Spotify | Q2-24 Earning

When bad economics still work.

Overview. Once more, Spotify impresses with great results while the market pumps the stock price close to its 2021 ATH.

EPS. $1.15 | $1.43 | 24.35% beat

Revenue. $4.17B | $4.10B | -1.70% miss

Business. It is very hard for me to wrap my head around this, but Spotify still attracts users, and lots of them as you can see. Be it for their ad-plan or their premium plan, growth doesn’t slow and the platform is now reaching 626M MAUs - a pretty big number. Even though slightly under their own guidance of 631M but it won’t make much difference for the market as everything else is great.

The company keeps adding tons of content outside of musics to its catalog - podcasts & audiobooks, while giving advertisers new tools for audio advertising. Management knows how to fidelize & convert their users to revenue over time.

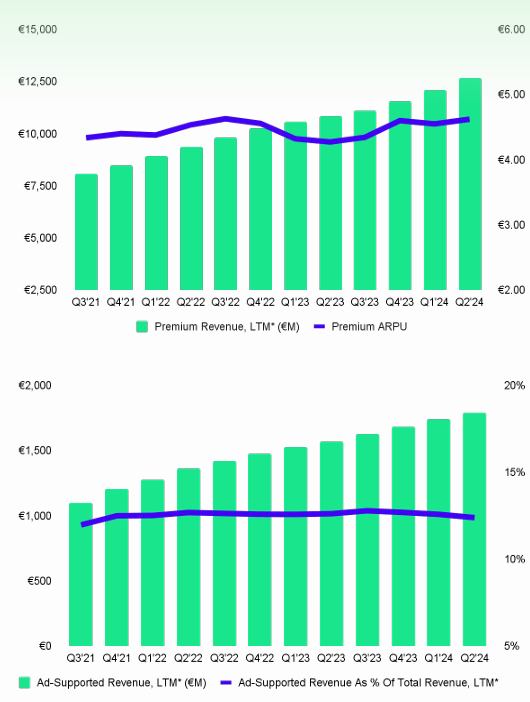

Revenues. Premium users are Spotify’s bread & butter and revenues will grow as long as they can convert newbies. Many (myself included) called Spotify a company with bad economics because their revenues rely only on subscriber growth so they need to always attract more, and the only way to do this is through marketing & always more content - which comes with bigger & bigger expenses. An infinite wheel which can only end one way and is better explained by this screenshot.

Revenues are growing, but ARPUs are forever flat - for both subscribers & ad-supported plan, which means the revenue growth is indeed only due to new subscribers - what happens when the music stops?

But Spotify is slowly proving us wrong - although I’m not convinced yet, as they are managing costs better and margins are growing, printing a second profitable quarter in a row, thanks to “a decrease in personnel and related costs and lower marketing spend”. A tendancy which will apparently continue as we will see with the guidance.

In terms of cash, Spotify ended the quarter with €490M of FCF, €81M of those coming from shares program and a net debt around $3B.

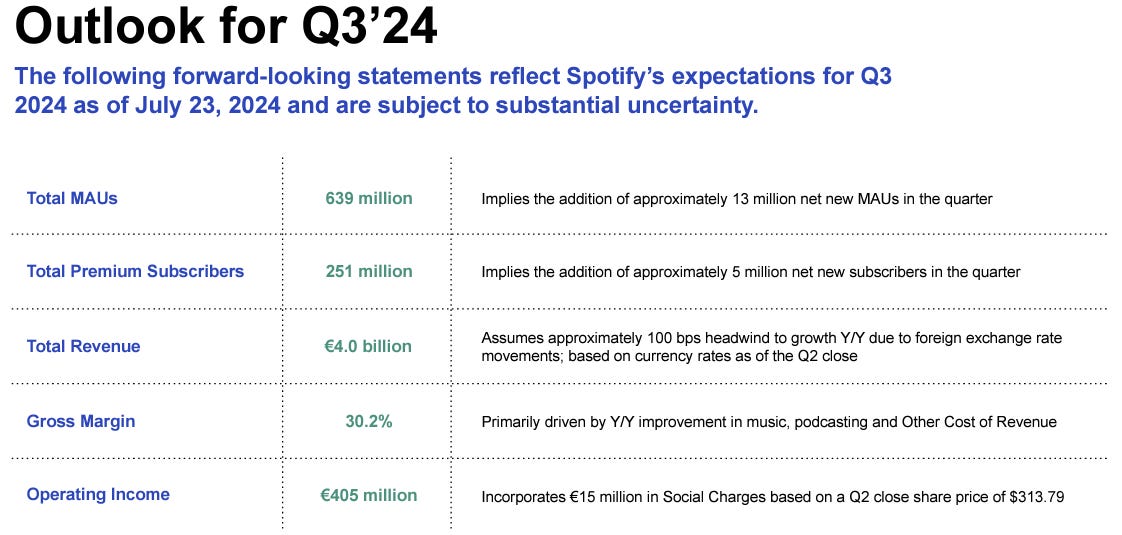

Guidance. Great results usually bring great guidance and even if the first signs of weaker consumer spending are showing, those consumers don’t cut on their music.

Another YoY double-digit growth in MAUs & subscribers, a rapidely growing gross margin, another profitable quarter, all of it with 20% revenue growth YoY.

Spectacular.

Conclusion. I am still not really interested by Spotify because I still believe the econnomics are pretty poor & YouTube is such a better app but this is personnal and I like to keep an eye on things.

Yet, I can’t argue that the company is showing a strong business and a management focused towards profitability & growing their margins through cutting expenses - which is what had to be done and the only way to get out of their wheel. The question is, will they still add users & new subscribers while cutting their marketing & content expenses?

It’s all working perfectly so far and I’m glad for shareholders who’ll probably hold their shares as long as things are good - I certainly would if I were in after such a quarter.

Thank you for reading it all! If you like it, please consider subscribing to receive it all directly in your inbox and not miss a thing!

Everything I share here is free but if you found the content valuable enough, you can always leave a tip!