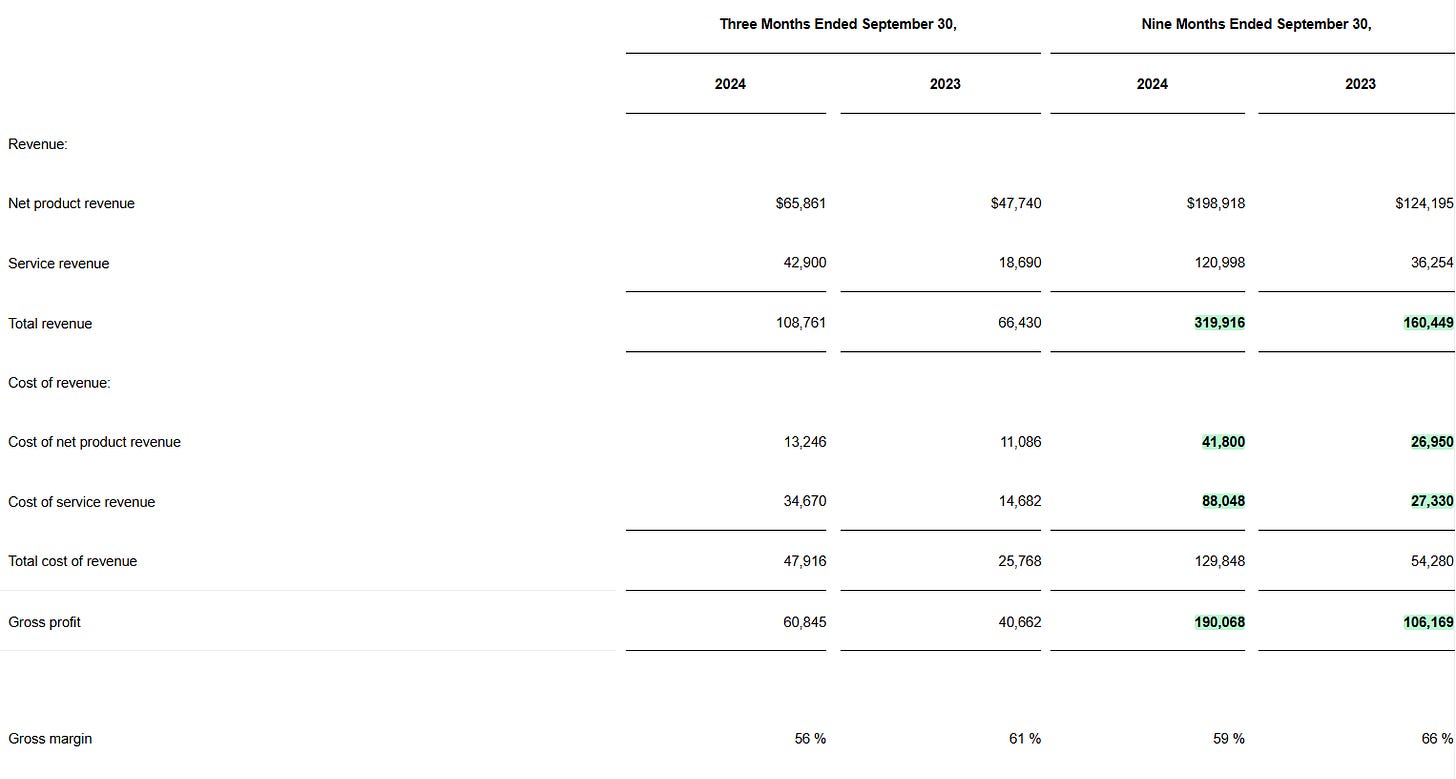

Revenues.

There won’t be much more to detail here.

If we focus on the nine months ending - which we should, we’re talking about a 99% YoY increase in revenues for a 79% increase in gross profits. As detailed earlier, margins have declined mostly due to one-time expenses on their logistics infrastructures & the use of third parties, but we won’t have TransMedics operating above 65% gross margins anymore as their service revenues will grow. Management is talking about a long-term goal stabilized around 60%, fluctuating QoQ.

“In Q3, the primary driver of transient decline in gross margin was related to the impact of investments in our infrastructure and a higher utilization of third party logistics partners to cover NOP mission as our planes received scheduled maintenance impacting our service margins.”

Expenses are pretty stable YoY which is very good news; at least growing much less than revenues which gives room for net margin expansion.

TransMedics is printing its third profitable quarter in a row, with $7M of OpCF mostly coming from share programs as dilution continues to finance business growth. The company ended the quarter with $330M of cash against $59M of long-term debt - a necessary evil to buy and operate its fleet & NOP infrastructures.

Guidance.

Management reiterated its FY-24 guidance between $425M & $445M - up 76% to 84% YoY. This would mean Q4-24 with at least $105M in revenues - up 60% YoY, which I am sure isn’t pleasing the market much as it shows a second quarter without QoQ growth and a slower YoY growth.

My Take.

So if I am to resume. The market is unhappy about declining QoQ revenues this quarter & potentially next quarter and shrinking gross margins. It’s all understandable, to be honest.

My view is, as explained by management, that flat QoQ revenues are due to seasonality and shouldn’t be much of an issue with R&D, new products coming very soon and winter at our doors. A bump in the road doesn’t change the entire thesis; no companies grow 100% YoY every year. But these questions are legitimate; we will need some confirmation that this is only a bump early in 2025; we also need to see that the fleet & NOP are net positives for OCS business. Having such infrastructures should strongly boost demand - hence revenues.

The shrinking margins aren’t a concern at all for me. It’s logical for them to shrink as they deploy their fleet, which is still very new. It will take time to optimize and we should expect fluctuations over the next quarters.

I won’t talk about valuation at all because growth is impossible to predict; what matters when deciding whether or not to invest at today’s prices is whether you believe seasonality had an impact and this is only a bump - that growth will return in 2025 with an optimized NOP & new OCS products plus original demand for a much better & safer product altogether.

To me, the narrative is unchanged; I keep a long-term horizon so buying is a no-brainer. But data showing slower growth can worry many even if management explains it by seasonality. The data is short-term and only shows so much. Ultimately, it’s our job to make choices based only on what could be.