Tesla | Q2-24 Earning & Call

Better than expectations, but still not good.

There is a battle on X today as to know if those results were mediocre or good enough….

Overview. My take is that it was better than many would have expected it - myself included, but it isn’t a good quarter for Tesla if you only look at the company itself. It gets slightly better if you take the macro & global conditions in consideration but I don’t think anyone can call this a good quarter.

EPS. $0.62 | $0.52 | -16.13% miss

Revenue. $24.73B | $25.50B | +3.11% beat

Globally, the investment case remains unchanged after this quarter and everything which was said there is still true.

With Elon himself confirming it during the earnings call.

“So I recommend anyone who doesn't believe that Tesla would sell vehicle autonomy should not hold Tesla stuff. They should sell their Tesla stuff. If you believe Tesla will sell autonomy, you should buy Tesla stuff.”

Business.

EVs. Nohing glorious, deliveries were higher than expected thanks to sales & financing solutions, enough to bring back QoQ revenue growth but this is short term confort as it ended up hurting margins.

It doesn’t directly on the data thanks to the impact of the Cybertruck on deliveries & prices - having a delivery decline YoY while releasing a new product means that there is a much stronger decline for the basic models, namely the S3XY Teslas.

In term of price per car, it seems to stay flat on my excel but again, with the impact of a much more expensive Cybertruck, it means that the S3XY Tesla prices really declined and brought gross margin with them to their lowest digit, ever - under 15% from around 16% last quarter.

“Cost per vehicle declined sequentially when we removed the impact of Cybertruck.”

This is all due to Tesla’s focus on market penetration above growth & profitability but there’s still some encouraging notes as “in U.S. alone in Q2, over two-thirds of our sales were to -- deliveries were to people who had never owned a Tesla before which is encouraging.”

The question of whether Tesla’s EV issues come from the demand or the macro still seems to be in favor of the macro, also be confirmed by inventories which came back to a normal number, making up for last quarter’s overproduction.

Now Tesla is still impacted by lots of headwinds, mainly the actual macro & potentially more troubles are coming with politics - between the U.S. elections and European regulations… They took the decision to lower their margins to penetrate the market and strangle competition - which is working as no other western EV maker is a serious competition to Tesla and most died/are dying today.

But this decision hurt the business.

FSD. The dynamic is the same as the last quarters, maybe even more lately as the subscription price has been reduced & FSD has been offered to new owners. More EVs, more subscriptions, more data, better software, etc...

Lots have been said on it during the call as it becomes clear that FSD is a big part for Tesla’s future, although we still don’t have clear data on retention, only a comment.

“Once people use it, they tend to continue using it.”

What matters now is when will Tesla be able to pass from supervised FSD to unsupervised FSD worldwide - regulation-wise.

“I think in our experience, once we demonstrate that something is safe enough or significantly safer than human, we find that regulators are supportive of deployment of that capability. It's difficult to argue with -- if you have got a large number of -- if you've got billions of miles that show that in the future unsupervised FSD is safer than human, what regulator could really stand in the way of that. They're morally obligated to approve.”

This doesn’t give a timeline but it gives the “how”. Tesla will demand to allow the supervised version in Europe & China and assumes this might be done before the end of the year - I would shave my head if Europe approves it that fast.

Licensing of FSD was asked again during the call but we didn’t have new information besides Elon confirming that they would only license FSD if it was worth it - meaning the partner would produce above a million cars working on FSD. This would take years as other brands will need to develop a car with the technical infrastructure to host FSD - cameras, connection, power, etc.

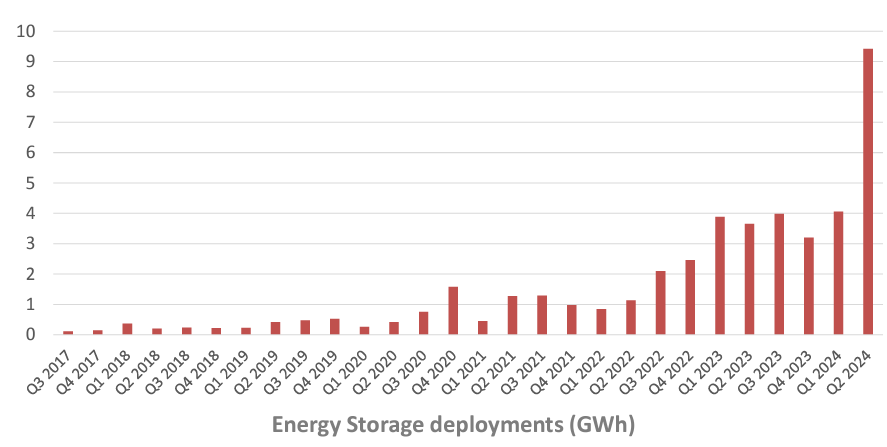

Energy. On the bright side for the company, the energy branch is finally showing results with a record 9.4GWh deployed this quarter.

This is a very big deal as many consider that the energy branch should become as big as the EV branch over the next year as the world turns to different & cleaner energy sources - and more autonomy.

“we are really demand constrained rather than production constrained.”

Elon specified in the call that growth came from both Powerwalls & Megapack and that the backlog was pretty strong up to 2026 which confirms the strong demand. It’s also important to acknowledge that deployments will fluctuate and classic QoQ or even YoY comparisons might not be useful.

“Energy storage backlog is strong. As discussed before, deployments will fluctuate from period to period with some quarters seeing large increases and others seeing a decline. Recognition of storage gigawatt hours is dependent on a variety of factors, including logistics timing, as we send units from a single factory to markets across the world, customer readiness and in case of EPC projects on construction activities.”

What matters is the tendency.

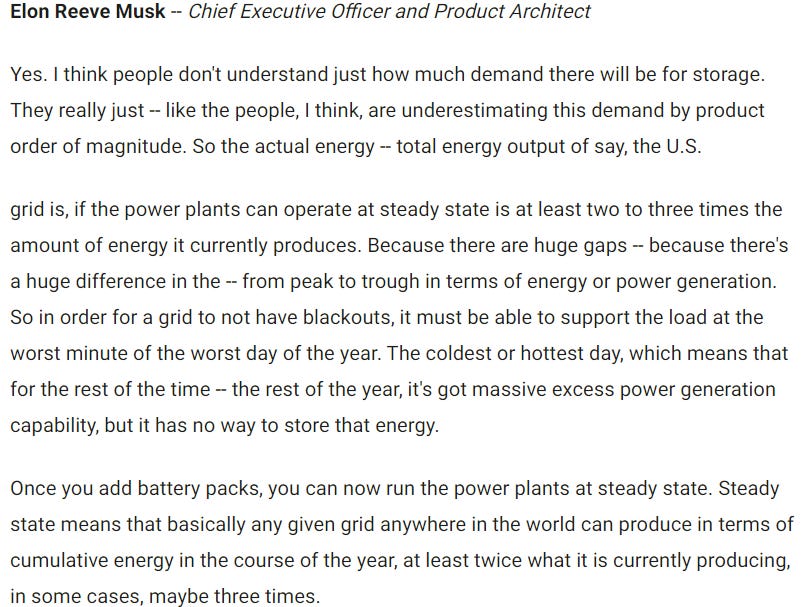

If you’re interested in how the grid works and why the Megapack is such an interesting & important product for the future, here’s a small extract of the call where Elon details it.

The batteries are also going well as the company is producing 50% more 4680 cells than in Q1, which is an important part for future cost reductions.

Optimus. Some news about Optimus who’s used for useful tasks in Giga Texas. We also had some classic Elon’s timeframe expectations - hardly trustable.

“we expect to have Optimus production Version 1 and limited production starting early next year [...] we expect to have several thousand Optimus robots produced and doing useful things by the end of next year in the Tesla factories. And then in 2026, ramping up production quite a bit. And at that point, we'll be providing Optimus robots to outside customers.”

Hard for me to imagine Optimus being publicly commercialized by next year but who knows?

Other Subjects. The robotaxi event was pushed to the 10/10 as they apparently needed to change some things (hm), but they’ll apparently present more than only the robotaxi that day so, wait & see.

Plans for new vehicles, including more affordable models, remain on track for the start of production in the first half of 2025 and the Roadster’s production should finally start next year - again, hm.

Supercharger stations & connectors grew strongly YoY & QoQ.

Some news on Giga Mexico which might not happen, depending on the next U.S president as Trump is talking about rising taxes on products (cars) coming from there.

“I think we need to see just where things stand after the election. Trump has said that he will put heavy tariffs on vehicles produced in Mexico. So it doesn't make sense to invest a lot in Mexico if that is going to be the case.”

Revenues.

Lots of small details to look at on this quarter's revenues.

Globally, the statement isn’t good. Revenues are flat or declining, margins are decreasing as the EV branch is struggling and the company focuses on market share & penetration. The rest is showing some strength but isn’t significant enough.

Let’s detail some things though.

First, $890M came from regulatory credits - which is 10% of the EV sales. These are incentives from governments to produce eco-friendly products with minimum waste. As Tesla produces EVs and focuses on cost efficiency & clean energy - this is their business after all, it translates to bigger incentives from the state. It exists, Tesla benefits from it, but those policies might change in the future - especially with Trump as they’re already talking about changing those things, although as Elon said during the call, this might hurt others more than Tesla as his company is one of the only profitable EV makers in the west.

“I guess that there would be like some impact, but I think it would be devastating for our competitors and for Tesla slightly. But long term probably actually helps Tesla, would be my guess, yes.“

Second, the energy & storage strong growth - up 100% YoY & 84% QoQ, and record revenues.

Third, a record quarterly revenue for the company despite pretty tough conditions for their EV branch - although this wouldn’t be the case without the regulatory credits so, take it or leave it.

And lastly, it’s important to note that the EPS miss only comes because of a restructuring charge that management expressed in their statement. Tesla would have beaten expected EPS without this one-time expense.

Balance sheet & cash flow. Tesla grew its debt to $7.35B to help its financing program as expected and this should continue through Q3-24 but isn’t an issue at all in my opinion. I already said it but this is the best way to leverage their monstrous $30.7B of cash at the moment.

“These programs had an impact on revenue per unit in the quarter. These impacts will persist into Q3 as we have already launched similar programs. We're now offering extremely competitive financing rates in most parts of the world. This is the best time to buy a Tesla.”

FCF came back positive again at $1.23B as CAPEX slowed a bit this quarter but Tesla committed again to spend $10B this year.

Conclusion.

More of the same for Tesla this quarter with a hurting EV business.

The bulls will say that the macro is tough and that it hurts their business while Elon makes the right decision to strangle competition with lower prices for better products even if it hurts the business short term.

The bears will say that Tesla is dying as margins are declining because no one wants there products so they try to sell them at any costs, slowly killing their business while FSD is only a fantasy.

My take is that I’ve never met an unhappy Tesla customers, than even in difficult times their cars sell a lot compared to competition, retention is strong & they attract lots of new customers. It pains me to see margins in freefall as an investor but I understand the choice for doing so, as the EV branch isn’t the bull case anymore. The energy branch is growing rapidely and is very interesting, FSD & Optimus are great long term project which could transform the entire world.

Everything is about autonomy and Elon knows it and focuses on it.

“So I recommend anyone who doesn't believe that Tesla would sell vehicle autonomy should not hold Tesla stuff. They should sell their Tesla stuff. If you believe Tesla will sell autonomy, you should buy Tesla stuff.”

Thank you for reading it all! If you like it, please consider subscribing to receive it all directly in your inbox and not miss a thing!

Everything I share here is free but if you found the content valuable enough, you can always leave a tip!