Portfolio Modifications - 02/25/25

Sell: Crypto | Buy: Google, Nebius, Hims | Selling & Buying List.

I’ve always said that fundamentals, research & convictions matter, but beating the market comes down to execution. That’s what these write-ups will be about.

I will share through them every change in my portfolio - stocks, options, everything. You’ll have access to each move I make, the reasoning & the plan behind it, before I even hit the buttons.

My goal is to deliver alpha over the long term, not just six months under easy market conditions. If/when proven this content is valuable, it will be shared behind a paywall. No rush, though; it’ll stay free until proven valuable.

So here’s the deal: you get full transparency on my trades, right when I make them. If - and only in that case, it brings real & long-term alpha, it’ll be accessible only for a fee.

I believe that’s fair enough, but feel free to provide feedback!

I promise you guys that I won’t be spamming you as much as I did this week & that I usually am not a degenerate pushing buy & sell every day. But so much is happening at the same time that I ended up rebalancing the portfolio more than I’d wish.

Here’s the actual situation.

I also got caught up at work, so I couldn’t send this report right in time for some transactions. The public portfolio was shared on the right timing, though.

Sell.

Cryptos | Bitcoin @ $87,464 & Ethereum @ $2,374.85.

I cut both positions today as I said I would yesterday if we were to lose our bottoms. Guess what? We lost them, and it doesn’t seem a small wick like we had some time ago - more like a real correction, but I could be entirely wrong.

For those who wonder, I remain a very, very big bull on Bitcoin fundamentally, but the asset continues to follow bubble-like patterns, and I won’t hold through an entire leg down. Next support lies around $70,000.

It’s very hard to anticipate how things will unfold, but as the asset loses its bottom and the market is clearly unhappy, I see no reason to keep too much risk on the portfolio and would rather miss some gains than accept a -30% drawdown.

Ethereum looks much better in terms of price action - because it didn’t move for two years. But again, I’d rather follow Bitcoin’s signs and leave it behind. We always have the possibility to start positions again with cash; we don’t have it with losses.

I will keep cash aside to rebuild a position when a bottom sets in or when we start to see a new uptrend. Until then, I have no reason to remain involved as the chances of V-shaped recovery are kind of low - except in the case of a crazy announcement.

Buy.

I’ve shared many times that I was expecting a correction due to the current economy. I’ve also shared many times that I remained a buyer as long as liquidity was positive and it still is at the moment. I don’t believe we are headed toward the correction today. We will, but so far, I continue to buy.

Hopefully, I’m right.

Google @ $179.39.

I opened half a position on Google today as the fundamentals remain damn strong while the price action is converging toward some great signals.

The stock is now in a monthly breakout retest and filling a daily gap while trading at forward multiples below its 10Y historical average. Nothing justifies this drop besides market sentiment. At the end of the day, price is all that matters, but not buying this price action on such a company would be criminal.

The 50EMA is waiting around $170 & I wouldn’t be surprised if we were to go there. I kept cash to grow the position if so & still have assets I’d sell to buy Google at those levels.

As long as bottoms are held - above $165, I’ll consider this a temporary correction & a buying opportunity and will DCA. Follow the portfolio for the DCA.

Nebius @ $35.71.

We went over this one already, right? Nothing changed. No signs of lower demand for their products, while we actually have signs of growing demand for hardware as China said they needed computing power.

The thesis remains the same, so I’ll continue to DCA.

Hims @ $40.42.

This one is a bit of a knife-catcher, but as I shared in the detailed review, I understand the sell-off but I don’t necessarily agree with it. Fair price remains around $25, so I won’t grow my average above this value.

But I do not think Hims is done, nor that the stock won’t go back up. This isn’t a growth-death story like Celsius, in my opinion - not yet, at least. We’ll need confirmations that Hims can do it, but the thesis remains strong for now.

Real support is at $35. The big test will happen then, and I’ll be patient to see how price action behaves. If we get some consolidation around that price, I’ll be a buyer again. Until then, hold and chill.

Selling List.

I still have 13% of the portfolio in cash and can raise more if I need to, under certain conditions.

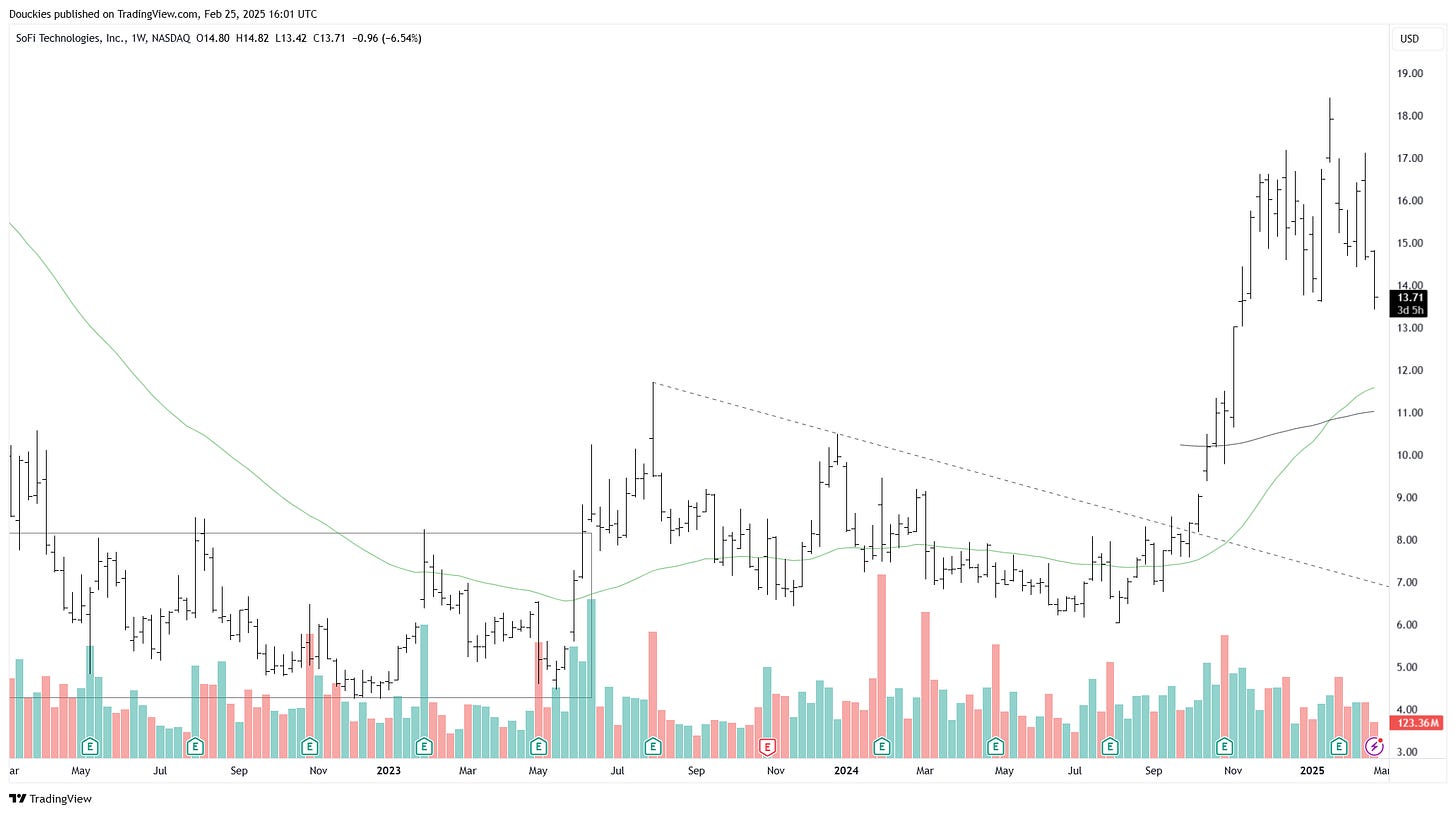

Selling | SoFi & Lululemon.

I would like to hold the name, but if it does end up breaking its bottom at $13.50, I will sell and take my profits as the next support would be about 20% below.

For Lululemon, I do not intend to sell it unless I need liquidity. I trimmed it already, but the fundamentals remain strong & the price action is pretty chill considering the day. No reason to sell strength, except for a better allocation.

Buying List.

Besides the names shared here, I keep my eyes on Uber @ $70 and Nvidia @ $121 while PayPal can also become interesting but I am no sure is the best bet on the market at the moment. Undecided yet on it but I did some operations today & we need to let the dust settle before doing more.

Follow the portfolio for the DCA. I’ll only update for sizable position changes or option plays.