Tesla | Q3-24 Earning & Call

Are there still bears out there?

I have been following Tesla for many months now and I believe the 10/10 event was great without showing anything we didn’t expect. This quarter is different, confirming the thesis that I, and many others, had on Tesla. I wrote this in the Investment Case I shared in early June.

“The investment thesis on Tesla relies entirely on its R&D, namely Optimus & FSD.”

I believe this quarter is finally showing that Tesla can pull it off not only technically but also business-wise. This is a game changer. EVs aren't the main business anymore; autonomy is.

Overview.

Some positive YoY comparisons for the first time since… too long.

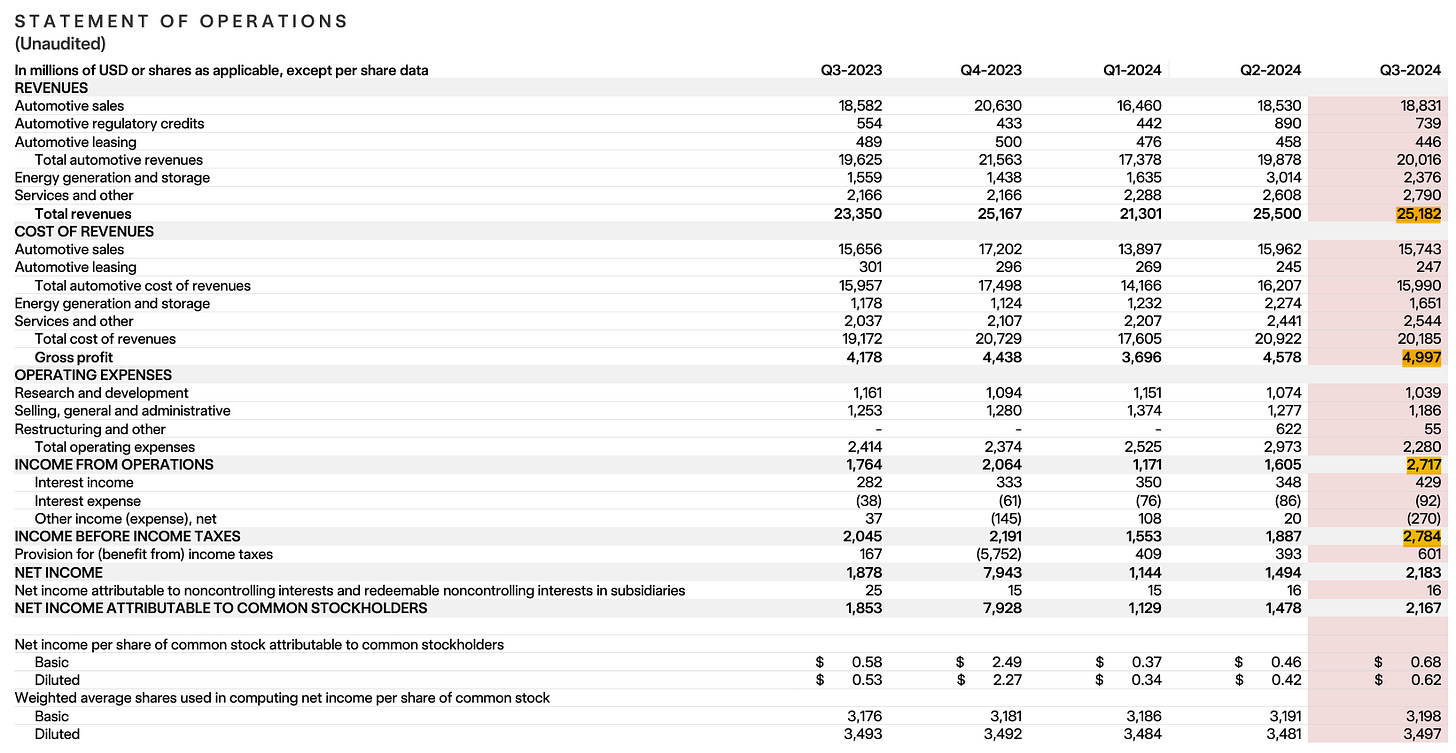

EPS. $0.58 | $0.68 | +17.3% beat

Revenue. $25.37B | $25.18B | on expectations

A pretty good quarter but some of this data makes it much better than it looks, starting with the margins, combined with a decreasing EV average price… lots of positives.

Business.

As usual, we’ll have to divide this into different parts. There’s a lot to say today.

EVs.

Starting with Elon’s plan for 2025 as he expects a “20% to 30% vehicle growth next year”. This would be a significant achievement that he expects to happen thanks to a combination of different factors, including the attractiveness of unsupervised FSD and the new, more affordable model.

Not much news has been given about this new model except confirmations of the timeline.

“So, regarding the vehicle business, we are still on track to deliver our affordable models starting in the first half of 2025.”

I have a hard time understanding what this vehicle will be though, as it should be produced soon but we have no idea of its design and Elon has comments like these:

“I think having a regular 25K model is pointless. It would be silly. Like it would be completely at odds with what we believe.“ […] “What we designed is optimized for autonomy. It will cost on the order of -- cost roughly 25K, so it is a 25K car. And you can -- you will be able to buy one exclusively if you want. So, it just won't have steering wheels and pedals.”

Is the new model not going to be a classic & cheaper model? Is supposed to be without steering wheels and pedals? Is it simply the Cybercab or another version of it? Hard for me to understand, to be honest.

In term of global strategy, nothing changed. The goal is still to constantly reduce the price of their EVs without impacting safety or quality. This quarter showed it once more with maybe the biggest decrease in price as it now includes the Cybertruck - a much more expensive product, and yet the lowest average price per EV.

“Our focus remains on growing unit volume while avoiding a buildup of inventory.”

About the Cybercab, Elon confirmed Tesla’s ambition to have it produced in volume & commercialized by 2026 with a run rate of “at least 2 million units a year”. As usual, it’s hard to have any idea of the truth in this so I guess we’ll need to wait & see…

About the Semi, Tesla is still on track to start production in H1-26, still far away considering the strong demand for the product and very high satisfaction from the few already using it.

“We have kind of ridiculous demand for the Semi.”

I can imagine why; Tesla is also working on adapting FSD for it, and having a self-driving semi will clearly be a game changer for many industries as cost per mile will largely decline - although we’re far from this as it is not comparable to other use cases. Besides FSD, an electric semi is already a significant improvement, which explains the strong demand for the product.

To finish on a good note, we can talk about flying cars & the roadster.

“You know, a friend of mine, Peter Thiel, we're really good friends. Peter was lamenting how the future doesn't have flying cars. Well, we'll see. More to come.“

I take this as a joke obviously. But who knows?

FSD.

One of today’s big subjects with lots of news. The total number of miles driven using FSD since inception increased by 25% since last quarter - a very rapid increase that shows a growing FSD take rate, whether from subscription or from free programs offered by Tesla to test the product, increasing the available data to train the software, already is better than ever.

“Version 13 of FSD is going out soon. We expect to see roughly a five- or sixfold improvement in miles between interventions compared to 12.5.“

With this information being one of the most important one:

“So, that's not sandbagging or anything else. Our internal estimate is Q2 of next year to be safer than human and then to continue with rapid improvements thereafter.”

Although data released in Tesla’s safety reports is very encouraging.

Keeping in mind that FSD is for now only used in specific conditions by a few users globally, a much smaller echantillon explains also explains better data; This also shows that Teslas, even without FSD, are safer vehicles than average - or that Tesla drivers are better; I’ll let the interpretation up to you.

Tesla is now doing whatever it takes to showcase this product to as many users as they can as many still do not believe in FSD.

“every time we have a significant improvement in the software, we'll roll out another sort of 30-day trial to encourage people to try it again.”

We also had some information about the hailing service and app Tesla is working on for its future fleet, which I wasn’t sure was anything else than a design but is used already for internal tests according to management.

“We showed some screenshots of this in the Q1 shareholder deck, and this is real. We've been testing it for the good part of the year.”

The app goes further than just hailing a Tesla; it also configures the EV to your profile & preferences before it arrives - that’s the future.

“It just so happens that we've used those building blocks to deliver great features for our customers in the meantime, such as sharing your profile, synchronizing it across cars so that every single car that you jump into, whether it's another car that you own or a car that somebody has loaned to you or a rental car that you jump into, it looks exactly like yours. Everything synchronized, seat mirror positions, media, navigation, everything is the same, just what you would expect from one of our robotaxis.“

Going further - not very far into the future, Elon & team confirmed that they are actively working with regulators to approve unsupervised FSD in California and Texas and therefore release this app “next year to the public,” and even better “maybe some other states actually next year as well.”

I’d be careful about timelines as we are talking about regulators; everything is in their hands. We know it could take forever just because… why not? The timeline says next year for now; once again: wait & see - I personally believe the U.S. elections will make a big difference in this subject, for obvious reasons.

Still, management is pretty confident.

“I mean, I guess like we think that we'll be able to have driverless Teslas doing paid rides next year, sometime next year.“

Energy.

Another wonderful quarter for energy deliveries which grew 52% YoY. Elon said already - and repeated during this earnings call, that deliveries & growth will fluctuate as they depend on “customer readiness, location of orders being fulfilled…”.

But demand is still strong, “we expect to grow deployment sequentially in Q4 to end the year with more than double of last year.”

Optimus.

Not much new this quarter - nothing since the 10/10 event at least. It’s still good to remind that Tesla might be (or is) the only company that “has all of the ingredients necessary to scale humanoid robots.” We’re talking about AI capabilities for training, engineering, scale manufacturing etc…

Revenues.

If business was great, revenues were even better - and I believe this is what set off the stock, now up more than 10%.

There isn’t much to say in terms of revenues but lots to say in terms of execution. We have an 8% revenue growth for a 16% net income growth YoY; this has been achieved through optimization and growing margins - something many gave up on as they expected Tesla’s margins to go down following their EV prices. Turns out they were wrong.

Before we dive into margins let’s talk briefly about the balance sheet which remains a fortress as usual for Tesla: net debt of $26B with record-high OpCF of $6.25B thanks to changes in operating assets amounting to $1.57B and stronger-than-usual net income. Tesla continues investing heavily in AI compute with $3.5B capex mainly for this purpose and ends the quarter with $2.74B FCF.

In summary: Tons of cash held & generated.

Margins.

Back to the main subject and the most important one today.

We have a combination of different factors; Tesla is reducing its EV prices while seeing its gross margin grow - meaning Tesla is finally making more money on each EV sold despite them being cheaper. They could of course make more money with a premium price and bigger margins but that would mean less volume… Would it be better, would it not?… Impossible to know, but Tesla’s goal is to render EVs mainstream and available to everyone.

My take is that we might have seen the bottom here as macro conditions are improving & the company proves they can reduce prices while growing margins. Combined with growing margins & importance for both the service & energy businesses, everything points out to growing gross margin from now on.

My Take.

I called this quarter the inflection quarter for few reasons.

Firstly, we are getting out of tough macro times; as interest rates lower around the world access to Teslas’ EVs will become easier. During this tough period Tesla kept making its cars cheaper and they’ll become more accessible each day from today onward. The macro storm - which Tesla had no control on, is passing.

Secondly, lots is happening regarding autonomy - and I believe we are at an inflection point. Tesla discusses unsupervised FSD rolling out in some states next year; people realize their software is ready for it - safer than ever and improving rapidly. More & more see its value and use it daily; I believe many finally realize it's real & possible but most importantly, the data starts showing it.

Thirdly, in terms of company performance & potential. Tesla’s businesses improve rapidly and we can expect many sources of growth from now on, real ones, not just thesis anymore. EVs have found their bottom regarding margins; sales growth is expected through FY-25 with new models coming & interest rates decreasing plus FSD becomes increasingly attractive; Texas & California will soon have unsupervised FSD - who doesn’t want this? The energy branch grows like never before amid strong demand, all while execution improves significantly: margins grow; costs are controlled; cash flows increase rapidly while investing heavily in future projects.

Who can still be bearish on Tesla?

I think this concludes this quarter and for once, I won't talk about valuation because it is impossible to value Tesla. This quarter gave me confidence that the thesis will become reality sooner than I thought, but confirmation will come when Texas approves unsupervised FSD. It's impossible to predict how demand will grow from there for both EVs & FSD. So why bother? It's a buy or don't situation and try to buy at the best price you can. Then? Hold strong.

I'll conclude exactly like my Investment Case.

“There's no other reason to buy into this ticker but to be an overly optimistic person, wishing for innovation to happen and for Tesla to be the one bringing it.”