Portfolio Modifications - 03/25/25

Option Calls: Alibaba & Nebius.

I’ve always said that fundamentals, research & convictions matter, but beating the market comes down to execution. That’s what these write-ups will be about.

I will share through them every change in my portfolio - stocks & options, reasonings & plans, before I even hit the buttons. I won’t update DCAs. I will only share my plans and new/closed positions in these write-ups - you can follow all transactions directly on the portfolio if interested.

https://savvytrader.com/wealthyreadingspro/long-term

My goal is to deliver alpha over the long term, not just six months under easy market conditions. If/when proven this content is valuable, it will be shared behind a paywall. No rush, though; it’ll stay free until proven valuable.

So here’s the deal: you get full transparency on my trades, right when I make them. If - and only in that case, it brings real & long-term alpha, it’ll be accessible only for a fee.

I believe that’s fair enough, but feel free to provide feedback!

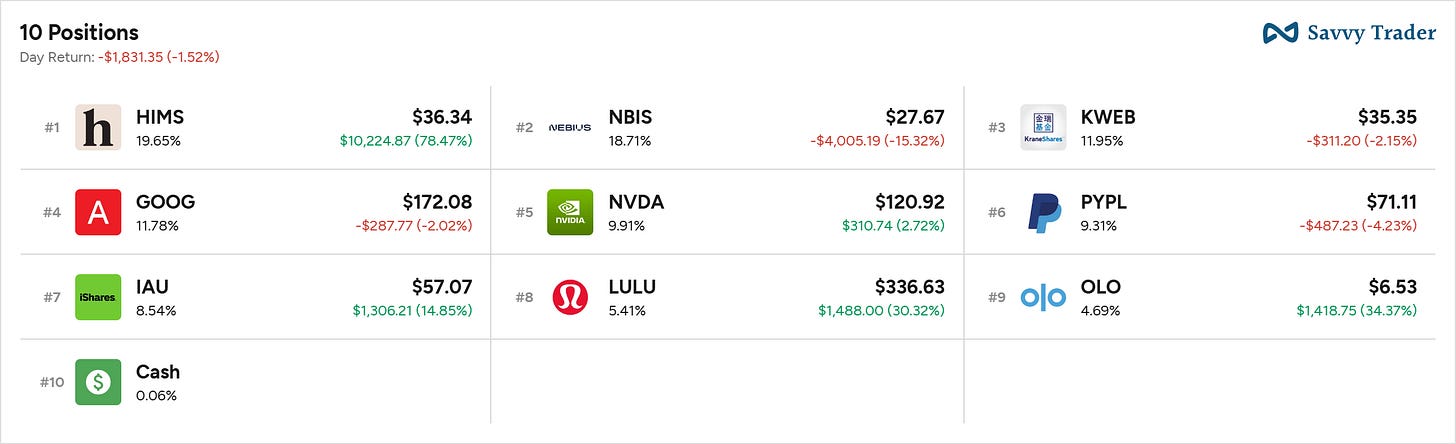

Pportfolio didn’t change at all since last time; it’s down 4% YTD as Nebius hasn’t been the best student lately.

Sell.

Alibaba | Jan16'26 100 Call @ $41.11

I took profits on calls I bought months ago, before I started sharing these write-ups, but I have to talk about the selling as I’m using the gains to buy more risk, not using fresh capital for it - I haven’t pushed any capital into the market for some time now, building a cash position.

It’s a bit weird to be selling long-term calls on a company I am very bullish on, which executes perfectly in a region I believe liquidity will go toward. Truth is, I was sitting on 336% gains & wanted to cash in some. That’s why I play option calls, to boost returns, not to be greedy as those have more inherent risk.

We’ve had big & rapid returns with 67% in ten weeks, and even for someone as bullish as I am, I wouldn’t be surprised if the stock took a breather.

This is why I am taking profits as for calls, time is literally money and if the stock were to consolidate for weeks or months, I’d lose tons of gains. I still believe we’re going higher & I’ll gladly buy more calls in the next months if we were to have a small correction.

For now, I have been saying for a long time that I was expecting a bounce in U.S. equities and it took a lot of time to come but I believe we’re there, hence buying more risk on U.S. equities right now, while the Chinese narrative could take a breather for the next few weeks. That’s what I’m betting on.

Still holding my shares though.

Buy.

Nebius | Aug15'25 35 Call @ $3.69

And this is why I am buying Nebius calls. Again. I only put 17% of my gains back into those calls, so I am not taking much risk here & I intend to keep the rest in cash and very probably sell puts with them. I will keep you posted.

In the meantime, you guys know my take on the need for computing power, and the market is just globally pessimistic lately, which doesn’t mean the narrative isn’t bullish anymore. Nvidia Investment Case tomorrow will detail how bullish I am.

I really expected Nebius to bounce on the breakout retest & you know I went big at that time. Calls and shares are underwater, but I am holding everything I shared and bought - NBIS Aug 15 '25 65 Call and NBIS Jan 16 '26 40 Call.

The stock is now in a beautiful range and I wouldn’t be one bit surprised to see it bounce back to its top around $40 in the next weeks, as long as we don’t have any terrible news or announce, that is.

I do not expect any as we have no significant macro release coming & tariffs aren’t scaring the market much - we have a new deadline coming on the 2nd of April but most have been announced, and we would need Trump to go crazy to scare the market now. The FOMC also gave lots of hope, as I shared Sunday in my review.

I do believe the negativity is passed and it’s time for the bounce I’ve been waiting for, but I don’t think we’re going back up structurally, hence the calls expiring in August and not later.

I’m piling more risk on in a risky environment, to be honest. But the rewards could be really good as most of the market participants are turning bearish, and this kind of negativity isn’t usually a sign of a top - on the contrary. Hated rallies are a thing and leaving most behind would be a good thing for a bounce.

That’s my play. It’s risky but controlled. Let’s see where it leads.

Appreciate these updates as always!