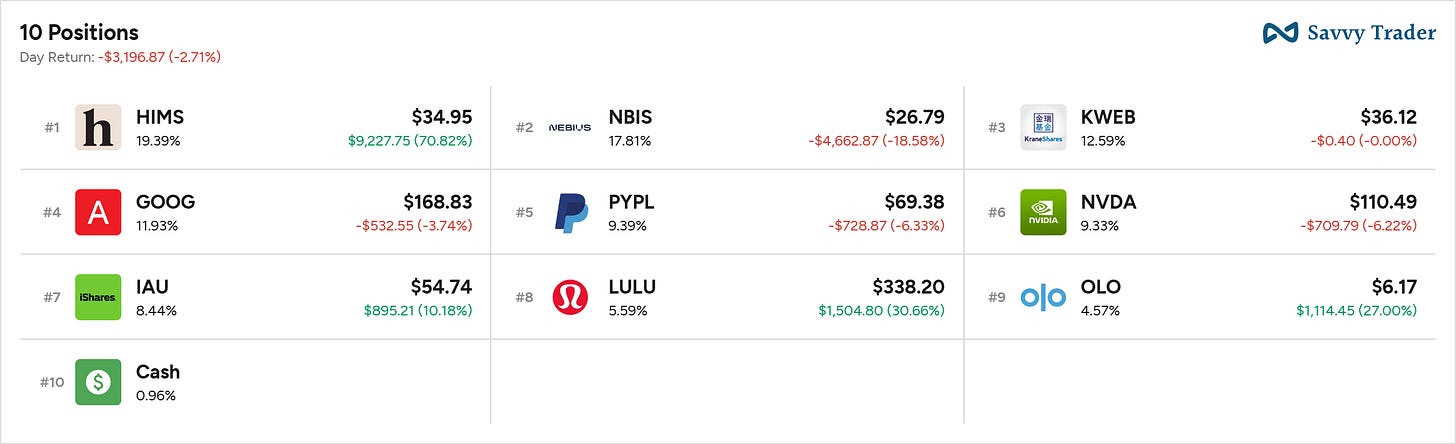

Portfolio Modifications - 03/09/25

Shares DCA: Google & PayPal | Option Calls: Airbnb & JD.com.

I’ve always said that fundamentals, research & convictions matter, but beating the market comes down to execution. That’s what these write-ups will be about.

I will share through them every change in my portfolio - stocks & options, reasonings & plans, before I even hit the buttons. I won’t update DCAs. I will only share my plans and new/closed positions in these write-ups - you can follow all transactions directly on the portfolio if interested.

https://savvytrader.com/wealthyreadingspro/long-term

My goal is to deliver alpha over the long term, not just six months under easy market conditions. If/when proven this content is valuable, it will be shared behind a paywall. No rush, though; it’ll stay free until proven valuable.

So here’s the deal: you get full transparency on my trades, right when I make them. If - and only in that case, it brings real & long-term alpha, it’ll be accessible only for a fee.

I believe that’s fair enough, but feel free to provide feedback!

Portfolio doesn’t change.

I continues to buy DCA on Google & PayPal this morning as I am still expecting a bounce to happen & believe we’re close to the bottom. Short term positions.

Buy.

Only buys today as I pushed some liquidity into my option call broker to be a bit more aggressive on the Chinese market. Before starting, all of the purchases here represent around 2.5% of my portfolio. We’re talking about aggressive positions but really not a lot of liquidity.

It’s often the case with options, as risks are much higher.

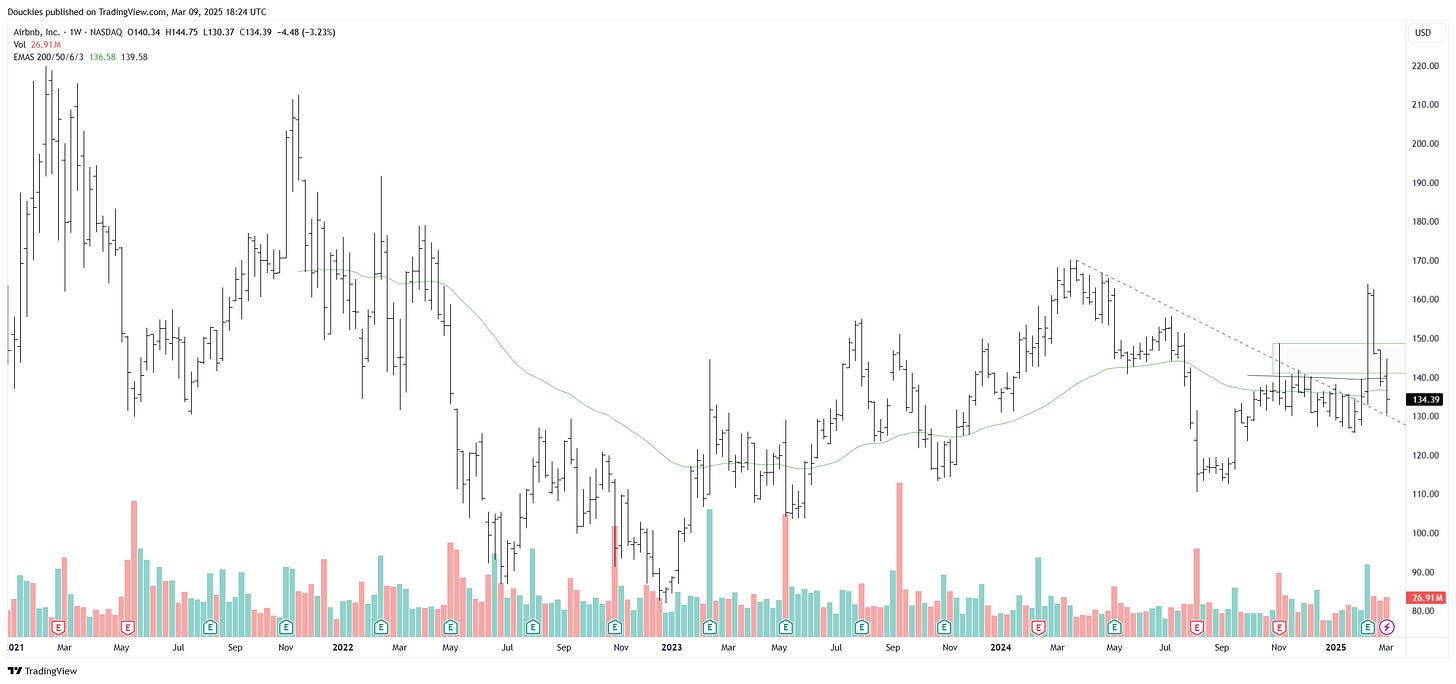

Airbnb | Aug15'25 195 Call @ $1.21.

You guys know my opinion on Airbnb. I love the company, I love the management, but no one loves the stock. Now, I chose to buy option calls & not shares for a specific reason: I am not optimistic about Westerners’ buying power over the next months, years.

One of the first things struggling households cancel is holidays. If my thesis is right for FY25, many Westerners will slow down on those, hence less usage of Airbnb. While easterners - those with growing buying power, aren’t using Airbnb much locally and aren’t used to the platform.

This is an issue, and it’s why, although I love the company and am bullish very long term, I am not comfortable owning shares right now. Calls are a different story, and you’ll notice those are six-month calls. I have a few reasons to be bullish short term.

First, quarters are still great for now. We’ve seen it recently with better-than-expected results and lots of optimism, while management said they would share their business expansion plans in the coming months. This means we will finally see a new revenue source for the company, which will build optimism.

Second, more broadly, I’ve shared many times that I’m bullish short term as liquidity is still positive, and we’re due for a bounce in the next few weeks.

The stock finally passed above the trendline. The quarter confirmed the data was solid and made the market happy, and we are now retesting that breakout due to a sell-off that has nothing to do with the company itself.

To me, this is the retest before continuation. Even if I’m not bullish for the next few years - not on the company, but on its sector, there are few reasons to be optimistic, short term.

I’m playing a bounce here, with enough time to see another quarter and the launch of their new services in production. I’d love to own shares, but I don’t think we’re in a good spot to start accumulation - unless you’re comfortable holding for the next decade & through potential big drawdown.

Market speculation on very strong fundamentals & a company I love.

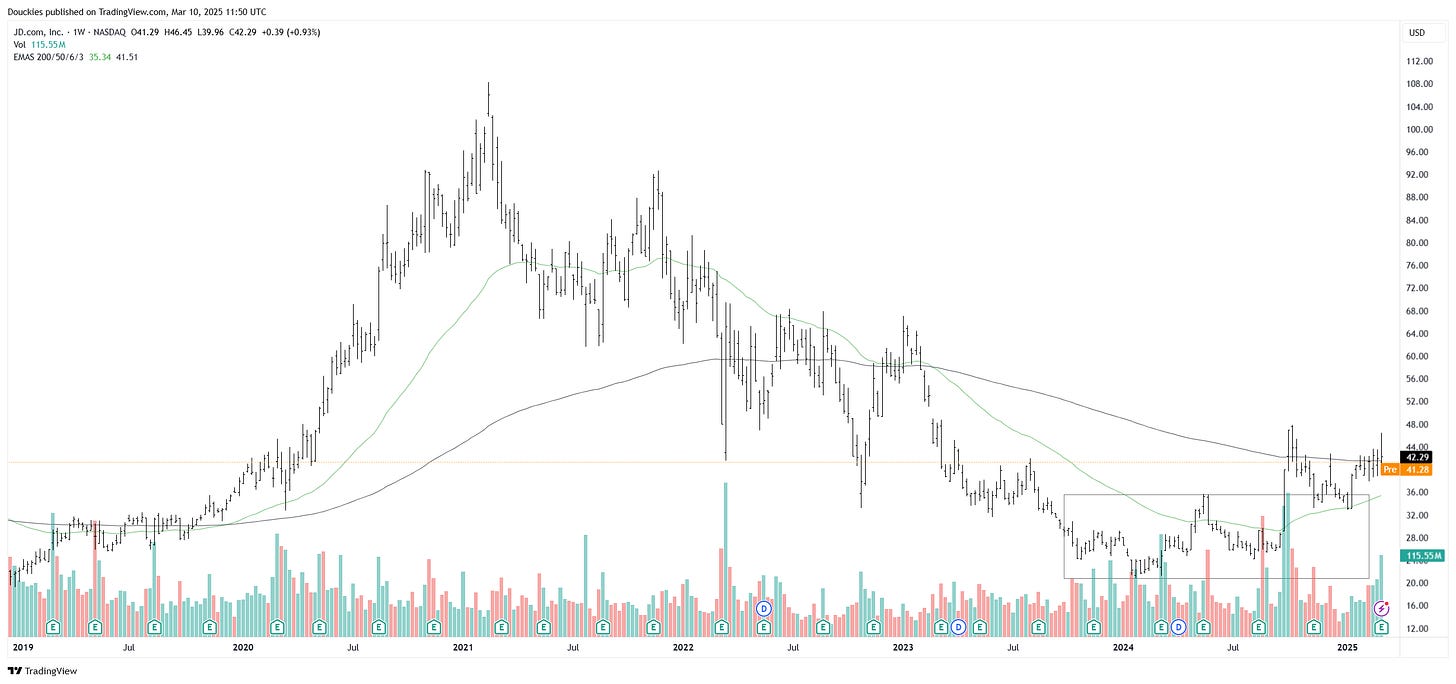

For the rest, you need to read my investment case on China; otherwise, these moves won’t make much sense.

We have a small pullback due to the inflation data that came out and calmed some expectations. As I said, I don’t mind a small setback; policies are strong for the long term. So, I’m starting to build long-term aggressive positions.

JD.com | Jun18'26 70 Call @ $3.09.

We’ve talked about it in the China Investment Case as one of the most interesting e-commerce bets in China, and its last quarter confirms how strong the company is. There’s very strong potential here, and this stock is still lagging behind some cloud plays like Alibaba or Tencent, which have already delivered nice returns.

The market gives those names the premium they deserve above their e-commerce branches due to their cloud and AI segments, which JD doesn’t have. But JD has a much stronger e-commerce part, which is part of my bull case in China - growing consumption.

It clearly has a place in a portfolio as long as we give the market enough time to acknowledge the potential and for China to show confirmations of growing consumption.

Price action is also very positive, ranging in a higher box after a first pump late 2024. I’ll continue to say that the Chinese trade will be volatile, so I wouldn’t be surprised if we were to go and retest the low of this box - 10% or 15% lower than today’s price, but that wouldn’t concern me. It would just make me buy more.

As these calls are for more than a year, this potential retest won’t be much of an issue if it happens. But it surely is time to start being more aggressive on China, without using all our powder.

I have more companies under my radars but that will be my only call play for China today.