PayPal | Q4-24 Review & Call

Stable & slighly positive wasn't enough.

The argumentation behind my PayPal position can be found here if you are interested.

Overview.

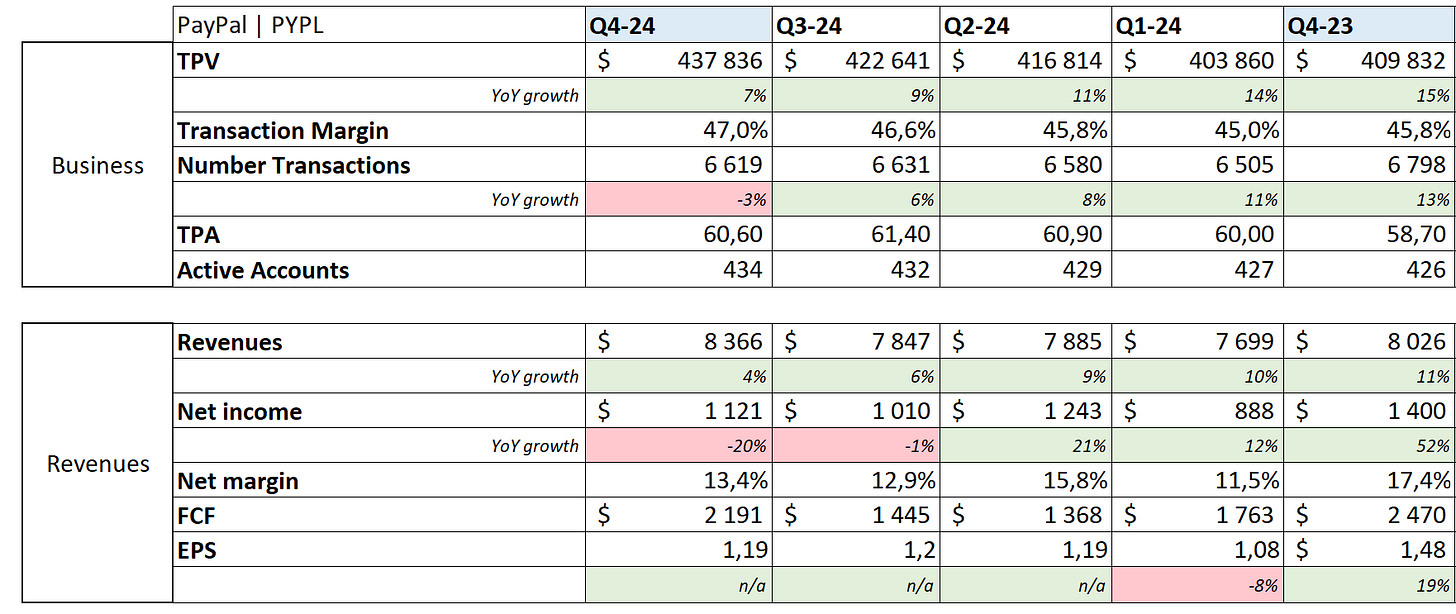

Revenue. $8.28B | $8.37B | +1.04% beat

EPS. $1.12 | $1.19 | +6.25% beat

$1.2B of buyback.

Things are moving well but not fast enough for the market.

The Bull Case.

This quarter showed lots of business improvements in almost every important part of the company. I’ll start by refreshing the bull case on PayPal rapidly before digging. Viewing the market’s reaction, it seems necessary to go back to it.

It was very simple, PayPal was a declining brand wrongly managed. The base business was to offer simplified payment systems to both merchants & consumers, so they can interact easily & cheaply.

This required a lot of different focus for PayPal through the years. Users acquisition, as no payment apps works without a user base. Creating its network effect was number one. The second step was to continuously create value for both users & merchants while keeping a healthy business.

This wasn’t done. Chriss took over a year ago to change that. The new management has had a few focuses but the main one was to use PayPal’s leverage - its user base, network effect & data, to reboost engagement & focus on healthy relations.

Since, Fastlane was built to drive better checkouts hence grow conversion & usage. Advertising will start to grow the network effect. Cashback was set up with the same objective. The company expanded with physical cards to again, grow its network effect & keep users on the platform for most of their spending. They also set up Buy Now Pay Later. & more. There have been tons of advances this year & the company has a clear roadmap.

“In '25, our key strategic initiatives will be to win checkout, scale Omni, grow Venmo, and accelerate SMB.”

My point here is. Things were bad. The needed changes were clear: PayPal needed to innovate & propose better services, grow user engagement, reinforce its network effect & refocus on healthy & strong potential businesses.

Business.

I will conclude before starting, management has been doing great, nothing short of it. Engagement is growing, partnerships are flying, technology is getting better for both merchants & end users, the latter are growing their usage through more & better services while those attract new users to the app.

The virtuous wheel just started rolling & we’ll talk about it below, right after a classic review of the fundamental metrics.

Classic Review.

Active accounts are back to growth, which means there are more new users than users being cleaned up as we know management decided to get rid of some unprofitable accounts some time ago.

TPV continues to grow, 7% YoY this quarter while strangely, the total number of transactions declined which probably means the average basket was much higher than usual.

TPV growth was mainly driven by branded checkouts which is a very positive news as it means more users & merchants rely on the better checkout system - proving its value for both. This is true for the quarter but not for the year which seems normal as the work to focus on healthy business has begun some months ago. This tendency has to continue in the future, a positive tendency.

We’ll talk about transaction margin & take rate below, so I’ll move on already.

The Positive Data.

Starting with Checkout. Any payment provider's dream is to have the best checkout technology and that is what PayPal now has, based on the latter data.

“With our upgraded experiences, we now have the leading checkout solution on desktop and mobile. When fully implemented, the upgraded experiences reduce latency by more than 40% and drive more than 100 basis points of conversion lift on average, consistent with the early results we've shared. These upgrades are now live for more than 25% of U.S. checkout traffic, which is up from 5% last quarter.”

“These upgrades” include Fastlane, which leverages PayPal’s immense user database to drive better conversion rates. This first paragraph here shows the first step of the long term goals: better products.

The one below shows that it also drives engagement from the end users, the second goal of PayPal: re-ignite users.

“From early data, what's exciting is that 25% of Fastlane users have never had a PayPal account before, and more than half have a PayPal account but haven't been active in the last 12 months. To say that simply, 75% of Fastlane consumers are new or dormant PayPal users.”

And this is true while Fastlane isn’t deployed with many partners, something which will change rapidly now that we close the holidays season & that partners are inclined to test & deploy new technologies - you don’t want to spook consumers in the busiest period of the year.

“And this has been obviously set up conversations throughout the holiday season as many of them weren't ready to actually do the integration. But now as we get into '25, it's full steam ahead.”

It’ll take more time to roll it out & be properly monetized as the team is still focused on releasing & proving the value of the product for now. But when it is, it will yield results.

“And now, we're starting to bring in new users through our Fastlane product, which, again, needs to continue to scale and will scale over the next few years. But we now have innovation in-market that is best-in-class to go after the guest checkout experience.”

Now, moving to healthier business. Braintree was a big focus for the company as the low margin system was driving volume, sure, but unprofitable or unhealthy one. Pareto’s law tells you that 80% revenues come from 20% users. There’s no point focusing too much on the unhealthy traffic.

“As discussed throughout the past year, we moved rapidly within our Braintree business to prioritize healthy, profitable growth and intentionally let go of unprofitable volume.”

So PayPal chose to upgrade Braintree, price it better even if it means being slightly uncompetitive & losing some merchants. But this had the required impact on the service’s margin, for the best.

“Transaction margin percent increased by more than 100 basis points for the second consecutive quarter, reflecting our focus on price-to-value and profitable growth.”

I know this can be controversial but this is management’s priority, let go some volume to focus on profitable volume. Seems a good deal to me, better focus on expenses & resources towards valuable partners.

And so far, this has been profitable for PayPal with comparable volumes but higher margins.

Lastly, new services & expansions to drive end user engagement & grow their network effect.

As we’ve seen, Fastlane was driving more end-user engagement because of it being a better solution, and PayPal needs to capitalize on those users, they need them to keep using PayPal to pay for everything. So the company expanded.

Firstly, to physical payment with their “PayPal everywhere.”

“We added more than 1.5 million first-time PayPal debit card users in the fourth quarter, and debit card TPV was up nearly 100% in Q4 […] Our debit card users are transacting twice as much as just a branded user and driving 20% higher average revenue per active.”

This is a net positive. Those users, this source of revenue is brand new. It still is small & doesn’t yield much in the company’s results but seems capable o growing rapidkly But it’s not all, the Buy Now Pay Later is also exploding in terms of volume.

“In 2024, we drove approximately $33 billion in BNPL total payment volume, growing 21% from the prior year.”

And the company also grows its financing portion to help & focus on SMBs. Take them early, help them, create a deep relationship & you’ll have long term & loyal customers.

“As the business matures, PayPal Business Loan offers more traditional merchant financing to match the increasing complexity and multichannel nature of larger businesses. Our business financing solutions increase loyalty and engagement, driving the PayPal flywheel. Merchants typically increase their PayPal volume by 36% after adopting PayPal Working Capital and 16% after taking a PayPal Business Loan. Our merchant lending originations were $3 billion in '24, demonstrating our leadership and that there's plenty of room to grow to support our customers.”

We can also talk about the numerous partnerships with Adyen, Shopify, Amazon & more to deliver their new checkout experiences, including Fastlane. With JetBlue to directly purchase flights from Venmo & more… PayPal is focused & working well on growing its profitable user base & improving the user experience of its app while delivering more value to its end users.

Just to add something, it is great for PayPal to focus on support as it will drive down costs, but I was talking in my Nebius IC of the need for AI training & inference, which will only grow in the future as any companies will need competent & intelligent LLMs. Here goes.

“We see tens of millions of support cases every year, and we've rolled out our PayPal Assistant, which is now really cutting down phone calls and active events that we have. We also are leveraging AI to personalize the commerce journey, and so working with our merchants to be able to understand and create this really magical experience for consumers.”

The bottom line here is that things are moving towards the good direction. My take on the market’s reaction is that things aren’t fast enough, which can be heard but is ridiculous. A $100B capitalization with relations to millions of clients cannot change that fast.

But changes are on the way. And everything seems to point towards better days.

Revenues.

The quarter is fundamentally good but this isn’t translated into revenues & I believe this is what triggered the stock’s reaction. At the end of the day, the results have to yield cash generation. Otherwise it’s just noise.

Quarter ends with a 4% & 6.8% quarterly & yearly growth respectively, correct results & respecting guidance but without any spark. Net income is declining due to growing S&M expenses & a restructuring gain in FY23, both for the year & the quarter.

No improvements and that’s not pleasing the market.

The rest is pretty good, the company generated $6.76B of FCF for a net debt of $4.3B, a very comfortable position which allowed the company to repurchase for $6B of shares outstanding, as planned.

PayPal also announced a new buyback plan of $15B pushing their actual buying power slightly under $20B while the company’s actual capitalization sits at $78B.

Guidance.

Guidance didn’t help as PayPal continues to push one quarter at a time, not giving investors any visibility, although it is hard for a company releasing new services & with fundamental modifications to know how things will unfold. Jaime said it herself.

“Having said that, we've left ourselves room to navigate different things because as we roll this out, the impact of how this will flow through may be uneven as we see it.”

We can extrapolate on this information & what was said during the call though.

“So, from a 2025 guide perspective, we still expect branded checkout TPV to grow about mid-single digits and to have consistent growth from last year into this year with some acceleration with our initiatives on top of that.”

If TPV grows 7% and take rates remain stable it logically brings us to a 7% revenue growth. Although the tendency seems to point to a shift towards higher margins so we could slightly grow PayPal’s take rate & expect slightly higher growth.

A FY25 between $33B & $35B seems possible. But this is just speculation & guidance is talking about only 4% to 5% gross profit growth, taking in consideration the lower rates environment hence less return on cash & client’s balances in the future.

“When you look at total all-in TM, we're expecting about $150 million of interest rate headwind on all-in TM there, too.”

Lots of uncertainty, but I’d put my base case with a slightly accelerating growth due to higher take rate as usage moves from Braintree towards higher margins products for their efficiency & the team focusing on Braintree’s margins.

Fundamentals seem to point that way & guidance is still very conservative here. Time will tell & we might have more information at the company’s investor day end of the month.

But I personally remain bullish on the company’s fundamentals.

My Take & Valuation.

I think you understood my take on this quarter. Fundamentals are really positive and it seems like the company is really on a transformative path. Data points towards this but the financials are still not impacted & that doesn’t please the market.

It takes time for results to yield, that's all. And the company remains conservative in its guidance as they don’t want to overpromise & underdeliver, the contrary is usually a better deal & I believe they will.

I would have loved faster results. But results are more important than the velocity at which they happen. The thesis remains unchanged.

As for valuation, I’ll keep conservative numbers & leave aside my own bullishness & a potential sandbagged guidance.

Using Jaime’s data here with a 5% YoY growth extrapolated up to FY26. At the current price, we’d need PayPal to trade at the financial 10-year multiple average to return our 11% which I basically interpret as… Buying PayPal today means you have no risks, you’d need the market to remain flat to yield good returns, including buybacks.

Anything better than this would yield better than good returns.