Portfolio update - July 24

The portfolio has changed over the last month, and I believe it’s time to have a rapid overview of some positions and decisions. Here’s what it looks like at the moment.

Some names are hurting the global performance as accumulation has been a bit too aggressive while the sector wasn’t receiving any liquidity; I already talked about this at length here.

https://x.com/WealthyReadings/status/1801375578014011568

But the real game starts now as almost all cash has been invested; both long-term and short-term plays are set up, with a few of them already giving satisfaction like Meta, Google, Palo Alto, or Uber.

PayPal. I considerably grew the PYPL position for a short/medium-term swing as we’re back to a very good risk/reward ratio here, in my opinion.

In terms of fundamentals, the lights have been turning green over the last few months as Alex and Jaimie are turning the ship around and seem to be making good decisions after another, some already showing results.

We’re talking about Fastlane with a strong take rate and impressive growth in conversion, which will raise demand from merchants for the product. We’re talking about other innovations like cashback & smart receipts being set up for the entire quarter this time, the new design of the app, the new advertising business and the very strong buybacks.

The market still hates PYPL, but it’s hard not to see that things are changing for what still is the most used online payment provider.

But what made me buy so much some days ago is the stock’s price action, endlessly bouncing in this $55-$70 range.

We’re now back at the lows while PYPL clearly printed a bottom at $50 and a higher low at $56 - a -5% risk at today’s price. What would it take to break that higher low, and what are the probabilities of it happening? I struggle to see anything strong enough to do so besides a black swan, which is by definition, unpredictable. Fundamentals are great, and Alex even pointed out that the company is already above its EPS expectations for Q2, probably due to strong buybacks.

The biggest probability here is to bounce back to the top of the range while the market grows its expectations for the next quarterly report end of July. Low risk, strong potential, hence the size of the position but I do not intend to hold it through the earnings as we never know how the market reacts to PayPal’s quarters.

I will hold PayPal as the long-term thesis still holds, but not with this position size.

Lululemon. The position is hurting the entire portfolio big time as I’ve been accumulating too fast, not believing that the market would punish the stock so much for “only” planning to grow double digits with 40% plus growth in China. Big mistake which taught me that ratios don’t matter as long as liquidity doesn’t flow.

I’ve still bought a bit more this Friday as the stock seems to finally stabilize around $300, which corresponds to a P/E ratio between x20 and x25 depending on NTM or TTM. It still could go lower though as consumers in the west are spending less while the contrary happens in the East. Let’s see if China and Asia at large can sustain Lululemon’s growth, as this is a big part of the thesis.

We’re still with a long-term investment here and not a short-term play. Being down -10% or -20% over a few months isn’t much of an issue as long as the company continues to execute according to the thesis.

Celsius. The same happened with Celsius. The stock has been falling like a rock over the last Nielsen report which showed slower growth and a small loss of market shares over the last few weeks. I’m not sure anyone will remember those details in three years from now if Celsius keeps growing 30%+ per year while expanding margins & buying back its shares.

Still, the truth is that the portfolio sits at a $68 medium cost, and this isn’t a good medium price for such a position size.

The stock is now playing around this old $50 support and could bottom here if the short-term data restores some optimism. We could still go lower otherwise as growth stocks tend to be harshly punished when things aren’t perfect during a few months.

What matters still is the long-term trends, and those are pretty bullish for now, so there isn’t much to worry about. Simply focus on finding the good accumulation price and creating a proper position size.

Ulta Beauty & Uber. Both are swing plays that I am still holding because the conditions are still good. The trade on ULTA was shared here.

https://x.com/WealthyReadings/status/1796141257758015965

The stock has been flat since but still holding its actual higher low, so only patience is necessary here.

The trade on UBER was triggered after a misunderstanding of its Q1-24, where the company missed EPS estimations only due to a one-time legal fee. It would have beaten estimations otherwise.

The stock then fell and went to retest perfectly its old ATH, which gave a pretty good opportunity. It already recovered a bit and the position is up +9% since, and I have no intention to sell it as long as things go well for the company and I don’t need liquidity.

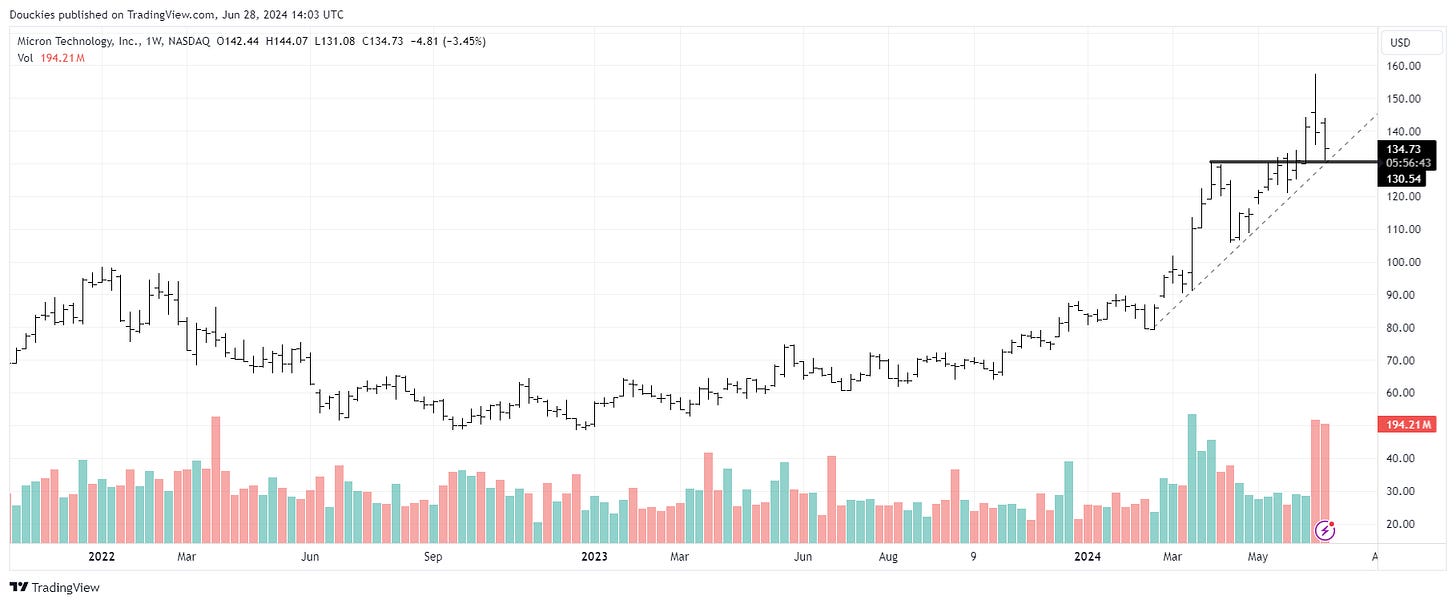

Micron Technology. A new swing I took position on this Thursday after once more, a strong reaction on what seemed to be pretty good earnings with confirmations that fundamentals were very, very strong.

https://x.com/WealthyReadings/status/1806344992685724083

Like UBER, the stock fell to retest an ATH breakout and a weekly trendline.

A pretty good convergence to buy, especially in the current hot sector of the market as Micron tech is selling hardware to scale AI training infrastructures. I’ll gladly grow the position if we bounce on $130 and intend to hold as long as liquidity keeps going into those stocks, hence watching Nvidia closely.

Airbnb, Olo, Alibaba, Palantir, Palo Alto & SoFi. I won’t have much to say about any of them as those are very long-term holdings, and I will only buy at proper valuation as long as execution is good.

I can simply forward you to each investment’s case to understand why I love the company and invest in the stock for the next years - not written on SoFi yet.

Rapid word on On Running & Palantir though, as the first one has been pretty extended lately and is now finally breathing close to prices I’d like to buy around $35. Gonna need a bit more patience here. Palantir is bouncing in its new range between $20 and $26. Still looking to buy a big chunk at the range bottom while keeping in mind that daily gap still waiting to be filled between $18 and $20.

Palo Alto has been behaving very well since it fell like a stone when announcing its new infrastructure and billing plans, and I simply regret not buying more as the investment case for any IT security company is growing by the minute while tech companies are growing their AI infrastructures with billions and billions of dollars and will eventually need to secure all of it.

I will look to grow my position on PANW over the next months - at proper prices.

Bit Digital. Still a very speculative play on the crypto market as BTBT holds both Bitcoin and Ethereum. The recent ETF approval of both should boost demand and revenues for this cycle. Planning to hold until the crypto market smells fishy - we’re not there yet, in my opinion.

Tesla, Meta & Google. Nothing to say here. Wonderful companies, simply not bought enough. Nothing to do but sit on our hands and wait for the market to be capricious and give more buying opportunities, and this will happen without any doubt.

Waiting for it, more reading!

Thank you for reading it all! If you like it, please consider subscribing to receive it all directly in your inbox and not miss a thing!

Everything I share here is free but if you found the content valuable enough, you can always leave a tip!