Pingoduo & Nike Q4-24 | Earning

Review of both companies' quarter & year.

Pingoduo Q4-24.

Nothing particularly exceptional here.

Revenue. $15.68B | $15.15M | -3.4% miss

EPS. $2.56 | $2.76 | +7.81% beat

Both sources of revenue continue to grow healthily, although growth is slower than it used to be. The company still closes the year with revenues up 59% and income up 87%, which are pretty great results, especially as growth came mostly from their transaction services - indicating growing consumption on their platforms.

It will be tough for the stock to rally, though. While China is attracting liquidity, it’s not enough to pump everything & PDD’s slowing growth gives no indication of where the plateau might be. Why would liquidity focus on a pure e-com play with decelerating growth instead of tech stocks with compelling narratives?

This is the question right now, and that’s why I said I prefer Alibaba to any other e-com play in China. I wouldn’t personally own PDD - except through the KWEB ETF, but my conclusion is that shareholders should have expected this. This quarter shouldn’t change anything about their bull case.

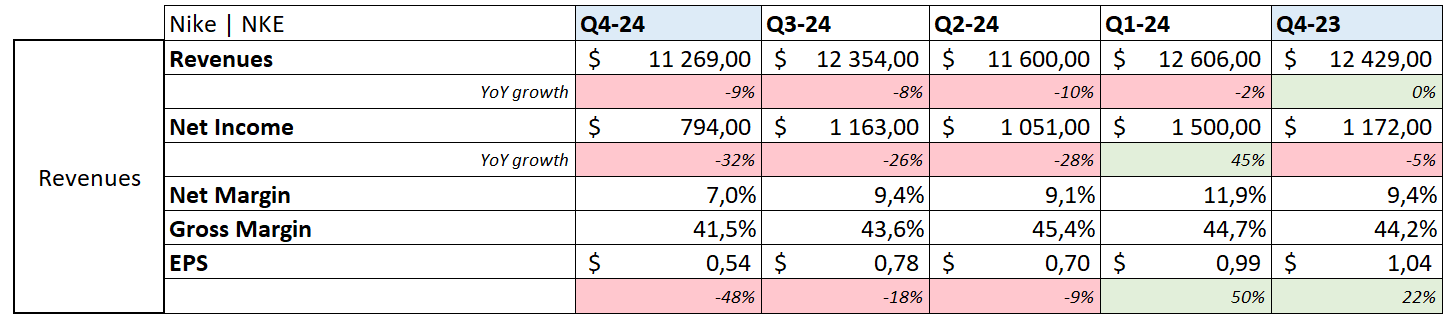

Nike Q4-24.

Another pretty tough quarter for the sportswear brand…

Revenue. $11.01B | $11.27B | +2.39% beat.

EPS. $0.29 | $0.54 | +86.21% beat

$499M of buyback.

As I say in my On Running reports, the key metric for brands is DTC revenue growth as it reflects demand for the brand itself. We’re talking about a -12% YoY decline, while wholesale is down -7% YoY - slightly less for both in currency-neutral, better indicator of demand. This trend holds across all geographies with the biggest decline coming from China at -17% YoY revenue, even as all other retail companies I follow are booming there.

There isn’t much more to say. Revenues don’t matter much when the situation is this tough for the brand and its fundamentals. It’ll take time to recover - I’m sure they will, but it will take time. Until then, I’ll continue to follow, but I’ll stay far away from the stock. I don’t see any value here & I don’t share social media’s optimism.