Portfolio Modifications - 04/01/25

Trim: Hims & Hers.

I’ve always said that fundamentals, research & convictions matter, but beating the market comes down to execution. That’s what these write-ups will be about.

I will share through them every change in my active portfolio - stocks & options, reasonings & plans, before I even hit the buttons. I won’t update DCAs, I will only share my plans & new/closed positions in these write-ups. You can follow the rest directly on savvytrader.

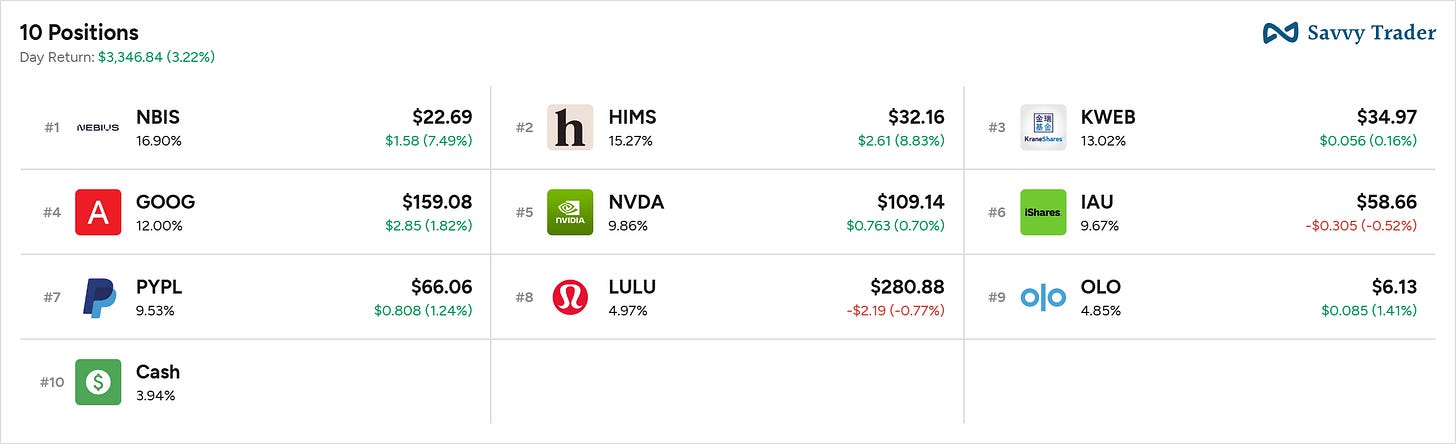

https://savvytrader.com/wealthyreadingspro/long-term

I also recently opened a Buy & Hodl portfolio on which I will DCA $4,000 every month & focus on buying the best assets I can at the best possible price, 100% focused on fundamentals & valuation, without any active management.

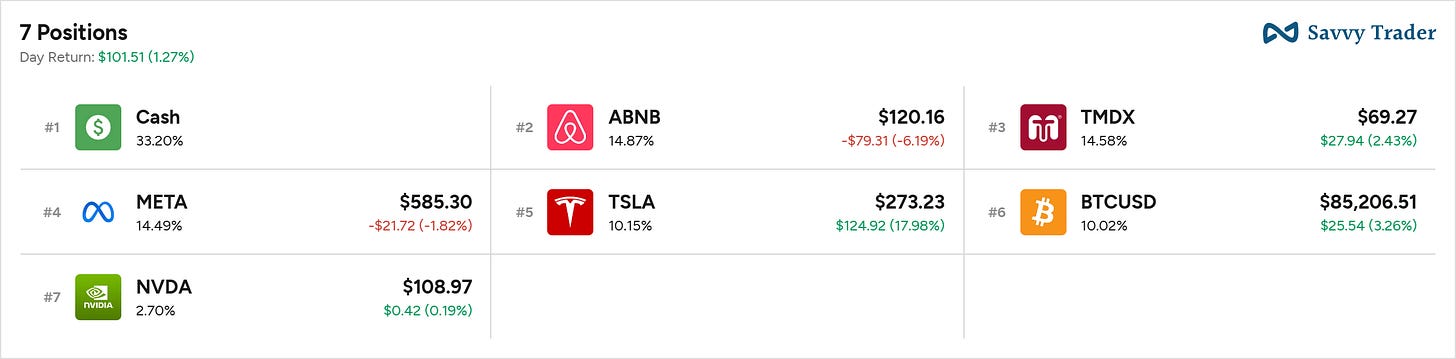

https://savvytrader.com/wealthyreadingspro/buy--hold

Keep in mind that both portfolios have completely different goals and I can behave very differently on both for the same name - accumulating in the buy & hodl while selling in the active portfolio for example. Different rules apply.

My goal is to deliver alpha over the long term, not just six months under easy market conditions. If/when proven this content is valuable, it will be shared behind a paywall. No rush, though; it’ll stay free until proven valuable.

So here’s the deal: you get full transparency on my trades, right when I make them. If - and only in that case, it brings real & long-term alpha, it’ll be accessible only for a fee. I believe that’s fair enough, but feel free to provide feedback!

Active Portfolio - This one changed for the first time since long as I did trim some Hims & Hers today.

Buy & Hodl - Added the monthly liquidity this morning & continued to accumulate some names. Slowly, keeping cash in reserve as I am still not bullish medium term.

Sell.

Hims Shares & May16 ‘25 31 Call @ $5.53.

We had good news today on Hims & Hers, but I still decided to sell a small portion of my position as I am not very bullish on the market in the medium term. Even if I am expecting a bounce in the next few weeks, I’d rather be a bit conservative and raise some cash early enough this time.

I sold 20% of my shares for a 57% gain and closed my calls for a 38% gain.

We will cover the news on Sunday in the report, but briefly, the company announced that they will sell Eli Lilly’s branded GLP-1 drugs on their platform starting today. This isn’t spectacular in my opinion in terms of business, but it shines some light on the potential legal issues Hims could have faced. It shows great relations between both companies, and this is important enough. More information on Sunday.

Besides this, price action isn’t everything but what I see here is a retest of a lost support, and even if it happens on a good new it doesn’t mean it will hold.

This isn’t a bullish chart.

I want to be clear though: Now that I have finally dissociated my buy & hold from my active portoflio, I will use the latter for swings & trend following much more often, it means the behaviours will be entirely different. I will gladly accumulate Hims shares on the Buy & Hodl if we reach my desired price while I will sell on my active portfolio. Different objectives mean different behaviours.

I remain really bullish long on Hims. But I am not short term bullish.