Portfolio Composition.

What asset goes into my portfolio, when & why.

This is the first part of a two-part write-up where we’ll talk about asset rotation & portfolio composition. We’ll see the basics here on why & how liquidity rotates, and we’ll talk about the actual macro situation next week to see where we are at & what indicators I focus on to watch and anticipate potential rotations - and try to extract the best performance from it.

Investing is about performance and I am not the biggest believer of Buffet’s buy-and-hold strategies. It’s good for some assets, for a portion of a portfolio, but not all of it. Some periods will be favorable to stocks, sometimes gowth & sometimes value, others to gold, and others will require to change geographies.

We should constantly adapt & try to be part of the biggest trend to extract the best performance. And while everyone is a genius in bull markets, things are very different when the tide turns. And the tide always turns.

Assets & Opportunities.

The world has many more assets than just stocks: commodities, bonds, cryptos, indexes, real estate & more, spread across different geographies & economies. Even cash, which is mostly seen as something “normal” to own - not as an asset, is one and should be held sometimes and sold others.

We have been blessed with one of the biggest and strongest bull markets ever since the crisis of 2008 and the money creation that followed. But again, things change, and this will also change one day.

The technological advancements, especially the internet, transformed investing for retails. While many were “stuck” in their country with access to their currency, bond, and stock market, we can now access most geographies around the world without leaving our chairs - if you live in the West at least.

This write-up will talk about these different assets and when, why & how I buy (or intend to buy) each. I’ll focus on portfolios so I won’t talk about real estate; when I talk about bonds, I mean government bonds delivered in local currency.

The Permanent Portfolio.

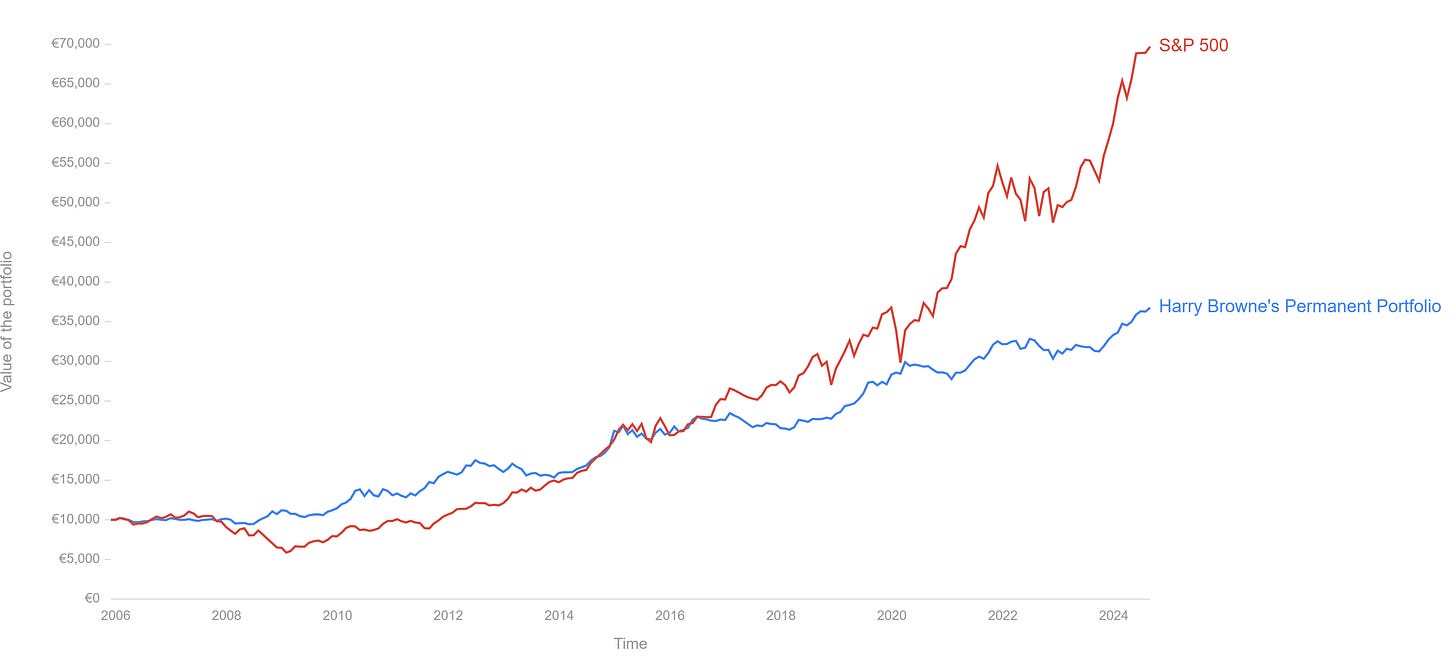

Harry Browne was known for developing what is now called the Browne - or permanent, portfolio.

A portfolio meant to yield correct real returns - after inflation, in any kind of economy with the least volatility possible. Its composition is pretty simple, with four major asset classes divided into equal parts. Each asset is meant to thrive in specific situations and compensate for the others, hence returning stable but correct real returns.

Most of the time, investors need to withdraw their investment because they need cash - often during crises, which usually correlates with poor performances from the S&P 500, as your need for cash typically coincides with poor economic conditions.

The Browne portfolio avoids those situations as it performs well in every economy, allowing investors to withdraw whenever they need with a positive performance. Many investors value stability above performance, and that is what this portfolio proposes.

It became the basis for most portfolio compositions.

It isn’t used much nowadays because of our new technologies & our capacity to invest in different geographies, allowing investors to escape their local economy. As stocks are globally the best performing assets, many would rather invest in another stock market if their local economy isn’t favorable to a stock rally than to buy anything else; the game nowadays is to be where the biggest performance is, and this usually is where the economy is the most favorable to a stock rally.

Let’s start with the portfolio and detail how & why it works before we talk about how it affects my own investing in the future. From a very high level, there are two factors that impact an economy: growth & inflation - and of course their opposites: decline & deflation.

Inflation & Deflation.

We talked about inflation & other concepts a few times already; most were explained in the Bitcoin Investment Case so I won’t come back on them.

Inflation can be seen from two prismes: the growth of monetary supply or the rising of prices. We’ll use the second definition on this write up which once again, is always a consequence of the first one but can also be impacted by other factors.

Inflation is the base situation of our western economies and is healthy as long as it is controlled - lower than our economy’s growth. It’s supposed to favor consumption & value creation and is a prerequisite for a thriving economy - and therefore a thriving stock market.

You want to own stocks in this situation but you could also hold gold & bonds, for a probably lower performance & less volatility. But we’re looking for performance so we’ll try and focus on the most performing asset in each condition.

An hyperinflation or stagflation is the opposite - when inflation is stronger than growth. It is probably the worst situation and the hardest to get out from. The local currency is constantly devalued, everything gets more expensive; it hurts consumption, companies, the labor market, and therefore the entire economy.

In these conditions, the only assets performing are usually scarce assets like gold - we could include Bitcoin fundamentally but its price action isn’t showing it yet.

During deflation, prices decline, growing purchasing power for those holding cash which creates an environment where most won’t invest their money. Why take risks when your buying power improves without doing anything?

Bonds can also be appealing as risk-free investments in a cash-yielding asset.

Growth & Decline.

Both inflation and deflation can happen in economic growth & decline. They are a defining criteria for which assets to turn to but aren’t enough by themselves.

A framework for growth could be drawn with some key components: adding value to an economy brings growth; and as I always say, value is energy transformed. To have a strong & growing economy, a country will need access to ressources, energy and a strong labor market.

It will help to have control over their currency and access to ressources & energy with it, infrastructures and a strong rule of law, but growth can happen without those three other factors - it cannot happen without the two firsts.

The Combos.

There isn’t a specific asset to hold for a growing or declining economy; we have to pair these with monetary policy. Below is the best theoretical framework of which asset to own in each situation.

Growth + Inflation = Stocks.

Growth + Hyperinflation = Stocks & Gold.

Growth + Deflation = Cash & Bonds.

Decline + Inflation = Gold.

Decline + Deflation = Bonds.

If you want a visual.

Once again, this is true for investors who do not have access to different geographies; they will want to jump ship depending on their country's economic situation - and this is why the Browne portfolio was so widely used & performed well back then.

In an ideal world, the best portfolio would be a 100% stock portfolio rotating between growing geographies. But real life is more complicated than that and by now, most investors try to balance the proportions of each asset in their portfolio depending on their personal objectives & perception of economies. There is a strong preference for stocks, but diversification remains important under certain conditions.

Portfolio management is a constant asset rebalancing, taking advantage of great economies sometimes & preserving capital other times. Now, those rotations do not happen overnight every month so there are no need to rotate assets regularly. We’re talking about fundamental shift in economies which can last years or decades.

You would have had great results holding the SPY over the last decade, but you would have had even better returns if you had a portion of gold on your portfolio when inflation started in America. And you would have done even better if you had allocated a portion of your portfolio to Bitcoin during the same period. This would have needed only one or two rotations in a decade - assuming there were no plays with individual stocks, but you get my point.

Examples.

Let’s use some examples to illustrate my point.

United States.

As I said, over the last decade the U.S. had strong growth with mild inflation, and the SPY has been performing very well, returning 232% during the period while gold returned only 104%.

As I said earlier, the tendency changed when inflation arrived around March 2021, and the SPY returned 41% while Gold returned 49% since. A simple rotation of a portion of the portfolio would have improved the performance.

India.

India is a great example of hypergrowth & hyperinflation, with the latter above 6% per year & the former even higher the last 10 years. It’s no surprises that the Indian stock market returned more than 280% during the period, outperforming the U.S. stock market by a good margin.

Japan.

The perfect example of very low growth, almost decline & deflation. Most Japanese households & companies chose to hold onto their cash or buy state bonds, which yielded much better returns & grew their buying power more than if they had invested in their own stock market.

Truth is, many took advantage of their weak currency to buy western assets and currencies which appreciated even more than their own but that is, again, only possible thanks to our technologies.

Europe.

And lastly, we can talk about my own geography which has been in stagflation for some years now, with stronger inflation than growth. Without any surprises, the stock market has been very poor while the Euro has been constantly devalued, decreasing the purchasing power of its holders. The asset which performed the best was gold, up 156% in the last decade while the EU50 is only up 44% and bonds got obliterated.

Once again, the best move a European could have made was to expatriate its capital in other geographies to have good returns, while a European investing only in Europe should have had most of its portfolio in gold.

Conclusion.

This write-up was meant to illustrate the mechanisms behind the permanent portfolio & why asset rotation is important, depending on our mindset & objectives - in performance, volatility etc.

The second write-up will be about my personal view of different economies at the moment & how I adapt my portfolio to it. It isn't enough to only look at individual stocks & hold them through thick & thin. Some periods are good for risks and others are good for more conservative stocks. Some periods are good for American index while others are better for emerging countries. Some periods are good for stocks and others are better for commodities or gold.

It's important to extract the most in the best conditions & to lose the least in tough conditions. It’s important to find a narrative & to extract the most from it. That's what investing & performance is about.

Great intro, looking forward to the sequel!

Coming on your screen early next week 👌