Portfolio Modifications - 06/23/2025

Venture Global, Sea Limited, Bitcoin & Alibaba.

I’ve always said that fundamentals, research & convictions matter, but beating the market comes down to execution. That’s what these write-ups will be about.

I will share through them every change in my active portfolio - stocks & options, reasonings & plans, before I even hit the buttons. I won’t update DCAs, I will only share my plans & new/closed positions in these write-ups. You can follow the rest directly on savvytrader.

https://savvytrader.com/wealthyreadingspro/active

I also recently opened a Buy & Hodl portfolio on which I will DCA $4,000 every month & focus on buying the best assets I can at the best possible price, 100% focused on fundamentals & valuation, without any active management.

https://savvytrader.com/wealthyreadingspro/buyandhodl

Keep in mind that both portfolios have completely different goals and I can behave very differently on both for the same name - accumulating in the buy & hodl while selling in the active portfolio for example. Different rules apply.

My goal is to deliver alpha over the long term, not just six months under easy market conditions. If/when proven this content is valuable, it will be shared behind a paywall. No rush, though; it’ll stay free until proven valuable.

So here’s the deal: you get full transparency on my trades, right when I make them. If - and only in that case, it brings real & long-term alpha, it’ll be accessible only for a fee. I believe that’s fair enough, but feel free to provide feedback!

Active Portfolio - Reduced Bitcoin position, increased Alibaba position & Sea Limited buy.

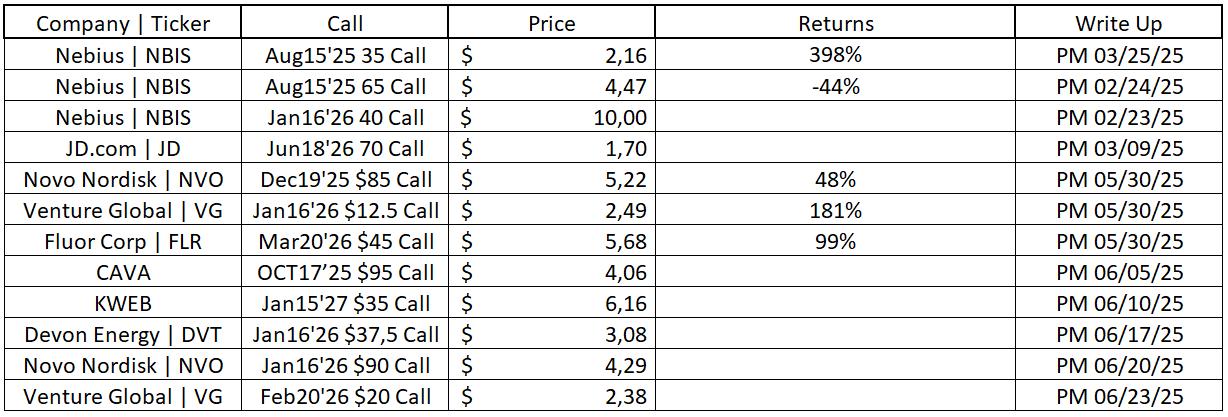

Option Portfolio - VG Feb20'26 $20 Call & NVO Jan16'26 $90 Call accumulation.

It seems that Substrack was broken and this write-up was apparently not sent to you earlier today… So I am trying to send it again, hopefully this time will work.

Buys.

This will be a pretty rapid write-up as every plan was shared earlier.

Venture Global Feb20'26 $20 Call @ $2,38.

This is what I shared Friday when I closed my position on VG after 181% profits:

“It will probably go higher in the quarters to come, but I expect the stock to take some time to form a real accumulation range or pullback… It might not, and I’ll be happy for holders then, but I had to take profits.

I’ll keep an eye on both stocks and will open new positions if given the opportunity as both remain great candidates for the next years.”

And this is what is happening today without any valid reasons in my opinion as even the escalations in the Middle East should not really impact LNG business negatively - on the contrary, as it should grow the demand for it, not to rely on a scarce resource mostly located in a conflicted region.

I couldn’t find any reasons for this sell-off and at this point, we should have some. My only interpretation is some overreaction in the energy sector combined with big profit-taking after such a run-up.

Price action is perfect, position is pretty big, and I will make it bigger if we stagnate at those prices instead of bouncing directly.

Novo Nordisk Jan16'26 $90 Call.

Bought a bit more - still very small position, on NVO today.

Sea Limited.

I also opened the position on Sea Limited on the trading account, no option, just a big position in shares.

How much is paid