PayPal | Q3-24 Earning & Call

Better than most think.

Here is a reminder on PayPal’s investment thesis if you do not know the company or the investment case.

Overview.

This quarter confirms the thesis so far.

EPS. $1.07 | $1.20 | +12.15% beat

Revenue. $7.89B | $7.85B | -0.54% miss

$1.8B of buybacks - that is massive.

"We are making solid progress in our transformation as we bring new innovations to market, forge important partnerships with leading commerce players, and drive awareness and engagement through new marketing campaigns."

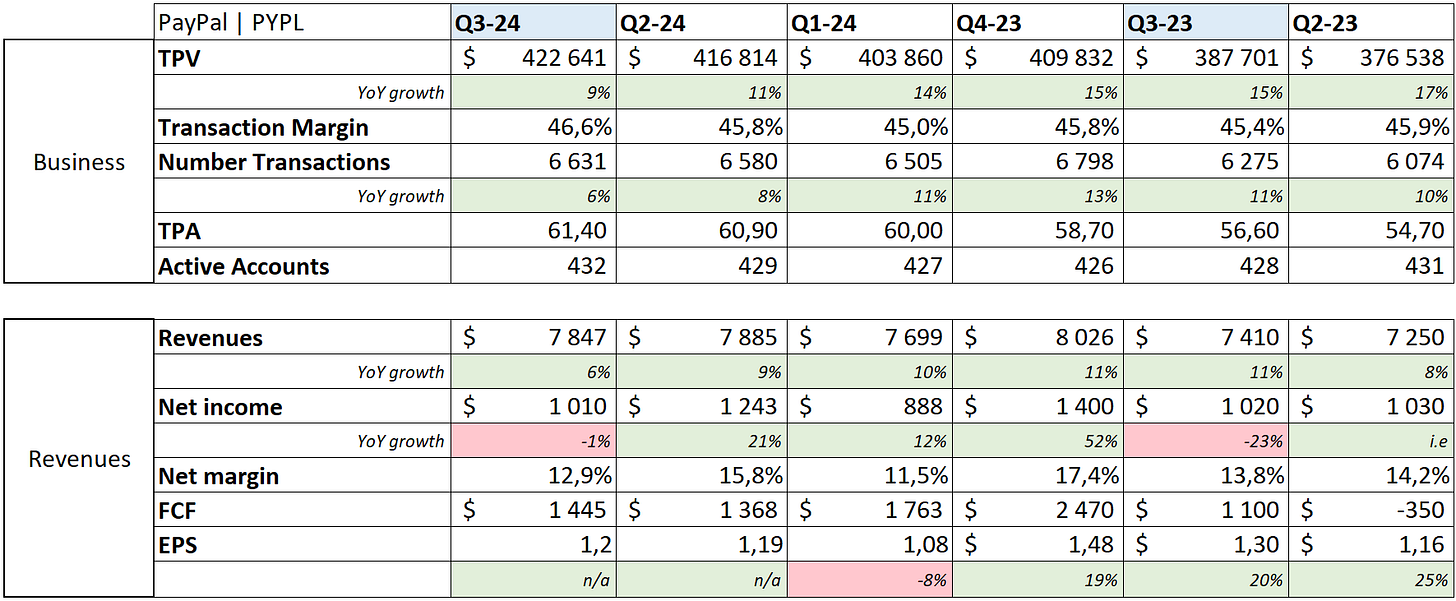

Lots of green, the only red is easily explained and a reminder that PayPal changed its way of counting EPS, so the YoY comparison doesn't make any sense.

Business.

As a reminder, what we want is pretty simple: that more & more people use PayPal or Venmo or any of their solutions for their transactions & daily usage while the company keeps a flat take rate on these transactions.

Growing volume is more important than growing take rate - which is fundamentally shrinking each quarter.

Every usage metric is growing both QoQ & YoY and most importantly, the transaction margin is also reclaiming values not seen since years - and should continue to grow. This all shows a much healthier business than a year before or even a quarter before, with strong execution & lots in the pipeline.

This is happening because PayPal has & keeps improving its apps, services & user experience.

“We've completed testing over the past few quarters and are now rolling out to customers new experiences on both desktop and mobile. These new checkout experiences are second to none. When implemented properly, the new product experiences are resulting on average in more than 100 basis points of conversion lift for vaulted checkout and up to 400 basis points of conversion uplift for one time checkout. We're also seeing a 15% to 20% increase in buy now pay later use.”

And the demand for a product follows quality.

“Since we launched PayPal Everywhere, we've added more than 1,000,000 first time debit card users.”

The same dynamic goes with Venmo.

“First is the Venmo debit card, which allows customers to spend with their balance both online and offline. We're in the early days of driving adoption, but we're seeing encouraging trends in engagement and monetization. In the quarter, monthly active debit card accounts grew 30% yet again. However, only 5% of Venmo active accounts are monthly active Venmo debit card users, demonstrating the opportunity ahead of us.”

Data is encouraging but this is just the beginning and the opportunity is still huge.

PayPal also works on its partnerships, we talked during the last months as the company is now providing Fastlane to Adyen's, Fiserv's & GlobalPayment's merchants, PayPal branded to Shopify and partnered with Amazon and its Buy with Prime service - and intend to further improve this partnership. Lot was done in a limited timeframe, and it's not over as management is "actively discussing more collaborations across the industry."

And yet, most of the levers which PayPal intends to pull to fuel growth aren’t yet released, adopted or properly monetized.

Coming back to the experience management talked above, those “are live on close to 5% of our U. S. Checkout traffic today and we're pushing hard to get them into the hands of more of our merchants throughout the holiday shopping season and into next year.”

Only 5%, only in the U.S.

Fastlane, a big part of the narrative, is only used by 1,000 merchants, mostly SMB.

“So just to be clear, we're over 1,000 merchants now on Fastlane and continuing to ramp. A lot of those merchants are some of the smaller businesses, small and midsized businesses that are part of platforms that we were able to turn on like BigCommerce as an example. A lot of the large enterprises, as you can imagine, are in the middle of their holiday season.”

The partnerships with other payment providers are still at the very beginning, most don't even propose the product yet, a product which isn’t optimized at all for monetization as management focus on adoption.

“And with respect to economics and how this will flow through, we are in the midst of a lot of conversations with merchants and all of that includes the pricing elements and we've got good arrangements with our partners well. Clearly, Fastlane will take time to ramp. And as we get through Q4 and through 2025, it'll take time to ramp and see in the numbers.”

But monetization will come.

And we' are very far from talking about the advertising business which once more, exists, but isn’t fully rolled out nor optimized.

Revenues.

There isn't much to say in terms of revenues but some clarifications.

We have a healthy 6% YoY growth, nothing crazy, only satisfying especially when taking the nine months ending as the growth jumped to 7.7%, a good figure for an already very big company.

The net income decrease is due to other expenses & higher taxes. PayPal's operating margin is actually 2% higher YoY but these expenses reduce income. A quarterly bump but the business is better than it was last year.

It's worth talking about interest revenues on customers' balances as we enter a period of rate cuts. This will negatively impact margins & revenues although Jamie commented that it should be minimum and slow to appear as the cuts should also be slow, except for a black swan event.

In terms of balance sheet, PayPal remains very strong with $3.8B of net debt & $1.4B of free cash flow - from $1.6B of OpCF, which allowed the company to do $1.8B of buybacks, which is… Massive.

A very strong position.

Guidance.

It's pretty hard to read the guidance but we should focus on the fact that most metrics have been revised upwards - slightly.

I won't focus much on the next quarter's guidance. Everything is positive in here to my opinion and a $3.92 EPS would put PayPal at 20x P/E at today's price, which doesn't seem excessive considering the pipelines, actual data & future buybacks.

There's still room to grow in my opinion.

My Take.

Many will consider this quarter to be a correct quarter, with fundamentals improving, a steady & growing demand for their products and an optimization at the business level. And I agree, very correct data altogether.

But what makes this quarter a great quarter in my opinion is that all of this is happening while PayPal hasn't launched or widely launched nor perfected monetization on its biggest weapons: Fastlane, its entire user base's data & its advertising service. This is rolling out slowly but Jamie & Alex both said that the focus was on adoption and nothing will be optimized for monetization this year.

Improving the company that much without having those services delivered, running & optimized is nothing short of great, as the potential is now much higher for FY-25. So yes, PayPal delivered a correct quarter and a correct-ish guidance.

And a bigger potential than ever.