Investment Plan | December 2024

A Review of my Current Portfolio, my Short & Mid-Term Plans and Buys.

I’ve already talked here about my investing methods & how I do things, in theory.

This write-up is about the application, my personal vision & actions in the markets.

Before we start, here is my global view of the economy; this is a pretty important read before going further as it’ll give the arguments on why I buy those assets & why I do not do like most you can read from on X or YouTube or else.

In brief - and not argued, here’s my view of the economy:

Short term - few months, we are still in favor of risky assets, which is why I still am holding the majority of my portfolio in crypto & small caps.

Medium term, from a market point of view, we have all the necessary ingredients to create a nice bubble, with constant liquidity injections, global inflation declining, cheap energy, stable consumers & rate cuts.

From an economy point of view, real consumption is declining, inflation is still real for important products, the labor market isn’t very healthy, and I personally do not see how Trump can apply his most important measures without hurting it further.

My base case is a bubble creation during the next months until it pops, followed or triggered by a return of inflation or a recession - or both.

I am not an alarmist nor one of those who call for a crash every week until it finally happens. But there are concerning aspects about the economy at the moment, although it’s impossible to know if this will lead to a recession nor when, just like it’s impossible to be certain about a potential come back of inflation.

If ever I get that wrong and the economy gets better while the market continues on a healthy upward trend, I will change my view. But as of today, I would rather own safe assets & slightly hurt performance to avoid a potential implosion that be surprised by it and lose capital.

Here’s a basic on portfolio composition which could help shed some light on what I am saying.

Preserving capital is the number one rule of investors.

Portfolio Review.

We’re off with a pretty strong performance, beating the SPY by 28% since inception in September - screenshot is fresh from this morning, left percentage is the portion of my portfolio, right percentage is the performance.

Every purchase was shared in the previous write-ups, be it the weeklies or the last buying plan - except for the KTEC which is the only index available on Savvytrader for the Chinese index & the IAU which is a gold ETF position I started to build recently. I talked about both but didn’t give precise accumulation points.

Portfolio's available here if you want to follow it.

https://savvytrader.com/wealthyreadingspro/long-term

Let's talk about actual actions now, but keep in mind my base case - bullish short term and inflation &/or recession in the mid term, as otherwise what I’ll share below doesn’t make much sense.

Crypto-related assets.

Includes ETH, BTC, CLSK, IREN & SOL.

Short-term, we had a leverage flush yesterday which usually gives the best entry prices. The behavior is simple to understand; as leveraged traders get bullish, they open more positions and accumulate stop losses at key levels, which, once triggered & without enough buyers to maintain the price, will trigger others, bringing the price down very rapidly until the market finds a price with enough buyers - usually spot orders much lower.

These events will continue as long as the market remains leveraged, and usually, many will try to catch the bottom which results in a second flush, often less violent than the first one. This repeats until leverage is cleared and we can go back to a healthy upward trend.

This is why wicks are usually retested, with some examples below on Ethereum.

I am not saying this will 100% happen, but there is a probability to see some choppy days this week or more, and to see $3,500-ish retested - or that this flush was just the retest of the previous wick. I personally have some orders there - and on other coins, to ride what is, to my opinion, the last leg of the actual crypto bull-run.

Medium-term, 3 to 6 months-ish, I intend to be out of all my positions. I have been, am, and will remain a big Bitcoin advocate and continue to consider it as one of the best assets there is. But it still behaves in bubbles and I do not intend to see its worth decline -50% or so without doing anything. I will hold through the bear market a portion of my Bitcoin. But I won’t hold it all. And I certainly won’t hold anything else.

If you’re interested in why I believe Bitcoin is an incredible asset, worth being held in part through its volatility, here it is.

In summary, when I judge the cycle is overheated, I’ll sell 95% of my crypto-related assets, holding only a small percentage of my Bitcoin. And I will of course share everything here when I do.

U.S. Equities.

Includes HIMS, LULU, PYPL, SOFI & OLO.

Things are a bit more complicated with the stock market than with the crypto market, on which I have a very clear view. I’ll divide these stocks into two categories.

The undervalued plays - PayPal, Lululemon & SoFi which I bought based on strong fundamentals & weak price action. They did well, but those aren’t strong enough fundamentally for me to hold them through a potential recession or inflationary period. I intend to slowly DCA out of those positions based on valuation to build others, and will cut them entirely if the market gets overheated.

The fundamental plays - Hims & Olo, which I have strong enough convictions to hold through a bear market, in a smaller proportion. I also intend to DCA out to get some liquidity, based on valuation, but won’t reduce my position below a certain size - in shares, not in dollars.

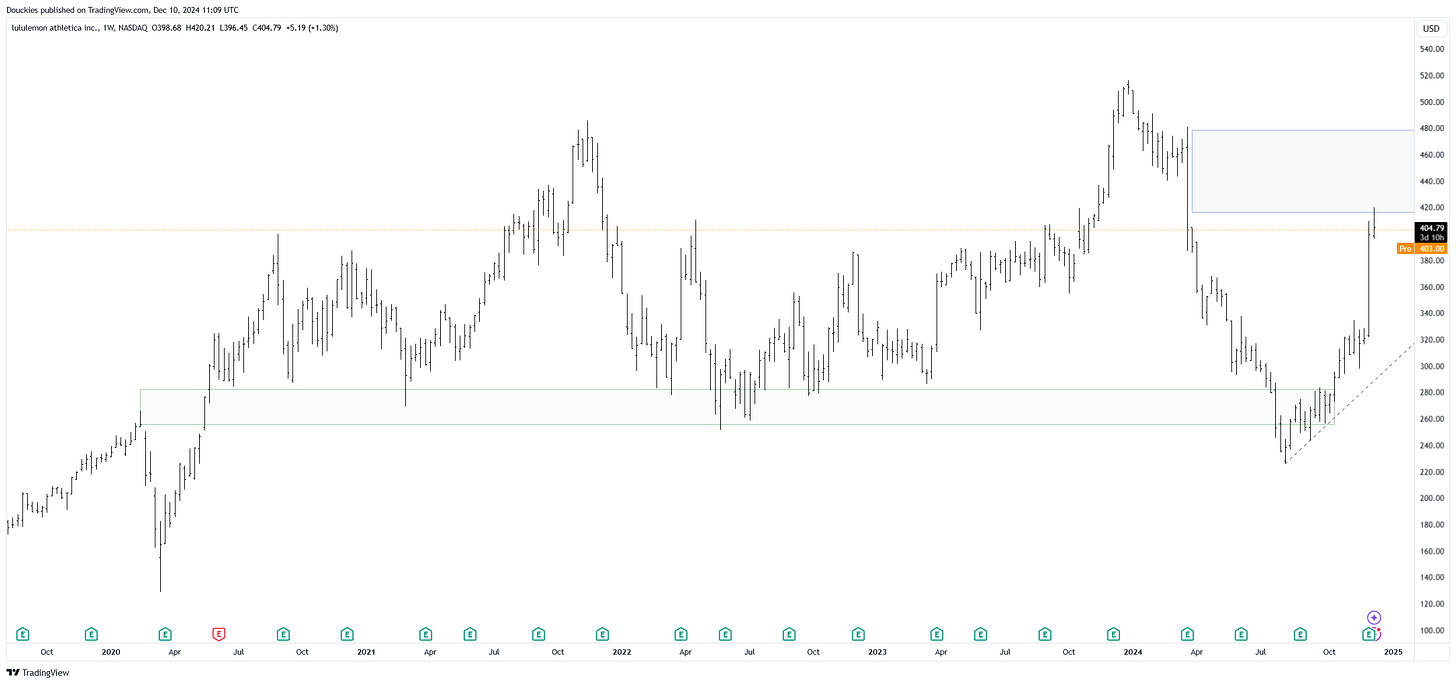

I do not yet have a clear view on how, when & at what price my selling will happen and I will update when I do. None of those stocks are extended enough to start today in my opinion, with an exception for Lululemon which is reaching a huge daily gap created during its last earnings, and is getting a bit pricey.

I will probably take some profits if we reach this gap during the next days/weeks, but I still intend to hold the rest a bit longer for now.

Diversification.

Includes GDX, IAU, KTEC, BABA, AMLP, XES & PDD.

Now we enter the realm of what I am actually buying, and yes, it is very far from what you can read on X or listen to on YouTube. I hold my growth & risk assets, but I don’t buy them anymore.

These are ordered by priority. Gold first, China second & energy third, with a short-term bonus at the end.

Gold.

Includes GDX & IAU.

Gold will probably be the biggest part of my portfolio ending 2025 or so as all my cases involve a return of inflation, and gold is known to be the best asset to store value in inflationary times. There isn't much thinking to do when it comes to it. If your view of the economy includes inflation, it is the best asset to hold. End of story.

My plan is to buy regularly as I DCA out of other positions.

I am in no rush for the moment but I wouldn’t be surprised to hold more than 30% of the portfolio onto gold by half 2025, as long as my view of the economy & the markets don’t change.

GDX is a gold miners ETF which I do not intend to accumulate more. The thesis is that as gold prices rise, miners become more profitable & increase their results & returns to shareholders, while most of their stocks aren’t that expensive. It is a speculative asset based on a defensive one.

China.

Includes KTEC, BABA & PDD.

I shared in the portfolio composition write-up that an investor looking for returns should always be invested in stocks of the most promising geography. It might not be China per se, but it surely is Asia at large.

I chose to buy the HSI around 20,000 points to have a larger exposure to China & to most Chinese companies which could be directly or indirectly impacted by the rise of buying power in Asia. I’ll continue to buy at interesting levels if I have liquidity available for it but won’t prioritize it.

Alibaba is another subject & I intend to grow my position. I said many times that this $90-ish retest looked very good, I already bought & intend to continue.

The investment thesis hasn’t changed at all since I wrote it.

I also chose to buy its little brother the other day as the stock fell sharply on what the market judged to be missed earnings - and I disagreed with that take. The chart was too juicy to ignore as I bought the retest of a long-term trendline.

Any retest on it will be bought.

Energy.

Includes AMLP & XES.

These are two energy plays, which wouldn’t do great in a recession but have an international reach, are impacted by the need for energy more than the energy itself and are currently not expensive.

All the information you need is here.

My priority right now is to accumulate gold, so most of the profits will go towards it, but these two ETFs will also slowly grow in the next months with a slow DCA - slower than Chinese stocks.

For the non-Americans, like me, both ETFs aren’t accessible, so I personally chose to buy individual stocks directly. Performance will be slightly different between my own assets & the portfolio, and I would rather own ETFs than individual stocks, but I had no choice. I chose to buy both SLB & COB and have my eyes set on BKR at $40. Those are more risky than the ETFs, but I personally judged it worth some liquidity.

Celsius.

Here’s the bonus, but I want to stress that this is a short-term play based on what I judge to be a market misunderstanding of Celsius’ business model. The thesis is explained in the conclusion.

I’ve been waiting to see a bottom to confirm that the market is done with its selling, and we might finally be there, just in time for what could be the strongest leg of the market.

I’d love to see a breakout above $30 to buy the retest with a bigger position. If this name shows strength in the next days, I’ll be buying.

Long Term Holdings.

This is where I stand today & my plan for the next months; I know many consider it boring, but that’s fine by me. Preservation of capital is the number one rule and we are not in the safest environment at the moment. I’d rather miss out on some returns for safety than hold assets I do not intend to into a tougher conditions.

But that isn’t true for all assets, so I'll still talk about the assets I plan to buy if we were to see a crash, correction, bubble, bear market, or whatever you want to name a potential downtrend, or gladly hold through it despites of price action.

I will focus on my top picks here; there are more great or undervalued companies, but concentration is important for performance. I’d gladly have the aggressive part of my portfolio concentrated on a handful of them if I could.

Bitcoin.

Always first, you should have seen it coming! I already linked the investment case above so I won’t do it again, but it is all argumented there.

Bitcoin is a commodity and as I said, continues to behave in bubbles with extreme highs & extreme lows. I do not believe we've seen the top of this cycle, but in anticipation, commodities always go back to their production price.

This production price is represented by the gray bands, which are an aggregate of electricity prices per region multiplied by the hashrate of the same regions, so it's an approximation. I have no doubts that we will see Bitcoin back inside of those bands in the next years and I will start my DCA again once we do.

Palantir.

One of the strongest fundamentals I can find on the market.

A name I have been trimming lately on my personal portfolio - I cut around 35% of my total position over the last weeks, which isn’t on the public portfolio because it was already expensive when I created it. The chart speaks for itself…

I personally consider Palantir a buy under $40, so we’re actually at twice what I judge to be its fair price, solely on expectations of what the company could become one day… Which is ridiculous.

Anything back or around that price would be a buy for me.

Tesla.

EVs, self-driving cars, robots, a booming energy branch… One of the strongest convictions of my portfolio, and I don’t intend to sell any shares, whatever happens in the market.

It remains impossible to value Tesla to my opinion, but I have very little doubt that this company has and will continue to change the world.

Continuous accumulation & hold is the best to my opinion, and its value certainly increased since I bought last around $160. Next year will be important for Tesla but to my opinion, everything under $300 is a good deal for the long term, while $250 will be a no-brainer for me.

Meta.

The social network king turning itself into so much more.

I’m part of those who believe that Meta isn’t that expensive, even today, but I still wouldn’t be a buyer.

The market & the stock need to cool down a bit to give great entry points, although this name remains one of the strongest at the moment, and it’s hard to know when we will have an opportunity again.

Transmedics.

Disrupting the transplants sector.

This boy is a different topic as it already is cheap to my opinion, fundamentally. But the market disagrees as it worries about next year’s growth.

There are two teams from here: Those who will DCA the downtrend and those who will patiently wait for a bottom. I’m on the second team as I try to avoid buying downtrends, but I would understand both on Transmedics.

I chose to remain patient because of my global view of the market and of that daily gap which still hasn’t been filled under $55, but I will start a position the second the market gives me the green light.

Others.

I have to mention some other names like Hims, of course, but also Google, Airbnb, On Running, Olo & more which I will always keep an eye on and will have a spot in my portfolio under the right conditions.

Here’s an overview of some U.S. equities I consider to be great and what I judge to be a fair price at the moment.

It doesn’t mean I will buy them all if I had the proper price. It means I will continue to look at them even if I am a gold buyer at the moment. Priorities will eventually change with time so it’s important to keep informed.

Conclusion.

I’ll start with the same sentence I used in my detailed Macro & Investment Narratives write-up.

“It isn’t a call for a market crash or the strongest recession ever.”

I have no idea what will happen in the next months but we all have to make decisions based on what we know, understand & think. I shared my view of the economy in the last write-up; this one is about what I do with it, although, once again:

“the economy & the markets are two wildly different things.”

One is driven by consumers, the second by liquidity, but they always end up crossing each other at one point.

For that reason, I am a seller of risky assets - cryptos & some U.S. equities, and a buyer of defensive assets - gold & energy, at the moment, while I transfer the risky portion of my portfolio to Chinese equities.

I will ALWAYS hold long term high conviction assets in any market condition, like Tesla or Palantir - which aren’t in the public portfolio only because of a timing issue, but which I personally own. Some positions are just not meant to be cut as long as the company is healthy & doing well.

This is my global plan for the next months. Once more, you have the portfolio here if you want to follow it on a day-to-day basis to see what I do & when I do it, but you will always receive the argumentations in your inbox.

https://savvytrader.com/wealthyreadingspro/long-term

Again. Very bullish for the next 6 months or so. Pretty bearish for the year after that. Timings are of course give or take and I’ll adapt my view & plans with the economy, market & policies applied after Trump takes office. Lots of factors to monitor, but this isn’t set in stone.

From now on, time will be the only judge.

Thanks very much for laying out your thoughts and action plan. I agree that CELH looks bottomish and it could yield some return as we continue to see a bullish trend.

Just curious, did you mean that as a European you can’t buy AMLP and XES? Thanks.

No problem, that's what this substrack is for 🫡.

Exactly, at least from Portugal there are regulation restrictions and I cannot buy them.