Portfolio Update

We're not entirely finished with the earnings season but the peak has clearly passed by now. I still have some of my holdings which will report over the next weeks (notably Palo Alto & Lululemon) and the last, but not least, of the magnificent 7 is reporting next week - that's Nvidia. But most of it is done and it's time to talk portfolio as I made some modifications lately and am planning to do more today.

The portfolio was initiated in March while $SPY was already up +9% and has of course lagged the index as I have been deploying cash slowly - still have 50% of it in cash at the moment I write this. Things will take time to show performance but taking cash out and subtracting the $SPY head start, the portfolio would be up +3.8% compared to $SPY up +3.6%.

This is simply to put some perspective as otherwise, the performance looks terrible... But isn't really. Here's the link if you want to follow it.

https://savvytrader.com/WealthyReadings/premium

The portfolio has $100,000 of cash and I won't add any cents to it. Long-term positions should be around 5% of the portfolio's original cash up to 10% maximum to play some undervalued stocks swings - only on great fundamentals, I won't touch any businesses I don't believe are healthy or sound. This is what we'll be talking about today as I'll grow some positions above that 5% limit.

Back to talking about stocks, fundamentals, and some charting. And the portfolio updates.

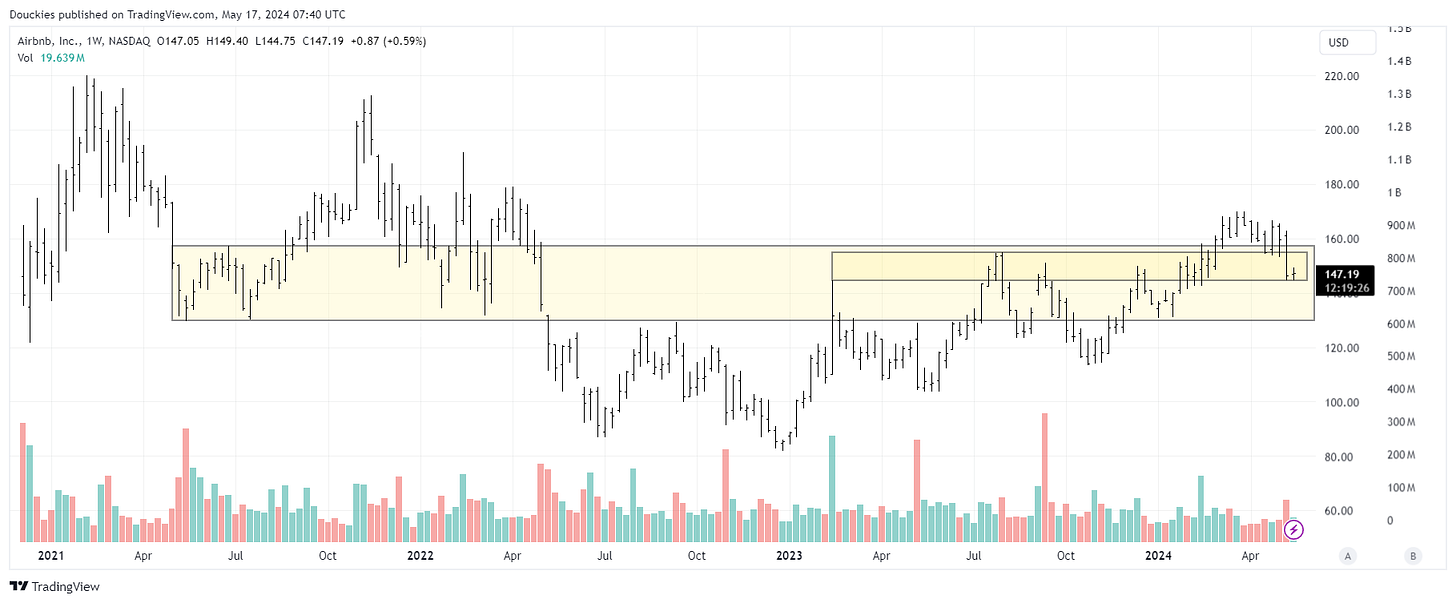

Airbnb. I don't talk enough about this wonderful company & I think the market forgets or doesn't realize its potential which I detailed in its investment case here.

https://buymeacoffee.com/wealthyreadings/airbnb-investing-case

I also commented the company's Q1-24 here if you want the longer version.

https://buymeacoffee.com/wealthyreadings/airbnb-q1-24-earning-call

In short, Airbnb's business has been growing very well, while proposing a service which has very few direct competitors and has one of the strongest network effects I've seen in any market. They're still expanding around the world where data shows a strong attraction to their service & plans to expand to new services over the next years while working on their brand image - with success.

Green lights.

Yet, the market sold their earnings for a "weak" outlook - clearly misunderstood decision as Q2 weakness is due to 2024 calendars and nothing else. The team literally said during the call that Q3 & Q4 should follow up to Q1's growth.

I already talked about its long-term prospect in my IC linked above but the potential returns were computed with the price at the time of writing - above $150.

The price changed but fundamentals & guidance didn't, so we now have a lower price with the same prospects. The only thing left to do for me was to buy the strong weekly retests.

I only use charts on great companies and the only thing I can see here is a missunderstood good quarter from a company that has tremendous potential over the next years & a chart retesting a weekly breakout.

$ABNB's position was a bit more than 3% of the portfolio and I plan to double it while under $150, bringing it to around 6% of it and giving me some room to buy more over the next months as I still am not sure how the market will react to Q2. Guidance for Q3 should restore trust in growth.

I have enough conviction on $ABNB to consider it undervalued & grow the position above 5%.

Lululemon. I talked a lot about this one lately and I will talk about it again! The Investment Case is available here if you don't know the company.

https://buymeacoffee.com/wealthyreadings/lululemon-investment-case

We're with a very different case than Airbnb in terms of business as we're talking about a sportswear brand so we'll have to look at different metrics to detail why $LULU is a good investment - to me. The thesis is simple:

A premium brand whose users are buying more & more and that is reflected in data like revenue growth, margin expansion & strong ROIC. Add to this a very good management who has delivered everything they promised (and more) and you got strong potential as the company continues to expand worldwide - with a strong focus on Asia.

Like Airbnb, the stock has been punished after a lower-than-expected guidance on Q1-24 and beaten down to a point where buying gives enough margin of safety in my opinion.

The base case is pretty conservative as the company is already above 15% of net margin and is guiding to a growth of 10% going forward, although as you can see even the bear case is compelling in terms of returns at today's price.

A great company, a strong and growing brand and a top-tier management. A beaten stock to attractive prices back inside of a very long range, strongly bought over the years.

No reasons for me not to grow the position and I will follow the same reasoning than with $ABNB, pushing to position to more than 7% of the portfolio as I really don't see much downside from here. It would require something worse than my base case to bring the stock lower and that isn't what I expect but I still want to keep some room as Q1-24 results are coming in two weeks and you never know how the market can react.

Alibaba. This doesn't come as a surprise as I talked about my buying on X. I didn't expect confidence in China to come back that rapidly nor the stock to move that strongly on its Q1-24 but it did, and I grew the position on strong fundamentals, good earnings & price action.

It is now time to ride the train, hoping this boy doesn't stop any time soon.

Uber. Everyone here surely knows Uber, I didn't write an Investment Case on it and I probably won't but I'll detail my view and why I'm buying today. This won't be a 5% position of my portfolio because it simply is a swing play, still based on strong fundamentals.

Firstly, why did the stock dip?

https://x.com/WealthyReadings/status/1788177302213288249

My take (which is shared by many) is that investors, as usual, focus on analysts' estimates & ratios but don't read the reports. Facts are, EPS missed and were negative. But if you stop here you didn't do your homework.

The truth is, negative EPS are only due to exceptional expenses due to legal charges and equity investment losses. Take those out, and the business would have shown a fourth profitable quarter with growing margins.

That is what really matters. The business is growing, revenues are growing and margins are growing as the management focuses on profitability and execution - and that will continue over the next years.

So yes, EPS were missed. It doesn't matter, everything is actually going well and the guidance is talking about gross bookings of $38.75B - up +18% YoY. Which means revenue growth largely above +10% YoY and as we expect margins to also grow, we can easily assume that the next years are pretty promising for the company.

I tried to reflect this here but I think none of those cases are right as it's very hard to predict how the company will execute over the next years - although if past is an indication, probably well. Those also assume lower PER than actually - which should happen as the company grows profitable.

I would even say that those are cases in a bear situation and the best case could easily become a base case if the company does execute as we expect them to over the next two years.

Execution will matter much more than one quarter's EPS miss.

Starbuck. I have been looking a bit more into $SBUX but have decided not to pull any trigger not even for a mid-term swing like with $UBER. I don't have enough safety margin nor convictions as the truth is that the issues came from its business. And no one knows when this will change, when users will come back.

Until then there's no reason for me to consider buying even if some consider the stock undervalued - which I don't...

https://x.com/WealthyReadings/status/1788958147391975896

Conclusion. Those are the reasoning behind my buys lately. Grow convictions on strong companies and study them well enough to understand their potential. Wait for the market to punish them with short-term sights or missunderstanding and buy in. This resumes the logic behind buying $ABNB, $UBER, $LULU & BABA.

Let's see where those go in the next months!

As usual guys, I only share my opinion & actions here and everyone has to take their own decisions. Nothing I write is investment advice! I only do me, you guys do you.

Thank you for reading it all! If you like it, please consider subscribing to receive it all directly in your inbox and not miss a thing!

Everything I share here is free but if you found the content valuable enough, you can always leave a tip!